Why invest in Cosmos? What are Cosmos Token investment pros and challenges? Here is everything you need to know about ATOM investing.

Cosmos is a decentralized network that is aiming to become the backbone for interoperability between all blockchains. In fact, some of the most prominent digital cryptocurrency protocols of today - such as Binance Chain, OKEX, and Kira Network - have been built using the Cosmos SDK framework.

Needless to say, such attributes have resulted in a renewed interest in Cosmos and its respective ATOM token. If you are a prospective buyer, you might rightly be asking yourself how to invest in Cosmos and make some profits?

If so, this beginner's guide will provide you with comprehensive information on how you can make your first Cosmos investment safely and cost-effectively using a regulated crypto broker.

How To Invest In Cosmos (ATOM) - 5 Easy Steps Guide

The idea of investing in Cosmos can be daunting to beginners; however, it is easier than you might think. In fact, the requirements to get started with an ATOM token investment are indeed minimal.

Let us offer you a quick overview of how to invest in Cosmos in five easy steps:

- Step 1: Open an account with a regulated broker

- Step 2: Deposit some funds with a debit/credit card, e-wallet, or bank transfer

- Step 3: Choose the amount you want to invest in Cosmos (ATOM)

- Step 4: Confirm the investment

- Step 5: Leave your Cosmos stored until you decide to cash out

As the 5-step walkthrough above highlights, the process of investing in Cosmos (ATOM) could not be easier. Best of all, there is no requirement to worry about cryptocurrency wallets - as regulated brokers like eToro will store the ATOM tokens for you!

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Contents:

- How Does Investing in Cosmos Process Work?

- Why Invest in Cosmos?

- How to Invest in Cosmos - Various Options Available

- How to Choose a Platform to Invest in Cosmos

- How to Invest in Cosmos Today - Step-by-Step Walkthrough

- How to Invest in Cosmos Today - The Verdict

How Does Investing in Cosmos (ATOM) Process Work?

Before getting into the details of investing in Cosmos, let us provide you with a quick introduction to this cryptocurrency and why it might be a good fit for your portfolio.

The Cosmos project was commissioned in 2019 with an objective to make the process of building blockchains easier. Today, the network has become well-established and has over 20 companies alongside it.

In the most basic sense, Cosmos is a collection of blockchains connected via a Hub - allowing for different networks to communicate and transact with each other, all in a decentralized manner. This makes way for solving many problems currently plaguing the crypto space, such as scalability.

This capability of the Cosmos network is a factor that will influence its performance in the crypto market. Alongside, the value of ATOM - which is the native token of Cosmos, will also be determined by its development updates, secured partnerships, and more.

Due to such factors and their relative infancy, the value of cryptocurrencies like Cosmos is always susceptible to fluctuations. If there are more investors eager to buy ATOM tokens, then the price of this coin will increase - and vice versa.

As an investor, you want to analyze whether the value of Cosmos is likely to increase in the future. If your research proves that the coin has growth potential - you can consider investing in Cosmos for the long term.

But make sure that you always retain a cautious attitude towards your investment.

Here is an example of how a Cosmos investment works in the real market:

- Suppose that you are highly confident that Cosmos will gain more value in the future.

- You choose a crypto broker that offers Cosmos.

- The broker quotes you $15 per ATOM token.

- You make an investment of $500 at this price, buy Cosmos, and store the coins in your wallet.

- After two years, the price of Cosmos has increased to $45 per token.

- Wanting to take advantage of this 200% increase, you decide to cash out your investment.

- This means that, on a $500 investment, your profit comes to $1,000.

Now, bear in mind that there is always a chance that the value of Cosmos will drop after you make the investment. If this happens, you need to be prepared to take in some losses.

This is why there is a rule of thumb that says - 'you should invest only what you are willing to lose.' In other words, it is necessary that you always consider the risks involved before investing your hard-earned money into any asset - including ATOM tokens.

By being strategic, you can limit your losses and take a calculated risk when thinking of how to invest in Cosmos.

Read Also: What Is Cosmos (ATOM)? Should You Invest In ATOM

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Why Invest In Cosmos (ATOM)?

To continue from the previous point - before putting your money behind the Cosmos project, you should conduct a study on the current standing and past performance of this crypto asset.

To offer you some insight on this, we have put together some considerations that can affect the future growth of Cosmos.

Cosmos Has a Valuable Use Case

In the crypto industry, there are a few key factors that help you identify a potential gem - a unique idea, a good development team, and their expertise to coordinate complex objectives that can yield practical solutions.

In this respect, Cosmos seems to have hit the trio. Interoperability is one of the valuable use cases in the current crypto status quo, and at the moment, there are not many projects that have been able to get this right.

Even then, a vast majority of the networks that offer this have built their solutions on the Proof-of-Stake consensus pioneered by Cosmos.

