Tesla is one of the fastest-growing companies in the world, with a stock that has won the hearts of several investors. Founded in 2003, this Palo-Alto-based company is now famous for not only producing all-electric cars but also for its clean energy generation and storage products aiming to accelerate the world’s transition to the zero-emission future.

The company went public in 2010, offering investors its 13.3 million shares. Tesla's stock market experienced meteoric growth, particularly following the recent 5:1 stock split. Now, Tesla owns one of the most talked-about and inviting stocks with more and more people investing in it.

If you want to become a Tesla shareowner and invest in its stock but don't know how to start buying shares, you are in the right place. In this article, you will be guided on how to buy Tesla shares in the UK and be introduced to the top broker platforms to make it a reality. We will also discuss Tesla's share price history and outlook to make it easier for you to decide what will be more perspective - to buy or sell Tesla stock.

Contents:

- Where To Buy Tesla Shares In The UK?

- Should You Buy Tesla Shares Right Now?

- Tesla Share Price History

- Tesla Share Price Prediction

- Does Tesla Pay Dividends?

- 3 Reasons To Consider Buying Tesla Stock

- How To Short Sell Tesla Shares In The UK

- What Are The Risks Of Buying Tesla Shares Right Now?

- Final Thoughts

- FAQ

Where To Buy Tesla Shares In The UK?

Tesla shares are traded on NASDAQ under the ticker TSLA. But you cannot buy them directly from NASDAQ; for this purpose, you must find a broker platform that will allow you to trade US shares in the UK. As Tesla stock is one of the most bought stocks, there will be lots of stockbrokers to offer you this service.

However, there are some factors you should take into account to choose the most appropriate online broker for trading Tesla shares. Among those factors are what trading and non-trading fees the broker charges, how easy it is to use its platform, what margin requirements it has, and most importantly, its reliability. Considering the last factor, the broker you will choose for trading must be regulated by FCA.

Here we will introduce some of the most appropriate and FCA-regulated stockbroker platforms to buy Tesla shares in the UK.

eToro - Buy & Sell Microsoft Shares with a Social Trading Platform in the UK

eToro is one of the most popular social trading platforms among investors in the UK and globally. It was founded in 2006 and has over 20 million registered users who are enabled to select among its 800 tradable stocks, including famous US markets as Microsoft, Amazon, Netflix, Tesla, etc. There are lots of factors that make this trading platform appealing among investors (starting from its commissions and reliability to the social tools it offers on the platform), which we will discuss here.

One of the key factors why eToro is so admirable is that it not only allows trading outright but also using CFDs. The latter are Contracts for Differences that enable you to leverage your share position by 5:1. This means that if you want to buy a Tesla share with CFDs, you only have to pay 20% of the margin requirement.

Perhaps, the most amazing thing about eToro is its commission policy. It does not charge any commission for trading, which means that there is no flat fee when buying and selling the Tesla share. However, you need to pay for the buy and sell spread of the asset.

The next thing that helps eToro to stand out is the several social tools it offers to its users. This platform is not only easy to use, but it has an interface similar to those of the social networks you have used. Here you can have your personal profile, interact with other investors, see their posts, etc. One of those amazing tools is the CopyTrade tool that enables you to automate your trading by copying those of the top traders.

Coming to its reliability, you can be sure that your funds are safe on eToro as it is regulated by FCA (United Kingdom), ASIC (Australia), and CySEC (Cyprus). The platform also supports several trading methods available in the UK, such as credit and debit cards, bank accounts, and also e-wallets like Paypal.

eToro requires you to deposit a minimum of $200 (around £146) to start trading on its platform. If you are ready to buy Tesla shares in the UK, you can visit eToro’s website here.

Should You Buy Tesla Shares Right Now?

Buying a Tesla stock has become much more like a trend today. The company stock market has begun to rise from 2020 and experienced tremendous growth in the last two years, catching the attention of several investors. While the company is among the fastest-growing ones, several financial analysts and investors are convinced that its stock is overvalued.

So, while the growing shares of the company may compel you to invest in it, there are some other factors to take into account before making the final decision. It’s better to do a bit of research about Tesla's share price history, the company’s outlook and also take a look at analyst’s predictions about its stock market.

In this part of the article, we will introduce some of the basic factors about Tesla and its stock market to help you decide to buy Tesla shares right now or not.

Tesla Share Price History

In 2003 American entrepreneurs Martin Eberhard and Marc Tarpenning founded Tesla Motors, which is named after the famous Serbian inventor, Nikolas Tesla. An innovative entrepreneur, Elon Musk invested in the company over $30 million and became the chairman of Tesla. In 2008, two founders of the company left it which resulted in Elon Musk taking over as CEO of Tesla.

The company started with building electric cars, but then it branched out into solar energy products and additional innovative services. It also produces energy generating and storing devices that are used both in businesses and homes. Later, Tesla bought the company called SolarCity, famous for producing solar panels. Finally, in 2017 the Tesla Motors was renamed Tesla to show that it not only sells electric cars but other products too.

Eventually, the company went public in 2010, offering the public its 13.3 million shares, each costing $17, and thus, raising capital of more than $226 million from the public investors. Tesla shares started to grow tremendously and reached their all-time high closing on January 26, 2021, when a share of the company was valued at $883.09.

There was also one split in Tesla's stock history - Five for One stock split was announced on August 11, 2020, and eventually was implemented on August 31. In a release, the company mentioned that the split mainly aimed to make stock ownership more accessible to employees and investors.

Tesla stock price history YTD, for more data: finance.yahoo.com

A few words about the stock split for those who are not familiar with this term. Essentially, it’s a decision made by the company’s board of directors which means that the company issues 5 times more shares, but the price for each share becomes lower. For example, if you had 1 Tesla share at the price of $1000 before the split, after the split, you would have 5 shares together valued again at $1000 (the price for each share is different now).

Tesla Share Price Prediction

While the 5:1 stock split has drawn the attention of several investors on Tesla stock, still the company’s shares are a bit dangerous to rely on. It had a significant growth lately, reaching its all-time high closing price on January 26, 2021 ($883.09 per share), and again started to drop. So there is lots of controversy about Tesla's stock predictions with many financial analysts considering that Tesla’s stock market is actually overvalued.

Tesla share price history, for more data: nasdaq.com

Taking a look at the Tesla stock prediction on CNN Business conducted among 32 financial analysts, 12-month price forecasts have a median target of 755.50, with a high estimate of 1,200.00 and a low estimate of 67.00.

Coming to the buy and sell recommendations, 36 polled financial analysts showed a consensus to hold Tesla shares right now. While 14 of them voted for holding and 12 for buying, 6 of them considered that you must sell it. With that in mind, there are more reasons that currently may compel you to buy Tesla stock, and we will discuss these reasons below.

Does Tesla Pay Dividends?

In its stock history, Tesla has never paid dividends to its shareholders. Lots of investors expect it to declare dividends as long as its rival companies, Ford and General Motors, were decent dividend payers that suspended in 2020. However, Tesla's announcement on its website says not to anticipate any dividends from the company in the near future. The problem is that the company is not profitable enough to pay dividends and wants to continue the growth momentum of the company.

As written on its website, in the section of frequently asked questions, “Tesla has never declared dividends on our common stock. We intend on retaining all future earnings to finance future growth and therefore, do not anticipate paying any cash dividends in the foreseeable future”.

Read More: Tesla Stock Price Prediction For 2021 And Beyond

3 Reasons To Consider Buying Tesla Stock

Tesla is a company that gained the hearts of several people with its innovative ideas. Lots of investors rely on its cutting-edge technologies and consider it a great buy. Still, many financial analysts think that Tesla stock is currently overvalued. It has a PE ratio of 1071 as of April 2021, which is extremely high compared to other well-bought stocks including Amazon, Apple, Microsoft, etc.

