LTC Price Forecast for 2021

We’ll be sharing the top Experts predictions for Litecoin in 2021.

Read our Litecoin LTC Price Analysis in 2021

Developed by Litecoin MIT graduate and former Google engineer Charlie Lee, Litecoin was initially touted as the silver to Bitcoin’s gold and sought to address perceived scalability and functionality flaws in the original cryptocurrency by utilising Scrypt as a proof of work scheme and offering much faster block creation time, as well as a much higher cap on the total supply of Litecoin tokens.

The formula appears to have been a success. Whilst Litecoin is still a long way behind its predecessor in terms of token value, the altcoin has well and truly established itself in the industry and at the time of writing was the fifth-largest cryptocurrency by market capitalisation, which stood at over $10.3 billion.

Looking ahead, Litecoin presents an interesting opportunity for investors. After a somewhat lacklustre 2020 - even factoring in the COVID-19 pandemic - the altcoin experienced a surge in value going into November and the bull run appears to be continuing into 2021. Of course, most cryptocurrencies are experiencing good fortunes of late, but the price of Litecoin more or less tripled between September and December last year.

So how long can we expect this run to last? Our Litecoin price analysis for 2021 aims to shed some light on the altcoin’s recent fortunes and finds out what some of the industry’s leading analysts are predicting for the year ahead.

If you want to buy LTC quickly and easily, check out eToro Exchange!

Contents

History of Litecoin Price Movement

Experts predictions for Litecoin in 2021

Factors affecting Litecoin price

Litecoin price analysis for 2021

Should you invest in Litecoin in 2021?

Litecoin Price Analysis 2021: Conclusion

Litecoin price analysis 2021 - FAQ

Litecoin - An Overview

To assess whether Litecoin is a good investment, any reliable Litecoin price analysis for 2021 should start with an overview of the technology behind the cryptocurrency and how it differs from other major coins on the market.

Litecoin was launched in 2011, designed by former Google engineer Charlie “Satoshi Lite” Lee. Mr Lee himself has been something of a divisive figure in the cryptocurrency space - gaining further notoriety when he sold off his Litecoin holdings when prices were at their peak. Mr Lee maintained that the move was done to alleviate a potential conflict of interest. He has also always insisted that Litecoin was never intended to compete with Bitcoin, but was instead to be used as a peer-to-peer payments system for small-scale transactions - a factor which any Litecoin price analysis for 2021 should make note of.

Litecoin’s code is directly descended from that of Bitcoin, so inevitably there are many similarities between the two cryptocurrencies. One notable similarity is that both use the Proof of Work protocol, meaning that the way BTC and LTC are mined is - on the surface at least - very similar. However, where Bitcoin relies on the SHA-256 algorithm, Litecoin makes use of the more recently developed algorithm, Scrypt. Another substantial difference between Litecoin and Bitcoin is block creation time. Litecoin takes just 2.5 minutes to generate a block - substantially faster than the ten minutes it takes the Bitcoin blockchain. Litecoin can also accommodate a total of 84 million coins, compared to the Bitcoin cap of 21 million.

So Litecoin can produce a greater number of coins than Bitcoin and its transaction speed is faster, which on paper should give the latter a solid advantage. However, these factors are largely psychological when it comes to investment and have value or usability advantages in the real world. However, it is important to note these differences for our Litecoin price analysis for 2021, as understanding them is key to identify the relationship between BTC and LTC price movements.

History of Litecoin Price Movement

When it comes to making a Litecoin price analysis for 2021 the only concrete information we have to review is the token’s previous price movement. By looking at this, we can sometimes build a picture of how Litecoin will respond to certain market pressures and start to form a realistic prediction as to its price growth potential.

