Are you interested in cryptocurrency trading in Australia? If so, then stay right where you are. In this guide, we are going to divulge all you need to know about trading this hugely popular asset class. This includes everything from what cryptocurrencies are and how you can trade them in Australia - to strategies, how to place an order with your broker, and how to sign up.

The first cryptocurrency ‘Bitcoin’ was revealed to the world in 2009. No one could have imagined that by 2022 this digital currency would be used - in some way shape or form, by well over 54 million people globally. Some of the most traded digital currency assets are Bitcoin, Binance Coin, Cardano, and Ethereum.

With that said, there are now estimated to be almost 12,000 cryptocurrencies available to trade. Cryptocurrencies can be traded against one another in a pair, such as Bitcoin against Ethereum. However, the vast majority of Australian traders tend to trade crypto assets against fiat currencies such as the US dollar.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

What is a Cryptocurrency?

A cryptocurrency is, in its most basic form, a virtual currency. The majority of digital crypto coins can be described as ‘decentralized networks’ - most of which were developed using blockchain technology and digital files.

When we say cryptocurrencies are decentralised, this means that they are not backed by a central bank - like in the case of the Australian dollar, US dollar and British pound for instance. We’ve mentioned that there are nearly 7,000 of these virtual currencies, a number which grows year on year - so the pairing possibilities are almost endless.

You could think of cryptocurrencies as digital tokens which you are able to use to trade, transfer, and exchange. Unlike the bank account you use for tangible, government printed money - traders keep their digital coins in a ‘crypto wallet’. For those unaware, a crypto wallet is essentially software you can use to store, send and receive virtual currencies.

Each wallet comes with its own unique code. This code is like your own personal pin number, called a ‘private key’ which enables you to access your own wallet. As such, you should never share this with anyone else. Cryptocurrency wallets also come with an ‘address’. This is a ‘public key’ which identifies you as the owner of the wallet, and enables you to receive digital currencies.

By this point, we hope that you have a better understanding of what a cryptocurrency is. With that in mind, let’s move on to how a virtual currency can be traded.

What is Cryptocurrency Trading Australia?

When trading, in any context - your end goal is to buy, sell and make a profit. Cryptocurrency trading, in particular, consists of you choosing a crypto-pair to trade - and then trying to predict whether its value will rise or fall.

In a nutshell, you are buying and selling digital currency pairs, in the hope that you have timed the market well, and speculated the pair’s price correctly.

We’ve put together a simple trading scenario which might clear the mist on your role as an Australian cryptocurrency trader.

- You decided to trade BTC/USD

- Therefore, you are trading the value of Bitcoin against the US dollar

- BTC/USD has been quoted to you at $13,200

- You place a buy order worth AU$500

- 3 hours pass, and you place a sell order at $13,800 - which is the current price of the pair

- BTC/USD’s value grew by 4.54%

- From your AU$500 stake - you made gains of AU$22.70

Many Australian cryptocurrency brokers enable traders to ‘go short’ as well. This means that you can benefit from the fall of the cryptocurrency in question. For this to make a profit you must place a sell order and hope that the value of your chosen crypto pair goes down

There are obvious similarities between cryptocurrency trading and forex trading. After all, the market is based around a pair of currencies contending against each other. Largely due to supply and demand, the currency exchange rate can shift by the second. This is where you come in, speculating on which way the asset’s value will fluctuate.

Just about any Fred Nerk with an internet connection can trade digital currencies these days. If you are unsure of where to start when cryptocurrency trading in Australia, then stick with us. We are going to dive into crypto pair categories and orders shortly. First, we are going to shed some more light on how cryptocurrency trading works in practice

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

How Does Cryptocurrency Trading Work in Australia?

We’ve touched on the fundamentals - that being you need to speculate on the rise or fall of the value of the crypto pair. However, there are other things to be aware of.

Any seasoned trader will tell you the importance of learning the ins and outs of the market you’re interested in - before risking your capital. You’d be surprised how many newbie traders in Australia dive right in and confidently assume they will learn as they go along. We strongly advise against this.

Cryptocurrency trading involves decision making, looking at technical charts and following crypto news. It’s not just a simple case of buying and selling without caution, so it’s always recommended that you do some research of your own before diving in at the deep end. With that in mind, this ultimate guide to crypto trading in Australia will ensure that you start off on the right foot.

We touched on earlier that the majority of people trade crypto against a currency such as the USD. This will not pose a problem for Australian traders though. You will be able to fund your trading account in AU$ with your usual payment method (provided your broker accepts it).

It’s advisable to sign up to a trading platform holding a licence from a reputable body like ASIC (Australian Securities and Investments Commission) or the FCA (Financial Conduct Authority). We will cover this in more detail later.

Cryptocurrency Pair Categories

When you are on the hunt for the best crypto broker for your trading endeavours, you will notice that digital currencies tend to be segregated into 2 types.

