Ethereum, like other cryptos, has gone through its struggles during the crypto winter. But 2023 has, so far, proved to be a bullish year for the second-largest crypto too. ETH has been in consolidation mode ahead of the most significant Fed policy announcements in years. The crypto has shown a colossal rise of 15% in ten days, and now investors are mulling to know how high ETH can go in 2023.

ETH Price Analysis

ETH has swiftly raised from earlier lows, while it was trading at $1,720 earlier this week. The crypto is now sitting at $1,814.63 with a 24-hour trading volume of $10,818,802,661. Although it is far too low from its 2021 all-time high of $4,891.70, it is all set for a bullish rally in 2023 and could touch a peak of $2000 soon, as predicted by experts. The cryptocurrency was up around 6% in the last seven days.

Given the upcoming updates and developments within the pipeline, the crypto’s deflationary nature post-Merge, and increasing interest from institutional investors, ETH is poised for long-term growth.

Effects Of Fed’s Announcements On Ethereum Price Prediction

The rising troubles in the US and global banking sectors have slightly affected the macro narratives driving digital currency prices lately. The fear of inflation and the Fed tightening regulations are still looming around the crypto sphere, which is affecting the price rallies of several cryptocurrencies.

As per reports, the US central bank is expected to lift interest rates by yet another 25 bps, which would take the federal fund's target range to 4.75-5.0%. Experts hope that the bank would soften its tone, given the outlook of the financial sphere with a series of regional bank collapses.

If the Fed’s decision is more aggressive than expected, then ETH could easily drop to its weekly lows of $1,700. While on the other hand, if the Fed comes across more softened, then ETH could trigger another bullish rally in 2023. The next near peak for the crypto bulls to hit is last August’s pre-Merge highs in the $2,030s, a further 12% rally from current levels.

How High Can ETH Go In 2023?

Ethereum is not merely the top crypto to invest in but also one of the most advanced blockchain networks hosting applications like dApps, DeFi projects, NFT marketplaces, and Metaverse projects. However troubled the traditional financial market sector has been lately, ETH has a bullish year ahead. Investors have finally started to see blue-chip cryptos like ETH and BTC as viable alternatives to the mainstream, fiat-based financial system. Therefore some experts argue that any contagion in the US banking space ahead would likely benefit Ether rather than hamper its growth.

According to the chart, ETH's strong recent bounce from its 200-Day Moving Average and recent golden cross, i.e., 50 DMA above its 200 DMA in early February, are long-term bullish signals for the crypto. A significant push into the upper/mid $2000 soon would be an added fuel for ETH’s dramatic growth in the coming years.

There are several catalysts that could make this distinct possibility a reality soon. The Merge has transformed Ethereum into one of the most advanced blockchain networks, and the upcoming Shanghai update would be another monumental strike for ETH. This would provide the network with the much-required technical underpinnings for future major upgrades like Sharding.

Additionally, several giant investors or ‘Whales’ have started accumulating ETH coins at an aggressive pace, which would significantly increase the token’s demand, pushing the price to new all-time highs. According to Ethereum price predictions, the crypto could lead the next bull run, marking its firm position as the best long-term investment option.

Can ETH Supply Deflation Improve Its Weak On-chain Activity

One of the bonuses of The Merge upgrade is Ethereum’s progression toward a more deflationary monetary policy. However, we cannot ignore the fact that the move to PoS has also made Ethereum less scrutinized in terms of energy consumption, which has been reduced by about 99.95%.

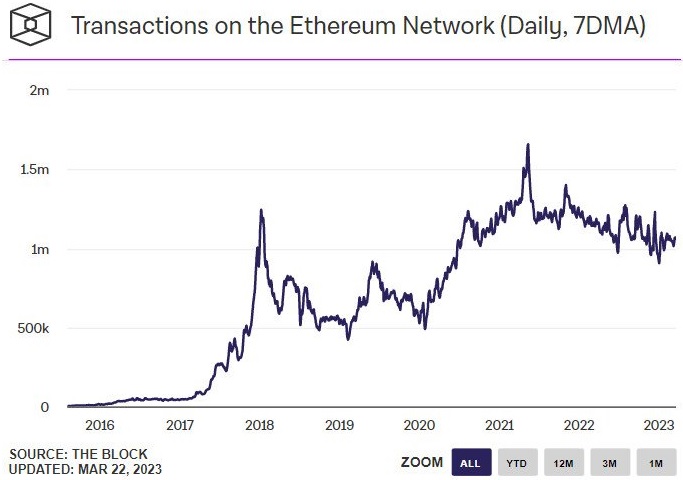

As per the on-chain data, activity on the Ethereum blockchain is not vigorous as expected and is yet to show a pickup pace highly needed for an ETH bull market rally this year. But industry experts believe that one main thing causing a spike in ETH’s activity is its deflationary nature. The reports show that the daily active and new addresses and the number of daily transfers continue to weaken within the bear market ranges.

However, ETH could still get a lift from its rising deflation rate. Although it was around 0.6% last time, it has briefly exceeded 5.0%on an annualized basis over the past few weeks.

A potential catalyst that would push ETH price to highs in 2023 is the upcoming “Shapella” upgrade scheduled for mid-April. It aims to facilitate staked ETH withdrawals for the first time, with greater flexibility in the long run, which would undoubtedly attract more investors. Assuming that stakers would prefer leaving their token to accrue interest for a prolonged period, this would significantly reduce the ETH’s circulating supply, eventually increasing its scarcity and skyrocketing the price.

The Bottomline

For those wondering how high ETH can go in 2023, the answer is to new highs if things go as planned, making it the best crypto to buy now for long-term profits. Although the market is highly volatile considering the macro-level conditions, price predictions show a positive outlook and a successful rally for Ethereum this year.

Read More: