Based in the UK and looking to buy Coinbase shares? If so, there are hundreds of regulated stock brokers to choose from. most of which give you access to the NASDAQ so that you can buy Coinbase shares. But how do you know whether Coinbase is a good investment, and which broker is best for you?

In this full guide, we explain how to buy Coinbase shares from the comfort of your home. We also review the best UK share broker that allows you to invest in Coinbase, and take a look at the factors you should consider before buying Coinbase shares.

Coinbase is one of the largest platforms for digital asset exchange that accepts customers from over 100 countries. It's also the leading cryptocurrency exchange platform in the USA, supporting all the states, excluding Hawaii. Founded in 2012, the platform initially accepted only Bitcoin trading, but over the years, it gradually expanded its selection of cryptos listing also decentralized altcoins.

Now, Coinbase supports trading of over 100 cryptocurrencies, has large liquidity, offers an easy-to-use interface for beginners, lots of educational content, and a personal wallet for retail investors.

Having a history of almost 10 years, the Coinbase company has gone public only recently - in April 2021. It chose the direct listing method (DPO) and skipped the Initial Public Offering phase, like Spotify, Slack, etc. As of July 2021, the company is the 268th most valuable company globally in terms of market capitalization with a market cap valuation of $65.99B, with each share costing $251.97.

So, if you are interested in buying Coinbase stock but don't know where to start, you will find all the necessary information in this article. It intends to introduce you to the company, its price history, and analyze the Coinbase market. We also have a step-by-step guide explaining how to buy Coinbase shares in the UK.

If you want to buy Coinbase shares quickly and easily, with 0% Commission, check out eToro Exchange!

Where to Buy Coinbase Shares in the UK

Coinbase is listed on the NASDAQ stock exchange under the ticker COIN. Still, you cannot buy stocks directly from stock exchanges so for this purpose, you must register for an account on an online brokerage platform in the UK, and your broker will take care of your trades.

Today, there are several online brokers offering different services with different price policies. As such, selecting a broker platform requires some research to find out what suits you best. After finding brokerage platforms that operate in the UK and support Coinbase, you should compare and select the one with lower trading and non-trading fees. Other factors to consider are safety, payment methods, trading tools, usability, etc.

Taking into account all these requirements, our research indicates that eToro is one of the best broker platforms to buy Coinbase stock in the UK.

eToro - Buy Coinbase Shares with Zero Commission

Your capital is at risk. Other fees may apply

Founded in 2006, eToro is one of the most famous trading platforms worldwide with more than 17 million registered users from over 100 countries. The platform supports trading various assets, including stocks and ETFs, cryptocurrencies, forex, indices, etc. There are over 800 available stocks on eToro, including those of such popular stock exchanges as NYSE, NASDAQ, Paris, Madrid, London, etc. And, the broker offers you to buy Coinbase shares.

One of the most significant advantages of eToro is that the platform does not charge any commissions for stock and ETF trading. It means that you don't need to pay any trading fees when you buy stocks and ETFs. For other types of trading, the platform charges low buy and sell spreads. Apart from buying shares outright, eToro also allows you to use contracts for differences. CFD trading is available on eToro with 5:1 leverage in the UK. It means that you need to meet a 20% margin requirement for buying one Coinbase share.

Another thing with which eToro stands out among other brokers is its social trading tools. eToro is the best social trading platform in the world. Here, you can have a personalized account, interact with other traders, participate in discussions and use its most famous trading tools - CopyPortfolios and CopyTrade. If you don't have enough time for research, you can use these tools to copy portfolios of experienced users or find an expert trader and mirror his trades with a click of a button.

Coming to its non-trading fees, eToro is one of the most cost-effective brokers. The platform doesn't charge monthly account fees and management fees. Using social trading tools is also free. However, eToro charges an inactivity fee of $10/month when you don't show any login activity in one year. Additionally, a small amount of withdrawal or conversion fee is also charged for non-USD contracts.

eToro can be accessible through a mobile app, but the platform also perfectly runs on a web browser. It's a very simple and quick process to register for an online account on eToro. After the registration, you must also verify your account as the broker is strongly regulated by tier-1 authorities. To assure safe trading on its platform, eToro is regulated by the FCA in the United Kingdom, ASIC in Australia, and CySEC in EU.

To start trading on eToro, you must have a minimum deposit of $200 on your account, which is around £145. To fund your account, you can use credit, debit card, bank transfer, or e-wallets, including Neteller, Skrill, and Paypal.

Should You Buy Coinbase Shares Right Now?

