If you are interested in trading the ATOM coin that fuels this unique and innovative platform - then please keep reading. Our how to trade Cosmos guide will provide you with everything you need to know to handle this digital token efficiently.

How To Trade Cosmos (ATOM) – Quick Guide

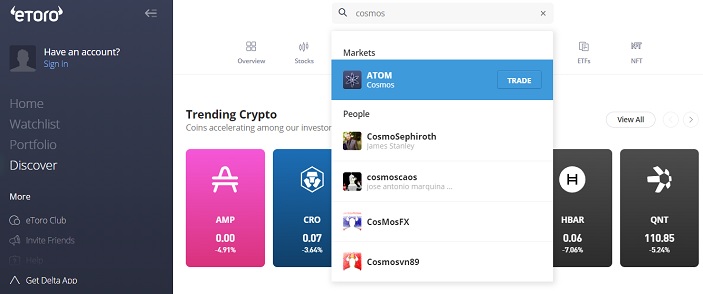

- Step 1: Open an account with a regulated crypto broker. You can trade Cosmos by opening an account with a credible broker like eToro.

- Step 2: Fund your account with a debit/credit card, e-wallet, or bank transfer.

- Step 3: Choose how many Cosmos coins you want to trade.

- Step 4: Buy ATOM (go long) or sell ATOM (go short).

- Step 5: Confirm your trade.

That’s it! By following these easy steps, you can trade Cosmos in less than 5 minutes.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Contents:

- How to trade Cosmos in 5 Easy Steps:

- What is Cosmos Trading?

- How Does Cosmos Trading Work?

- How to Trade Cosmos Online - Setting up a Trade

- How to Make Money Trading Cosmos

- How to Trade Cosmos 2023 - Step-by-Step Walkthrough

- How to Trade Cosmos Guide - The Verdict

- FAQs

What Is Cosmos (ATOM) Trading?

Whether you are trading cryptocurrency like Cosmos or precious metals such as gold and silver - the fundamentals remain the same. You buy and sell a financial instrument with the hope of making a profit.

However, as much as this sounds simple, the volatile nature of the cryptocurrency markets can make it slightly tricker.

- For example, at the start of February 2021, the value of ATOM was $8.14.

- Fast forward to May of the same year, and the token reached $29.48

- This alone shows us that you can never truly know which direction a crypto TRADE will take.

With that being said, you can take steps to give yourself a better chance of making a profit. For example, taking time to read how to trade Cosmos guides like ours - or teaching yourself how to predict the price fluctuations of ATOM as precisely as you can.

For instance, if there is a high demand for ATOM, the price will increase. On the other hand, if traders start to part ways with their tokens, then you may see a negative impact on the value of Cosmos.

As you can see, learning to pick up on these patterns can be highly beneficial to your Cosmos trading journey.

Let's look at how this would play out in a Cosmos trade:

- The price of Cosmos is $13.00

- The crypto pair in question here is ATOM/USD

- You believe that at $13.00 - the price of Cosmos is undervalued.

- Therefore, you place a buy order on the pair at a total stake of $350.

- After some time, the quote for Cosmos is now $20.80

- This rise highlights an increase of 60% of your initial trade.

- Wanting to close your position and bank your new profits, you create a sell order.

Our example shows that if this were indeed your trade - then you would have walked away with a huge profit of 60%! Meaning - you would have made a gain of $210 on a stake of $350. We would like to say that this is a daily occurrence on all Cosmos trades.

However, researching how to trade Cosmos and the market's price fluctuations is undoubtedly the only way to make consistent gains. Just keep in mind that no matter how high the potential profits are, a substantial loss can also quickly come around - so start slow, and then build your trades up as your experience grows!

Read Also: What Is Cosmos (ATOM)? Should You Invest In ATOM

How Does Cosmos (ATOM) Trading Work?

When it comes to the fundamentals behind trading Cosmos, you will find they run parallel with many other financial instruments - for example, gold, stocks, and commodities. That is to say, they all involve supply and demand, and you must have a comprehensive understanding of what powers them to make profitable trades.

- However, one main difference between the aforementioned assets is that cryptocurrency is far newer to the trading sector.