Whether it’s another bubble that will burst or not remains to be seen. Tesla is actually a prospective company standing out with some key factors that make it a unique and maybe profitable company from the long-term perspective. That said, here are three reasons why you should invest in Tesla stock.

Tesla is the Leading Car Producing Company in the World

Not only Tesla is the world’s largest car company in terms of market cap ($800 billion), which is more than those of Toyota Motor, Honda Motor, and General Motors combined together, but after surpassing China’s BYD sales, it’s now leading the race with the production and sales of electric cars.

Despite the Covid-19 pandemic, Tesla produced almost 180,000 cars in the last quarter of 2020, which is 71% higher compared to the same quarter of the previous year. The company aims to produce 500,000 vehicles by the end of this year. This number was almost implemented in 2020 with the production of 499,647 cars.

Tesla car production growth: source statista.com

Tesla has 2 major factories at this time working on car production, and the other two are still in the process of development. Lately, the company upgraded its California facility to produce the more expensive Model S and Model X in addition to the Model 3 and Model Y. There is also a Gigafactory in Shanghai building Model 3 and Model Y, the production of which started in 2020 and will grow over the coming year.

Two others are being built in Berlin and Texas - The latter will be facilitated to serve as the primary producer of Tesla Cybertruck and Tesla Semi.

Tesla is also Famous for Its Energy Generating and Storing Products

Along with its all-electric cars, Tesla also stands out with other innovative products. Tesla also produces solar panels and solar roofs, including Powerwall, Powerpack, and Solar Roof, which is used in businesses and houses, enabling them to manage renewable energy generation, storage, and consumption. By this, Tesla aims to reduce the use of fossil fuels as much as possible and move towards the zero-emission future.

Tesla is also famous for its Supercharger Stations that are designed to charge up all the electric cars existing in the market in the most effective way.

Tesla Collects a Huge Database

And finally, this is by many opinions the most crucial factor when analyzing Tesla's valuation. What is valuable about Tesla is the data the company collects and stores with the help of its cars since its foundation. Through cameras and other navigation tools on its vehicles, Tesla collects lots of driving data all the time. This database has a massive valuation which will rise per year with more and more data being collected.

How to Buy Tesla Shares - A Full Step by Step Guide with eToro

Now that you have gained some basic information about Tesla stock and the company’s outlook and have decided to buy its shares, it’s time to be introduced on how to do it. In this part of the guide, we will show you step by step the whole process of how to buy Tesla shares in the UK on the eToro platform.

Open An Account with eToro

To trade on the eToro platform, first of all, you need to be registered there. For this purpose, visit etoro.com and click on the “Join Now” button on the right top of the website. You will be transitioned into the registration window, where you must choose your username, fill in your email, choose a password and click on the “Create Account” button.

Fund Your Account

When you are registered and have verified your profile on eToro, you cannot still start trading as you need to first deposit some money to buy Tesla shares. For UK residents, the minimum deposit is equal to $200. For doing this, eToro enables several payment methods available in the UK, so you can use the following payment methods to fund your account:

- Credit and Debit Cards

- Paypal

- Skrill

- UK Bank Transfer

- Neteller

On a side note, eToro allows you to trade on a demo account which is given indefinitely and allows test the platform with virtual money.

Buy Tesla Shares

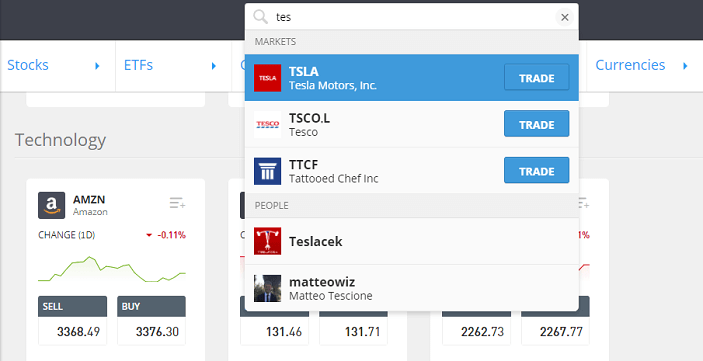

After depositing the minimum requirement on your eToro account, you can finally start trading. To buy Tesla shares, you must search the stock in the search bar for its ticker - TSLA and then click on the first result. You will be led to a page where you can read lots of information about Tesla stock, including news, research, articles, etc.

