Forex trading for beginners covers an immensely wide range of topics. Sometimes it can be hard to even know where to start.

Learning to trade forex requires knowledge of analysis, strategizing, mathematics, political and economic issues, and most importantly, yourself.

It can often be overwhelming, especially at the beginning, but we at Trading Education are strong believers that anyone can learn how to trade.

That’s why we put together this comprehensive and highly informative forex trading for beginners guide that outlines the many areas you, as a forex trader, will have to understand.

The best way to learn how to trade forex is with Trading Education’s free forex trading course. Click here to find out more or read to the end of this article.

Forex Trading For Beginners Takes Dedication

Before taking up forex trading we cannot stress enough the importance of having the following characteristics:

- Patience. Don’t risk jumping into forex trading too early!

- Persistence. Learning how to trade forex takes a lot of time!

- Detached attitude. You cannot let emotions run your trades!

- A hunger to learn. As a forex beginner, you should be more interested in learning than making money.

- Know your limits. You need to know when to stop trading and take a break.

The very beginning

By studying the history of exchanging currency, beginners learning to trade forex can better understand why it works the way it does.

Forex, FX, foreign exchange or whatever you like to call it, has a very long history. It goes back all the way to the early rules of how we trade. It’s origins lie in the intrinsic value we give items.

Some say that the history of foreign exchange goes all the way back to the Babylonians, more than 3,000 years ago.

However, at this point in time, speculation didn’t exist. The exchange rate between two different nation’s currencies was fixed, it didn’t move up and down like it does today.

Most of the changes in how we trade forex go back to the 20th century.

The value of most currencies was based on the amount of gold they were worth. This proved problematic as gold had a habit of either reaching extremely high or low prices. What was needed was something more stable that didn’t fluctuate in price so much.

This led to a period of introducing international regulations to prevent such crises from happening again.

Then came WWII and the US emerged as the dominant world power with the strongest and most stable economy.

It was then decided at the Bretton Woods conference in 1944 that only the value of the US Dollar would be pegged against gold and all other currencies the value of currencies were to be pegged against the US Dollar.

This was an incredible historic achievement and brought with it a great deal of stability that was urgently needed after the war. Quite often today we still measure the price of currencies against the USD.

This wasn’t the last change to take place though

Despite the US having the world’s largest economy, it didn’t mean that it was immune to economic problems.

By the 1960s the amount of gold the US had declined significantly due to large spending, which resulted in holders of the US Dollar losing faith in the US being able to pay back its debts.

This then changed in 1973 when the then US president Nixon decided to formally abandon the gold standard as the basis of the value of the US Dollar.

From this point, we entered the period of mass speculation where currencies values floated freely in price. Some have referred to the current system we have today as Bretton Woods II.

In the 1970s and up until the late 1990s, it was mostly large institutions and central banks that were able to profit from these differences in currency price.

The 21st century

Now, let’s fast forward to the present day where conditions have never been better for beginners of forex trading. The forex market now shifts $5 trillion a day and is the largest market in the world.

Forex as we now know it is concerned with trading one currency against another.

The UK is the biggest player, accounting for 36.7% of all forex trades. This is not too surprising as the UK does not charge tax on earning made from trading forex.

The second largest country in terms of forex trades is the USA at 17.9%. Perhaps more Americans would trade forex if the laws on trading the instrument were not so strict. In fact, many of the world’s largest international brokers do not accept clients from the USA.

Other major forex trading hotspots, in no particular order, include Singapore, Hong Kong, Japan, Australia, Canada, Denmark, France, Germany, and Switzerland, respectfully.

As you can imagine, most of these countries also host major stock exchanges and are also active in trading other instruments such as stocks, shares, commodities and ETFs.

Forex trading really started to boom with the advent of the Internet. Before this, most forex traders were, as we mentioned, large institutions.

Technically, individuals who trade forex are known as retail traders and today a big part of the forex trading market is dominated by them.

So why do people trade forex?

You’re probably wondering why people decide to begin trading forex when there are so many other different market instruments available to trade such as stocks, shares, indices, etc.

Here are just a few of the most enticing reasons to trade forex:

- Volume and liquidity. The forex market is highly active and prices are constantly fluctuating up and down. This is good because it means there are almost always opportunities to buy and sell currency pairs. No other financial instruments rival that of forex, except perhaps cryptocurrencies.

- Not much capital required. Starting out in forex trading is relatively cheap in comparison to trading stocks, for example. At the time of writing this article, one stock of Facebook would cost you $182.58. In comparison, forex traders can trade as little as $0.000125 on some platforms. This is largely down to how forex pairs are broken down to the fourth decimal.

- Trade 24 hours a day, 5 days a week. The forex market is open from Sunday 5 pm until Friday 4 pm EST (the United States Eastern Standard Time) every day, without breaks. In comparison, certain stocks and commodities can only be traded at specific times.

- Leverage. This is where a trader is allowed to multiply their trade by basically borrowing from their broker. For example, if a broker offers 1:100 leverage, this would mean that if you make a trade of $5, it will be multiplied to $500. Most European brokers only allow 1:30 leverage and US-based brokers can offer up to 1:50 leverage, but there are some brokers out there that allow up to 1:3000. It must be noted though that leverage is highly risky (we will return to this topic shortly).

Volatility explained

As we mentioned above, one of the best features of trading forex, in comparison to more traditional forms of investment, is that the prices are constantly fluctuating up and down.

We call this volatility. When the market is very active, we can refer to this as being highly volatile.

Naturally, a phrase such as ‘volatility’ doesn’t sound particularly pleasant. Of course, why would it? Who would want to invest in something that you cannot say for certain can be predicted? It gives off the impression that you will most likely lose money.

Well, actually, volatility is in fact highly useful when it comes to trading forex.

It presents numerous opportunities to enter and exit the market, meaning you have more opportunities to make money.