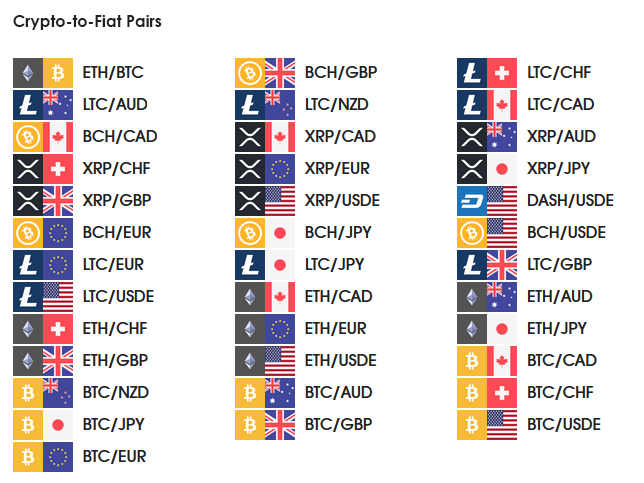

Crypto-to-Fiat

We briefly mentioned fiat currencies, so you are aware already that this means a government-approved currency such as the Australian or US dollar.

A crypto-to-fiat pair is a cryptocurrency such as Bitcoin, paired with a fiat currency. Commodities like Brent crude oil and gold are traditionally priced using USD also. The reason for this is that the US dollar is the most traded and in-demand currency in the world.

Below you will see an example of how crypto-to-fiat trading works, using a simple scenario:

- In this scenario, let's say you are trading Bitcoin against USD

- Your ASIC approved broker quotes BTC/USD at $11,000

- You feel BTC/USD is undervalued

- As a result, you open a buy order worth AU$800

- After a couple of days, the price of BTC/USD has risen to $12,650

- Your premonition was correct - the value of the pair has increased by 15%

- You action a sell order via your broker

- As you can see, your initial stake of AU$800 is now worth AU$920

- Your gains from this trade amount to AU$120 - less fees

In our above example, we used BTC/USD - but there are heaps more fiat currencies and crypto coins to trade in pairs.

You will see below just a handful of other tradable crypto-to-fiat pairs that are popular with Australians. That is of course if they are included in the pairs offered by your trading platform of choice.

- BTC/ETH

- BTC/XRP

- BTC/BCH

- BTC/AUD

- ETH/AUD

- XRP/AUD

Crypto-to-Crypto

Crypto-to-crypto pairs are sometimes referred to as ‘cross-pairs’. In a nutshell, this is two different cryptocurrencies competing against each other.

For instance, you might trade Bitcoin against Litecoin. This would be displayed as BTC/LTC. In our example the base currency is Bitcoin, whilst the quote currency is Litecoin.

Whilst on the subject, let’s offer an example of that particular trade:

- Crypto-to-crypto pair BTC/LTC is priced at 230.71

- This means that for 1 Bitcoin - you get 230.71 Litecoin

- Your role as a cryptocurrency trader is to correctly predict the inevitable rise or fall of the pair’s value

In all honesty, if you are somewhat of an inexperienced cryptocurrency trader, you might be better sticking with crypto-to-fiat pairs. The reason for this is that pairs are much easier to calculate when it comes to potential profit and losses if there is a familiar tender like AUD or USD.

Read More: Top Cryptocurrencies To Invest In Australia In 2021

Cryptocurrency Trading Australia: Trading Orders

Now we have explained what crypto trading is and how it works - we are now going to shed some light on what orders you can utilise. After all, orders are an integral part of cryptocurrency trading. Without them, your broker won’t know what position you want to take in the market.

Buy and Sell Orders

We thought we would start with buy and sell orders, not least because they are probably the most commonly used, and also the simplest to comprehend.

You know by now that when you are trading cryptocurrency in Australia, your goal is to correctly guess whether the value of your chosen crypto pair is going to go up or down. Moreover, the price of any asset is determined by the market demand and also the supply.

Please find below an example of how you might utilise a sell order in a real trading environment:

- You decided to trade crypto-to-fiat pair BTC/AUD (Bitcoin/Australian dollar)

- Let’s say you have a feeling that the value will plummet

- This leads you to place a sell order with your broker

Now in the case of a buy order:

- BTC/AUD is quoted at $19.198

- You predict that the value of the pair will go up

- With this in mind, you instruct your broker to execute a buy order

As you can see from our above examples if you think that the price of a pair will fall - you place a sell order. If on the other hand, you think the price of the pair will rise - you place a buy order.

Market Orders

When placing a market order, you are buying or selling your crypto coins for whatever the going price is at that time.

In the name of clarity, please find a simple example below, illustrating when a market order might come in useful:

- You want to buy or sell your crypto pair in an instant - at the current price

- With this in mind, you place a market order

- As a result, your broker executes your request at - or as close as possible - to the present market price

A market order is in no way a guarantee that you will get the exact price you wanted. However, it does guarantee that your order will be executed immediately.

Limit Orders

You could think of a limit order as you pre-establishing your chosen buy or sell price boundaries- or better. Put simply, this type of order enables you to instruct your broker to action a super precise entry strategy.