Coinbase Global incorporation is a remote-first-operated cryptocurrency exchange platform company founded in 2012 by Brian Armstrong and Fred Ehrsam. The platform allows trading Bitcoin and several other altcoins and provides market information and description for 50 cryptocurrencies. It's also possible to exchange, send and receive cryptocurrencies and to store your coins on Coinbase digital wallet.

In March 2018, Coinbase was listed as the largest cryptocurrency exchange platform in the US in terms of trading volume. Though Coinbase has several competitors in the market, it has many advantages that make the platform popular in the US and worldwide.

By and large, Coinbase has an excellent user experience. The platform is easy to use, accepts various funding options, and supports buying coins with fiat currency. Coinbase also offers a Coinbase Pro account which is best designed for advanced traders.

Above all this, Coinbase has a good reputation and is already trusted by several investors. The platform already has 56 million verified users, while more users registered during the first quarter of 2021 than during the last three quarters of 2020.

However, Coinbase's stock price started to drop soon after going public, and according to some analysts, the recent drop makes Coinbase's stock an attractive investment, especially in the case of Bitcoin and the crypto market will recover soon. So, Let's take a look at Coinbase's stock price history and discover the reasons why it is a good long-term investment right now.

Coinbase share price history

Coinbase went public on April 14 via a direct public offering. At that time, the company's stock was worth $328, and it reached its all-time record of $342 on April 16; after that, the prices started to drop dramatically. On May 6, Coinbase stock was trading at $256.70. Up to May 11, the stock showed a significant recovery increasing again above $300.

But this did not take too long, as the prices again fell below $300. And since then, there have not been any attempts to rise again above $250. On June 8, Coinbase stock hit its all-time low and was traded at $220, after which it started to slightly recover. At the time of writing, one Coinbase share is worth $244.

Coinbase stock price history

One of the main reasons Coinbase stock experiences decline for the first months of going public is selecting a direct listing method. In contrast to DPO, Initial public offering is a bank-banked method and limits the initial supply of shares. And this is not the first example in the market - there are other markets that went public via DPO and had similar experiences, including Asana, Palantir, etc.

The second reason can be associated with the decrease in the number of monthly transactions on the platform. Coinbase is a cryptocurrency exchange platform, so it charges fees for transactions. The company makes money from those fees, which are relatively higher compared to other similar exchanges. Consequently, the more transactions are conducted on the platform, the more profit it gets.

In general, there are two reasons for the decrease in the number of transactions on the Coinbase exchange - the increasing competition and the recent drop in the cryptocurrency market. More and more cryptocurrency trading platforms emerge nowadays, many of which offer more competitive prices. So, the competition rises, and Coinbase may lose many of its users. And, dropping prices of Bitcoin and altcoins also influence the number of MTUs and the value of transactions.

Read Also: Understanding the Market Value of a Company

Coinbase share price prediction

How will the Coinbase stock be worth in the future? No one can be entirely sure, but here are some of the predictions made by market analysts or unique algorithms.

According to the poll conducted by CNN Business among 19 market analysts for a 12 -month price forecast, the median target for Coinbase Global stock is $355. Per-share is valued at $650 as the maximum price and $225 as the minimum price. Meanwhile, 12 of those polled analysts recommend buying Coinbase stock, 4 of them recommend holding, while only one of them recommends selling.

Coinbase stock price predictions according to CNN Business poll

Another poll introduced on the platform Wallstreetzen indicates that the median price of Coinbase stock for a 12-month price forecast among 14 analysts is $366. The maximum and the minimum Coinbase prices are similar to those of the previous poll. 8 of them strongly recommend buying, 2 of them recommend buying, 3 recommend holding Coinbase stock, while only 1 recommends selling shares.

Coinbase stock buy and sell recommendations, according to Wallstreetzen poll

While these are the market predictions of Coinbase stock which are rather promising, we should also bear in mind that it's not the only thing to consider. We also need to pay attention to its potential to grow and be sure why Coinbase is worth buying. Below we will introduce some of the reasons to buy Coinbase stock.

Your capital is at risk. Other fees may apply

4 Reasons to Consider Buying Coinbase Stock

Coinbase plays a major role in the cryptocurrency ecosystem

The Coinbase platform has gained a good reputation in the United States and is known as one of the best-decentralized exchanges to buy Bitcoin, Ethereum, and 50 other cryptocurrencies. These digital assets became more accessible to the public due to Coinbase.

Coinbase will recover its profitability when Bitcoin prices rise

As we already mentioned above, Coinbase makes money from the transaction fees. So, every time people buy or sell Bitcoin or other cryptocurrencies, the platform charges a small percentage of funds from the user.