If the market only ever went up in price, what use would it be to you? Sure, if you bought into the market and sold at a profit, next time it would be more expensive to enter, making trading pointless.

It would prevent people with little capital from entering, which prevents it from moving. If money simply sits in one place and doesn’t move, it is not profitable.

The bull takes the stairs, the bear takes the elevator

When the market is aggressively climbing in price, it is often referred to as Bullish; in contrast, when the market is aggressively declining in price, it is often referred to as Bearish.

Bull markets tend to climb step by step before peaking and falling. Bear markets are more characterised by dramatically steep falls in price.

This is because markets are on the rise when people are buying - the small steps upwards - and fall when they reach a certain point and everybody starts selling.

Also, much of this is also largely down to institutional traders who are able to make much larger orders than retail traders. When their targets are met and they sell, the market can decline steeply in value.

The best currency pairs are not those that are high or those that are low, but the ones that are active and are reasonably predictable.

Volatility is not always guaranteed though. At points, it can be quite stagnant, in what is often referred to as ranging.

When the market starts ranging, it’s still moving up and down, as it always does, but is not moving in a general direction in what we call a trend. (We’ll explain trends further down in our article).

In such conditions, the market most likely will not reach any significant highs or lows either.

It should be remembered though that, volatility can be dangerous.

In extreme market conditions, especially if you are a beginner, it might be best to avoid trading and wait for the market to settle down a little bit.

This is because, in such conditions, it is likely you do not have a strategy and it can be harder to put in place one as it is difficult to analyse what is affecting the market.

How to view a currency pair

One of the most basic things beginners of forex trading must know is how to view a currency pair.

Currency pairs will often look something like this: USD/EUR.

USD, as you can probably guess, is short for the United States Dollar. When it is written as USD, this is what is known as a ticker symbol.

When it is written next to another currency, in this case, the Euro (EUR), and divided by a slash, that means that the number you see with it is the price for that currency pair.

For example, if you see USD/EUR, this will mean that the buy or sell price is how much one US Dollar will buy in Euros and vice versa.

Majors, minors and exotics

Most brokers break down their pairs to three types: majors, minors and exotics.

- Major pairs are the most commonly traded currency pairs, are offered by nearly all brokers and are always traded against the USD.

- GBP/USD. The British Pound, sometimes referred to as simply Sterling or “pound”, but also nicknamed the Cable.

- EUR/USD. The Euro.

- JPY/USD. The Japanese Yen, often nicknamed the Gopher.

- CAD/USD. The Canadian Dollar, often nicknamed the Loonie.

- AUD/USD. The Australian Dollar, often nicknamed the Aussie or Ozzy.

- NZD/USD. The New Zealand Dollar, the Kiwi.

- CHF/USD. The Swiss Franc.

- Minor pairs are any of the above currencies when traded against each other, excluding the USD. For example, GBP/EUR. In total, there are 14 minor pairs, though some may argue there are more or less.

- Exotic pairs are made up of one major currency and another currency that we have not mentioned so far. For example, USD/ZAR (South African Rand) or EUR/TRY (Turkish Lira). Many beginners trading forex avoid these pairs as they can be more unpredictable. Some brokers do not offer some of them at all or may have specific rules on trading them.

What are CFDs?

CFD stands for ‘Contract For Difference’. It is the most common way to trade forex pairs and knowing how they work is advantageous for beginners of forex trading.

The concept of CFDs first came into action in the UK in the 1990s. Originally, it was used as a way to buy and sell shares, stocks or other market instruments without technically owning it.

CFDs are agreements between the provider and investor that the investor will purchase the product at an agreed time and sell it again at another.

The investor is attempting to profit from the change in price from when they entered the agreement to when they leave the agreement.

By the early 2000s, CFDs became highly popular with many online brokers. Some have even attributed their popularity to how CFDs made the process of trading easier.

CFDs require someone to buy and sell at the same time. For example, if you are selling GBP/USD, it requires that someone else on the other end buys them.

This is important as it acts as a way to reduce risk. On top of that, CFDs also made it possible to buy or sell in real time, which wasn’t previously an option.

You should understand that if you purchase a currency pair in the form of a CFD, you do not technically own the underlying asset. So, for example, if you make a buy order for USD/EUR, you cannot simply withdraw those Euros.

For traders, this is beneficial because they are able to purchase financial instruments at a lower cost. Though that said, brokers will normally take a fee from the trader for opening the agreement.

CFDs are not only used to buy and sell currency pairs, they can also be used to trade shares, commodities, futures and other market instruments.

Brokers

These are the companies we use to make trades happen. Today practically all brokers operate online, though there are still a handful that accept trades over the phone.

They operate by using high powered data connections to take in traders orders and push them through a data centre.

The most reputable being in New York, Tokyo, London, Sydney, Singapore, and Hong Kong, though there are many more throughout the world, particularly in Europe.

Brokers are highly competitive, especially in the world of forex trading and are always striving to offer retail traders the next best thing.

Deciding what broker to use can be one of the toughest decisions beginners learning to trade forex can face.

Dealing desk brokers (DD)

Also known as market makers, dealing desk brokers set their own prices. This means that they are usually on the other side of your trade, meaning that when you buy, they are the ones selling to you, or when you sell they are the ones buying from you.

Because of this, many feel that market makers have a conflict of interest and they may trade against you to profit from your losses.

While in some cases this may be true with illegitimate brokers, most market makers actually do this to remove risk.

Some people prefer to avoid dealing desk brokers because they want to trade in real market conditions where the prices can be higher or lower which may prevent more opportunities to enter or exit the market.

However, some people do prefer dealing desk brokers because the price you buy or sell at is more likely to stay the same. Thоse are usually traders who might not be ready to deal with such volatility yet.

Non-dealing desk brokers (NDD)

These brokers supposedly do not trade against you and do not set their own prices.

The line between dealing desk broker and non-dealing desk broker can sometimes be blurred. Often, they borrow features from one another and different account types can further complicate things.

