Planning to invest in stocks in 2021? Want to stay ahead of the stock trends? Then you’re probably asking yourself:

“What stocks should you invest in in 2021? Will 2021 be a good year to invest in stocks? Which stocks will be the best return on investment in 2021? What can we expect from the stock market in 2021?”

Let’s take a look!

2020 was a pretty anxious year for the stock market and many of us are longing to find out what 2021 might hold.

We’ve made it easy with our complete guide to the top 15 stocks to invest in for 2021.

Beginners have difficulties finding the best stocks in 2021. We’ve all been in this situation, so don’t worry! We understand how confusing it is when looking for new stock investments.

If you look back to articles on ‘stocks to invest in 2020’, no one could have predicted that the worst pandemic in 100 years would blow all our expectations to dust.

The future of the stock market is never certain, so making stock predictions can be tricky - especially since the periods of volatility in the wake of the coronavirus pandemic.

However, the good news is that some stock experts have said 2021 could be the year of the stock market.

And now looking forward to what remains of 2021, it’s impossible to ignore the fact that things have changed a lot. Albeit, perhaps not as terrifying as we initially thought.

In this article, we’ll look at potentially some of the top 15 stocks that could explode in 2021! As well as why they’re important and what gives them value.

Top 15 Stocks to consider in 2021

Before we take a closer look at the best stocks in 2021, here are our top 15 picks:

- Tesla (TSLA)

- Castle Biosciences (CSTL)

- Zoom (ZM)

- Netflix (NFLX)

- Disney (DIS)

- Nvidia (NVDA)

- PayPal (PYPL)

- ServiceNow (NOW)

- eBay (EBAY)

- Alphabet (GOOG)

- Facebook (FB)

- Nucor (NUE)

- Amazon (AMZN)

- Apple (AAPL)

- Microsoft (MSFT)

You can buy all of these top stocks, as well as many others, with eToro and pay 0% fees!

Will Stocks in 2021 Be Impacted By The Coronavirus?

The coronavirus is the elephant in the room. We can’t afford to not talk about it when discussing the state of the stock market of 2021.

It’s a discussion that needs to happen, no matter how often you keep hearing it, no matter how sick your ears are of that cursed word.

Experts are predicting that the coronavirus will likely continue well into late 2021, which means we may have a very rough 2020/2021 winter (especially if we see more lockdowns!). And then there’s the possibility that we might still be dealing with it in early 2022 as well.

Daily new coronavirus cases. Source: worldometers.info

But there’s an important illusion you need to clear from your mind - you need to stop thinking of the coronavirus as a bad thing and start thinking about it as something that is happening, an event. It is now a certainty.

The best stocks traders don’t worry about if the market is doing amazingly or is doing badly, what matters is if there is something to trade, a direction to follow along to.

The biggest change is that you, as a stock trader, will have to adapt your approach to trading in 2021 to make sure to steer away from stocks that might be unpredictable in 2021 and focus on the rising stars.

So, you need to have the dreaded virus at the forefront of your mind whatever stock you decide to trade in 2021.

That said, you should also have the opposite in mind as well. Though the chances are a lot slimmer, you should also prepare yourself for what will come after the coronavirus as well (more on that at the end!).

Top 15 stocks to explode in 2021!

Here’s our list of the top 15 stocks to explode in 2021! Keep an eye out for them! They may do exceptionally well next year.

You will see A LOT of websites when you type into Google what stocks to buy in 2021, and it is quite interesting to notice that not many of them have the same choices.

That can be down to a lot of reasons.

Potentially they view the situation very differently, they have different info, know more or less about certain industries, and then there are some that have actually bought the stocks they are pushing online (at Trading Education, we would never do this! Totally unethical!).

So, you really need to be careful with what you want to trade. Don’t focus too much on people’s advice, look at the charts and come to your own conclusions!

Let’s move on! Here are Trading Education’s top 15 stocks to explode in 2021!

1. Tesla (TSLA) - There’s No Stopping The Cars Of The Future!

Tesla must be one of the coolest stocks to own in the last few years. It really has brought people closer to the possibility of owning a functioning electric car, making it our first entry on our list of top 15 stocks ready to explode in 2021.

Tesla stock price, July 2020 to July 2021. Source: google.com

Is Now A Good Time To Buy Tesla Stock?

Tesla made the very idea of an electric car a ‘cool’ concept, whereas before it just didn’t have the same appeal.

That appeal is partly down to Elon Musk who is also the CEO of SpaceX and the founder of The Boring Company.

But aside from popularity, Tesla has proven it can meet production goals as well. A few years ago, Musk said they planned on producing up to 500,000 by 2020 and many thought this was not possible.

Well, actually Tesla missed the mark, but only by 450 cars. And all this happened during the coronavirus pandemic!

So, it is largely accepted that they definitely would have smashed that record if they didn’t have to close up for a while.

This accomplishment shows that Tesla is beyond an idea and is now a reality. It is now very possible that they are about to transform the car industry.

Is Tesla A High Risk Stock?

Stock traders who trade Tesla though need to be very careful of Elon Musk, whose erratic behaviour has gotten them into trouble a number of times.

He is a big Twitter user and every time he Tweets something controversial, there is always the chance that it could hurt Tesla’s price.

In fact, back in May 2020, one of Musk’s tweets cost the company $14 billion, after he wrote “Tesla stock price too high imo”.

And if we look back to 2018, Musk and Tesla were both fined $20 million each by the US Securities and Exchange Commission for a misleading tweet about taking the company public.

Musk also put his employees under a lot of pressure to return to work in California while the coronavirus was still rampaging on, reopening the factory despite an order prohibiting it.

The situation leaves us with several questions. What other rules are they willing to break to succeed? And how could the stressful working conditions result in a decline in quality?

Should I Hold Tesla Stock?

Despite the risks, Tesla is largely surging, reaching its peak in January 2021 before making a slight decline in February.

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $67.00 | $1,471 |

| Gov Capital | $554.27735 | $958.08455 |

| WalletInvestor | $589.618 | $874.152 |

| WallStreetZen | $137.00 | $1,200 |

Have you considered buying Tesla (TSLA) stock?