This proves that Cosmos has utility and is already playing a crucial role in the blockchain sector.

Cosmos Internet of Blockchains

The end goal of Cosmos is to develop an Internet of Blockchains (IBC) that are able to communicate and operate with each other in a decentralized manner.

This allows for better communication, faster transactions, and overall optimization of different blockchain networks interacting with each other. This is achieved through a number of tools like Tendermint and Cosmos SDK.

This endeavour of Cosmos is considered to be one of the most important milestones of the cryptocurrency industry. This is because there are several other Proof-of-Stake protocols that can benefit from the IBC - such as Polkadot and Kusama.

Such further additions can lead to Cosmos playing a more prominent role - driving its price up further.

Cosmos Has Released Several Updates

Across the first half of 2021, Cosmos released several updates that have added to its value. For example, in February, Cosmos became the first public blockchain to integrate with China's BSN - which only consisted of private and permissioned networks until then.

In addition, the Graph has also integrated with Cosmos, among other blockchains. Later, Tendermint announced that it would be allocating $20 million for projects that are looking to build on top of the Cosmos network.

Cosmos also has a growing ecosystem - which consists of projects such as Binance Chain, Crypto.com, and Terra.

All things considered, Cosmos could continue to hold the advantage of being the pioneer of interoperable blockchains. Its native token ATOM can be used for staking and also serves as a governing coin on the network.

However, while considering the topic of the future potential of this project, it is also crucial to analyze its shortcomings.

The main concern regarding the future of Cosmos is the competition of its objectives and roadmap targets. Furthermore, there is nothing stopping other prominent networks like Binance from creating their own Hub via the Cosmos network.

If this happens, the demand for ATOM coins might be reduced, leading to a bearish market. As such, before investing in Cosmos, you should always consider the potential risks - which is essential in determining how much of your capital you should delegate to this digital asset.

Check Out: Pros And Cons Of Investing In Cosmos (ATOM)

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

How To Invest In Cosmos (ATOM) - Various Options Available

Once you are clear about your Cosmos investment strategy, you will need to find a crypto provider that can give you access to this exciting asset.

When thinking of how to invest in Cosmos for a longer period of time, you will want to buy ATOM coins and hold on to them - until you find the right time to sell them for a profit.

As such, you need a secure and trustworthy provider that can facilitate your crypto investments. Due to the popularity of this industry, you will come across numerous platforms promising exciting features.

Consequently, you should be extremely careful when you pick your crypto provider. In fact, your choice of platform will ultimately be decisive of your user experience when investing in Cosmos.

Keeping this in mind, let's discuss the two main options you have - cryptocurrency exchanges and brokers.

Cosmos Exchanges

Cryptocurrency exchanges are platforms where buyers and sellers meet to trade their digital assets, such as Cosmos.

On the face of it, there are many exchanges that are quite reputable, have millions of registered users, and allow you to purchase Cosmos easily. However, once you actually get into the process of investing, you will notice that it is not always that straightforward.

This is because many crypto exchanges do not permit you to buy Cosmos directly using fiat currencies. Meaning, you cannot purchase ATOM tokens by depositing US dollars or euros. Instead, you will only be able to get hold of Cosmos by exchanging another digital asset for it.

Now, as a beginner - you can understand why this might be tricky for you. If Cosmos is the first cryptocurrency you are investing in, you will not have any other digital coins to exchange it for. This means that you will have to buy another asset just so that you can swap it for ATOM tokens.

Moreover, you will also have to find a safe cryptocurrency wallet to store your digital tokens after making the investment. Such minor attributes can make the overall process of investing in Cosmos more challenging for newbies.

But, above all, the most significant aspect that works against cryptocurrency exchanges is a lack of regulation - which can add to the risk of your investments. This is why we would suggest that you consider using a regulated broker when thinking of how to invest in Cosmos.

Cosmos Brokers

There are a few reasons why we would suggest that you use a regulated broker instead of an unlicensed cryptocurrency exchange:

- To begin with, a regulated broker can offer you a safer and secure investment environment. Since these are licensed by financial authorities, such platforms have to abide by the strict guidelines that ensure the overall quality and transparency of their services.

- Regulated brokers will also allow you to invest in Cosmos directly using fiat currency. This means you do not have to go through the hassle of exchanging another cryptocurrency. You can simply pay for your ATOM tokens using your preferred payment method to make your investment.

- Many regulated brokers also offer in-built crypto wallet services. Meaning, once you purchase Cosmos, you can store it within the platform without having to move it elsewhere. This option will also make it effortless for you to cash out your investment more conveniently.

- Some regulated brokers also charge you relatively low investment fees and commissions when compared to cryptocurrency exchanges. In fact, you might even be able to find commission-free brokerage platforms that can give you access to Cosmos at much lower charges.