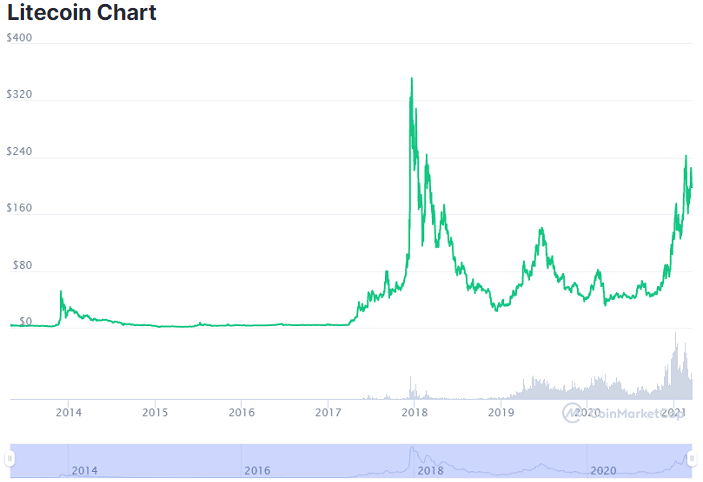

Like most cryptocurrencies, Litecoin started life worth very little. In fact, between 2011 and 2013 there was very little movement and the most interesting thing that happened during this period was when LTC reached parity with the US dollar. However, by 2013 Litecoin - and cryptocurrency in general - had really begun to capture the public imagination and in November of that year, the price of Litecoin suddenly surged to over $38. This was a short-lived phenomenon however and LTC went into protracted decline across 2014, sinking back below $3 by the end of the year. From 2015 onwards, there was very little excitement with Litecoin and prices gradually crept up from a low of under $2 to somewhere around the $4 mark by March 2017.

This year was a good one for Litecoin. Prices steadily increased in the first half of the year and come august LTC was trading at over $72 per token. However, it was in November when things really started to get interesting. Having climbed to around $90, LTC suddenly surged and reached $237 by December. This was thanks to a combination of factors, including, inevitably, the growth of Bitcoin, increased investor understanding of Litecoin and something of Charlie Lee’s increased media presence.

Naturally, this unprecedented spike drew a lot of attention and, whilst the price of LTC soon went fell significantly - down to around $12 by March 2018 and dropping again to $33 by August - LTC has consistently traded at much higher prices ever since the 2017 spike. Things reached a low ebb at the beginning of 2019, with LTC hovering around $30 but a bull in June saw prices soar to $133. Litecoin then declined further, dropping as low as $42 by the end of the year.

With two significant spikes in its history leading up to 2020, many investors believe we can expect similar movement in future. Of course, 2020 prices were hugely affected by the COVID-19 pandemic, but as we shall see in the next section of our Litecoin price analysis for 2021, LTC had a somewhat different experience of the crisis than many other cryptocurrencies.

Litecoin price analysis 2020

The COVID-19 pandemic was, to say the least, an unexpected event for the financial markets. As such, we can hardly use the price performance over the last twelve months to make a Litecoin price analysis for 2021. However, it’s still important to look at how the altcoin weathered the storm, as well as its recovery since the crisis began.

Litecoin started 2020 on a low ebb. The token was trading at a high of $68 in January, before continuing to steadily decline until reaching a two-year low of $39 in March. However, here is where things get a little interesting, as Litecoin was already on an upward trajectory come April, whereas most other cryptocurrencies were still reeling from the effects of the COVID-19 pandemic on the markets. Prices had crept up, albeit indirectly, to $63 by August before dropping back to $45 the following month. However, from October, Litecoin has been impressively bullish and prices had soared to $129 by December - a price surge that has certainly generated investor interest as we head into 2021.

Would You Consider Investing In Litecoin?

Experts predictions for Litecoin in 2021

To come up with a Litecoin price analysis for 2021 that’s worth reading, it’s important to get information from as many sources as possible. With this in mind, what follows are the opinions of some key crypto industry figures on what they feel the near future holds for Litecoin price.

John McAfee

John McAfee is a major investor in alternative markets and an unabashed proponent of cryptocurrencies. As such, his predictions, analyses and investments often have a knock-on effect for the real-world crypto cryptocurrencies.

Whilst Mr McAfee hasn’t made a full Litecoin price analysis for 2021, he has been quoted as saying that Litecoin has not had the growth in value that it should have. He also made the bold claim that Litecoin has the potential to out-perform Bitcoin when it comes to value increase. Mr McAfee has previously made predictions for Bitcoin which panned out, so there’s every chance he is worth listening to with regards to Litecoin.

George Tung

George Tung is a respected cryptocurrency analyst, who has made a pretty bold Litecoin price analysis for 2021. He believes that Litecoin price has a very real chance of reaching $1500 by the very end of 2021 - which would be an increase of over 800% on the price at the time of writing. Admittedly, this is arguably the most optimistic outlook we have found for Litecoin, but George Tung has been lauded for his insights on numerous occasions.

