The Best Stocks to Buy in 2021: (In-Depth Review)

Do you want to be a part of the smash-hit top stocks that are going from strength to strength positioned nicely at the top? What are the best stocks to buy this year you’re wondering? Looking for the top 20 stocks to buy in 2021? We’ve got you covered! We have the top-performing stocks that every investor should consider or add to their growing portfolio for 2021.

Top 20 Stocks to Buy in 2021

Picking only a few of the best, top-performing, glowing stocks to be a part of in 2021 and to keep a hold of for the long-term, is actually a tough choice to make.

There are some spectacular stocks aiming and achieving brilliant financial results, which have gained tremendous strength over the years and in the present along with carrying forward into the future, are only set to get better.

As these top stocks are set to not go out of fashion anytime soon, it’s time to become involved in the action.

Being a part of such mega-stocks relies solely on the individual's financial situation.

If you are a beginner into trading stocks it’s worth conducting as much research as you possibly can.

To read and gain a thorough understanding in learning the skills of trading stocks, our How To Trade Stock and Survive Stock Trading Guide has all the information covered for you.

From learning the stock trading market to keeping an open eye firmly on what to avoid before you look to invest your money. The full guide is bursting with vital information and a step by step guide into your stock trading journey.

Without further delay, let’s take a look into the Top 20 Performing Stock ideas as we dive into each stocks summaries, ideal for you to make a confirmative choice when considering to add any of these top stocks to your portfolio.

Top 20 Stocks to Buy in 2021:

4. Diamondback Energy Inc (FANG)

7. Etsy Inc (ETSY)

10. Tesla Inc (TSLA)

13. Apple Inc (AAPL)

16. Microsoft Corporation (MSFT)

18. Honeywell International Inc (HON)

You can buy all of these top stocks, as well as many others, at eToro and pay 0% fees!

And here it is, the list of 20 top stocks for 2021.

A good mix of 20 of the most powerful, solid, well- known along with newcomers in comparison, top-performing stocks that are set to make further growth going into 2021 and for years to come.

Best 5 Growth Stocks in 2021 from the List

Okay, all of the stocks mentioned above have of course seen huge growth over the years, which has led to these stocks becoming some of the best within the market and being positioned where they are in the present day.

However, there are some stocks that are set to grow better than others.

So we have broken them down for you.

Here are our top 5 Growth Stocks to be a part of for the long-term.

1. DocuSign

2. Airbnb

3. Lendingtree

5. PayPal

A growth stock, if you are a beginner to stock trading is any share within a company that is predicted to grow higher than the average growth rate for the financial market.

You will witness that growth stocks are different from dividend stocks.

With growth stock companies, once their revenue has been generated they will reinvest their monies straight back into the business in order to accelerate their growth within the short-term to progress to the long-term.

Which from the above, means that growth stocks don’t normally pay dividends as the company’s place that money back into their business in order to achieve more.

In the short-term, many investors believe that the share price for a growing stock is typically more expensive in comparison to others.

But note, not all growth stocks share prices are super-high; you can find a happy balance of performing growth stocks with a reasonable share price, although typically are priced higher than other stocks.

But the reality is, their share price and their P/E ratio (price-earnings ratio) maybe or seem high but in the long-term, the potential for growth and capital to be potentially made from these performing stocks could be huge.

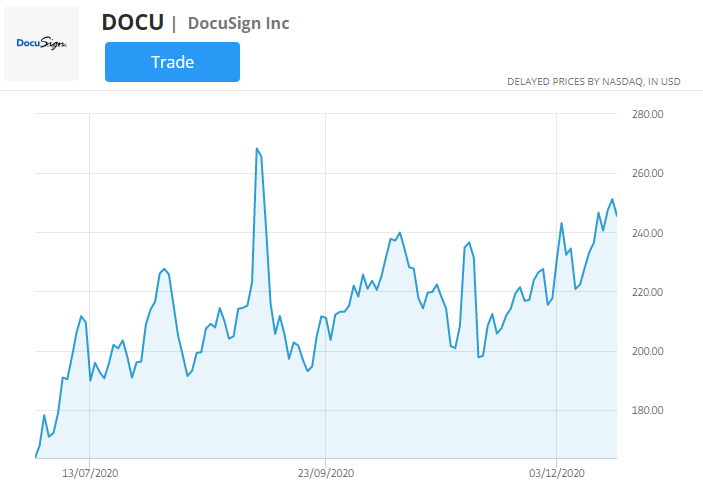

1. DocuSign (DOCU)

DocuSign is leading the way for the world and individuals to sign electronically. In times when you need an agreement signing within any field, DocuSign allows you to sign from any device and from anywhere within the world.

The forward-thinking company has not just heightened within 2020 due to Covid-19 with the strict safety measures in place, DocuSign was doing extremely well before the pandemic.

From signing big-asset legally binding contracts to the signing of a smaller commitment agreement, the company is moving forward into the electronic future.