2. Castle Biosciences (CSTL) - Getting Ready For Some Major Growth?

Castle Biosciences is a skin cancer diagnostic company that’s seen some amazing growth in 2021 and may be undervalued. They provide personalised genomic information to aid in treatment decisions.

Castle Biosciences stock price, July 2020 to July 2021. Source: google.com

Is Castle Biosciences A Good Stock To Buy?

Contributors to Forbes noted in March 2021 that Castle Biosciences dropped 24% in 10 trading days, but stated that: “[w]e believe the stock, after the recent drop, may trend higher in the near term”.

And explained that the drop was related to the company’s Q4 results that failed to meet expectations. However, revenue was higher than estimated and gross margins declined primarily because of a growth in staff before product launches.

Elsewhere, Simply Wall St notes that one of the rewards for trading Castle Biosciences stock is that revenue is forecast to grow 30.86% per year.

So, Castle Biosciences stock likely has some huge potential if you’re willing to look at the numbers behind the numbers.

Could Investing In Castle Biosciences Be Risky?

Continued growth might not be as big as we previously expected. The Forbes article was written in March 2021 after a major drop and positively believed that a bigger increase could be on the way.

And yes, while there was an increase, it wasn’t as big as stock traders wanted it to be, which could suggest that Castle Biosciences has run out of steam.

Simply Wall St has also identified two significant risks to Castle Bioscience stock - 1) it is currently unprofitable and not forecast to become profitable over the next three years, 2) shareholders have been diluted in the past year.

Is CSTL A Buy?

If you believe that Castle Biosciences could play a real role in eliminating cancer, it could be a win for you. Bad news aside, the company is still growing - the real question is: at what pace?

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $73.00 | $94.00 |

| Gov Capital | $60.89995 | $152.74185 |

| WalletInvestor | $62.657 | $96.488 |

| WallStreetZen | $70.00 | $94.00 |

Have you considered buying Castle Biosciences (CSTL) stock?

3. Zoom (ZM) - Keeping businesses alive during the quarantine

If there is any company most of us will remember when looking back to 2020 in the years to come, it is definitely going to be Zoom.

Though they have actually been around since 2012, the company really burst into everyone’s lives in 2020 as an alternative to other video conferencing software such as Skype, which has fallen from grace in the last few years.

Zoom stock price, July 2020 to July 2021. Source: google.com

Should I Buy Zoom Stock?

Zoom had amazing growth throughout 2020. According to Statista, in the fourth quarter of 2020, they made $188 million in revenue, and for the fourth quarter of 2021, they are projected to make $883 million in revenue, a gigantic increase.

Zoom revenue by quarter. Source: statista.com

Founder, chairman and CEO Eric Yuan is confident that Zoom will continue to grow, even as we move past the pandemic, believing that working from home is here to stay.

Instead of believing that people will simply return to the office after the pandemic, many people who only got a taste of working from home in 2020 will likely prefer it and not want to go back.

He also stated: “We recognise this new reality and are helping to empower our own employees and those of our customers to work and thrive in a distributed manner”.

Highlighting the fact that many companies do not all work in the same location and need tools like Zoom to operate.

Is Zoom Stock Overvalued?

Stock traders need to consider if they believe Zoom will outlive the pandemic.

When most of us finally return to the office, will Zoom still be seen as the video conferencing tool of choice? Or will it just fade away? That question will define if Zoom will be one of the top 15 stocks to explode in 2021.

Another key thing stocks traders need to consider about Zoom is that early on some security experts noticed vulnerabilities that could be manipulated.

On top of that, there were also concerns over Zoom’s privacy policy which appeared to give them a lot of power over users’ data.

If these vulnerabilities have not been properly addressed and something happens, it could severely harm Zoom’s stock price.

Thankfully, it does look like some action is being taken with Zoom introducing 2FA (two-factor authentication) as well as several other improvements.

Zoom Stock Buy Or Sell?

Despite the numerous security concerns, it didn’t stop people from using Zoom at all and the stock has done really well because of the pandemic.

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $242.00 | $525.00 |

| Gov Capital | $334.63905 | $717.646 |

| WalletInvestor | $328.321 | $619.001 |

| WallStreetZen | $250.00 | $570.00 |

Have you considered buying Zoom (ZM) stock?

4. Netflix (NFLX) - Will This Streaming Giant Be Able To Fight Off Rivals?

It really isn’t surprising that Netflix is on this list, even before the pandemic Netflix was massively popular. It started the golden age of online streaming as we know it.

Netflix stock price, July 2020 to July 2021. Source: google.com

Is Netflix Stock Worth Buying?

While many other companies may create their own streaming services, Netflix is already strongly established, with a wide range of content from many different sources, including their own original content.

In 2020, Netflix’s number of subscribers continued to increase. According to Statista, they passed the 200-million barrier in the fourth quarter of 2020.

Netflix subscribers in the millions. Source: statista.com

Further to that, according to Backlinko, Netflix gained 36.57 million new subscribers in 2020, its highest ever.

Netflix paid subscriber growth. Source: backlinko.com

It’s that wide variety of content and experience in the market that make it likely to be one of the top 15 stocks to invest in for 2021.

Why Netflix Might Be A Risky Stock To Invest In?

Netflix is not alone in this industry anymore. Rivals are coming thick and fast, many of them being well-known television and film-related companies, such as HBO and Disney (see below).

Neither are as big as Netflix’s largest rival though - Amazon Prime Video, which has approximately 150 million subscribers (supposedly 11% of the market globally) and a lot of content only available to them.

Netflix also has another major risk: it’s expenditure on content production, which continues to grow year by year.

Backlinko also highlights how Netflix spent approximately $17.3 billion on video content in 2020, up a bit more than $2 billion in 2019.

Netflix spending on video content in billions. Source: backlinko.com

The risk here is if for whatever reason Netflix fails to turn a profit, its expenditure could outweigh its revenue. It’s an issue many production companies come into.