We will now give you an example of when you may use a limit order:

- Let’s suppose your cryptocurrency pair of choice is quoted at AU$180

- You want to enter your position at AU$160

- With this in mind, you place a limit order

- The aforementioned crypto pair falls to AU$160

- Your broker executes your order

Because your order is so specific, limit orders are much more suitable for short-term investors. Crucially, note that your trade request will remain pending until your limit order price has been achieved.

Stop-Loss Orders

Stop-loss orders are popular with Australian traders, mainly because they are very useful when it comes to mitigating losses. It’s a good idea to use stop-loss orders on each and every trade to ensure you don’t lose more than you had anticipated.

Please find below a simple example of when you might place a stop-loss order when trading cryptocurrency in Australia.

- Let’s say you’re trading BTC/USD (Bitcoin/US dollar)

- You fancy your chances on this pair, so place a buy order of $3,000

- You are unwilling to make a loss of more than 12% of that stake

- With that in mind, you place a $2,640 stop-loss order

- The price of BTC/USD falls to $2,640

- You placed a stop-loss order so your broker closes your trade at that specific price

In the above example, it wouldn’t have mattered if the pair continued to tank in value, as your stop-loss order prevented further losses!

Take-Profit Orders

Now we’ve covered a few of the most popular cryptocurrency trading orders used by the Australian trading community - let’s tell you about take-profit orders. Much like in the case of stop-loss orders, take-profit orders are a great way to manage your risk vs reward exposure.

Let us put together an instance when you might action a take-profit order:

- Imagine you are trading ETH/AUD

- You place a buy order worth AU$1,000

- In this case, let’s say that your goal is a profit of 20%

- With this in mind, you place an AU$1,200 take-profit order

- If or when ETH/AUD hits that amount - your broker closes your trade for you

- You’ve locked in your gains of AU$200

By using the orders we’ve detailed in this section of our guide, you are able to gain some much-needed control over potential losses and gains.

When you’ve created a take-profit order, for example, this is executed automatically by your broker. This means that you can relax to a certain extent - meaning you do not have to manually close your orders at the right time.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

What Cryptocurrencies Can I Trade in Australia?

Millions of us trade online every single day. After all, where there is demand for an asset, chances are you will be able to buy or sell it. Without meaning to beat you over the head with it, there are thousands of cryptocurrencies that can be traded in Australia.

We’ve given you some examples of orders throughout our guide so far, so the likelihood is that you are eager to check out your crypto options

With that said, we’ve listed below some just of the digital currencies available to trade in Australia - to inspire you.

- Bitcoin

- Bitcoin Cash

- Stellar

- Cardano

- IOTA

- Ethereum

- Ethereum Classic

- NEO

- Dogecoin

- Shiba

- Solana

- Binance Coin

- ZCash

- Dash

- EOS

- Ripple

- Litecoin

If you want to get an idea of how much these cryptocurrencies are currently priced at - you can check with your broker. Alternatively, check out a price tracking platform like CoinMarketCap.

All of the above cryptocurrencies are available at Australian broker eToro - and can be traded commission-free. Although they are all priced against the US dollar - eToro also offers several pairs quotes in GBP, EUR, AUD and JPY.

Am I Able to Make Money Trading Cryptocurrency in Australia?

Yes, you can indeed make money trading cryptocurrency in Australia. Of course, saying you can doesn’t mean you will. Don’t be too disheartened though, the trading of any asset comes with risks attached.

The truth is the best way to predict your trading future - is to create it. By gaining a good understanding of the cryptocurrency market and making the most of all of the tools available to you - why shouldn’t you have a shot at making a profit?

We are going to dive right into trading strategies shortly. However, first, let's explain how you actually make money by trading cryptocurrencies in Australia.

Below you will see an example of both going ‘short’ and going ‘long’:

Example a) Going short on BTC/AUD - Believing the price will fall

- Imagine you are trading Bitcoin against the Australian dollar

- On Tuesday, BTC/AUD has been quoted by your broker at AU$21,000

- You action a sell order on the pair worth AU$500

- Friday comes around and BTC/AUD is now quoted at AU$18,500

- The value of this crypto pair has fallen by 11.90%

- You correctly went short so now action a buy order - subsequently closing the position

- The AU$500 outlay has become AU$559.90

- You made gains of $59.90 on this trade

As you can see from the above, you placed a buy order to enter the position and then a sell order to close it.

Example b) Going long on ETH/AUD - Believing the price will rise

- Let’s hypothesise that you are trading ETH/AUD

- Your broker quotes you AU$550

- You believe the price will rise

- You action an AU$1,000 buy order

- 2 hours later ETH/AUD is priced at AU$580

- The newly quoted price of AU$580 illustrates a 5.45% increase

- You decide to place a sell order to cash in your gains

- The result is that your initial AU$1,000 grew to AU$1,054.50

- You made gains of AU$54.50 on this trade

In this scenario, you entered with a sell order and to close the position, you placed a buy order.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Cryptocurrency Trading Australia: Tried and Tested Strategies

By this point in our guide, we have detailed the inner workings of cryptocurrency trading in Australia, including tradable crypto-assets, order types and a few tips along the way.