In most cases, however, non-dealing desk brokers offer either ECN (Electronic communication network) or STP (Straight Through Processing) market access or a combination of the two.

Brokers that provide ECN trading are highly popular because their pricing is based on numerous other market participants (liquidity providers) who can input the order. It should be mentioned though, that ECN brokers are likely to charge a commission for each transaction.

STP brokers are becoming less common, but are still used by many traders. In some senses, they can be said to be a kind of middle ground between ECN and market maker brokers. This is because they either pass trades via a liquidity provider or it will go through the broker themselves.

What should a good broker have?

There are a number of things that can make a good broker stand out.

- Compensation scheme. They should adhere to some regulations with regards to safeguarding your money.

- Segregated funds. Your money should be placed.

- Educational materials. Good brokers want you to learn how to trade and to be profitable. They will invest time and effort into teaching you how to trade. They should have a good amount of educational materials on their site. Exceptionally good brokers may even speak directly to you about this.

- Good range of markets. This is important for diversification. You’ve likely heard the phrase putting all your eggs in one basket? Well, when it comes to trading, it’s not a good idea, and by putting your eggs in many baskets, you can reduce risk.

- Awards. Good brokers like to boast about their achievements. If they are successful, it is a good sign that they are legitimate and can be trusted. If they have awards, you’ll probably notice them very quickly or they might have a specific page on their website just for their awards. The more recent those awards are, the better.

- Low or no fees. For a long time now brokers have been very competitive over reducing as many fees as possible. Some, however, still charge fees for a variety of purposes.

- Good customer service. Your broker should not be difficult to contact. They should also be helpful in their approach and seek to solve issues.

- Good online reviews. This should be one of the first things to check. What do people who trade with them think about their service? Some reviews can be quite insightful.

Unregulated brokers

Signing up to an unregulated broker is extremely risky and is a trap some forex beginners fall into. They are not monitored by any governmental or independent organisations, which means that they have absolutely no legal obligation to give your money back.

In fact, there have been many horror stories of naive traders signing up to unregulated brokers and not being able to withdraw their deposit or earnings.

They may make up reasons as to why they are unable to pay, such as the payment technology isn’t working, or they may just pretend to not know what you are talking about.

Some are also known to offer unfavourable or unpredictable trading environments.

You can usually see which brokers are regulated at the bottom of their website, though bear in mind that international brokers may only display the financial regulator relevant to the country you are located in.

If you are unsure who regulates a broker, you can always ask them and obtain some proof.

Top financial regulators

- EU regulators. Financial regulators in the EU must adhere to the laws of the ESMA and the MiFID II, and so many of the regulations in EU countries are the same, though the way in which they regulate brokers may differ. All EU regulators provide a ‘passport’ to other brokers. For example, if a broker is regulated in the UK, they will be regulated throughout all other EU countries.

- FCA: Financial Conduct Authority, UK

- CySEC: Cyprus Securities and Exchange Commission

- BaFin: Bundesanstalt für Finanzdienstleistungsaufsicht, Germany

- AMF: Autorité des marchés financiers, France

- CNMV: Comisión Nacional del Mercado de Valores, Spain

- Central Bank of Ireland: Ireland

- IIROC: Investment Industry Regulatory Organization of Canada

- US regulators:

- NFA: National Futures Association

- CFTC: Commodity Futures Trading Commission

- ASIC: Australian Securities and Investments Commission

- MAS: Monetary Authority of Singapore

- SFC: Hong Kong Securities and Futures Commission

- FSA: Financial Services Agency, Japan

- DFSA: Dubai Financial Services Authority, Dubai, United Arab Emirates

- FSB: Financial Services Board, South Africa

- IFSC: International Financial Services Commission, Belize

- FSC: British Virgin Islands Financial Services Commission

- FSA: Financial Services Authority, St. Vincent and The Grenadines

- SCB: Securities Commission of the Bahamas

- FINMA: Swiss Financial Market Supervisory Authority

- FMA: Financial Markets Authority, New Zealand

- SEBI: Securities and Exchange Board of India

There are, of course, many other financial regulators around the world.

Trading platforms

There are many different trading platforms available to use to input trades and view charts that are great for beginners learning to trade forex.

Key things to look out for:

- Easy to navigate. Nothing should be more than a few clicks away.

- Customizability. Ideally, you should be able to rearrange the platform so it works the way you want it to.

- Speed. You want the platform to place your order as quickly as possible to ensure it processes the price you want.

- Low or no commissions. Some brokers charge commissions for using their technology. Ideally, you want to avoid this as much as possible as these fees can pile up. If you sign up to a broker that charges commissions, make sure you understand them and calculate them into your trades.

- Indicators. These can notify you when certain market conditions are taking place. They can be useful and can help you plan when to buy and sell certain instruments.

- The ability to also trade other market instruments. As you develop as a trader, you may want to branch out into other market instruments, such as stocks. This is good for diversification.

- Licensing. Ensure that there will be no licensing issues when using the software. This can depend on the platform and the broker you use.

Your decision should really be down to the platform you feel most comfortable with. No platform can be decisively said to be better than any other.

MT4 and MT5

MT is short for MetaTrader. Their two platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the most popular trading platforms available and are offered by almost every single broker and have been used since the early 2000s.

Many wrongly assume that MT5 is an updated version of MT4 as it is a later version, and, well, 5 comes after 4. This isn’t true. In fact, MT5 was made in order to do some things that MT4 can’t.

MT4 was specifically designed for retail forex traders, while MT5 is more oriented towards CFDs in general, as well as stocks and shares.

That said, MT5 does come with some improved features that MT4 doesn’t have. While both are considered to be highly customisable, MT5 has more timeframes and six types of pending orders, in comparison to MT4’s four.

Further to that, MT5 also has unlimited charts and an economic calendar.