Consequently, if many people make transactions, more money will be charged, and profitability will increase. But the cryptocurrency market is down at the moment, which results in fewer people making fewer transactions. If the prices of Bitcoin and other popular altcoins recover after this crash, the amount of monthly transacting users will also increase, bringing more revenue and profitability to the exchange.

Coinbase Pro and other tools

Coinbase stands out among other cryptocurrency exchange platforms with its tools and interface. Though fees are comparatively higher than other platforms, it has a lot to offer its users. Firstly, there are two account types - the standard one and Coinbase Pro. The standard account is elementary to use and is designed mainly for newbies in the field. It's a straightforward process to open an account and buy your first coins. Coinbase Pro is equipped with more powerful tools and market resources. It's for experienced traders and has less expensive fees.

Coinbase is a fully regulated and licensed broker

Users can enjoy safe trading on the platform. As a matter of fact, it is one of the few regulated and licensed crypto exchange platforms in the world. In addition, Coinbase also has a mobile app that is suited for both iOs and Android users. It can be easily downloaded and installed on your phone.

Does Coinbase Pay Dividends?

Companies that pay dividends distribute a small amount of money from their earnings to their stockholders. You cannot make too much money with just dividends, but companies with dividends are a great plus anyway. In this case, you make money just by holding their stocks.

As for Coinbase, the company never paid or declared dividends to its stockholders. As mentioned on Coinbase's website, in the section of frequently asked questions, for now, the company does not intend to pay any dividends in the future.

What Are the Risks of Buying Coinbase Shares?

Clearly, the primary risk associated with buying stocks is losing your money. Investing in a stock isn't an easy game, and if you don't want to lose at the end of the day, you had better do careful research before making your final decision. It's crucial to know all the pros and cons of the company you plan to invest in and be aware of its ability to increase or decrease prices. So, never put your capital in a random stock, and if you do so, be ready to lose it.

Another risk associated with Coinbase stock can be the competition. The number of cryptocurrency exchange platforms is growing rapidly. Even though Coinbase enjoys a good reputation among investors, other platforms can emerge with more competitive fees and better services.

How to Buy Coinbase Shares - A Full Step by Step Guide

Now, when you are familiar with Coinbase, its share price history, and made a firm decision to buy Coinbase shares, let’s go through the step-by-step guide to learn how to buy Coinbase stock in the UK. We will show you the whole process with eToro.

1. Open an Account and Verify Your ID

You do not need to spend too much time registering for an online account on eToro as the process is simple and straightforward. For this purpose, you need to visit its website, click on the "Join Now" button, and fill in the necessary information. Firstly, you need to provide your username, email and create a password. After this, you need to finish the registration process. Click on the button "Complete Profile" near your avatar and continue the registration process.

You must provide some personal information in this phase, including your name, surname, date of birth, address, etc. Be careful while filling in these sections; as long as later you will confirm your identity with your passport, so you need to write it right.

When you provide your personal information, eToro will also ask some questions about your investment goals, experience, etc., to more clearly understand what type of trader you are. Next, you must verify your profile with a phone number.

As long as eToro is regulated by tier-1 authorities, all the customers on the platform also must verify their accounts. So, after providing all the necessary information about your identity, you need to go through the Know your customer phase to start trading. For the verification process, eToro requires Proof of Address and Proof of Identity. The documents you must provide to prove your address can be a utility bill or a bank statement, while to verify your identity, you must provide a copy of your passport or driver's license.

It usually takes three business days to get verified on eToro, but it can be even earlier. When you get your account verified, you can continue with the next step.

2. Deposit Funds

To start trading on eToro with a verified account, you must transfer some funds to buy stocks and meet the minimum deposit eToro requires. For this purpose, you must link your credit or debit card to your eToro account and transfer funds, or you use a bank transfer method.

E-wallets like Skrill, Neteller, and Paypal are also acceptable. Take into account that eToro requires a minimum deposit of $200 (around £140) to allow you to trade on its platform. As for any other fees related to funding, eToro charges withdrawal and conversion fees for non-USD contracts as all the transactions on the platform are conducted with USD.

3. Buy Coinbase Shares

When you have a verified account and deposited money on it, you can start buying Coinbase stock. You can begin exploring eToro to find out what tools it offers, what educational content can be helpful for you, etc. You can make use of its social trading tools, communicate with other investors too, or take a look at their portfolios.

Finally, when you are ready to place an order, you can start the buying process. It's also essential that you have a trading strategy if you are not copying the trades of other investors. Trading strategies can be of two kinds - active and passive. Active requires that you always keep an eye on the market, be careful with the market movements, etc. Passive strategies, on the other hand, do not require too much attention on the market. These are mainly for retail investors, who buy stocks and hold them for a long time with the intention that the prices will go up in the future and they can profit from it.