Is NFLX Stock A Buy Or Sell?

Netflix stock is predicted to keep doing pretty well for the next few years.

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $340.00 | $1,154 |

| Gov Capital | $398.1094 | $590.04545 |

| WalletInvestor | $491.976 | $568.442 |

| WallStreetZen | $342.00 | $720.00 |

Have you considered buying Netflix (NFLX) stock?

Read Also: 10 Best Growth Stocks to Buy

5. Disney (DIS) - Larger And More Diverse Than You Would Expect

A super important thing to bear in mind about Disney is that they don’t just make films, which has, of course, been very disrupted during 2020.

Disney stock price, July 2020 to July 2021. Source: google.com

Is Disney Stock A Good Stock To Buy?

They are also a huge streaming service, launching Disney+ in November 2019, and with a wealth of popular films and TV shows to showcase.

Not only do they stream Disney content, but also from partners like National Geographic, Marvel and Pixar to name a few. It has probably been their saving point, preventing 2020 from being a really rough year.

On top of that, they of course also make money from merchandise too, which is immensely popular with young kids. Disney has a lot of ways to pull in revenue.

In turn, this has made them notable rivals of Netflix. While Netflix may have a more diverse range of content to stream, Disney is very wealthy and could in time overcome this.

And to top it all off, Disney may reopen parks in 2021, which will bring in a great deal of revenue.

Could Disney Stock Be Risky?

Disney stock took a huge dive in 2020 as the coronavirus shut down tonnes of businesses.

While there isn’t anything special about this, if we see some kind of catastrophe happen because of the coronavirus, or perhaps it ends up lasting longer than we previously thought, it will likely harm the stock.

Though a drop could be seen as a good chance to get in a cheap stock. At the time of writing, funny enough, Disney stock is at an all-time high.

Perhaps though it is better prepared this time with the revenue coming from Disney+.

Is Disney Stock A Buy Or Sell?

Disney could make a great hedge option for Netflix and there’s absolutely no reason why you can’t trade both if you have good insight into the industry.

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $147.00 | $230.00 |

| Gov Capital | $150.51715 | $238.9125 |

| WalletInvestor | $160.077 | $198.585 |

| WallStreetZen | $97.00 | $230.00 |

Have you considered buying Disney (DIS) stock?

6. Nvidia (NVDA) - $40 Billion Acquisition Could Make Them Giants

Nvidia Corp designs graphics processing units (GPUs) primarily for gaming and other markets. They also produce ‘system on a chip’ units for vehicles and mobile devices.

Nvidia stock, July 2020 to July 2021. Source: google.com

Is Nvidia A Good Investment?

Statistics from Macroaxis seem to suggest that Nvidia could be a particularly good investment opportunity, with their analysts considering it a ‘Strong Buy’ (83.33%, from 24 opinions).

Macroaxis notes that while Nvidia’s market performance isn’t too significant, its odds of distress are very low (less than 3%) and that they are unlikely to experience any financial distress in the next two years.

This potentially means that Nvidia is one of the safest investments on this list right now.

But there’s also much bigger stuff in store for Nvidia. Specifically, their $40 billion acquisition of Arm, whose technology is primarily used in consumer electronics (e.g., smartphones, tablets, smartwatches).

In a press release, Nvidia stated:

“The combination brings together NVIDIA’s leading AI computing platform with Arm’s vast ecosystem to create the premier computing company for the age of artificial intelligence, accelerating innovation while expanding into large, high-growth markets”.

However, it will take until at least early 2022 for the acquisition to be completed, as it will have to be approved by Chinese regulators.

But that could also mean buying Nvidia stock ahead of the acquisition could be a great idea.

Is Nvidia A Risky Investment?

Nvidia’s acquisition of Arm could leave it vulnerable if any negative news comes out, according to Jose Najarro. Plus, there is also the possibility of regulators rejecting the acquisition for whatever reason - and there is still plenty of time for that to happen.

Seeking Alpha’s Daniel Shvartsman also explained that while “there’s nothing to really fault the company with [...] there are some looming headwinds and towering valuations at play”.

Highlighting how as the company continues to expand, the number of risks it faces only gets bigger.

So, while acquisitions do sound pretty exciting, there are plenty of things that could get in the way of making them done deals.

Is Nvidia A Buy Or Sell?

Nvidia is very well ingrained in the tech world, so even if it fails to get a hold of Arm, it is still an exceptionally good stock to have right now.

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $440.00 | $1,000 |

| Gov Capital | $677.9379 | $999.7249 |

| WalletInvestor | $757.431 | $942.239 |

| WallStreetZen | $540.00 | $1,000 |

Have you considered buying Nvidia (NVDA) stock?

Check Out: What Are the Top 7 Best Tech Stocks To Buy

7. PayPal (PYPL) - The primary way to send money during the pandemic?

Perhaps it is not too surprising, but PayPal had a genuinely great time during the coronavirus pandemic, acting as an alternative way to send money to people you cannot physically reach.

PayPal stock price, July 2020 to July 2021. Source: google.com

Is PayPal Stock A Good Buy Now?

Its payment service made it a lot easier for people to send money to one another during lockdown and travel restrictions, becoming an important lifeline for some users.

Comparing PayPal’s stock performance to just three years ago is truly staggering. It’s a huge improvement that could potentially mean that it will be one of the top stocks to explode in 2021.

PayPal also offers some of the lowest transaction fees for sending money, making it appealing for those who would prefer not to use a bank to send money.

Is PayPal Stock Overpriced?

People may keep using it if they find it easier after the pandemic, but we should also mention that there is a rising number of online payment services that may steal PayPal’s thunder from under them, many of which are arguably more in tune with consumers’ needs.

PayPal now has Apple and Google to contend with who have moved into the industry with Apple Pay and Google Pay. And to make things worse for them.

Facebook Messenger is also adding a payment feature with no fees too. All three of these companies have a large reach of users already which will make adoption pretty easy.

And finally, PayPal recently started charging inactive accounts fees which certainly won’t win over new or existing users.