- In fact, the more traditional markets have crypto beat by over a hundred years.

- Not to worry, though, as Cosmos trading offers its own modern spin and can provide you with valuable investment opportunities.

As we previously mentioned, you must have a firm understanding of the workings behind trading the popular token ATOM. That is why the following segments of our how to trade Cosmos guide will cover the main crypto trading factors you need to know.

Cosmos Trading Price Movements

If you are familiar with trading Cosmos or any cryptocurrency - you will know that the price movements can tell you which direction you wish to take your position. For example, if there was a high increase in the value of Cosmos, this could indicate more traders believe it is a worthwhile investment.

This could be through a celebrity endorsing the token or straightforward word of mouth in groups like Reddit or Telegram. On the opposite side of the board, you could see a decrease in the price of Cosmos. This fall could mean more traders are selling, or there has been a negative impact somewhere in the market.

At the time of writing, you can see Cosmo's current and historical value on several exchanges. What you may notice is that each crypto exchange’s price may differ from the last. For example, one exchange may display ATOM/USD at a price of $13.15, and the next will show as $13.18.

This is called slippage. It happens due to the price fluctuations that occur each second in the cryptocurrency markets and shouldn't cause any major concern.

Cosmos Trading Pairs

If you followed us along with this how to trade Cosmos guide, you would have noticed we talked about cryptocurrency pairs. These pairs essentially tell you which assets you are going to trade.

You can decide between trading two digital currencies, which would be known as a 'crypto-cross.' Or you can opt for a trade that has one side cryptocurrency and the other fiat currency. These are called 'crypto-to-fiat' pairs.

Let us give you some background on each, so you can choose which one suits your needs best.

- A crypto-to-fiat pair tends to be the more straightforward option and best if you are a newbie to trading Cosmos.

- The reason for this is unlike the thousands of cryptocurrencies you can choose from - there are only a handful of fiat-based options, with USD being at the top of that list.

However, you may come across many brokers offering multiple alternative currencies, such as ATOM/GPB, ATOM/EURO, or even ATOM/KRW. As we said, though, trading Cosmos against the US dollar tends to be the most common and does come with many advantages for new members of the trading game.

These include tighter spreads, which is something we touch on later in the guide. But also higher liquidity, which means you can enter and exit the market in a smooth and stable manner.

The next option is your crypto-cross, meaning the two sides of the pair consist of different digital currencies.

- For example, you could opt for ATOM/BNB (Binance Coin) or a more common pair like ATOM/ETH (Ethereum).

- Although you have dozens of other crypto-to-fiat pairs containing ATOM - this can quickly become overwhelming if you are a beginner.

Especially when it comes to speculating on the future price movements of each cryptocurrency you come up against. That is why many experienced traders will suggest starting with crypto-to-fiat trades. In doing so, you can get your feet on the ground without having to guess which digital assets better suit one another.

Long or Short-Term Trading

Before you start your Cosmos trading journey, it is a good idea to consider what style suits your budget and investment plan. For example, if you feel that Cosmos will increase in price and become a valuable investment for the long run, you would adopt the buy-and-hold method.

It is relatively straightforward; you would purchase the token outright, ideally from a regulated broker, then store it in a crypto wallet until you feel it is time to sell and make a profit. This method is also known as HODLing and does take a certain amount of willpower.

You will need to stay strong in your trading plan and ride out any fluctuations that Cosmos may have. However, as many skilled traders will know, this can result in significant profits.

- The other option you have is short-term trading. This method focuses more on the price movements of an asset rather than the long-term value.

- So, in theory, you would open a position with a smaller stake, then close for a profit within hours, days, or at most weeks.

Short-term trading can be highly lucrative. However, this approach relies heavily on a firm understanding of technical analysis, including dozens of indicators and chart reading. Therefore, if you have just begun to trade Cosmos, the buy-and-hold method may be a good starting point.

Keeping that in mind, if you are still interested in smaller but more regular gains - then you could look into Cosmos CFDs (contracts for differences) or trading crypto pairs that have higher liquidity, such as ATOM/BTC or ATOM/ETH.

