If you want maximum profit and minimum risk from cryptocurrency trading, you should know how to identify a market trend. Trend traders tend to be more profitable than counter-trend traders, and the cryptocurrency market is no exception. Therefore, learning how to identify a price trend is crucial for all traders.

If you don’t know how to identify a market trend in cryptocurrency, we have good news for you. Because in the following article, we will show you how to anticipate price movements based on a price trend.

In financial trading, no one knows what will happen next. However, in the stock market, there is a central exchange where the majority of trading happens. This allows stock traders to see trading volume that may help them anticipate price movements.

But, what about the cryptocurrency market?

The cryptocurrency market is a decentralized market where future prices depend on the activities of buyers and sellers. Moreover, blockchain technology ensures that there are no middlemen between buyers and sellers who know how much money investors hold. However, the nature of cryptocurrency price trends are the same as any other market.

Before we go on to how to identify a trend, let’s first look at what it means by trend:

What Is A Cryptocurrency Market Trend?

A cryptocurrency trend is the perceived direction of price movements over a particular period. ‘Trend’ and ‘range’ are common terms in the financial market where trend means following a specific price direction.

In a downtrend (bearish trend), prices move lower by creating lower lows in the chart, indicating that sellers are stronger than buyers.

Similarly, in an uptrend (bullish trend), price moves up by creating higher highs where buyers are stronger than sellers.

In the above illustration, we can see two market trends where higher highs and lower lows are marked.

Identifying trends is one of the reliable ways to conduct technical analysis. There is a saying that “trend is your friend,” which means that trading strategies that work with price trends tend to be more profitable.

Cryptocurrency market trends are similar to other financial markets, where it is best to buy when the market is trending upwards and sell when the market starts to trend downwards.

There are many ways to forecast the price of cryptocurrency, and in the following section we will discuss the most reliable methods to determine cryptocurrency market trends.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

How To Identify Cryptocurrency Market Trends

Trend analysis is at the core of making investment decisions. It increases the possibility of making a profit when you enter a trade if the price is trending.

Like other financial markets, cryptocurrency price moves like a zigzag where there is a bullish correction within a bearish move and a bearish correction within a bullish move. Therefore, we can easily anticipate the price based on cryptocurrency trend analysis:

Identify Cryptocurrency Trends Using Ichimoku Cloud

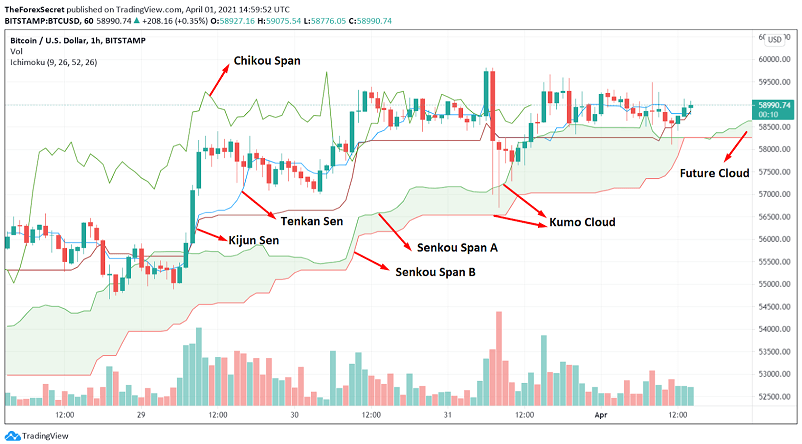

Ichimoku Cloud or Ichimoku Kinko Hyo is a technical indicator with multiple elements that shows the clear direction of an asset’s price. Let’s get familiar with Ichimoku Cloud elements:

- TenKan Sen: This is the average price of the last nine candles, high and low. It shows short-term price sentiment.

- Kijun Sen: The average price of the last 26 candles, high and low. It shows medium-term price sentiment.

- Kumo Cloud: The combination of Senkou Span A and Senkou Span B. This area is considered a strong price reversal zone.

Chikou Span: A lagging span that shows the current price in a line chart but 26 periods earlier. If the Chikou Span is above the Kumo Cloud, the market sentiment is bullish. Similarly, if the Chikou Span is below the Kumo Cloud, the current market sentiment is bearish.

