Now cryptocurrencies are not just an "internet thing". They are now finally ending allegations of "Scams" or "Ponzi schemes" as some critics have called them. Things have changed. Now it is not just retail investors who are investing. We are talking about large world-renowned financial institutions, which are investing big money in Bitcoin.

October 20, 2020, will be remembered as a historic date for cryptocurrencies. On this day, the largest payment platform in the world, Paypal, decided to make it possible for its users to purchase cryptocurrencies on its platform. This news not only caused a tumult among the supporters of cryptocurrencies but also surprised the critics.

It was this moment that marked the beginning of the crypto bull-run, where the price of Bitcoin went to a new record of $41,941 on January 8, 2021. This was a new milestone for Bitcoin. Few thought in 2009 when Bitcoin was launched that there would come a day when Bitcoin would reach and even exceed the $40,000 price tag!

2020 - The Year When Institutionalization Era Of Cryptocurrencies Began

In general, 2020 has not been a good year. It is a year that we all want to forget as soon as possible. 2020 will be remembered as the year of the COVID-19 pandemic. We will remember it as a year of isolation and quarantine.

The COVID-19 pandemic caused significant damage to the world economy. However, the way the crypto market responded to these economic changes showed that the COVID-19 pandemic went in favour of cryptocurrencies.

Initially, in early 2020, cryptocurrencies experienced a drastic decline. In March Bitcoin price went below $4000. It did not take long, however, and cryptocurrencies began to recover.

When the world economy was experiencing difficult times, some large investors saw it as reasonable to invest in Bitcoin. They believe Bitcoin could serve as a safe-haven asset and hedge against inflation.

Some of the most prominent investors of 2020 in Bitcoin are Microstrategy with $1.3 billion; Ruffer Investment with $744 million; Square with $50 million; Stone Ridge with $115 million and Massachusetts Mutual with $100 million investment in Bitcoin. Moreover, Grayscale totalled a whopping $13 billion in crypto assets under their management.

Furthermore, JP Morgan started banking Gemini and Coinbase; Visa and Mastercard began rendering services to cryptocurrency companies; Paypal launched crypto services, and Fidelity introduced a new Bitcoin index fund.

These are some of the biggest moves of some of the world-renowned companies towards cryptocurrencies. And it was these investments that made cryptocurrencies experience the bull-run with Bitcoin that peaked at $41,941 on January 8, 2021, and Ethereum at $1,336 on January 10, 2021, not far from the all-time high of $1,432 it reached on January 13, 2018.

Microstrategy’s Michael Saylor - The True Bitcoin Supporter in 2020

Michael Saylor, the CEO of Microstrategy - largest independent publicly-traded business intelligence company, which invested $1.3 billion in Bitcoin, has promoted Bitcoin non-stop on Twitter and in the mainstream media. After the company’s massive investment, Saylor has repeatedly said that Bitcoin is a sophisticated digital gold and a “masterpiece of monetary engineering”.

In an interview with CNBC, Saylor said that every institutional investor is looking for a safe haven asset and that asset is Bitcoin.

“Bitcoin is engineered synthetic pharmaceutical-grade gold. It's all of the benefits of gold, but you can't make any more of it”, Saylor stressed. Further, he said that eventually, other big companies will have to convert their treasury assets into Bitcoin.

These words come from a CEO of the largest independent publicly-traded business intelligence company, with the leading enterprise analytics platform.

Bitcoin all-time price movements. Source: Coinmarketcap

The fact that Bitcoin has reached this point shows the potential it has and its future. If we rely on Saylor’s words, soon other large reputable companies will likely see Bitcoin as a place where they can convert their treasury assets.

Crypto Market Cap Exceeds $1 Trillion

January 7, 2021, is another historic date for cryptocurrencies as they reached another milestone. In this date, the cryptocurrency market cap’s total value passed $1 trillion for the first time in its history.

Total cryptocurrency market capitalization chart. Source: Coinmarketcap

Many people were surprised by this crypto achievement, but not the co-founder of Chainlink Sergey Nazarov.

"While outsiders may view the cryptocurrency industry being valued at over $1 trillion as an incredibly significant milestone, in actuality our space is still in one of its very early stages of development and growth," said Nazarov.

Analysts believe that this increase has come after all the institutional investments mentioned above. According to them, these investors are losing faith in the dollar and are investing in assets like Bitcoin.