Before you conclude that MT5 is better than MT4, you should be aware that some brokers, specifically those that focus on forex trading, don’t offer MT5 or they may not allow certain functions on it.

Plus, MT4 is often regarded as easier to use, which makes it more appropriate for beginners trading forex.

Most often, MT4 and MT5 are downloaded and used as an application on a desktop computer. But today they can also be used on a browser via a broker’s website, or even on your phone or tablet via an app (more on that below).

The choice of which one to use is down to you.

cTrader

The cTrader platform is less popular than MT4 and MT5 and is not offered by as many brokers.

That said, it is growing in popularity and is seen as a good alternative, especially for those looking for something more user-friendly and designed for fast execution.

Naturally though, if a platform has been designed to be an improvement of its rivals in some areas, it will likely sacrifice performance in some others.

For example, MT4 and MT5, have both been highlighted for their security and reliability, over cTrader.

Mobile trading

Mobile trading has burst into popularity in the last few years with many brokers developing their own in-house mobile trading apps.

For many traders, mobile trading is very liberating as it allows them to conduct trades wherever they are.

In most cases though, brokers usually offer MT4 or MT5, which can be directly downloaded from the Play Store for Android users or the App Store for iOS users. It is also developed directly by MetaQuotes Software Corp., the company behind the two.

cTrader is also available via mobile, however, it is usually a version that has been adapted by the broker.

Mobile trading apps can vary significantly in how they operate and what they can offer. Some can be near mirror images of their browser versions, while others can be very limited in what you are able to do on them.

Some mobile trading apps can also be used on tablets as well and some very innovative brokers even allow trading via smartwatches.

Though when it comes to mobile trading, for many traders it may be better to implement more complex trades from your desktop as it will be easier.

Robots

Robots or Expert Advisors (EAs) are programmes that traders use to monitor the markets using complex algorithms and can notify you when to make a trade or can even automatically make a trade for you.

Many of these robots are made for MT4 and many brokers develop their own robots.

Before using such programmes, it is important to thoroughly test them out first. The best way to do this is with a real account in a real environment. Some traders may use mini or micro accounts for this to minimise any potential losses.

As a beginner, robots can be great for notifying you when to trade, but it may be best to leave the automated trading features until you are a more advanced trader.

If you do decide to use automated trading, never leave them unmonitored. It’s a recipe for disaster.

This is because while they can detect trends, they are not aware of what events are happening in the wider world that can impact the market. For this, they need human intervention to prevent them from making mistakes.

Some highly advanced traders with excellent technical skills can even build their own robots.

What to look for in a robot

There are also many robot scams out there as well. To make sure what you are signing up for is safe to use, you can do the following:

- Check reviews. This should always be the first thing you do. If the product or company has very bad reviews or no reviews at all, this is a major red flag.

- Check the company. Do they make claims that cannot be possibly true?

- Pricing. Is this robot ridiculously cheap? Scammers usually look for quick short-term profits, instead of establishing a long-term relationship with traders. Established companies, on the other hand, will continue to look for ways to offer you new products. If their robot works so amazingly well, why would they charge so little for it?

- Support. Are you able to call or email the company and ask them about the product? They should be able to answer any questions you might have about how it works. You can also test their attitude as well. If they are polite and helpful this is a good sign.

Aside from scams, there may also be robots that are made by legitimate companies, but their robots do not work well. Again, it is important here to check out the company and reviews.

Account types

When you sign up to trade with a broker, you will usually have a choice of different accounts.

Different account types can work well with specific types of strategies, so make sure you have a good idea of what kind of account type will be best for you.

Further to that, there are some account types offered by brokers that have additional benefits, such as the ability to earn interest on your balance.

Demo accounts

Demo accounts are accounts offered by brokers where traders can experiment with the platform and see if they like the broker or not.

While many advise signing up for a demo account before setting up a real account, this ignores the fact that demo accounts do not show you how the platform really operates.

This is especially true in regards to how the market moves and how orders are placed. Often they will put the order directly through, which, in real life, doesn’t usually happen.

They don’t take into account slippage, which is how much the price of an instrument may change between you placing the order and the order being made.

This is important because not all brokers have the same amount of slippage.

On top of that, demo accounts will often give you way more virtual money that you’ll ever have in real life. Some even let you play around with up to one million USD.

This isn’t helpful because there is no risk involved in trading. What does it matter to you if you have one million dollars and you lose $5,000 on a bad trade?

For forex trading beginners, this is especially not helpful.

In real life, $5,000 is likely going to be a lot of money to you and it will require you to think more about how you risk it.

Trading accounts

A standard trading account is what you will most likely sign up for when you start trading.

While trading accounts are usually quite basic, they can also be quite different between brokers depending on the market access they offer.

They may offer ECN accounts, STP accounts or DMA accounts or some kind of combination of any of the three.

Islamic/Swap-free accounts

These are accounts that do not charge you interest for holding a position overnight.

They are often referred to as Islamic accounts because those that follow the Muslim faith view such fees as exploitive, which goes against their faith. Therefore, Islamic accounts were made to accommodate Muslim traders.

Since then, many of the top brokers now offer this option as well.

Most of the time, you will not see this as an option when looking at a broker. Usually what would happen is you’ll open an account with the broker and then request that they make the account an Islamic or a Swap-free account.

Or they may just not include swap fees at all.

Micro, mini and cent accounts

These are accounts that are designed specifically for dealing with small amounts.

Many traders enjoy using these accounts because they often require a smaller deposit and they offer more control and precision on the amount you trade.

It should be mentioned though that some brokers offer such features with their standard trading accounts.

When considering signing up to a micro, mini or trading account, traders should look into whether that account will become a standard account after a certain limit is reached.

For example, if your account reaches $1,000, you may lose certain privileges like higher than normal leverage.

Managed accounts

Managed accounts are great for those who want to get involved in trading forex, but lack the knowledge to do it themselves.