Cosmos Trading

At this point in our how to trade Cosmos guide, you know that if you want to hold onto your ATOM coins long term - you need to find a regulated broker, do your research and then essentially wait it out.

However, if you opt to trade Cosmos short-term, you may encounter investors who practice swing or day trading. In these cases, traders tend to favour financial tools such as CFDs.

CFDs allow you to enter and exit trades quickly and without requiring ownership of the underlying asset. Let's look at what a CFD does and what factors you need to consider before using one.

- CFDs allow traders to speculate on the price movement of Cosmos without needing to own it outright.

- CFDs can come with cheaper fees, and some brokers may offer you leverage.

- You can go long and short on Cosmos CFDs, as you are predicting whether the price will rise or fall.

As you can see, learning to sell short-term by using CFDs can be an excellent skill to have in your trading arsenal. However, we must mention that due to the high risk involved in this trading style, the US does not permit any form of CFDs.

If you are using a regulated broker in the UK, you can find CFDs on more common assets, such as forex and indices. But, as of January 2021, brokers can no longer offer cryptocurrency CFDs to clients.

If you happen to be in a location that does not provide CFDs, you can opt to trade Cosmos on a crypto exchange. Although, there is a high chance you won't be able to use a fiat-based currency as they are usually unregulated.

If this were to happen, you would look to trade the crypto pair ATOM/USDT. USDT is the stablecoin known as Tether, meaning it holds a similar value to the US dollar.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

How To Trade Cosmos (ATOM) Online - Setting Up A Trade

So, now that we have covered some of the fundamentals, we can focus on perhaps the most vital step: how do you go about setting up a Cosmos trade? First, we need to learn what each order means, how they send directions to your broker and how you can use them to their full potential.

Below we have included a walk-through of these orders to make sure you have the best understanding.

Buy and Sell Order

As this section of our how to trade Cosmos guide is dedicated to different orders, it makes sense to start with the mandatory ones. These would be our buy and sell orders. Essentially this will instruct your broker on which way to navigate your ATOM trade.

For example:

- If you feel the value of Cosmos will increase and you want to profit from the rise of the markets - you will create a buy order.

- Likewise, if you feel the price of Cosmos will decrease and you want to profit from the fall of the markets - you will create a sell order.

It is safe to say; these orders are the most straightforward. However, it is good to note that you will need both a buy and sell order for every Cosmos trade actioned by you.

Let us clarify; if you open a buy position, you will use a sell order to close the trade. And vice versa, you will use a buy order to complete a sell position.

Check Out: Should You Buy Cosmos (ATOM)?

Entry Price

We have discussed the obligatory order; now, let's cover your entry price and strategy. Typically, when you are trading cryptocurrencies like Cosmos, you have two choices.

A limit or market order. If you have prior experience in cryptocurrency trading, then you may already be familiar. If not, allow us to explain.

- Suppose you are looking to have your Cosmos trade executed at the current market price. In this case, you will create a market order. Your broker will instantly action your market order as close to the current price as possible.

- However, as we mentioned earlier, there is always the chance of 'slippage.' This means that the price you initially opted for in your market order has fluctuated slightly.

- Limit orders give you much more control when trading Cosmos. You, as the trader, get to set a specific price to enter the market.

- For example, if the value of ATOM is $13.15, but you believe there is a possibility you can get it at a lower price - you will create your desired limit order price.

A limit order gives you a level of flexibility and control by focusing on a preferred price for your Cosmos trade. In contrast, a market order focuses more on the speed of the trade's completion rather than the price of the asset itself.

Exit Strategy

Lastly, we have two exit strategies that many proficient traders use to manage risks and enhance their Cosmos trades. Brokers will present these as the 'stop-loss' or 'take-profit' order.

Let's start with stop-loss order:

- A stop-loss order is designed to close your trade automatically when your predetermined price is met - consequently limiting any considerable losses. In most cases, investors will set their stop-loss price limit at a maximum price drop of 1%.

- A take-profit order works to lock in any profits your Cosmos trade might achieve. Again, you work with a price determined by yourself, and when that target has been reached - your position will close. In this case, traders can start small with a profit target of 3%. Or, if long-term investing, then something significant like a 40% gain.