As of the company’s third-quarter October report, DocuSign’s total revenue was up by 53% to $382.9 million (£285.9 million). Along with the company’s total revenue, the brand’s subscription was up by 47% and its additional service revenue saw an increase to $16.3 million, up by 43%.

CEO, Dan Springer hit the nail on the head with his statement on the performing and growing cloud platform.

“As companies accelerate the digital transformation of their business and agreement processes, DocuSign’s east entail role as an essential cloud platform continues to grow.”

Having a market capitalisation of $45.9 billion and its share price being one as it stands currently around 280.00, which as you can see is not the cheapest of stocks but is also not the most expensive.

Although this brand has already been establishing itself as a leading business to be a part of, there is certainly more room for huge growth as the world goes further into the digital world.

DocuSign is a growth stock that is strongly recommended for investors who are looking to add a growth stock to their portfolio.

Your capital is at risk. Other fees apply.

2. Airbnb (ABNB)

Okay, as the world has been on hold realistically for almost 12 months, witnessing international travel almost come to a standstill, yet Airbnb has still shown good results overall.

This year has been a turbulent year for Airbnb showing a 32% down on its revenue and with an adjusted reported a net loss of $341 million within its first quarter.

However, leading into the second, third and going into the final quarter, the company has made a remarkable recovery and is leading the way forward with bookings to-date, more so than big-branded hotel names.

As the world pushes towards a remote- work ethic and with individuals eagerly awaiting a holiday or just a small mini-break around the globe, these are just two strong factors that make this company a growth stock.

As of today, Airbnb’s valuation is at $34.6 billion which is a good increase from its $18 billion at the start of the year.

Additionally, Airbnb’s share price to date stands at 165.34.

With the new year coming closer towards us, all being well, we are hoping to return to a new normal of being able to jet-set around the globe once again.

Making this growth stock a good addition to your growth stock category.

Your capital is at risk. Other fees apply.

3. LendingTree (TREE)

LendingTree is vastly showing the world what a mid-cap stock can achieve and leading into the future, could potentially convert into a large-cap stock in years to come. (anything is possible).

This year, LendingTree has been the survivor for many citizens and business owners across the United States.

The online business platform connects individuals who wish to look at borrowing in terms of credit cards, loans, insurance and much more via the platform.

The platform allows borrowers to shop the competitive rates and other forms of financial services along with connecting borrowers with investors to gain the best products suited for their individual needs.

LendingTree has a market cap of $3.58 billion to date with a share price of 275.63 as of this report.

As the firm's third-quarter reports confirm, LendingTree is set for a potential soaring 2021 and a bright future ahead.

Let’s be realistic, Coronavirus or no-coronavirus, financial services are always in demand.

In light of this year's events, the brand has arguably permitted and archived fantastic results, maybe even better than anticipated at the start of the year.

Which makes LendingTree a great growth stock to look to buy for 2021.

Your capital is at risk. Other fees apply.

4. Intuitive Surgical (ISRG)

Intuitive Surgical the creators of robotic surgical equipment including the masterpiece, da Vinci surgical system.

The da Vinci surgical is a robotic surgical system which has to be operated by a human operator.

Surgeons are able to carry out minimally invasive surgeries which are carried out through small instruments. Each instrument is placed on the end of three or four operating arms, with the addition of a 3D camera alongside to make vision clearer.

This masterpiece design of technology is set to become a game-changer within medical theatres across the globe.

The product's advantages include improved access to hard- reach areas, enhanced visitation that the naked eye may not see and greater surgical precision to name just three big advantages for the product.

However, within the medical field nothing comes cheap.

These pieces of equipment are set at $2 million each, which is a big amount for businesses to payout.

So in light of this, ISRG has gone one step further and has created a leasing arrangement for hospitals to be able to have unlimited access to this fantastic piece of equipment within their hospital.

As of the second quarter, just under 6,000 da Vinci surgical systems were installed worldwide up by a total 9% year-over-year.

Although this stock isn’t cheap, you will see it’s share price hold fairly high with its P/E (price-to-earnings ratio) standing at 89.89.

Nethertheless, Intuitive Surgical has been pulling in the figures and the demand for more being strong across the world, which is what makes this stock not only a growth stock but a large-cap stock in which is a perfect addition to your portfolio for now and for the future.

Your capital is at risk. Other fees apply.

5. PayPal (PYPL)

Another forward-thinking growth stock in which many would have heard of by now is, PayPal.

PayPal is the leader of digital payments as the world moves slower towards cashless payments and as the world moves gradually online.

As for many businesses across the globe, big or small, saw products forced into being ‘must-haves’ instead of ‘take it or leave it’ products, contactless payments became one of which everyone needed.

PayPal is proving to be the leader within the digital payment revolution with over 321 million active accounts globally as its member base grows going into the future.15.2 million new accounts were created within Q3, up by 55% year-over-year.