Next, we are going to explore some tried and tested strategies for you to consider using in your own crypto trading endeavours. From swing trading and market corrections to useful tools and technical analysis!

Cryptocurrency: Swing Trading

When swing trading, positions tend to be kept open for between 1 trading day to a few weeks maximum. In this strategy, studying the trends of the market offered by charts is essential.

Short-term cryptocurrency traders in Australia often use swing-trading - with the main idea being to spot assets which are showing a prominent trend, trading in the parameter of a channel.

Put simply, the focus with a crypto swing trading strategy is to concentrate on short-term trends and modest gains. Cutting your losses or buying, based on your findings when analysing the market.

Let’s give you an example of swing trading, using Litecoin and the US dollar as our pair:

- LTC/USD has been on an upward trend for weeks - so your buy order has been making some nice gains

- Having performed some research, you suspect the pair is no longer desirable

- You now need to catch the market correction in time by closing your trade

- With this in mind, you create a sell order on your LTC/USD trade

- But, you then place an additional sell order to catch the downward trend!

If on the other hand, LTC/USD continued its upward trajectory, you would likely keep that position open and ride the trend for as long as possible.

Utilise Market Corrections

Market corrections are not to be confused with a ‘market crash’. While a market crash can last for months, if not years - market corrections, on the other hand, are short-lived. - In fact, they might only persist for around a few days or weeks.

In a nutshell, these market corrections are actioned when there is a prolonged upward or downward trend in the price of cryptocurrencies that is ‘temporarily’ halted.

Let us give you an example of market corrections and how they are used:

- Envisage that BTC/LTC has enjoyed an upward trend for a little over 3 weeks

- Let’s say the pair has experienced gains of 38%

- This couldn’t possibly continue on an upward trend at this rate

- Moreover, crypto investors are bound to cash in their profits at some time

- At which point, the value of BTC/LTC falls and changes direction

In our example, BTC/LTC changes direction because the amount of people selling a financial asset supersedes the number of people buying it. This is supply and demand in a nutshell.

Although these ‘corrections’ can be taken as a strong indication of the collapse of the BTC/LTC upward trend - it is merely a temporary intermission.

With this in mind, you may just decide to proceed with a buy order via your broker, in sync with the market correction. This gives you the opportunity to jump on the upward trend whilst the price is low.

Understanding Technical Analysis

Technical analysis is one of the most important factors when trading cryptocurrency in Australia. Studying charts and utilising trading tools can give you a much clearer indication of the market sentiment of cryptocurrency pairs.

As well as technical analysis, we’ve put together a list of the most helpful tools and software used by cryptocurrency traders today (of course, there are heaps more):

- Crypto charting tools - Tradingview, Cryptowatch

- Market data - Coinmarketcap, OnchainFX, CryptoCompare

- Calendar tools - CoinMarketCal, Coindar

- Network statistics - BitcoinVisuals, CryptoMiso

- News aggregators - CryptoPanic, FAWS

- Research reports - Crypto Research Report

- Crypto tax tools - Cointracking.info, TokenTax

- Portfolio trackers - Blockfolio, Cointracking, Blox

- Portfolio rebalancing tools - Shrimpy, 3Commas

- Blockchain explorers - Blockchain.com, Etherscan

Now, back to technical analysis. Although it can take months or even years to get to grips with technical analysis, by having a basic grasp to begin with - you are giving yourself the best chance of success.

With that in mind, we have put together a list of the most useful indicators and charts for your consideration.

Relative Strength Index

This momentum oscillator (RSI) tracks the pace and price fluctuations of a crypto asset. It’s a very useful tool for cryptocurrency trading. This is because the index illustrates when an asset is oversold and overbought.

Knowing whether an asset is being overbought or oversold is going to help you to anticipate potentially profitable trading opportunities.

Candlestick Charts

Candlestick charts are one of the most basic forms of technical analysis, and they can be used to aid you in speculating the future price of a cryptocurrency.

High wicks on a chart tend to point towards a super volatile market - therefore could indicate a market correction in the imminent future.

If the top wick on the candlestick chart is short, this likely shows that the highest value of the digital asset was noteworthy, in terms of the crypto coins’ price history. A longer top wick points towards a temporary bearish market.

If you see that the wick at the bottom is short, this can mean that traders are selling - which will likely lead to an increase in supply. The increase in supply of the asset in question will usually mean a drop in value.

Support and Resistance Levels

Support and resistance levels are essentially horizontal lines that can be added to your trading chart of choice.

These horizontal lines serve two main purposes:

- The support level is the level at which a downward trend is likely to end - mainly due to crypto traders purchasing large amounts of the pair at this price point. Because demand here is high, the price of the cryptocurrency rises - and so the support line is created.

- When it comes to the resistance level - this works in the same way as supports lines, albeit, in reverse. In other words, this is a price point which acts a defence against continued upward momentum.

Bollinger Bands

This statistical chart will show you the value and volatility of cryptocurrencies, over time. By studying Bollinger Bands you will be able to at least shed some light on which direction you think a digital crypto pair will go.