Is PayPal Stock A Buy Or Sell?

Despite a growing number of rivals in the industry, PayPal’s outlook is positive.

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $250.00 | $375.00 |

| Gov Capital | $257.6384 | $398.38415 |

| WalletInvestor | $293.435 | $366.326 |

| WallStreetZen | $210.00 | $370.00 |

Have you considered buying PayPal (PYPL) stock?

Don't Miss: 7 Safe Stocks That Won’t Bleed Your Portfolio

8. ServiceNow (NOW) - Technical Management Support Company Is A Major Hit

ServiceNow is likely a company that you haven’t heard of before, and for some, it may be a bit too technical to understand. In short, they are a cloud computing company that provides IT service management to a number of companies.

ServiceNow stock price, July 2020 to July 2021. Source: google.com

Why Is ServiceNow A Good Stock?

As you can imagine, companies like ServiceNow are increasingly in demand to help companies handle their IT infrastructure which only ever grows in importance.

ServiceNow has been steadily growing over the last few years, with only a few major stock price falls over the last three years.

Generally speaking, they are on the up and up and, as you may have guessed, have also had a great 2020.

All this makes ServiceNow possibly one of the best growth stocks for 2021 and possibly one of the top 15 stocks to explode in 2021.

Is ServiceNow Stock Overpriced?

Though it needs to be mentioned that in the cloud computing arena, they have rivals, and it may primarily be their management service that gives them their value.

Some of their biggest rivals include Micro Focus, Intel, VMware, SAP, and IBM, all of which are already pretty huge.

Michael Wiggins De Oliveira, writing for The Street, has also highlighted that ServiceNow’s growth prospects have been slowing down for a while now.

This could result in stock traders concluding that ServiceNow stock is overvalued.

Is NOW A Buy Or Sell?

Tech drives so much of our world now to the point where we absolutely depend on companies like ServiceNow to keep us up and running. And with that in mind, it’s not very likely that ServiceNow will be disappearing anytime soon.

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $520.00 | $695.00 |

| Gov Capital | $471.80185 | $737.4858 |

| WalletInvestor | $541.280 | $666.713 |

| WallStreetZen | $500.00 | $695.00 |

Have you considered buying ServiceNow (NOW) stock?

9. eBay (EBAY) - Leading The Way For The Collectables And Used Items Niche

eBay used to be a major player in eCommerce in the early 2000s and since then lost a lot of popularity, but the coronavirus has given it an edge that may only be temporary but is definitely worth trying to trade.

eBay stock price, July 2020 to July 2021. Source: google.com

Is eBay A Buy?

eBay is not likely to overcome major rival Amazon, only being worth a small fraction of their value, but still could have the possibility of returning a nice profit in 2021.

That said, eBay and Amazon do not operate in entirely the same market.

As Amazon has grown, it tends to focus more on new products, while eBay focuses more on used items and collectables, giving it a niche that it dominates.

eBay also appears to have done well for itself during the coronavirus pandemic, with revenues increasing sharply after major declines in 2019.

eBay revenue in the millions, US dollars. Source: smartinsights.com

Is eBay Overvalued?

The straight-up question stock traders should be asking themselves is after the pandemic, will eBay continue to have a use? What’s to stop eBay stock from just falling off a cliff when we can shop more freely again?

Further to that, while we mentioned above that eBay has found its niche for collectables and used items, there are still other up-and-coming platforms they need to contend with.

The fastest rising rival is Etsy which while it focuses more on handmade and vintage products, could easily put the squeeze on eBay.

Another important concern highlighted by Simply Wall St is that eBay has a lot of debt, approximately $7.58 billion as of September 2020.

Is eBay A Buy, Sell Or Hold?

It is these unique things that make eBay potentially one of the top 15 stocks to explode in 2021.

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $59.20 | $100.00 |

| Gov Capital | $53.7166 | $79.49375 |

| WalletInvestor | $66.371 | $77.085 |

| WallStreetZen | $58.00 | $81.00 |

Have you considered buying eBay (EBAY) stock?

10. Alphabet (GOOG) - Tech Giant Is Solidly Ingrained In Our Lives

Google (technically known as Alphabet) has always been a good stock to trade, though historically it has had some sharp ups and downs, which should encourage you to be somewhat cautious.

Alphabet stock price, July 2020 to July 2021. Source: google.com

Should You Invest In Google Stock?

Stock traders should remember that Google has a wide range of applications, which continues to make Google one of the top 15 stocks to potentially explode in 2021.

On top of having the world’s most used browser (Chrome, 63.59% of the market), Google is also the owner of Android, which powers many of our smartphones and retains a lot of control over the apps Android users can download (via the Play Store).

Browser market share worldwide, June 2020 to June 2021. Source: gs.statcounter.com

In fact, according to StatCounter, approximately 72.83% of the world’s population uses Android phones.

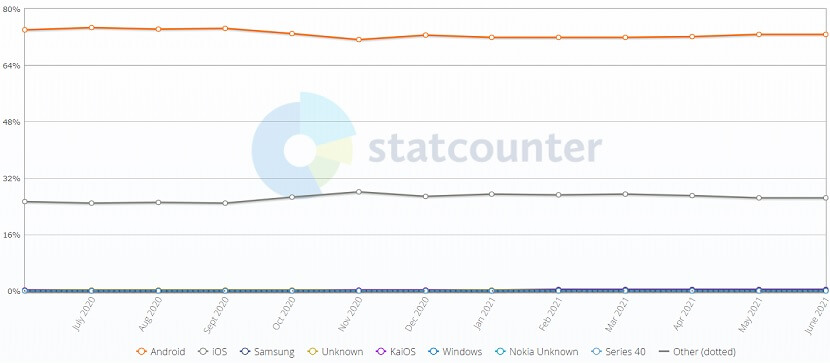

Mobile operating system market share worldwide, June 2020 to June 2021. Source: gs.statcounter.com

But this is just a small fraction of what Google is really about. According to Investopedia, Google actually generates most of its revenue from its advertising service, Google Ads.