Here is a step-by-step example of what a complete Cosmos trade may look like:

- You choose to trade the crypto pair ATOM/USD - the current value is $13.17

- You believe the price will rise, so you opt for a buy order.

- You want to get in straight away, so you select a market order at the current price. ($13.17)

- Not wanting to risk any losses of more than 1%, you set your stop-loss at $13.03.

- You want your position to close when an earning of 5% has been established. Therefore, you create a take-profit price of $13.82.

What you have as a result is a well-designed Cosmos trade that will cover you regardless of which direction the market takes. Of course, everyone would prefer the profit outcome. But, you need to remember that all traders experience losing positions.

Nevertheless, all you need to do is determine your targets, then let the broker do the rest.

How To Make Money Trading Cosmos (ATOM)

All the information we have covered thus far in our how to trade Cosmos guide will help you set up and understand the ATOM marketplace.

However, there are a few other details you need to take into account before moving forward.

Stake

First up is the stake. Not to worry, this term is actually a lot less daunting than it sounds. It merely means how much you are prepared to risk per ATOM trade. Like any financial trade, the more you risk, the more it can determine your outcome: a huge profit or one sore loss.

To give you an example,

- You stake $330 on Cosmos and make a tidy profit of 5%; this equals to gains of $16.50

- If you risked $3,300 on your Cosmos trade, it would have resulted in you making a $165 profit.

As you can see, the size of your stake shapes whether you make a higher profit or a larger loss. However, without having a crystal ball or incredible luck, you won't be able to predict every trading outcome.

This is where the bankroll management strategy comes into play. This strategy takes out any emotion and gives you the opportunity to set up a maximum stake allowance.

- Many traders will limit any risks by only staking 2% of their trading capital per Cosmos trade.

- For example, if your account balance is $1,050, the maximum you would risk on a position is $21.

- If your credit is on the higher end, such as $20,000 - your stake would be $400.

Many brokers allow you to begin trading Cosmos for a much more reasonable price.

Cosmos Trading Leverage

If you happen to reside in an area where Cosmos CFDs are permitted - you may be interested in the next segment of our how to trade Cosmos guide. In nutshell, you can use leverage to help amplify the profits on your ATOM trades.

Although, this can also have an adverse effect and set you up for some notable losses.

If you are interested in leverage, then please see our example below:

- You create an $80 sell order on ATOM/USD.

- You implement leverage of 1:4.

- Your profit is 8%.

- Your profit minus leverage is $6.40

- Your profit, including leverage of 1:4, is $25.60.

The difference you can make with leverage can be outstanding. If you signed up for an unregulated exchange, there are offers of leverage shooting up to 1:100. However, keep in mind not everything is as easy as it seems, and trades can quickly become volatile.

Fees to Trade Cosmos Online

A broker is much like any business and has to turn a profit. The way brokers achieve this is by charging a combination of fees and commissions. Regardless of whether you plan to trade ATOM against crypto or fiat currencies, you will be subject to some charges.

That is why we suggest looking into any costs involved before you sign up for a brokerage site. To give you an idea of what fees to look out for, we have included a list of the most common below:

Cosmos Trading Commission

No matter where you are based or which coin you choose to trade - most brokers will charge you a commission of some sort. After doing some digging, we have found that it is usually a percentage of your trade value.

A standard sum we see at popular platforms like Coinbase is 1.49% per buy or sell order. For example, if you placed a Cosmos trade at a total stake of $160 - your commission to the broker will be $2.34.

Keep in mind that you must close a buy order with a sell order - meaning you will pay 1.49% again based on your exit value.

Cosmos Spread

As we mentioned earlier in the guide, every Cosmos trade will have a buy and sell price. The difference between these prices is called the spread. Therefore, the greater the distance between both prices, the higher the fee will become.

Let's say your broker charged a spread of 0.9% on ATOM/USD. For you to make any profit on this pair, the value must increase by 0.9%. Anything above this percentage will be noted as a net profit.