Considering these aspects, you can clearly see why you might want to have a regulated crypto broker by your side when investing in Cosmos.

You should always take the security of your Cosmos tokens seriously, and the first step to achieving that is finding a regulated online broker.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

How To Choose A Platform To Invest In Cosmos (ATOM)

While we have covered the several benefits of choosing a regulated broker for your Cosmos investments, we should say that selecting one is not going to be easy. Especially if you have no previous experience with brokerage platforms, then you will need to be extremely cautious.

This is because the crypto space is riddled with platforms offering you top-notch features, but unless you are careful, you will find yourself paying exorbitant fees.

With this in mind, let us tell you what key features you need to look for when searching for a broker to invest in Cosmos.

Licensing and Reputation

Our How to Invest in Cosmos Guide has clearly laid out the importance of choosing a regulated broker and the many perks that come along with it.

However, you might still be wondering what exactly is meant by regulation and how it affects the way crypto brokerage platforms engage with investors like you.

For those unaware, there are several regulatory bodies set up across the world that look over the investing and trading industry.

For example, to name a few, there is:

- FCA in the UK

- SEC in the US

- CySEC in Cyprus

- FSA in Japan

- ASIC and Australia

The main purpose of these bodies is to prevent any misconduct by the respective brokerage platform. To ensure that, they have designed several sets of rules pertaining to the specific services.

For instance, regulated brokerage platforms offering Cosmos are required to be completely transparent regarding the risks involved with investing and trading. In addition, they are also required to verify the identities of all its registered users.

Alongside, regulated Cosmos brokers cannot combine their company funds with client capital. In fact, it is mandatory for them to keep your capital segregated from theirs so that your money will always be available to you.

Such rules can play a significant role in the quality of the services offered by your chosen Cosmos investment platform. After all, if they do not follow these guidelines, their licenses would be revoked.

In other words, when you use a regulated broker to invest in Cosmos, you will receive unparalleled protection, which you will certainly not have access to elsewhere.

Fees to Invest in Cosmos

Fees are certainly a decisive factor when considering how to invest in Cosmos. However, do not always let high charges turn you off a broker. Sometimes, it is worth paying more if you can get the right balance between added protection, convenience, and safety for your Cosmos investments.

Furthermore, the fees are widely different between brokerage platforms. As such, you will need to carefully analyze what you are liable to pay and whether it is worth paying for in return for the service you receive.

When choosing an online broker for your Cosmos investment, you are likely to come across a variety of fees, such as:

Commissions

Whether you are making a Cosmos investment or cashing your tokens out, your broker will charge you commissions. The amount you have to pay will vary, depending on the amount involved in the transaction.

- For example, if your chosen broker has a commission structure of 3% on cryptocurrency investments - this means that a stake of $1,000 on Cosmos is going to cost you $30 in fees.

- If the commission is 2%, and your investment in Cosmos is $500, then you have to pay $10.

- What you shouldn't forget is that these commission charges will also apply when you are selling your Cosmos investment.

- That is if your ATOM coins are worth $5,000 when cashing out, a 3% fee will cost you $150.

That said, some crypto brokers might have different rates for buy and sell transactions. Furthermore, you will also be able to find brokerages that charge you no commissions at all.

In the latter case, you will need to take a closer look at the other types of fees charged.

Deposits and Withdrawals

Another common fee that will concern Cosmos investors is the charges on deposits and withdrawals. Usually, you might have to cover the transaction costs involved in processing your payments.

This, again, will depend on the payment method you choose, the type of currency you are depositing, and the total amount. It is important to be aware of these costs, as it can easily make a dent in your potential profits.

Minimum Cosmos Investment and Payments

The concept of minimum investments is not new to the financial space, and the same applies to cryptocurrency markets also. This is the specified smallest amount of money that you are required to invest into your chosen digital asset - in this case, Cosmos.

As with everything else, this requirement can also change drastically from one cryptocurrency platform to another. While some brokers require you to put up a few hundred dollars as a minimum, there are also those who have no such policy at all.

Like you can imagine, it might be in your favour to choose a crypto broker that has the lowest minimum investment requirement for Cosmos so that you need not risk high amounts to get exposure to this digital token.

Alongside, you should also check how you can deposit money to process your Cosmos investments. In the era of digitalization, you will find platforms that offer access to the easiest and fastest payment methods - such as debit/credit cards and e-wallets like PayPal.

There might be those among you who prefer a wire transfer. However, this might take longer to process - which might prevent you from making a Cosmos investment right away.

Storage and Cashing Out

If you seek to make a Cosmos investment for the long term, then you will need to think of storing your ATOM tokens in a safe wallet. However, you will need to figure out whether you want a hard or cold storage solution for your Cosmos coins.

Moreover, if you happen to lose your private keys (password), you might never be able to receive your Cosmos investment.