Here are some of the main features of this statistical chart:

- Bollinger Bands display a centreline and 2 different price lines

- The centreline shows the moving average of the pair

- The price lines are standard deviations of the crypto asset

- If the ‘bands’ are close to the moving average line - this could indicate low volatility, with a likelihood of a change in direction later

- Should the lines be distanced from each other, the opposite is true and you could expect low volatility to follow

As our example illustrates, Bollinger Bands aid traders in spotting the upcoming volatility of a cryptocurrency pair. This might give you a good indication of when to enter or exit the market. You can also use additional indicators in conjunction with this chart - like the BandWidth or BBTrend.

Moving Averages

A moving average aims to reveal price trends, without the additional ‘noise’ - meaning minus any severe price movements. This helps create a clearer picture of which direction a currency pair might go.

Moving averages include:

- Smoothed moving averages

- Simple moving averages

- Exponential moving averages

- Linearly weighted moving average

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Cryptocurrency Trading Australia: The Benefits

Just in case you are still undecided about whether or not you want to embark on cryptocurrency trading - it is now time in our guide to detail the benefits of trading this popular asset.

Short-Term/Long-Term Trading

Whilst you might not know your own preference right now, some traders prefer to trade on a long-term basis - keeping positions open for years. Others favour short-term trading - holding positions for minutes, hours or days at a time.

Should you be interested in investing in cryptocurrencies, you might want to utilise a buy and hold strategy. This allows you to access the underlying digital currency on a direct basis. In this case, you would utilise your aforementioned crypto wallet and set up an exchange account.

With that said, you can invest in 16+ cryptocurrencies at ASIC-regulated broker eToro without needing to worry about complicated wallets. Best of all, you can invest just $50 into your chosen coin - which is about AU$70!

Crucially, when trading cryptocurrencies on a long-term basis you will need to avoid CFDs. The main reason for this is because CFDs left open in the long-term invite overnight financing fees. For those unaware, overnight financing fees, or swap-fees, are a form of leverage interest. This fee is charged daily for holding trades overnight.

On the other hand, CFDs are great for short-term cryptocurrency traders as they allow you to go short, apply leverage, and in some cases - benefit from zero-commissions.

Buy and Sell: Potential Gains Either way

When trading the stocks market, investors buy certain shares believing that the price will rise - resulting in a profit.

The same goes for cryptocurrency trading, with the added bonus of being able to speculate either way - as explained earlier, this is achieved by going long or short.

To reiterate, if you believe the currency pair you want to trade is going to go down in price - sell it by going short. If you have a feeling the price will rise - go long.

24/7 Cryptocurrency Trading

The majority of stock exchanges operate 5 days a week, between the hours of 9 am and 5 pm.

This means that if you work full time like the majority of Australia - trading around work commitments could be challenging. Even when it comes to cashing out - some trading platforms do not offer weekend trading.

On the contrary, when cryptocurrency trading Australia you are able to trade digital assets around the clock - meaning 24/7.

Trade With Leverage

In this section of our ultimate guide to crypto trading, we are going to explain the benefits of trading digital coins with leverage. As noted above, a key characteristic of cryptocurrency trading via CFDs is leverage.

CFD leverage enables traders to gain more exposure to the market, whilst paying a small percentage of the price of the trade. It is a bit like your broker offering you more than you have in your account - comparable to a loan.

Leverage is measured as a ratio, and at this time you can access as much as 1:30 with some Australian brokers. This means that for each AU$10 stake, you could have an additional AU$300 to pump into your trade.

Here is a simple example of how leverage might affect your cryptocurrency trade:

- Let’s say you currently have AU$1,500 in your trading account

- You wish to trade BTC/USD

- Your broker offers you 1:2 leverage

- This means you can now trade BTC/USD with AU$3,000

As you can see from our example, applying leverage doubled your stake in BTC/USD. With that said, it’s vital that you remember that whilst this leverage can increase your profits - the same can happen to your losses, should the trade not go the way you thought it would.

It’s important to note that due to recent changes in ASIC regulation, which kicked in on 29 March 2021 - leverage will be capped at 1:2, which is the same as the UK and Europe (as per ESMA rules). This still enables you to trade crypto whilst doubling your stake.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Cryptocurrency Trading Australia: The Drawbacks

We have informed you of the benefits of trading this speculative asset class, so at this point in our guide, we are going to detail some of the drawbacks to consider.

Disadvantages of the AU Cryptocurrency Trading Scene

Potentially a Super Volatile Market

The value of assets shifts continuously. However, Bitcoin for example can fluctuate by as much as 10% in a single trading day. This means cryptocurrency trading has the potential to be highly volatile.

There are ways to implement a level of damage control, like the aforementioned stop-loss and take-profit orders for example.

Utilising more than just buy and sell orders gives you the advantage of being able to mitigate losses and secure your gains. Not only that but you don’t need to worry about keeping an eye on things in real-time, as it is your broker's job is to execute those orders for you.

It has to be said though, most people choose to trade cryptocurrencies because they like that volatility. Let’s face it, when the risks are high, your profits can potentially be even greater.