Other Cosmos Trading Fees

- Deposits / Withdrawals: One other charge you may encounter when trading Cosmos is a withdrawal or deposit fee. These fees can differ depending on which payment method or currency you plan on utilizing. Some can reach as high as 5% per transaction. Therefore, it is key to review these fees prior to signing up.

- Inactivity Fee: This fee is one that many people forget to check. An inactivity fee is commonly used by brokers when a trading account has been untouched for a year or more. The broker will take out this fee each month until the account is closed, the funds have run out, or you place a trade.

- Overnight Fee: If you are in a region where Cosmos CFDs are permitted, you may be responsible for an overnight financing fee. Brokers charge this fee for every day or night your position is left open. Some brokers may demand even more on the weekend.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

How To Trade Cosmos (ATOM) 2023 - Step-by-Step Walkthrough

At this point, you have made it to the final segment of our how to trade Cosmos guide. If you are ready to get started then follow our walkthrough below and begin your ATOM endeavours!

Step 1: Choose a Cosmos Trading Site

You first need to decide which cryptocurrency broker best suits your Cosmos trading goals. At this time, there are many different sites, each offering an array of ATOM services.

We have included a list of the fundamental factors to consider when picking your online broker.

- Regulation: Do the likes of the FCA, CySEC or ASIC regulate your chosen broker?

- Fees: What fees or commissions does the broker require you to pay.

- Payment: Is your preferred payment method support by the brokerage site?

- Account Minimum: When you are trading Cosmos, is there a specific stake amount or minimum deposit required by the platform?

- Cosmos Pairs: What crypto tokens or fiat currencies will be available to trade against Cosmos?

- Trading Platform: Do you find the site user-friendly and easy to navigate?

- Mobile: Does the platform offer an app to use on the go?

Step 2: Open a Cosmos Trading Account

Once you have chosen your broker, you need to open up the site and create your account. Similar to any online platform, you will need to register some personal details to get started. Your name, address, email, and date of birth are the most commonly asked.

However, if you opt for a regulated platform, you may need to include a photo ID. A passport or driver's license is usually accepted but be sure to check the terms and conditions on each site.

Step 3: Deposit Funds

When your account is verified, you are ready to deposit some funds. In most cases, you will have many different payment methods to choose from - such as debit cards or e-wallets. Keep in mind to check the minimum deposit amount required by the broker.

Step 4: Choose Cosmos Trading Market

When you have made your first deposit, you can start trading Cosmos. If you have a plan in mind, you can go straight ahead and search for your ATOM pair. However, you can always look over the Cosmos exchange pages to see what is currently doing well.

Step 5: Place Cosmos Trade

The last thing you need to do is place your Cosmos trade. If you need a recap of what any of the orders or strategies mean - you can head back through our how to trade Cosmos guide. If not, you can confirm your order, and you have actioned your first Cosmos trade!

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

How To Trade Cosmos (ATOM) Guide - The Verdict

We have covered a lot of ground in our how to trade Cosmos guide, from strategies to picking a reputable broker. Ultimately, if you want to trade Cosmos effectively, it is vital you do your research and map out any risks you may face.

We are keen to see where the Cosmos platform will go and hope you can use our suggestions in your future ATOM trading journey!

eToro – Best Platform To Buy Cosmos

eToro have proven themselves trustworthy within the crypto industry over many years – we recommend you try them out.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Read Also:

How to trade Cosmos FAQs

Is trading in Cosmos safe?

Trading Cosmos is safe as long you opt for a broker regulated by respected financial bodies.

How do I trade in Cosmos?

To trade Cosmos, you need to open an account with a regulated broker, deposit the minimum amount, and input your stake and orders.

Can you get rich by trading Cosmos?

While many traders make a monthly income from cryptocurrency trading, it is not an easy feat. There is a lot of time and effort put into the craft. We suggest doing as much research as you can before jumping in.

Is Cosmos trading legal in the US?

Cosmos trading is legal in the US. However, if you plan to use CFDs, these are not permitted in the US due to security laws.

Can you trade Cosmos with Leverage?

In order to trade Cosmos with leverage, you must be in an area that supports it. The US and UK currently do allow the use of leverage on any cryptocurrency trades.