There is obviously a fair amount of risk involved in opening a managed account as you are not in control of how your money is used.

You will not learn anything about trading by opening one of these accounts. In reality, you are not really a trader but more of an investor.

Not only will this mean you will not be able to start trading any faster, but you’re also risking the chance of being scammed as you’ll never know if you’ll be able to trust the individual in control of your funds.

There are three different variations of these PAMM, MAM and LAMM.

- Percentage Allocation Management Module (PAMM). With this option, investors can choose to allocate a percentage of their money to copy trades of others, which is good for diversification. It is perhaps the most flexible option available for those looking for a managed account.

- Multi-Account Manager (MAM). With this account type, investors place their money into the hands of a master account manager who makes the trades on their behalf. Investors who use this option still have the ability to trade themselves as an individual and have the ability to choose their preferences, for example, if they do not want to trade a specific instrument or a forex pair.

- Lot Allocation Management Module (LAMM). LAMM accounts are similar to PAMM accounts but differ in that the investor chooses the lot they wish to invest instead of the percentage.

Social and copy trading

This is a feature that is becoming more common among brokers.

Copy trading

Copy trading, also known as mirror trading, is where you can copy the trades of other traders.

On some platforms, you can even subscribe and automatically copy all of their trades, though this is not normally advised unless you can be completely sure that this trader has a good strategy.

You should remain vigilant and not rely on any trader to make your money for you.

Be careful when judging the success of a trader as their ratings on such platforms can often be misleading.

Judge them by their overall success, not by their short-term success. A risky trader may make a lot of money one day and then lose a lot of money the next, which you do not want to do.

Social trading

This is essentially the same as copy trading but incorporates elements from social media platforms, such as Facebook, where traders can create a profile, make posts and like and comment.

Social trading allows traders to communicate with each other and discuss trading ideas. It can also be a great place to learn more about trading.

Such platforms can also be great for firsthand news about what is happening in the market instead of relying solely on news.

Most traders are also more than happy to discuss their trades with forex beginners and help with any questions they may have.

Not all social trading platforms are that socially active, however. Some platforms may be mostly used by traders just to trade and they may not be too interested in talking to each other.

If possible, check how active the platform is before using it. Platforms with more users tend to be more active than those with just a few.

Simplicity is key

This doesn’t just go for beginners trading forex, it goes for all traders.

Here are some of the top reasons why simple strategies work best:

- Easier to complete trades

- Fewer things can go wrong

- Less complicated things can go wrong

- Easier to learn

- Effortless to repeat

All this makes a big difference. You can become more profitable and make fewer mistakes without all the stress.

Leverage

This is a surefire way to overcomplicate your strategy and potentially make some humungous losses.

Using it while trading will mean you will need to take into account other factors.

Most importantly, you will have to pay back what you used, plus interest, meaning you need to calculate this into your trading strategy.

Here’s an example:

Let’s say you have $100 and you make a trade and end up with $110.

You decide to make the same trade again, but this time you use leverage at a rate of 1:10, turning your $100 into $1,000.

Your trade is successful and makes $1,100.

You first need to pay back the $900 you borrowed, then you need to pay back any interest.

Let’s say for the sake of this example, the interest rate is 10%, you will need to pay back $20, leaving you with $180.

However, we don’t want to scare you away from using leverage. Just bear in mind that it can be very dangerous and perhaps is better to wait until you are an advanced trader to use in it your trading strategy.

Almost all popular strategies rely on trends

Trends are important for both long-term and short-term strategies. Understanding how they work can be one of the most beneficial things you can do when beginning to trade forex.

A trend refers to the overall direction a market instrument is taking. Markets do not just move up and down randomly.

Most strategies only work in certain situations so you need to understand the direction of the trend that is taking place, when it’s trending upwards, downwards, ranging, and when the trend is changing.

Trends can be characterised by support and resistance levels. Support is the point where the price will not go any lower and traders start buying, while resistance is the opposite, the market will not go any higher and traders are selling.

Many traders avoid trading when there is no confirmed trend up or down. Though there are some strategies that work in such markets.

When implementing a trading strategy, you should place your trade when you are completely sure the trend will work in your advantage.

This may mean missing the best possible opportunity, for example, when the market reaches the lowest point to buy or when it reaches the highest point to sell.

Unfortunately, you are not psychic and most of the time you will not be able to guess when these moments will occur, and so you may miss them.

You can, however, use them as an indicator of change and start your strategy or change your current strategy and start a new one.

The point is to utilise the changes in market direction, not just the highest and lowest points, as they are just a part of it.

Trend trading is a great idea as it usually presents opportunities when the market is up or down.

When should I trade?

As we mentioned earlier in this forex trading for beginners guide, the forex market is open five days of the week, 24 hours a day.

While this means you can trade whenever you want, ideally you should be trading at specific points when there is a good amount of activity in the market. This activity presents opportunities for you to buy or sell.

A good way to know when to trade is by using a forex economic calendar. Economic calendars list economic events that may have an effect on the market. However, they do not always impact the market as much as you would expect (more on this in fundamental analysis, below).

Ideally, you should have a good selection of news outlets to inform you of potentially good or bad times to trade.

Some traders follow the Sell in May and go away approach to trading.

This is where you trade during the Winter months (November till April), when the market is more active and take a break from trading during the summer months (May till October) when many people go on holiday and there is less market activity.

However, this is used more by traders of other market instruments, such as stocks. When it comes to forex, this approach is not relevant to all currency pairs and depends on the economy of the currency.

Trading signals services

Trading signals are used by all traders, beginners in forex trading and advanced. They act as notifications that provide analysis and make suggestions on when you could be the right time to buy or sell an instrument.

Signals can come in many different forms and can be received as a text message, an email, or notification via an app on your phone or desktop. This could be the company’s own app or through another such as Telegram, for example.

In most cases, you can also set how frequently you want to receive them as well. Some traders may prefer them every 30 minutes, others may only want them once or twice a week.