Is Google Stock Overvalued?

There has been some dent in their popularity in the last few years due to some not liking how they attain data on users as well as their monopoly as an internet search engine. This has even led some to move to alternative browsers like Brave.

There have also been big talks about breaking up the company in the US to make the market fairer. In Europe, there were similar concerns.

And Google has gained some trouble in other parts of the world because of the lack of tax they pay. While it seems they are now paying a fairer share of their taxes, the issue didn’t help their image.

2021 so far has seen Google involved in perhaps too many scandals. The first of which involved the backlash from firing AI ethics researcher, Timmit Gebru.

Then, Google got into a spat with Australia when the country planned to pass a law that would make Google have to pay for content from local news. This resulted in Google threatening to block Australia from using their services.

So, in the end, the picture isn’t so pretty and there is a lot to think about.

Is Google Stock A Buy Or Sell?

Google might get itself into trouble every now and again, but the fact remains that it is an integral part of many people’s lives. Its reach is far and vast, and it isn’t likely to be going anywhere any time soon.

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $2,500 | $3,127 |

| Gov Capital | $2,148.868 | $4,367.59995 |

| WalletInvestor | $2,410.500 | $2,878.290 |

| WallStreetZen | $2,056 | $3,000 |

Have you considered buying Alphabet (GOOG) stock?

11. Facebook (FB) - Despite Scandal After Scandal, This Stock Just Won’t Go Away

Facebook has been a super important stock play since its early days and will probably continue to be for decades to come, making it probably one of the top 15 stocks to explode in 2021.

Facebook stock price, July 2020 to July 2021. Source: google.com

Is Facebook Stock A Good Buy?

It really isn’t hard to see why Facebook is a strong stock to buy.

Firstly, Facebook dominates much of Europe, Africa, the Middle East, North and South America, Oceania, and South Asia as the most used social media platform.

World map of most popular social networks, January 2021. Source: vincos.it

They have no real competition, except in Russia and some former Soviet states where Vkontakte is more popular, and WeChat in China, for example.

Just like Google, Facebook collects data from its users and uses this data to assist advertisers to target you better while using their platform. This is primarily how Facebook makes its profits.

And 2020 was an excellent year for them. According to Mike Isaac, writing for The New York Times, Facebook’s revenue grew in the fourth quarter “to $28 billion, up 33 percent from a year earlier and beating Wall Street estimates”.

Also, as we mentioned above when discussing PayPal, Facebook Messenger is moving into providing payments to rival PayPal.

Though there will supposedly be no fees involved, there is still the possibility they could be introduced later on. Further to that, this will also give them more info on their users’ finances.

Is Facebook Stock Overvalued?

There have been waves of scandals that have not helped Facebook’s image over the years.

That said, Facebook is very used to scandals and they don’t seem to have much of an effect anymore. Despite them all, Facebook stock continues to surge.

Though they did cause a minor drop in usage among young people a couple of years ago, these days it’s almost as if we all expect scandals and continue to use the service they provide anyway.

And just like Google, there is also some distrust of Facebook over how they acquire and use the data they gain on users.

But further to that, the use of the platform to spread disinformation is also a major issue, with some calling for regulation to be put in place.

Remember that scandal we mentioned above between Google and Australia? Well, Facebook was also involved in the scandal too.

And one final concern about Facebook stock, also highlighted by Mike Isaac, was that the company was closely watching a court ruling in Ireland that could prevent them from transferring data from the EU to the US.

Is FB Stock A Buy Or Sell?

Just like Google, Facebook is also a deeply integrated part of many of our lives. Even those of us who do not use it can recognise its reach.

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $275.00 | $460.00 |

| Gov Capital | $289.98345 | $420.72865 |

| WalletInvestor | $338.958 | $393.600 |

| WallStreetZen | $275.00 | $460.00 |

Have you considered buying Facebook (FB) stock?

Read More: How To Invest In The Tech Sector

12. Nucor (NUE) - Steel Recovery And Infrastructure Plans Suggest Growth

Nucor is the largest steel producer in the USA and the biggest scrap recycler in North America.

Nucor stock price, July 2020 to July 2021. Source: google.com

Is Nucor Steel A Good Investment?

Nucor’s outlook is gleaming mostly thanks to the recovering steel industry. As Aditi Saraogi of Zacks via Yahoo Finance explained that “often times, a rising tide will lift all boats in an industry [...] This is arguably taking place in the Steel – Producers space”.

World Steel Association forecast that they expect “steel demand will grow by 5.8% in 2021 to reach 1,874.0 million tonnes (Mt), after declining by 0.2% in 2020”.

That decline in 2020 was due to the coronavirus, and the World Steel Association assumes that infections will stabilise with the progress made by vaccinations.

United States steel production. Source: tradingeconomics.com

In the United States specifically, President Biden’s eight-year $2 trillion infrastructure plan has boosted steel demand. As Argus explains:

“[It] would put about $200bn into road and rail projects, which would lift demand for long steel products such as reinforcing bar (rebar) and wire rod”.

Nucor, as the US’s largest steel producer, has a lot to gain in 2021 as it recovers from the coronavirus and likely plays a role in boosting America’s infrastructure plans.

Is Nucor Overvalued?

The biggest risk highlighted by Simply Wall Street is Nucor’s earnings are forecast to decline an average of 46% per year for the next three years. Suggesting that Nucor is already well past its peak.

They also note that Nucor has a high level of debt, and significant insider trading over the past three months.

Elsewhere, TipRanks foresees other major risks to Nucor. Those being tax increases and tax changes, and environmental regulation which could result in substantially increased costs, plus regulation on greenhouse gas generation could also be a problem.

Should I Buy Nucor Stock?

Nucor has two powerful forces on its side in 2021 - an industry-wide recovery from the coronavirus and a huge infrastructure plan. Together, most weak points look insignificant.

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $100.00 | $121.00 |

| Gov Capital | $81.4181 | $118.88125 |

| WalletInvestor | $80.860 | $107.085 |

| WallStreetZen | $48.00 | $114.00 |

Have you considered buying Nucor (NUE) stock?