“A major price level has been hit, and Bitcoin has proved that this is not the asset class you want to mess around with. It has proved itself to all disbelievers today”, said AvaTrade analyst, Naeem Aslam.

“Institutional traders are the ones who have really got the rally going”, he further added.

As per Coinmarketcap at the moment, the total value of the crypto market cap is $1,034 trillion. Bitcoin makes the most of it with $715 billion followed by Ethereum with $132 billion.

Percentage of total market capitalization (Dominance). Source: Coinmarketcap.

From Crypto Critics To Crypto Investors

Just as they have many supporters, cryptocurrencies also have critics. But, although they used to criticize Bitcoin and cryptocurrencies, now some of them have become investors.

One of them is the Dallas Mavericks owner Mark Cuban who has always used critical rhetoric towards cryptocurrencies. In a series of tweets with Tyler Winklevoss, Cuban said he had invested in cryptocurrencies before and had never sold them.

Also, Jamie Dimon, Chairman and CEO of Wall Street banking powerhouse JP Morgan once called Bitcoin a fraud. “It’s worse than tulip bulbs. It won’t end well. Someone is going to get killed”, he said when asked about Bitcoin in 2018.

However, in 2020 JP Morgan changed its position by 180 degrees by launching its JPM stablecoin. Moreover, JP Morgan is paying close attention to cryptocurrencies now. On January 5, 2021, JP Morgan published a note saying that Bitcoin could rise to $146,000 in the long term as it competes with gold.

The fact that crypto critics are already investing in them clearly shows that cryptocurrencies are gaining approval among investors.

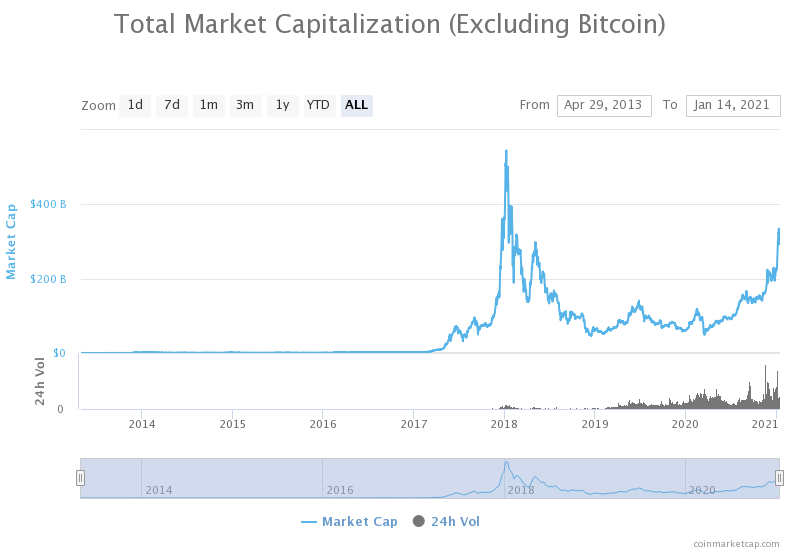

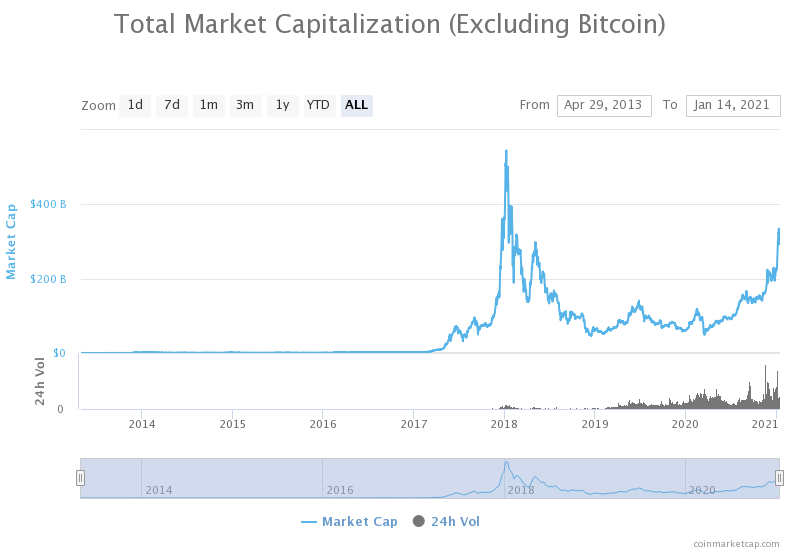

Altcoins Surge After Bitcoin’s Rally - Is 2021 The Altcoin Season?