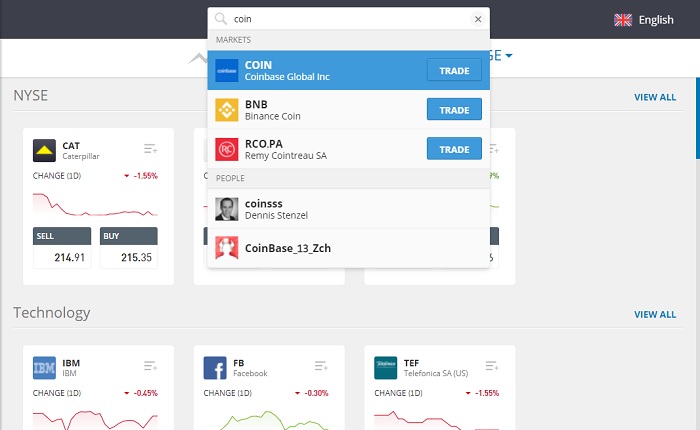

After you have decided how to trade, you can search for Coinbase in the search toolbar. Then click on the first result, and a window will open up in front of you. Here you must fill in how many shares you want to get (remember that you can also get fractional shares on eToro) and finally click the buy button. If the market is open, your order will be completed immediately.

However, if you are trading during the non-trading hours, you will see the "Set Order" button instead of the "Buy" button. No need to worry; just click on the "Set Order," and your broker will take care so that your order is completed when the market opens.

You can also tell your broker to buy stocks at the price you want by choosing to get execution through a limit market order. If the prices fall down to that point during the trading day, the order will be completed, and you will see the number of shares on your account.

Your capital is at risk. Other fees may apply

How to Short Sell Coinbase Shares in the UK

Besides buying and holding Coinbase stock, you can also short sell the shares if you believe that the prices will decline in the future. To start with, make sure that the broker platform you have chosen for trading allows short selling. For example, you can short sell on eToro using Contracts for Differences or CFDs.

In this case, you and your broker make a contract and agree on the terms beforehand. You borrow a particular amount of shares from the broker and sell it immediately in the market. When the prices fall, you buy shares that you borrowed from your broker at a lower price and return them to your broker. Short selling is an exciting strategy to use, and it essentially enabless to trade in both directions.

Final Thoughts - Buying Coinbase Shares UK

In a nutshell, Coinbase is one of the well-known cryptocurrency exchange platforms globally with an excellent reputation among traders. This digital asset exchange offers a simple interface for its beginner users, and the Coinbase Pro account for experienced traders. The platform also has good educational content, trading tools, and a personal crypto wallet.

Coinbase went public in April, and the prices dropped significantly from the initial value and currently, it seems to be trading at a good value if you are looking to get exposure to bitcoin and to crypto-related assets.

So, if you want to buy Coinbase stock, you should have an account on a brokerage platform, verify it and start buying Coinbase stock in the UK. If you are ready to buy Coinbase stock, you can visit the eToro website and return to our guide to learn how to buy Coinbase shares online in the UK.

eToro - Buy Coinbase Shares with 0% Commission

eToro have proven themselves trustworthy within the stock market over many years – we recommend you try them out.

Your capital is at risk. Other fees may apply

FAQs How to Buy Coinbase Shares in the UK

What was the Coinbase IPO price?

There are two ways for the companies to go public - initial public offering (IPO) and direct public offering or direct listing (DPO). In the first case, the company is backed by a bank that underwrites new shares for the company. Later, the company offers those shares to the public. It's a more expensive way to go public and involves lots of bank fees. The direct listing method is much cheaper, as no shares are needed to create. Coinbase went public via DPO, not IPO, thus being the first major DPO company on NASDAQ. The reference price that NASDAQ gave Coinbase was $250 per share.

What is the highest Coinbase stock has ever been?

Coinbase hit its all-time high level on April 16, 2021, when it was trading at $342 per share.

Is Coinbase stock currently overvalued?

Well, right now it is not very clear if Coinbase stock is overvalued or undervalued. According to some market analysts, Coinbase stock was overvalued from the first minute it was listed due to the high market valuation of $85 billion. At the same time, other investors and analysts believe that Coinbase is a big deal in the crypto market and in the financial world, in general. It would also be fair to say that some people see Coinbase as a revolutionary phenomenon that can have the same buzz as Tesla and other popular tech stocks.

Is Coinbase profitable?

Unlike many other high-growth companies that go public without any profitability, Coinbase is already a profitable company. During the first three months of 2021, Coinbase made a revenue of $1.8 billion and profits of $771 million, a huge increase from the $32 million in the previous year.