Unregulated Market Exchange

Whilst there has been talked over the years about regulating cryptocurrencies in Australia - this is easier said than done. After all, no single person or authority owns Bitcoin, making it hard to regulate in the truest form.

Additionally, digital currencies are not regulated is that they are not ‘legal tender’ so to speak. This means that the value of the asset is not decided by a monetary authority.

Put simply, this means that they are not printed or circulated by a major bank or government. You can’t pay your taxes with them and they are not a ‘fiat’ currency. Instead, the value of cryptocurrencies is decided by the market sentiment - supply and demand.

Should the lack of an authoritative regulator give you the fear, then you should 100% stick to a fully licenced broker such as Australia’s own ASIC, FCA of the UK or CySEC of Cyprus. We are going to cover regulation in more detail further down this guide.

Cryptocurrency Trading Australia: Possible Broker Fees

It’s crucial to be mindful that there are fees to take into consideration when cryptocurrency trading Australia, or any country for that matter. The broker is going to charge you fees in order to make some money for providing a service to you.

Each and every trading platform is different in this respect, so with that in mind, we have compiled a list of potential fees you might expect to pay when trading online.

Crypto Spreads

To reiterate, the spread is the difference between the buy and sell value of a cryptocurrency pair. This is an important factor when considering which brokerage firm you might want to sign up to.

There are a lot of trading platforms out there, such as eToro, that offer commission-free trading on cryptocurrencies. As the broker won’t make any money in commission, it’s important they try to counteract that loss with spreads. This spread is usually shown as a percentage or in pips.

Let’s give you an example of the spread in a hypothetical trade:

- Let’s say this time you are trading LTC/GBP

- The quoted buy price of this pair is £41.20

- The sell price of LTC/GBP is £41.96

- This shows us that the spread on this crypto pair is 1.84%

In this example, before you can break even, your profit on the trade needs to be 1.84% - anything above that percentage you can add towards your gains.

Trading Commissions

As we’ve mentioned, there are commission-free online brokers out there. However, we should point out that some actually charge a commission on each and every trade.

In this case, every buy and sell order is going to be liable for a fee. Most trading platforms in Australia charge fees in the form of a percentage of your order value.

Below you will see an example of how this could affect your crypto trades, and we’ve based this on a broker charging 2% commission.

- You want to trade BTC/USD

- You stake AU$1,000 on the pair

- The broker charges you the 2% fee, which equates to AU$20

- For whatever reason, you elect to close your BTC/USD position

- At the time of exiting, your trade is worth AU$1,400

- Again your broker needs 2% for carrying out your order, which is AU$28 (2% of AU$1,400)

- Opening and closing this trade has cost you AU$48 in commission alone

Whilst this is something to watch out for when you are looking for a good trading platform, as we said, there are brokers offering zero-commission crypto trading - notably eToro.

Account Inactivity Fees

Whilst not all trading platforms charge fees for not using your account - some do. Our ultimate guide to crypto trading in Australia found that this can vary by quite a lot.

For instance, there are brokers who like for you to be actively trading month in month out and will charge you a monthly fee for not using your account for 30 days. Others might charge a small monthly fee - but after 12 months of inactivity.

For the reasons mentioned, it is always a wise move to check the fee table and the terms and conditions of any trading platform. Do this before signing up and parting with any cash.

Overnight Financing Fees

As we touched on, overnight financing fees are charged on any trading position left open overnight. This is especially the case with cryptocurrency CFDs, due to the leveraged nature of the financial instrument.

To save any confusion you should know that overnight financing fees are otherwise called ‘swap-fees’ or ‘overnight funding fees’. It’s a bit like leverage interest, payable for every day that a trade is left open.

You will see below a simple example of these fees and how they are charged:

- Imagine it’s Wednesday - you action a short-sell order worth AU$2,000 on BTC/USD

- You leave that position open

- First thing on Sunday morning you close your trade

- Using eToro as an example, you will be charged $0.23 per day - Wednesday to Friday

- Saturdays and Sundays come with a $0.69 overnight financing fee on this specific pair and order size

- As such, keeping your BTC/USD position open from Wednesday to Sunday morning will cost you $1.38 at eToro

Using our example above, if you had elected to go long on that same trade with zero leverage you would not have paid any swap-fees at all.

Transaction Fees

By transaction fees, we mean crypto deposit and withdrawal fees. Not every trading platform charges a transaction fee - however, it is still important to be mindful of them.

Some broker platforms charge a small fee for each and every withdrawal, others might just charge you if you request to withdraw under a specified amount. Either way, it’s pivotal to check each broker’s fee table before signing up.

Cryptocurrency Trading Australia: Optional Software and Signals

We’ve gone into great detail about the various tools and technical indicators which will be an integral part of your trading pursuits.

At this point in our guide, we are going to walk you through three (of many) trading software add-ons utilised by cryptocurrency traders.

Crypto Trading Signal Software

It might be that you want to fully submerge yourself in cryptocurrency trading. By that we mean keeping an eye on the markets, reading charts and placing each order manually when you spot potential trading opportunities.

However, should you be the type of trader who doesn’t mind a more hands-off approach, then a crypto trading signal service might be of interest to you.