Dan Gambardello

Dan Gambardello is another keen promoter of cryptocurrencies and is often bullish on Bitcoin and Litecoin. Gambardello was one of the few people who accurately predicted Litecoin’s meteoric rise to almost $250 back in 2017. What’s more, he made this call when the token was still trading below $5. Looking ahead, Gambardello has also been very optimistic regarding his Litecoin price analysis for 2021 - he believes that Litecoin price has the potential to reach $1,000 by 2021.

Charlie Lee

Admittedly, this is a somewhat biased source, but Charlie Lee, the creator of Litecoin, has recently hit back at critics following the December bull run. Mr Lee said that LTC has high liquidity on every exchange and pointed out that it will soon have access to 350 million PayPal users and continues to deliver on its promise of low fees and fast transactions. He was also keen to point out that the LTC blockchain enjoyed nine years with zero downtime. The sentiment here is that Litecoin is deserving of its recent price spike and continues to have relevant real-world application that could positively affect prices moving forward.

Ryan Selkis

Of course, not everyone is bullish on Litecoin and Ryan Selkis, the CEO of Messari didn’t pull any punches when setting out his Litecoin price analysis for 2021. He didn’t hold back, describing LTC as a “pile of s***” – going on to claim that Litecoin is little more than a testnet for Bitcoin. He arrived at this conclusion due to the Litecoin blockchain testing major upgrades such as SegWit, lightning and sidechains before they were rolled out on the BTC network.

Factors affecting Litecoin price

1. Bitcoin

The price of Bitcoin always has a knock-on effect for the rest of the cryptocurrency market. Not only is BTC by far the largest cryptocurrency, it also operates as a kind of reserve currency for crypto trading on numerous large-scale exchanges. As such, the price of BTC is a major indicator as to the health of the crypto market in general. Another factor that makes Bitcoin relevant to a Litecoin price analysis for 2021, is that both BTC and LTC have similar real-world applications.

Despite Charlie Lee insisting that Litecoin was not intended to compete with its predecessor, any inroads Bitcoin makes into being a viable peer-to-peer payment method for smaller transactions could diminish LTC’s value in a practical sense, which will, in turn, affect its potential for price growth.

2. Regulations related to cryptocurrency

Anyone serious about investing in cryptocurrency will need to keep abreast of the latest regulatory changes around the world. Nowhere has this been more apparent than with the SEC ruling that hit Ripple in December 2020, wherein the U.S. Securities and Exchange Commission ruled that the Ripple network’s native token, XRP, was a tradable security rather than a currency.

This change instantly affected how XRP could be traded in the US and saw the token’s price drop by almost 50% in just a few days. Of particular relevance to this Litecoin price analysis for 2021 to consider, is the impending EU regulatory changes, which were outlined towards the end of 2020 and due to come into effect - to some extent - over the next 12 months.

3. Retail Support

Litecoin was set up to offer an alternative peer-to-peer payments platform for smaller transactions. Of course, for this intention to be realised, Litecoin must have adequate support from retail and commerce outlets around the globe.

An important development for our Litecoin price analysis 2021 was the news that PayPal has included LTC in its list of supported cryptos. As Charlie Lee noted, this means an additional 350 million people can easily buy and spend Litecoin via the popular payment platform.

4. Buyer demand

The price of any financial asset is dictated by supply and demand - and cryptocurrencies are no exception. Whilst investors have very mixed opinions regarding Litecoin, it does have several prominent supporters in the industry and has recently shown that there is plenty of demand out there.

The substantial rise that LTC experienced in December 2020 will attract plenty of investor interest and there is every chance that Litecoin will experience a further surge in demand off the back of this, as we head further into 2021.

Read More: What Will Drive Litecoin Price in 2021?

Litecoin price analysis for 2021

No Litecoin price analysis for 2021 can tell you exactly how the altcoin will perform in the coming year. Even past performance does not give us a lot to go on, as Litecoin, more than any other major crypto, has experienced short, steep price spikes that many analysts have been at a loss to predict with any accuracy.

If, for example, we look at technical analysis from TradingBeasts, we can see that their Litecoin price analysis for 2021 has limited range: The average price for the first three months of the year barely changes, but the platform forecasts LTC to rise steadily from $143 to around $165 by the end of 2021.

Whilst time will tell how accurate this prediction is, it is plain to see that this trajectory does not match the historic price movement of Litecoin. So can we expect an LTC price surge at some point in 2021? Well, DigitalCoinPrice has suggested just that. Analysts at the site believe that the altcoin surge by 26% in January alone and will break $220 by early summer. Its analysis sees Litecoin close the year at around $217 in December.

Should you invest in Litecoin in 2021?

Many crypto experts had reservations about Litecoin heading into 2020 and there were several credible platforms and industry voices predicting that the altcoin was unlikely to perform well in the near future. However, as we have seen, the price of LTC surged at the end of 2020, prompting renewed interest from investors.

Whilst Litecoin still has its detractors, ultimately most platforms are predicting growth for the coming twelve months. How much growth varies from platform to platform, but our Litecoin price analysis for 2021 believes that LTC could be a good investment if you manage your expectations.

Of course, the token may break into four-digit figures as some experts have speculated, but serious investors should align their expectations with the predictions of platforms like TradingBeasts and DigitalCoinPrice, with LTC making small but sustainable gains across the next 12 months.

Ready To Invest In Litecoin?

Litecoin Price Analysis 2021: Conclusion

Litecoin had a very bullish end to 2020, forcing many reputable crypto analysts to reassess their predictions for LTC in 2021. The next 12 months are expected to be very positive for the crypto markets and Litecoin has shown that it is still very much up there with the big players. Whilst our Litecoin price analysis for 2021 should only be used as a guide and not a substitute for independent research, we have found that there is every reason to expect growth from Litecoin in the coming year.

If you’re looking to invest in the altcoin, then it would be advisable to act quickly, as most analysts are speculating that the most significant LTC price growth will occur in the first half of 2021. However, as always, cryptocurrencies are very unpredictable and you should only invest in Litecoin as part of a diversified portfolio.

eToro – Best Broker to Buy LTC

eToro have proven themselves trustworthy within the crypto industry over many years – we recommend you try them out.

Virtual currencies are highly volatile. Your capital is at risk.

Litecoin price analysis 2021 - FAQ

Will Litecoin keep rising in 2021?

Litecoin experienced impressive price growth in December 2020 and this continued into January. Our Litecoin price analysis for 2021 subsequently found that many analysts had reappraised LTC’s potential for the year ahead, with many predicting stronger growth than initially expected. How long Litecoin’s bull run will last remains to be seen, but there’s every chance the altcoin will perform well in 2021.

How will Litecoin perform in 2021?

We conducted a Litecoin price analysis for 2021 and found that there are a few reasons to believe next year will be a positive one for the altcoin. Whilst prices may not reach the huge figures seen with BTC, savvy investors may find that adding LTC to their portfolios is a worthwhile move.

What are the experts predicting for Litecoin in 2021?

Expert opinions are somewhat split with regards to a Litecoin price analysis for 2021. However, the general consensus is that LTC will experience growth fairly consistently. Whilst analyst George Tung may be slightly optimistic with his prediction of $1500, many reputable platforms see LTC reaching a very believable $200 - $220 by December 2021.

Is now a good time to invest in Litecoin?

Our Litecoin price analysis for 2021 noted that the altcoin has experienced changing fortunes in recent months, with many experts predicting huge growth in the first half of 2021. As such, investors looking to add LTC to their portfolios should probably look at moving sooner rather than later.

Where can I buy Litecoin?

If our Litecoin price analysis for 2021 has piqued your interest but you are unsure as to where you can buy cryptocurrency, we recommend a reputable trading platform, such as eToro, where you will not only have access to the crypto markets, but also forex and other financial instruments. There are also plenty of learning materials for those new to trading and investment.

Is Litecoin a better investment than Bitcoin?

Litecoin was developed as ‘silver’ to Bitcoin’s ‘gold’. Whilst the latter is a far, far bigger cryptocurrency in terms of market cap and coin value, LTC should not be dismissed. After all, it’s comparatively low price means investors can acquire more tokens with a smaller financial commitment. What’s more, many investors prefer to HODL their BTC, which makes LTC a good Alternative for shorter investment strategies.

Read More about Litecoin:

What Is Litecoin and Is It Worth Investing in LTC in 2021?

Is Litecoin a Good Investment and Should I Invest in Litecoin?

How to Buy Litecoin - Beginner’s Guide 2021

Pros and Cons of Investing in Litecoin, Will It Be a Millionaire Maker?