They are particularly useful for people who cannot watch the market all the time because they have other priorities. Instead, they can stick to trading only in certain moments.

Finding the right signal service can be difficult as there are many companies that offer such services. Subscribing to a signals provider requires you to really trust that they are legitimate.

Even if they are legitimate, you might not know how accurate they are. They may lack the technical skills needed to accurately predict the direction the market is heading in.

The best signals providers use a mix of robots and human analysis. This way they can benefit from the accuracy of machines and be appropriately monitored by expert analysts.

Many brokers also offer trading signals. If you trust your broker, you can likely trust the signals they provide.

Most common strategies in use today

Here are some of the most common forex trading strategies people are using today. Many of which are perfect for forex trading beginners.

We implore you that when you start trading, you dedicate time to learning and trying to implement strategies instead of just guessing and hoping you will make a profit.

We’ve said it before and we’ll say it again - without a forex trading strategy you are basically gambling. You do not have any goals or expectations and you are exposing yourself to significant risk.

You can read more about creating your own trading strategy here.

Carry Trade

An excellent strategy that is simple to understand and great for beginners in forex trading, as well as professionals. It is also a great strategy to use when the market is not very volatile.

The carry trade strategy aims to profit from the different interest rates between two different currencies.

It works by selling a currency with a low-interest rate and using the profits to buy another currency with higher interest rates.

Ideally, to conduct a carry trade, you will want the currency you are selling (the funding currency) to have very low or no interest rates, such as the Japanese Yen, as opposed to the currency you are buying which should have very high-interest rates.

Before undertaking a carry trade, you need to know which currencies have the lowest interest rates. Most often, these are currencies that belong to countries that attempt to stimulate their economy and purposely keep rates low.

The rates between the AUD/JPY and NZD/JPY are known to be good pairs to use when performing a carry trade.

The carry trade is a great way to utilise leverage. That said, with any trading strategy that involves using leverage, there is always a risk and it is best to stick to a reasonable amount, such as 1:10 at the very most.

Remember, in order for the carry trade to work, interest rates between the two currencies need to stay the same.

Scalping

Scalping is a strategy for traders who wish to make profits by making many small trades. Over time, all these small trades add up and make a nice handsome profit.

To implement this strategy though, you really need to have a good live feed and a broker that allows direct access to the market so you can take advantage of the small changes that take place.

More importantly, though, you need to have a good exit strategy and be able to stick to it. The better you stick to it, the more consistent you can be in building your profit.

If you don’t stick to your exit strategy, it can be very risky as you could potentially make a loss that wipes out all of your gains.

Scalping can also take a lot more time than many other strategies. With scalping, you could spend all day trading and may need to make hundreds before you make a profit you are satisfied with.

We’ll stress again though, to really use this strategy effectively, you must have the right tools to hand.

Fibonacci Retracements

In order to use this strategy, you will need to have a broker that allows you to use the Fibonacci retracement tool. Forex beginners with a good understanding of the Fibonacci sequence will have an advantage when implementing this strategy.

As we mentioned earlier, many of the best trading strategies require you to have a good understanding of trends and this is one of them.

Traders that use Fibonacci retracements essentially believe that history will repeat itself. They look for points where an ongoing trend momentarily dips and will look to potentially buy or sell at those moments.

To work out the right moment to buy or sell, traders who use this strategy will use the Fibonacci retracement tool to identify points in the dip. These points are commonly 38.20%, 50% and 61.80%.

These are the points where the trend will likely continue either upwards or downwards, and so traders will set buy or sell orders at those moments in anticipation of them occurring.

If the instrument is trending upwards, it is a great opportunity to buy at a cheaper rate and sell later on as the trend continues.

When the reverse is true and the instrument is trending downwards, it is a great opportunity to sell at a higher rate before the trend continues.

Before retracing the dip and carrying out your trade, ensure it has finished first by waiting for the trend to continue upwards or downwards as it should.

This is vital because if it continues to follow the dip, the strategy will not work. It may even indicate that the trend you were hoping to ride has ended and a new one has started.

It is also a good idea to place stop-losses above or below retracements just in case.

Swing trading

Swing trading is highly popular and to those with little trading knowledge as it is easy to grasp. It is also a trading strategy that can be used for other financial instruments as well.

Traders that use this strategy employ analysis (mostly technical and to a lesser extent, fundamental) to predict which currency pair will rise to a profitable point. They will also mostly use charts ranging from the last few days.

Once identified, they will act quickly to purchase the currency pair and hold the position for a few days before it reaches their desired point and then start selling.

Traders that use this strategy need to be aware of swap-fees that may be charged to the trader for holding the position overnight. Further to that, they are also exposed to any sharp changes that may happen overnight.

Moving Averages

Even if you do not use any strategies related to moving averages, understanding how they work can be very beneficial for any beginner learning to trade forex.

This can be done by selecting the closing prices of a particular time, ten days for example, and dividing them by that same number. This gives your moving average.

However, moving averages are usually identified with tools or indicators that are displayed on charts, so normally you will not have to work it out yourself.

Moving averages help traders see the underlying trend in the market more clearly.

Specifically, they are useful because with them we are better able to see wider trends as we are focusing on the average price over a period of time instead of the current price.

By doing this we remove the minor dips up and down and focus on the real direction the price is heading.

To make use of this strategy though, traders need to view the moving average alongside the current price and compare the two.

When the current price is above the moving average, this is seen as an uptrend and when it is below the moving average, it is seen as a downtrend.

If the moving average swaps from an uptrend to a downtrend, this is called a trend reversal. It is at these key points traders seek to buy or sell.

When a downtrend becomes an uptrend, this is seen as a signal to buy. When the opposite happens - an uptrend becomes and downtrend - this is seen as a signal to sell.

Keep in mind that moving averages only show past prices. Because of this, you cannot solely rely on them, especially in regards to sudden price decreases.