A signal service scans the relevant markets 24 hours a day and 7 days a week - sending traders real-time signals. This includes information on the asset and when to buy or sell to hopefully make gains.

Let’s have a look at how a cryptocurrency trading signal service would help you:

- In our example, your trading signal is referring to BTC/USD

- The notification will include a suggestion to buy this pair

- A limit-order suggestion of $13,200

- A stop-loss suggestion of $13,100

- Finally a take-profit suggestion of $13,300

Of course, the above example is hypothetical. However, as you can see, cryptocurrency trading signal services do the research for you. All that is left to do is decide whether or not to action the suggested order with your broker of choice.

Crypto Trading Automated Robot

Unlike the aforementioned trading signal software, crypto trading automated robots (or EAs) also create your trading orders for you. This is an entirely passive way of trading. Which incidentally is suitable for both novice traders and people who simply don’t have the time to actively trade.

Here are some key benefits of using a cryptocurrency trading EA:

- As human beings, we need sleep and rest to maintain mental and physical function - automated robots can scour the markets 24 hours a day, 7 days a week

- Controlling one's detrimental trading emotions of greed and fear can be tricky at the best of times - automated robots operate using algorithms and signals. Thus removing the psychological aspect of trading

- There is no need to spend months or years learning how to read price charts and understand technical analysis - the EA does the legwork for you

MetaTrader4 Software

There are various avenues if you are interested in trying a crypto trading automated robot. One of the most popular ways to utilise this type of software is via third-party trading software MetaTrader4.

If this sounds like something you could be interested in, then have a look at our step by step guide to getting your own crypto bot (via MT4).

- Find an automated robot provider you like and sign up

- Pay the required upfront fee

- Click on the link (usually sent via email) - download the software

- Find an online broker which is compatible with MT4

- Elect to install/download MT4

- Using your trading platform sign in details - sign into MT4

- Add your automated robot software to MT4

- Authorise the software to execute trades on your behalf

Not only that, but MT4 is highly respected in the crypto space and has a plethora of trading tools on offer.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Cryptocurrency Trading Australia: Four Tips and Tricks

By now you hopefully feel confident enough to begin a career in cryptocurrency trading. Before we delve into how to sign up, we’ve listed 4 tips and tricks for you to consider.

Number One: Use a Licenced Brokerage Firm

Throughout this guide, we have mentioned ASIC and regulation. This is because we think it is extremely important to stick with licenced brokers. This body is responsible for governing and regulating brokerage firms in Australia, to maintain a safe trading environment for all.

ASIC trading platforms are obligated to keep your trading funds in a separate account to the broker’s own account. This is called ‘account segregation’ and protects you in the unlikely instance the company goes bankrupt or experiences embezzlement etc.

Additionally, no ASIC approved broker is allowed to provide financial services without a minimum company account balance of AU$1 million. Look out for the ASIC logo, or head over to the official ASIC website to check the legitimacy of the trading platform for yourself if you are unsure.

Number Two: Gain an Understanding of the Crypto Market

Much like with any new chapter in your life, especially one involving money, you need to have a clear understanding of it and do your homework.

In addition to guides like this, there are all sorts of helpful cryptocurrency trading courses and books available - most of which are accessible online.

When it comes to online crypto trading courses you can find heaps by carrying out a simple internet search of what you are interested in. They can really help traders to understand how to manage risk and spot potential cryptocurrency trends. Not only that, but you can learn to strategise, read price charts and more - from the comfort of your own home.

We at Trading Education offer a wealth of courses that can help you take your cryptocurrency trading endeavours from zero to hero in no time at all!

Number Three: Try a Copy Trading Feature

Copy trading is a growing global phenomenon in the trading community. For those unaware of this feature, it gives traders the ability to select a trader with a proven track record and copy them.

On leading social trading platform eToro you can elect to copy all future trades of an investor you like the look of, or you can mirror their entire portfolio.

To elaborate a little further, if the copy trader was to invest 2.6% of their own portfolio into Bitcoin, your own trading portfolio would reflect this. Irrelevant to your account balance, 2.6% of your portfolio is also invested in Bitcoin.

Through a trading platform such as eToro, you can copy a trader for as little as $200 (about AU$284). If you had an account balance of $1,000, you could essentially copy 5 different pro traders - which is a great way to diversify your portfolio and soften your risk.

Read more: Copy Trading: The Ultimate Beginner’s Guide

Number Four: Use Demo Trading Accounts to Your Advantage

If you have no idea what a demo trading account is, they enable traders to buy and sell cryptocurrency (or any asset) with ‘paper’ funds. This means you can trade in a market which reflects real-life conditions - without using your real money.

Demo accounts are there to be taken advantage of, whether you are a complete crypto trading novice, or want to practice a potential strategy. These accounts are usually free, although not all brokers offer them.

Trading platform eToro gives all clients a free trading account, which comes with $100,000 in demo funds.

Cryptocurrency Trading Australia: Quick Checklist for Choosing a Broker

There are hundreds of cryptocurrency brokers out there in Australia, all of them falling over themselves to offer a superb online trading experience. As such, it can be a daunting task selecting the right one for your own trading style.