As such, a regulated broker that allows you to keep your Cosmos coins within your online account might be a good option, especially for beginners. This will also save you time at the time of cashing out your investment - as you will be able to do it directly from within your portfolio on your brokerage platform.

Later, when you have learned more about storage solutions or have increased your crypto holdings, you can choose to move your digital assets to an external wallet if needed.

Check Out: Is Cosmos Worth Investing?

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

How To Invest In Cosmos (ATOM) Today - Step-by-Step Walkthrough

Earlier in our How to Invest in Cosmos Guide, we laid out the five easy steps you can follow to complete the process.

However, the beginners among you could benefit from a more detailed and comprehensive explanation of each of these steps.

So, once you have decided which crypto broker you want to work with, here is what you need to know to get started with your first Cosmos investment.

Step 1: Open an Account

Head over to the website of your chosen regulated broker to create your investment account. Like any other site, you can do this by providing your email address, and choosing a strong password.

After confirming your email and entering your basic personal information, your account will be ready for the next step.

Step 2: Provide Some ID

Regulated brokers will also have another requirement that you will need to complete while setting up your account - the KYC process. This means that you will need to offer proof of your identity by providing a government-issued ID with your photo - such as your passport or driver's license.

The broker will also have to confirm the residential location you have provided, which you can complete by uploading a copy of a utility bill or a bank statement that contains your name and home address.

Completing this step is crucial to obtain unfettered access to all the features of your chosen broker - including fiat currency deposits and withdrawals.

Step 3: Deposit Funds

To begin the Cosmos investment process, you will first need to make a deposit into your brokerage account. You can do this by choosing one of the payment methods available on the platform.

If you are planning to invest in Cosmos right away, it is better to choose a method that will result in an instant deposit, such as a debit card, credit card, or an e-wallet like PayPal.

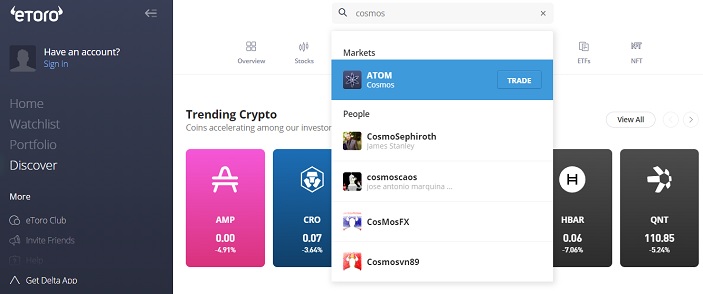

Step 4: Search for Cosmos

When your account is funded, you will be equipped to make your first Cosmos investment. You will be able to find the Cosmos trading page by searching for it. If nothing appears when you search for ‘Cosmos’ - try inputting ‘ATOM’.

Next, specify that you want to buy Cosmos and enter the amount you want to invest in this digital asset.

Step 5: Complete Cosmos Investment

When you feel ready to proceed, confirm your selections to complete your first Cosmos investment.

The ATOM tokens you bought will be instantly updated in your brokerage portfolio. You can then choose to store it on the platform (if such an option is available) or withdraw it to an external crypto wallet - until you are ready to cash out.

Step 6: Cash Out Your Cosmos Investment

Once you feel ready to sell your Cosmos investment, you can go to your brokerage portfolio and cash out your ATOM tokens from there. You will then be able to withdraw the proceeds to your original payment method.

If you have decided to store your Cosmos coins in an external wallet, this will require the additional step of transferring them to your chosen brokerage site first.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

How To Invest In Cosmos (ATOM) Today - The Verdict

In the saturated crypto universe, you need a unique idea that offers incremental improvements. And Cosmos is a project that has become successful in this regard.

That said, before considering how to invest in Cosmos, you should always conduct your own research on whether or not this asset is a good fit for your portfolio.

You will also need to find a regulated platform that can facilitate your Cosmos investments without compromising on your preferred payment method - alongside a competitive fee structure.

eToro – Best Platform To Buy Cosmos

eToro have proven themselves trustworthy within the crypto industry over many years – we recommend you try them out.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Read Also:

How To Invest In Cosmos (ATOM) FAQs

How can I invest in Cosmos blockchain?

You can make an investment in Cosmos through a regulated broker that offers ATOM tokens.

Is Cosmos a good investment in 2023?

The price of the native token of Cosmos, ATOM, has substantially increased since the beginning of 2021. However, past performance does not always indicate the future direction of an asset. As such, we would suggest that you tread lightly and invest only small amounts.

What is the minimum I should invest in Cosmos?

The minimum amount you need to invest in Cosmos will depend on your chosen brokerage platform.

Where should I store my Cosmos tokens?

Once you have completed the purchase of Cosmos, you can withdraw your tokens to an external crypto wallet. Alternatively, you can also choose a brokerage platform that offers an in-built storage facility.