Hedging

Hedging is a common practice and is used in a number of different financial areas.

It is where you trade two instruments that usually counter each other. Think of it as an insurance policy.

If your desired pair does badly, then the counter pair that you also invested in will be doing well. This way you have reduced your risk and minimise your losses.

In some cases, you may have even made something out of it. Though, in most cases, this really is a strategy used to avoid risk not make a profit.

Bolly Band Bounce Trade

The Bolly Band Bounce Trade is another one of the few strategies that is suitable for a ranging market.

It relies on using Bollinger Bands which outline volatility in the current market. It also assumes that when the market is ranging, it acts like an elastic band - when it reaches highs it will bounce back to the lows and vice versa.

When the market nears the high points of the Bollinger Bands, it is a good point to sell, when it reaches the lowest points, it is a good point to buy.

Profits generally are quite small, but at least it’s something.

This strategy will, however, be less effective once a trend forms. An advantage of this strategy is though you can identify when a trend is emerging when prices start to rise above or dip below the Bollinger Bands. This should be seen as a signal to change strategy.

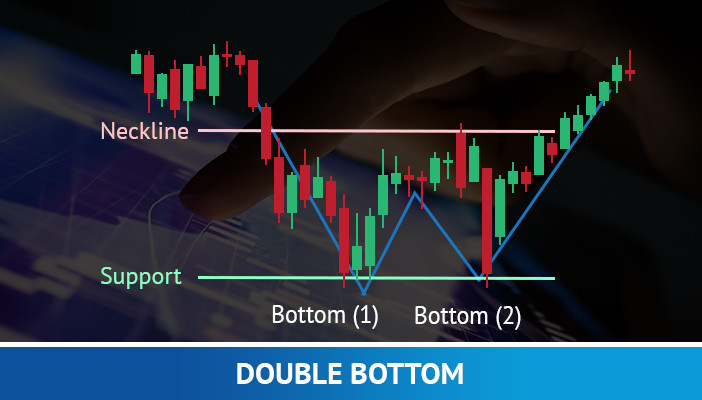

Double tops and double bottoms

You could say this is technically two strategies.

Double tops happen when an upwards trend reaches as high as it can go and is about to reverse into a downward trend.

When this happens we often end up with two tops, the second of which acts as a signal to traders to start selling.

A double bottom is the reverse of a double top. In a double bottom, a downward trend is unable to go any lower and we get to two bottom points and then a new upward trend begins.

This is a good point to buy because you know that the market will not go any lower.

For beginners trading forex, this strategy is highly popular because double tops and double bottoms are very easy to spot and occur frequently.

When using this strategy, it’s important to wait for the pull-back to be sure that the strategy can be implemented.

You should also use stop-losses and take-profit orders too, just in case.

Intraday trading

Intraday is another way to say within the day and focuses on trading the highs and lows of the day. There are a number of other strategies related to this approach.

By opening positions in the morning and closing them before the end of the day, you don’t leave yourself at risk from volatility at night.

Usually, you’ll make multiple trades throughout the day before picking a point to stop.

This strategy isn’t without flaws though. You will not always have a chance to close your position and you can still run into losses.

Channel Pattern

With channel patterns, the aim is to identify the highest and lowest possible points in a trend and attempt to use them as entry and exit points.

Again, using a channel pattern strategy also requires a good understanding of trends. It also requires that you use a broker that offers the ability to view channel patterns on top of charting software.

With your channel pattern, you want to look for the highs and lows of a trend.

They can be used to measure downwards trends, upwards trends and when the market is stagnating.

What you are looking to do is take advantage of the potential dips between the ups and downs that take place in that trend, when it momentarily dips down or up before the trend continues. A trend is never completely straight up or straight down.

The channel you have made can be used to predict where they are likely to be.

The last thing to mention about channel patterns is that you need to be able to spot when the trend is changing or this strategy will not work and it can result in losses. Do not assume a trend will continue forever.

Key things every forex trading strategy needs

While trading strategies can come in very different forms, some fundamentals always stay the same.

- Goals. Specifically, how much do you plan to make from this kind of strategy? Once decided, you need to implement stop-losses and take-profit orders.

- A good broker. When we say that, we don’t just mean one that is regulated, which is also very true. Some brokers do not allow you to implement certain trading strategies and they may have certain rules that prevent strategies that they feel are unfair to them.

- Patience. Many beginners of forex trading struggle with this. Without patience it can be hard to fulfill their strategy.

Analysis

One of the most complex things forex beginners can miss out on and often one of the hardest things to learn.

However, you shouldn’t be intimidated by it. There are plenty of types of analysis people can learn.

Analysis can take many forms. Some of it is very observational and can be easily seen. Other types of analysis can be more complicated but can be very revealing.

An important thing to remember about analysis is that it is not only about looking for potential opportunities, it is also about knowing when to avoid the market.

For example, many traders don’t bother trading if the market is ranging. And others will avoid it if it is too volatile and unpredictable.

Fundamental

This is the most basic form of analysis and mostly involves analysing external events that may affect the forex market.

Most of the time, you will perform this kind of analysis by watching and reading the news.

Fundamental analysis is quite tricky because you’ll likely never end up with an exact idea of where the market will go.

Generally speaking, events that can affect the forex market include:

- Political. Not just actions that are taken by politicians, but their stance on issues or potential changes they may implement.

- Economic. Poor or good economic performance.

- Natural. Such as natural disasters.

These events don’t always affect the market. In fact, it largely comes down to if they are expected or not.

For example, if it is already known that the UK will announce its yearly GDP estimate and it is likely to be good, it will not dramatically raise the price of the pound because people were already aware of the positive news.

That said, some events, such as natural disasters obviously cannot be predicted.

As you can expect, good economic news can mean the price of a currency will increase. Bad economic news can mean a currency will decrease in price.