Cryptocurrencies are correlated, although the correlation has been less noticeable than during the crypto boom in 2017. However, altcoins have again risen following the growth of Bitcoin.

“We have seen [altcoins] pump – both before and after [January 11th] correction – in ways that we have not really seen since 2017,” said Andrew Tu, the executive at quant firm Efficient Frontier.

Ethereum reached $1,336 on January 10, 2021, not far from the all-time high of $1,432 it reached on January 13, 2018. This is also the expectation from crypto analysts, given that Decentralized Finance (DeFi) is on the rise and given the launch of Ethereum 2.0 in 2020.

(DeFi) aims to revolutionize the finance world, for example, by getting rid of the middleman like the banks when someone borrows a loan. Investors see Ethereum as the blueprint of (DeFi).

The total market capitalization of altcoins. Source: Coinmarketcap.

Historically, when Bitcoin experienced bull-run altcoins have followed as well. For example, in 2014, when Bitcoin rocketed to $1200, Litecoin followed and got close to $50. In 2016 Bitcoin halving took place. A year later, in December 2017, Bitcoin reached almost $20,000.

Both Ethereum and Ripple also rallied after Bitcoin’s halving event in 2016. Ethereum surged towards an all-time high of $1,432 in early 2018. XRP also followed and reached its all-time high of $3.34.

If we consider these developments in the past, and the way the market is setting momentum, 2021 could indeed be the altcoin season. In addition to Ethereum, some of the altcoins with the most potential in 2021 are Ripple, Stellar, Chainlink, Cardano, TRON and Tezos.

If you want to know in detail what are the best altcoins to invest in 2021, take a look at this article.

Where Is Cryptocurrency Headed In 2021?

It should be taken into account that all the comparisons made now with the "crypto boom" of 2017 may not be accurate, because now things are different, given that we have institutional investors involved, unlike in 2017 that most investments came from retail investors. So, now we are dealing with other factors, which move prices.

However, cryptocurrencies are starting 2021 with a special focus, and building momentum that could lead to new records in their prices. If large financial institutions continue to invest in Bitcoin in 2021, then in all likelihood, its price might skyrocket, as some analysts have predicted towards $100,000 or even higher. And, given that Bitcoin dominates the market by 69%, having such an impact, then even altcoins are likely to follow it.

Start Investing In Cryptocurrencies With eToro

Why should you use eToro? eToro is the best social trading platform in the world. It is a very easy platform to use. Above all, eToro traders can share news, ideas, and thoughts about certain developments in the world of trading. Thus, if you are new to trading, you have the opportunity to learn more within the platform.

eToro – The Best Cryptocurrency Platform

eToro have proven themselves trustworthy within the Crypto industry over many years – we recommend you try them out.

Virtual currencies are highly volatile. Your capital is at risk.

Key Points

- October 20, 2020, will be remembered as a historic date for the crypto sphere, as Paypal, decided to make it possible for its users to purchase cryptocurrencies on its platform.

- In 2020 institutions started considering Bitcoin as a safe-haven asset and hedge against inflation.

- The most prominent investors of 2020 in Bitcoin are Microstrategy with $1.3 billion; Ruffer Investment with $744 million; Square with $50 million; Stone Ridge with $115 million and Massachusetts Mutual with $100 million investment in Bitcoin.

- Grayscale totalled a whopping $13 billion in crypto assets under their management.

- JP Morgan started banking Gemini and Coinbase; Visa and Mastercard began rendering services to cryptocurrency companies; Paypal launched crypto services, and Fidelity introduced a new Bitcoin index fund.

- After $1.3 billion investment in Bitcoin, Microstrategy’s CEO Michael Saylor has shown support for Bitcoin and has said that Bitcoin is a sophisticated digital gold and a “masterpiece of monetary engineering”.

- January 7, 2021, is another historic date for cryptocurrencies as the crypto market cap exceeded $1 trillion for the first time in its history.

- Crypto analysts believe that 2021 could be the year of altcoins.

- If large financial institutions continue to invest in Bitcoin in 2021, then in all likelihood, its price might skyrocket, as some analysts have predicted towards $100,000 or even higher.