Here we can see the visual representation of how to identify a price trend using Ichimoku Cloud.

Now we will see the exact way to identify the uptrend using Ichimoku Kinko Hyo:

- Step 1: The price is above the Kumo Cloud, indicating that the long-term market is bullish.

- Step 2: Tenkan Sen is above the Kijun Sen, pointing out that the short-term trend is bullish.

- Step 3: Chikou Span is above the Kumo Cloud and facing no barrier from the price.

- Step 4: In the Future Cloud, Senkou Span A is above the Senkou Span B.

We can consider the trend as an uptrend only when these four conditions are met. Now look at the image below:

Here we can see the H4 chart of BTC/USD where all conditions for an uptrend have been met. Moreover, the price faces dynamic support from the Kijun Sen, suggesting further possible bullish pressure on the price.

Now, let’s have a look at how we can identify a downtrend using the Ichimoku Kinko Hyo:

- Step 1: The price is below the Kumo Cloud, indicating that the long-term market is bearish.

- Step 2: Tenkan Sen is below the Kijun Sen, pointing out that the short-term trend is bearish.

- Step 3: Chikou Span is below the Kumo Cloud and facing no barrier from the price.

- Step 4: In the Future Cloud, Senkou Span B is above the Senkou Span A.

Here is a visual representation of a downtrend identified by the Ichimoku Cloud:

Identifying Cryptocurrency Trends Using The Golden Cross

The golden cross happens when a short-term moving average crosses above the long-term moving average.

In the golden cross system, the most reliable moving average values are:

- 50 EMA (short-term)

- 200 SMA (long-term)

The price should be above the 200 SMA and 50 EMA in an uptrend, pointing out that both short-term and long-term traders are bullish. Later on, when the 50 EMA crosses above the 200 SMA, it indicates further bullishness in the price. Therefore, when a golden cross occurs, we can consider the trend as an uptrend and look to buy.

Here is a visual representation of a golden cross in the crypto market:

While the golden cross is a way to identify an uptrend, the opposite of the golden cross is the ‘death cross’ which indicates a downtrend.

The image above is from a H1 chart of ETH/USD where the price moved lower as soon as the death cross appeared.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Identifying Cryptocurrency Trends Using Multi-Timeframe Analysis

The main aim of this method is to get a macro view of a cryptocurrency’s price from higher time frames. Later on, you can zoom in on the price and identify the price trend based on important support and resistance levels.

Let’s have a look at the step-by-step approach to identifying a cryptocurrency market trend using multi-timeframe analysis:

#1 Identify Key Levels

Key levels are where prices can start a new trend. We can easily spot key levels by watching the market on a higher timeframe. When the price approaches a key level, we usually expect it to rebound. On the other hand, when a key level is broken, we may expect the trend to expand.

When the price moves above key support levels, you can buy. Conversely, when the price moves lower from key resistance levels, you should sell.

In the above image, we can see the BTC/USD daily chart with key support and resistance levels from where significant moves are expected.

#2 Identify Near-Term Event Level

After identifying a long-term trend, you should focus on short-term trends and when both short-term and long-term trends show the same direction, consider the trend as strong.

First, you must identify that the price will move higher than the current key support level and identify the near-term event level, which is a price zone that works as both a support and resistance level.

When the price breaks above the near-term event level, you can consider the trend as a bullish trend as shown in the image below:

Conversely, in a downtrend, you must identify the price as moving lower than the key resistance level. Then, if the price breaks below the event level, you can consider it a downtrend.

We can see how the price moved lower by breaking below the event level with impulsive bearish pressure in the above image.

However, to get the most from trend trading, you should have a profitable trading strategy with good money management rules too.

Conclusion: How To Make Trading Decisions Based On Trends

If you can understand how to spot cryptocurrency market trends, you can easily make money from them. However, to truly be profitable, you need to buy and sell cryptocurrency with a systematic approach.

You should also have a trading strategy that finds buying and selling points and place stop losses and take profit orders at appropriate levels. However, even if you follow all the trading rules, some risks are unavoidable. Finding a sustainable trading strategy is the only way to last in crypto trading for the long run.

eToro – The Best Platform To Buy Cryptos

eToro have proven themselves trustworthy within the Crypto industry over many years – we recommend you try them out.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.