13. Amazon (AMZN) - More Than Just Ecommerce, These Guys Sell Everything

Amazon has a lot of rivals in our list of top 15 stocks to explode in 2021 - they’re in competition with everyone.

Amazon stock price, July 2020 to July 2021. Source: google.com

Should I Buy Amazon Stock?

They are also rivals of Netflix and Disney in the streaming business, eBay in the eCommerce business, and Google, ServiceNow and Microsoft (SPOILER ALERT! We’ll get to them in a moment!) in the cloud computing business.

They really have as many fingers in as many pies as possible, which for many companies doesn’t work very well, but somehow, it works really well for Amazon.

And to make things crazier, 2020 has been one of Amazon’s best years, making Jeff Bezos, the world’s richest man, even richer (well, until Elon Musk came along!).

Is Amazon Stock Overvalued?

Amazon’s image is quite polarising depending on who you talk to. Stock traders love it, but Amazon’s workers? Not so much.

A big issue that tends to get swept under the rug is worker rights. It’s no secret that employees are poorly paid and overworked (perhaps Amazon plans to replace them all with drones!) but could one day explode if not dealt with.

Most recently, in 2020, it reached the point where Amnesty International stepped in to support the workers, calling on Bezos (who is now the executive chairman of Amazon’s board) to improve working conditions.

In fact, there is a lot to be concerned with at Amazon. There’s even a whole Wikipedia called ‘Criticism of Amazon’, and it’s fairly big, highlighting a lot of issues.

Amazon is perhaps the most criticised company on this list.

Amazon Stock Buy Or Sell?

Amazon stock is one of the most talked-about stocks in decades and that talk gains them a lot of investor attention. With so many tentacles wrapped around so many different industries, it is difficult to see them losing.

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $3,775 | $5,500 |

| Gov Capital | $3,126.9324 | $4,402.0045 |

| WalletInvestor | $3,540.740 | $4,144.550 |

| WallStreetZen | $3,280 | $5,500 |

Have you considered buying Amazon (AMZN) stock?

14. Apple (AAPL) - The First-ever Two Trillion-dollar Company

Apple stands out above its competitors for its innovation, often leading the way in several areas, starting technological trends, in turn, it has given them a lot of value and gaining them the second-highest spot on our list of top 15 stocks to explode in 2021.

Apple stock price, July 2020 to July 2021. Source: google.com

Should I Buy Apple Stock?

And we should also not forget that Apple was the first-ever two trillion-dollar company, reaching that glorious moment in 2018.

An interesting thing about Apple that makes it one of the best stocks to buy for 2021 is they have a habit of buying back stock from the market, which can bring up the price.

Just like all the other stocks on our list of the top 15 stocks to explode in 2021, Apple has had a really great 2020, though there were a few sharp falls here and there, including one major fall in August.

Is Apple Stock Overvalued?

There was a very sinister scandal involving Apple in late 2020 where it was revealed that the company had lobbied the US government to relax a bill designed to prevent the US companies from using forced labour in China, specifically in relation to Uighur peoples.

As it turns out, Apple relies heavily on labour in China and supposedly benefits from forced labour in the Xinjiang region of China where up to 1 million Uighur people are in internment camps.

It’s a sordid tale and can have two potential negative outcomes for Apple stock. Firstly, users may decide to move away from Apple, disapproving of their business practices.

Secondly, stock traders should also consider what might happen if the bill does go ahead and how it may impact Apple’s production.

Is It Worth Investing In Apple Stock?

It’s super likely that Apple won’t just be one of the top stocks to explode in 2021, but probably the rest of the decade.

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $90.00 | $185.00 |

| Gov Capital | $127.1481 | $194.6927 |

| WalletInvestor | $138.701 | $169.425 |

| WallStreetZen | $78.75 | $185.00 |

Have you considered buying Apple (APPL) stock?

15. Microsoft (MSFT) - The World’s Most Used Software Is Only Growing

Microsoft tops our list of top 15 stocks to explode in 2021! And when you really think about it, it’s not surprising at all as it continues to have a monopoly over operating systems.

Microsoft stock price, July 2020 to July 2021. Source: google.com

Why Is Microsoft A Good Investment?

When you compare Microsoft with Apple, its primary rival, Microsoft has a huge advantage in terms of users. Back in 2017, it was reported that Microsoft had approximately four times more users than Apple.

While Apple was reported to have around 100 million users, Microsoft was reported to have around 400 million, and supposedly, there could be up to 1 billion Windows-powered devices out there as well.

Further to that, Microsoft has an impressive number of applications that can cover most business needs and are a lot cheaper.

Many businesses can run solely on Microsoft applications for both business-to-business needs and business-to-client needs. They have become the standard.

Plus, as we mentioned above, they have also become a rival for Amazon, moving into cloud computing with their cloud computing service Azure, another industry that is growing in importance.

And, finally, just like Apple, Microsoft is known to buy back stock which is really good as it can pump up the price every so often as well.

Is Microsoft Overvalued?

Just like Amazon, Microsoft also has its own Wikipedia page outlining all its criticisms.

One of its most recent criticisms, as of 2020, is when the company decided to fire dozens of journalists and replace them with AI technology on their Edge browser and on the MSN website.

So, while Microsoft’s image is a little better than others out there, they too get into trouble sometimes.

Is Microsoft Stock A Buy Or Sell?

Do you see people using Microsoft computers giving them up anytime soon? No, it’s not very likely.

| Price Forecaster | Lowest Price | Highest Price |

|---|---|---|

| CNN | $256.70 | $340.00 |

| Gov Capital | $233.9183 | 344.21915 |

| WalletInvestor | $275.861 | $312.241 |

| WallStreetZen | $234.00 | $325.00 |

Have you considered buying Microsoft (MSFT) stock?

How to Pick the Best Stocks in 2021?

Like we said at the beginning of this article, you really need to have a good understanding of how the coronavirus has affected the stocks you think are a good trade.