When you think you are ready to buy Tesla stock, click on the “Trade” button and fill in the number of shares you want to buy.

Then click on the “Open Trade” button, and that’s all. However, it’s also possible to get the button “Set Order” instead of “Open Trade”. This means that you are making a buy on non-trading hours. So, just click on that button, and your order will be automatically done when the market opens.

How To Short Sell Tesla Shares In The UK

If you are not sure you want to buy Tesla shares and actually believe the Tesla share price is currently overvalued, you can also short sell Tesla shares on eToro using Contracts for Differences. If you are not familiar with this term, short selling gives you the opportunity to make a profit when the price of the asset drops. And, while short-selling via traditional brokerage firms may require to open a margin account and meet strict requirements, CFDs is the best option to short sell financial assets without having to open a margin investment account.

For this purpose, just sign in to your eToro account, click on the “Trade” button and switch on 'Buy' to 'Sell'. Then choose the amount of the shares you want to short sell and click on the “Open Trade” button. As we have mentioned previously, eToro enables you to trade CFDs with the leverage of 5:1, which means you need to pay only 20% of each Tesla share.

What Are The Risks Of Buying Tesla Shares Right Now?

While Tesla is leading the car industry with its sales and production, still investing in its stock is considered quite a risky thing by many financial analysts. Firstly, they think that Tesla stock is overvalued with its $677 per share. Besides, it has a very high PE ratio (1071) compared to other fast-growing giant companies, including Apple (35.98), Amazon (80.65), Microsoft (38).

And, despite the funny case that led the company to produce short shorts, there is still a talk about the Tesla stock being in a bubble that is going to burst in the near future. Recently, Lansdowne Partners fund manager, Per Lekander, told CNBC that the company’s share will fall considerably.

Final Thoughts

In conclusion, though Tesla took over the role of the leading company in the car production market, there is still lots of controversy about its shares. But in every risk, there's also an opportunity. The company enlarges the production of its innovative products and takes another giant step into the field of electric car production. So, for lots of investors, Tesla stock is a must-buy stock from the perspective of long-term investment.

The fact is that Tesla stock is volatile, and not all investors can handle it. As such, you'll have to figure if you wish to invest in Tesla for a long-term investment or use this stock as an asset for day trading activity. After all, Tesla is widely covered in the news and Tesla stock is very popular among investors. So, if you can take this risk, we suggest you simply click on eToro the website link to start trading Tesla shares in the UK.

eToro - Buy Tesla stocks with 0% Commission

eToro have proven themselves trustworthy within the stock market over many years – we recommend you try them out.

Your capital is at risk. Other fees may apply

Read More:

What Are the Top 7 Best Tech Stocks To Buy

What Are The Best Undervalued Stocks In The UK

Which Top 10 UK Stocks Will Explode

FAQ

What is the highest Tesla stock has ever been?

The all-time high Tesla stock closing price was 883.09 on January 26, 2021. While the 52-week high stock price is 900.40.

Is Tesla Part of FAANG?

No, Tesla is not a member of FAANG. FAANG members are Facebook, Amazon, Apple, Netflix, and Alphabet (former Google)

Is Tesla's stock overvalued?

Several financial analysts consider that Tesla stock is actually overvalued, and it’s another market bubble that will burst soon. Besides, Tesla has a higher PE ratio than such biggest companies as Amazon, Netflix, Apple, etc.

What is the Tesla PE ratio?

Tesla's PE ratio as of April 08, 2021, is 1081.84.