With that in mind, it’s a good idea to think about your personal trading goals and learn about the market.

We’ve put together a simple checklist of important metrics to consider when searching for your ideal trading platform.

- What are the deposit and withdrawal options?

- Is the cryptocurrency trading platform regulated by ASIC or similar?

- Does the broker offer the specific asset/market you are interested in?

- Is the cryptocurrency trading platform user friendly and easy to navigate?

- Are the spreads tight and the fees low?

- Does the cryptocurrency broker offer live chat and have positive feedback when it comes to customer support in general?

The long and short of it is - there are heaps of fantastic and highly regarded online brokers you can use when trading cryptocurrency in Australia. With that said, eToro tops the bill for us as it offers commission-free trading, is fully regulated by ASIC, and allows you to trade or invest in cryptocurrencies at the click of a button.

Ready to dive into crypto market?

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

How to Open an Account With a Cryptocurrency Broker in Australia

The vast majority of trading platforms make it super easy to sign up and get started.

However, in the name of being thorough, we have drawn up a 4 step guide on how to open a cryptocurrency trading account in Australia right now.

Step 1: Sign Up With a Crypto Exchange

Once you have found a broker you like you can elect to open your new account. This usually involves clicking ‘sign-up’ on the website. Followed by entering your full name, email address, date of birth and mobile number - when prompted.

You will likely need to provide the trading platform with a clear photograph of your photo ID (Australian passport or driving licence are easiest). This is standard practice amongst ASIC regulated brokers, as it’s important that they verify who you are to prevent financial crime and such like.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Step 2: Fund Your Trading Account

Next, you need to deposit into your account using your preferred payment method from what is accepted by the broker.

eToro will allow you to pay by credit and debit card, e-wallet (e.g Skrill, Paypal), or bank transfer. If you need to pay by a specific method, then you should always check what the broker accepts before signing up.

Next, you will need to choose how much you would like to deposit into your account. Trading platform eToro has a minimum deposit of $200. There is a 0.5% forex fee when paying with Australian dollars - or anything other than USD for that matter.

Step 3: Select a Pair to Trade

Next, you need to decide what cryptocurrency pair you would like to start with. Generally speaking, you should find that there is a search facility - or at least a menu where you can select from a list of crypto-assets.

This is why it is important to check first what digital assets the broker can offer you - before you part with any money. eToro offers 16 cryptocurrencies that you can invest in, and heaps more that you can trade via fiat and crypto-cross pairs.

Step 4: Place an Order

Now your account is funded - you can place an order and start to trade. We have discussed crypto trading orders in detail - so you know you will need to start with buy or sell - depending on which direction you think the pair will go.

As soon as you have filled in the order particulars and have decided on your stake - the money will be deducted from your account and your trade will be actioned. Now you can sit back and hope for a profitable cryptocurrency trade!

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Conclusion - Cryptocurrency Trading Australia

You will never be short of options when trading cryptocurrency in Australia. We’ve mentioned that the most traded cryptocurrency pairs include Bitcoin - alongside Ethereum, Ripple, and Bitcoin Cash. Additionally, there are over 7,000 tradable digital assets to choose from, and a bunch of fiat currencies to pair them with.

The lion's share of Australian brokers will provide you with leverage when trading cryptocurrencies. This means with leverage of 1:2 you can double your investment. Always tread with caution when trading with leverage as it can also magnify your losses.

There are some incredibly useful tools available to Australian cryptocurrency traders, such as technical indicators, educational videos and demo accounts - to name a few. Demo accounts, in particular, can be used as a free crash course on how the markets, and a trading platform, work.

FAQs Cryptocurrency Trading Australia

How can I pursue cryptocurrency trading in Australia?

In order to begin cryptocurrency trading in Australia, you need to find a broker who offers crypto assets. Next, you will need to sign up, deposit, and place an order - based on whether you think the value of the pair will rise or fall.

Can I short cryptocurrency in Australia?

Yes, you can short cryptocurrencies in Australia. In a scenario where you believe the cryptocurrency pair is priced too highly, for instance, BTC/LTC - place a sell order on your crypto CFD with your broker.

Am I able to apply leverage to my cryptocurrency trades in Australia?

Yes. The vast majority of brokers offer leverage. However, remember this is via Contracts For Differences - so make sure the trading platform offers crypto CFDs. Take note, in March 2021, Australians will be capped to leverage of 1:2 when trading cryptocurrencies.

What is the most liquid crypto pair to trade?

The most liquid crypto-to-crypto pairs to trade are BTC/ETH, USDT/BTC, ETH/LTC, and BTC/LTC. Crypto-to-fiat pair BTC/USD is the most popular in terms of trading volume.

How am I able to tell if a broker is legitimate?

A great way to tell if your broker is legit and genuine is to look for its licence logo from the appropriate regulatory body. For example ASIC (Australian Securities and Investments Commission), the UK’s FCA (Financial Conduct Authority), or CySEC (Cyprus Securities and Exchange Commission).