Perhaps be more cautious this year than in previous years as the circumstances are a little less predictable than in previous years.

You should also bear in mind that governments can be a little unpredictable during these kinds of emergencies, and their reactionary measures can have a big impact on a stock.

For example, let’s say the US state of California orders every employer to close up for a period of time, it could massively affect tech companies based in Silicon Valley, and as soon as work stops, the price of their stocks could dip dramatically.

Aside from this, you also need to remember everything you already knew about trading stocks. Don’t let your skills vanish in unfamiliar situations.

You can also look back at similar economic situations to see how stock traders found worthy trades.

Don’t throw out what you know about stocks because of the crisis, if ever, you need to follow them more carefully than you ever have.

In the end, being mindful of risk always pays off!

Read Also: How to Pick Stocks: A Complete Guide for New Investors

This Market Won’t Last Forever!

Some stocks may do really well because of the virus, but after the virus, their demand may disappear, and we hear less about them. So, it’s important to spot the right moment to get out while you still can.

For example, Zoom has become incredibly useful during the pandemic, but after the pandemic, will it still have the same use?

Many companies will return back to the office and when that happens, the number of zoom users may drastically decrease.

It also works the other way around as well.

The coronavirus caused a huge manufacturing decline. In the US alone, it is estimated that revenue from manufacturing will be down by approximately 10% for 2020.

We’ve also seen it in the commodities market as well as there is less demand for metals and other materials typically used for manufacturing. If there is no one to work on these materials, there is no need for companies to buy them.

But when the pandemic passes, we’ll probably see manufacturing pick up back to normal levels.

Ready To Dive Into The Stock Market?

One last comment about our top 15 stocks to explode in 2021. Remember, the stocks we’ve highlighted in this article are one’s we have faith in, you may look at the situation very differently and there is nothing wrong with that.

Doing your own research is super recommended!

Ready to dive into the stock market?

How to Buy Top Stocks in 2021 With 0% Commission

Now you know what the top 15 stocks to explode in 2021 are, you’ve got a solid foundation to start your stock investing. The next step is to find a reputable stockbroker.

If you’re interested in investing in one, or some, of the top stocks in 2021 listed on this page - we would suggest checking out eToro.

This online broker gives you access to over 1,700+ shares (including the 15 picks listed on this page) - all of which can be purchased on a commission-free basis.

While eToro is super-popular in the UK, Australia, and much of Mainland Europe, the broker is also experiencing a surge of account sign-ups from the USA.

Here’s what you need to do to buy stocks from eToro:

Step 1: Open An Account With eToro Today – Pay 0% Commission On Stocks

To buy shares online you will need to open an account with a trusted and regulated broker. If using eToro, the registration process takes minutes. You simply need to provide some personal information and upload a copy of your ID.

Step 2: Deposit Funds

You’ll need to deposit some funds into your eToro account to buy your chosen stocks. This comes at a minimum of $200 ($50 in the USA) and you have several payment methods to choose from.

If you want to buy shares instantly it’s best to use a debit/credit card or an e-wallet like PayPal.

Do note that in several countries, the minimum deposit is significantly higher, so make sure you check before you sign up!

Step 3: Search for Shares

Once your eToro account has been funded you will then need to search for the company stock you wish to invest in. You’ll then need to click on the ‘Trade’ button to go straight to the investment page of your chosen stock.

Step 4: Place a Commission-Free Buy Order

Finally, you will need to place a buy order to complete the share purchase process. This is easy as all you need to do at eToro is state the amount that you wish to invest.

It doesn’t matter if you are buying shares in a firm like Google that has a stock price in the thousands of dollars as eToro allows you to invest from just $50. This is known as ‘fractional investing’, as you will be buying a ’fraction’ of a share.

Once you confirm the buy order, the shares will be added to your eToro portfolio. If the shares in question pay dividends, this will be reflected in your eToro account as and when they are paid. You can sell your shares at any time when the markets are open.

If you want to invest in the stock market and consider the top stocks to buy today, there’s no better place to do so than eToro. Simply click the link below to sign up today!

eToro – Buy Top Stocks With No Commission

eToro have proven themselves trustworthy within the industry over many years – we recommend you try them out.

Your capital is at risk. Other fees may apply

Read More:

5 FTSE Stocks To Buy For A Stock Market Crash

5 Stocks That Could Be Worth $1 Trillion by 2035

7 UK Shares To Buy Now With £5,000

9 Small-Cap Stocks With Growth Potential

Key points

If you remember anything from What Top 15 Stocks Will Explode in 2021? make it these key points.

- Amazon has a lot of rivals in different industries. Despite this, it is still going strong.

- Microsoft and Apple are two of the top 15 stocks to explode in 2021. The two continue to show a lot of strength in the coming year.

- Nvidia is incredibly strong right now. Acquiring Arm could make it into a super stock and take it to the next level (we just might have to wait a bit).

- Tesla is still highly popular but comes with great risks too. It has some of the best returns but is also predicted to have some steep declines.

If you enjoyed reading What Top 15 Stocks Will Explode In 2021? Please share with anyone else you think it will be of interest to.

Please Note: Past performance is not an indication of future performance. The value of investments can go down as well as up. Any opinions, news, research, analyses, prices, or other information contained on this website are provided as general market commentary and do not constitute investment advice. Trading Education shall not be responsible for any loss arising from any investment based on any recommendation, forecast or other information provided.

FAQs

Still have questions on what stocks will explode in 2021? Perhaps these frequently asked questions will help.

What Are Growth Stocks?

Growth stocks are defined as stocks that accumulate earnings and make sales faster than most other companies.

Typically, such companies are highly active in reinvesting their revenue to expand the company and have clear goals to grow their operations.

And it is this growth that makes them so appealing to stock traders as it is assumed that as they continue to grow, so will the price of the company’s stock.

What Are The Best Safe Stocks To Invest In The Long-term?

If you are looking for safe stocks, then you want to look for those that grow slowly and steadily and have minimal damage when disaster strikes.