Fundamental analysis is good to give you a broad sense of where the market currently is and where it potentially might be heading. But it is not accurate, it is only empirical.

After fundamental analysis, you should look into more scientific forms of analysis for a real understanding of what is happening in the market. Combining the two will give you the best understanding of where the market is heading.

Technical

Technical analysis is solely the study of what is happening on the charts in front of you.

It largely involves looking back at the changes that have occurred over a certain period of time and assessing if they are likely to happen again or not.

With that information, traders can decide what points will be good to enter the market and what points will be good to exit the market.

As you would expect, technical analysis can sometimes be very complex and can require a good understanding of the charting tools you have.

When conducting technical analysis you weed out the abnormalities to see the market for what it really is.

By combining technical analysis with fundamental analysis, you can see in detail how certain events affected the market.

Wave

Wave analysis or as it is otherwise known as the Elliott wave principle, is a form of technical analysis that assumes that markets go through cycles and that trends can be predicted.

The basis of this analysis is that the market moves up or down largely because of a positive or negative outlook by traders.

According to Ralph Nelson Elliott, who invented wave analysis, these cycles occur because of the psychology of traders. By understanding their mentality, we can predict with a good degree of certainty how the markets will move.

Even if you dislike this form of analysis and never use it, understanding it can be very useful and parts of it may help you develop a broader understanding of what is happening in the market.

How does wave analysis work?

An easy example for you:

Typically, the price of a currency pair will reach a low point and traders will start to buy believing it to be a good point. This is called the first leg. This is followed by a shorter second leg down of buyers selling and profiting from the initially low entry point from before.

The third leg is usually the largest with traders believing they have found a trend and jumping on it, unaware that in doing so they are actually creating the trend. This is then followed by the fourth leg where traders are selling after the huge rise in price after the third leg. In a sense, this is where most of the profit is made.

The fourth leg, however, is still small in comparison to the rise of the third leg, and other traders attempt to jump on the rise at the last minute and again push the price up even further in leg five. Leg five, though usually very small, is the highest point the forex pair will reach.

This is then followed by an A, B, C retracement where the market will go down significantly after 5 in A, attempt to regain ground in B, and then slide down again to the lowest point in C.

In reality, though, things are never this simple. Many theoreticians have since added their own ideas to theory to make it more cohesive and relevant to real life trading scenarios.

However, it is quite useful in explaining the psychology of a trader. Particularly in how they spot trends and how, for a variety of reasons, traders can be late joining them and, in a sense, even create them.

Risk management

Our guide on forex trading for beginners couldn’t possibly be complete without mentioning risk management. It is perhaps the most important part of forex trading.

There are many estimates in regards to how many traders lose money trading forex. Some as high as 96%, others ranging between 60%-89%.

Others claim that actually, traders win more trades than they lose, but their losses are often larger than their gains.

Either way, it highlights a significant problem in how traders recognise risk and plan for it.

You can't even consider making a profit if you do not properly allocate your risk.

Risk management is a crucial part of any trading strategy. As with any trading strategy, it is possible to lose more than you may earn.

You need to set yourself limits

With every trade, you need to know how much you are willing to gain and how much you are willing to lose.

This is called risk-reward ratio.

You can work out your risk-reward ratio by properly analysing the market and identifying what your chances are for making a profit and what your chances are of losing.

This, of course, needs to take into consideration how much of your account you are willing to place into a trade.

Many will advise not risking more than 1% of your account per trade. So if you have £5,000 in your account, it’s not worth risking more than £50. This is especially true when you are a beginner.

Different market conditions call for different risk-reward ratios, so make sure you understand what kind of environment you’re about to enter.

A basic thing to remember about risk-reward ratios is that your reward should be greater than your risk.

Ideally, the two numbers should not be close.

You need to think about what is worth your time. With £50, would you prefer to make a small £5 on top or £500?

With every trade, there is a risk and is the risk really worth it when the returns are so small? Save your time and mental energy for making bigger, more-worthwhile profits.

Things will never 100% go the way you want them to!

It just never happens. No matter how closely you follow this forex trading for beginners guide, no one can promise you success.

You may miss your ideal profit by a few pips or you may miss it completely. Unfortunately, that’s the reality of trading.

Often, you will not be able to enter at the most important point and you may not exit at the most perfect point either.

But in all honesty, in most cases, you will not know what the highest or lowest points are until they have passed.

Having the right mindset about losing money is a must.

As long as you win more trades than you lose, you’ll be fine. Many traders aim for 50-55% win rate.

One of the last pieces of advice we at Trading Education can give newbie traders is to keep a journal of all of your trades and take note of what works for you and what doesn’t.

eToro – Best Social Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider

Key points

If you remember anything from this forex trading for beginners guide, make sure it’s these points.

- Forex trading has been around for a long, long time. It all goes back to how we trade goods.

- Many traders prefer forex over other market instruments. Forex is cheaper to start trading, can be traded most days of the week, and is highly active.

- There are many different types of brokers, account types and platforms. Finding the right combination for you requires a good deal of research.

- Many popular forex trading strategies rely on trends. In most cases, you need to understand how the market moves in order to implement an effective strategy.

- Understand the risks involved and take precautions. Never leave yourself exposed to risks that you cannot handle or do not understand.

The best forex trading for beginners guide is absolutely free

That’s right, Trading Education is literally giving this expertly crafted trading guide away totally for free!

The Ultimate Guide To Forex Trading would normally cost you £2,500. But lucky for you, our partners are paying for it instead!

What will you learn?

- Foundation in forex trading

- Mechanics of forex trading

- Advanced analysis forex trading

- Strategy Trading for forex trading

How can you get it now?

Easy, sign up to one of our partners and we’ll give you the course for free. Once you’ve signed up and made a deposit, email your account number over to [email protected] and we’ll get you set up.

Click here for more on our free forex trading for beginners guide. This could be the best investment decision you’ll ever make!