According to Matthew Frankel, writing for The Motley Fool, the seven best safe stocks to invest in are:

Berkshire Hathaway, Disney, Vanguard High-Dividend Yield ETF, Procter & Gamble, Vanguard Real Estate Index Fund, Starbucks, and Apple.

Do note that ‘safe stocks’ are less likely to grow quickly and therefore are best treated as a long-term investment.

What Are The Best Marijuana Stocks For 2021?

Tilray Inc. (TLRY), High Tide Inc. (HITI), and GrowGeneration Corporation (GRWG) are the best marijuana stocks for July 2021, according to StockMarket.com’s Josh Dylan.

Tilray is a leading cannabis company in terms of revenue, High Tide manufactures and distributes cannabis consumption accessories, and GrowGeneration is the largest hydroponics supplier in the US.

What Are The Highest Dividend Stocks Of 2021?

SoFi Weekly Income ETF (TGIF), Realty Income (O), AbbVie Inc. (ABBV), Chevron Corporation (CVX), and AGNC Investment Corp (AGNC) are the best dividend stocks of 2021, according to StockMarket.com’s Adam Lawrence.

What Are The Best Biotech Stocks Of 2021?

Agios Pharmaceuticals Inc. (AGIO), Sage Therapeutics Inc. (SAGE), and Innoviva Inc. (INVA) are the best biotech stocks for Q3 of 2021, according to Investopedia’s Nathan Reiff.

What Are The Best Renewable Energy Stocks Of 2021?

Clearway Energy (CWEN), Canadian Solar (CSIQ), Ford (F), Atlantica Sustainable Infrastructure (AY), Nio (NIO), SolarEdge Technologies (SEDG), and Hannon Armstrong Sustainable Infrastructure Capital (HASI), according to Kiplinger.

(They explained the seemingly odd choice of Ford because of its ‘doubling down on going green’.)

What Stocks Will Double In 2021?

No one can say with any certainty what stocks will double in 2021, though so far, the stock market has been doing fantastically this year.

Realistically, looking for stocks that are supposed to double probably isn’t the best use of your time. The best thing to look for is stocks that have strong growth.

Note that stocks may continue to surge as more money is poured into the economy by coronavirus stimulus packages.

But keep in mind there is always a chance the stock market may have a few tumbles in 2021. Bull markets never last forever!

What Are The Best Stocks To Buy For Beginners?

According to Grant Sabatier of Millennial Money, these 15 stocks are the best to buy for beginners.

- Amazon (AMZN)

- Alphabet (GOOG)

- Apple (AAPL)

- Costco (COST)

- Disney (DIS)

- Facebook (FB)

- Mastercard (MA)

- Microsoft (MSFT)

- Netflix (NFLX)

- Nike (NKE)

- Pinterest (PINS)

- Shopify (SHOP)

- Spotify (SPOT)

- Teladoc (TDOC)

- Tesla (TSLA)

What Are The Most Undervalued Blue-chip Stocks?

According to John Csiszar, writing for Yahoo Finance, the most undervalued blue-chip stocks of 2021 are:

Ford, Intel, Bank of America, LyondellBasell, IBM, Simon Property Group, Macy’s, Lockheed Martin, Carnival Cruise Lines, and Southwest Airlines.

What Are The Best AI Stocks For 2021?

According to Josh Divine of U.S. News, the 10 best AI stocks are:

- Nvidia (NVDA)

- Apple (AAPL)

- Alphabet (GOOG)

- Amazon (AMZN)

- Microsoft (MSFT)

- IBM (IBM)

- Facebook (FB)

- DocuSign (DOCU)

- Micron Technology (MU)

- Taiwan Semiconductor Manufacturing (TSM)

Will The Stock Market Crash In 2021?

The Motley Fool’s Sean Williams believes that a crash is on its way - we just can’t pinpoint when it could happen. He adds that: “history is pretty clear that crashes and corrections are inevitable parts of the investing cycle”.

Williams explains that the current market rebounded far too well following a bear market, inflation has increased immensely, and margin debt reached a new high of almost $862 billion in May 2021 (up approximately 60% from the year before).

It is worth noting though that a number of experts and pundits have been betting on the stock market crashing for the last few years. There are hundreds of reasons they can point to, and so far - luckily - none of them have been 100% correct (at least on the crashing part!).

But remember that markets change, regulations change, companies change, consumer habits change and so on. What this means is that what can sow the seeds of a stock market crash might not be the same as in previous years.

How Can I Find Out What Hedge Funds Are Buying?

With a lot of research! Some online groups might share such sensitive information, but as you can imagine hedge funds would prefer that information wasn’t available.

Perhaps the best way to find out what hedge funds are buying is if you can get hold of their quarterly 13F form. This form is required to be filled out by institutional asset managers with over $100 million in assets.

While it should show most of what they are holding, these forms are not always reliable.

You can also check groups on platforms like Reddit as well where there is a strong community of traders but be careful to ensure what they are saying is the truth.

What Are The Most Shorted Stocks 2021?

Data from Statista suggests that Carver Bancorp (CARV), Creatd (CRTD), PubMatic (PUBM), Clover Health Investments (CLOV), and Clene (CLNN) are some of the most shorted stocks of 2021.

Stocks with the most short sell positions as of June 2021, by share of float shorted (top 10). Source: statista.com

What Stocks Are Going To Split In 2021?

In July 2021, the following 10 stocks will split according to Fidelity:

- AG Mortgage Investment Trust (MITT)

- Arcos Dorados Holdings (ACRO)

- Ashford Hospitality Trust (AHT)

- Cadillac Ventures (CA)

- Carbeeza (CA)

- Fredonia Mining (CA)

- FS Bancorp (FSBW)

- Jayden Resources (CA)

- NowVertical Group (CA)

- Nvidia Corp (NVDA)

What Are The Top New IPO Stocks Of 2021?

According to U.S. News’s John Divine, the biggest IPOs for 2021 are:

- Instacart

- Robinhood Markets

- Nextdoor

- Stripe

- ThoughtSpot

- Monday.com

- The Fresh Market

- Krispy Kreme