PayPal also made history within its business this year having made its biggest total revenue of $5.46 billion.

The leading company also offers consumers interest-free “Buy now pay later” instalments with different options for US and U.K. citizens.

This stock like most mentioned above comes at a cost to be a part of.

PayPal's current share price is at 240.42, but on the back of that the company has a price-to-sales statistic of 14. Which is a solid middle figure.

There is a lot of hype surrounding this growing stock. After watching and looking at the figures the company has brought in and anticipating to bring in, it is looking to develop and grow strongly over the year and many years to come.

Your capital is at risk. Other fees apply.

Growth Stocks in 2021 - Last note

Although not mentioned within this list, one sector set to grow hugely within the coming years is the Cannabis Industry.

And one stock in particular that stands out from the crowd is Canopy Growth.

The leading Canadian cannabis company has been in the business since 2013. Over the years it has been a leading company producing and selling medical marijuana until Canada legalised recreational use of marijuana, enabling the brand to have it all.

In 2018 the American producer and marketer Constellations Brands entered into the growing brand with a huge 38% ownership of the company.

As the US is looking set to potentially legalize recreational usage of cannabis across most or if not all US states one day, this is one growing stock that is sure to add diversity and growth to your portfolio.

To read and learn more on Canopy Growth’s statics and learn more on the top cannabis stocks, we have all the statistics available on hand for you in our Top 11 Best Performing Cannabis Stocks.

Ready to dive into the Stock market?

Your capital is at risk. Other fees apply.

Top 5 Stocks for Beginner Investors

If you're new to stock trading and currently finding your feet, you are more than likely wondering as to which stocks are solid, good- performing stocks.

Here we have the top five on the list that are ideal starting stocks to add to your beginning portfolio.

Although mentioned on the growth stocks list, the five that are mentioned are also good stocks to invest in to start, however, may show a little more volatility than these big names.

5 Stocks for Beginners

1. Facebook

2. Amazon.com

4. Netflix

5. Apple Inc

It’s safe to say, you will have heard of these top five players mentioned above and there are many clear reasons along with many addy factors as to why they have made this list, to being solid stocks for a beginner stock trader.

As a beginner stock trader it’s wise at first to conduct as much research as possible into your chosen stocks.

Even though large-cap stocks will be less volatile than smaller-cap stocks they still pose some risk elements, as nothing is ever guaranteed when investing.

1. Facebook (FB)

The social media platform that has taken social media to the next level.

Facebook also has Instagram, WhatsApp and Facebook messenger all under its tech umbrella, making it the most successful social media tech company on the plant.

From the company’s latest third-quarter reports in September, saw the company’s revenue grow by 22% from last year including an increase of 28% in its share price.

Facebook is set for further astonishing growth in 2021 and for the foreseeable as the company carries on evolving and striving into the future of social media with its latest additions and updates.

As it’s market capitalisation stands around $780 billion, it’s share price can be cheaper then what you may think to buy, especially in comparison to other large-cap stocks.

As it stands as of today the company’s share price is 267.09.

On a different note, even though from the business side of the company looks great there could be potential lawsuits that could end up in the mix.

This has always been a concern for the global brand due to the fact it is a social media platform and situations could arise unexpectedly but could become costly.

But In the bigger picture, Facebook is and more than likely will carry on being the world's largest and dominating social media platform within 2021 and for many years to come.

Your capital is at risk. Other fees apply.

2. Amazon.com (AMZN)

Amazon, Amazon, Amazon where do you start with this mega-hit worldwide retailer.

The mega-hit online retailer has to date, over 112 million US Amazon Prime subscribers too which enables subscribers to stream movies and music, same-day or one or two-day delivery services and much more.

And to confirm, Amazon Prime is a paid subscription set at a cost of $120 per year or $13 per month.

The fast e-commerce company has a market cap of $1.61 Trillion and also has a very high share price in comparison to other large-stock companies.

2020 has had an accelerating effect on the brand, as it has seen its revenue soar throughout each quarter report.

The company’s latest report, being its third quarter, shows a further increase of 37% up from the previous year's third-quarter results.

Within the past month, Amazon also announced its new adventure offering an online pharmacy to its list.

With no signs of slowing down anytime soon, only archiving and striving for more success, as the company stands with a percentage of 77% up year-over-year, there is no stopping this dominating global brand.

Which is why if the share price is within your financial means, this is one stock to buy and keep hold of.

Read More: Amazon Stock Price Prediction For 2021 And Beyond

Your capital is at risk. Other fees apply.

3. Microsoft Corporation (MSFT)

The company that brought us Microsoft Windows that changed our lives as we know it.

That’s not including what they have archived alongside these exceptional market systems.

Microsoft Corporation has gone to create Internet Explorer Browser, Microsoft Office Suite, electronics, personal computers and more.

Considered as one of the ‘Big Five’ the growth potential for the tycoon company is still huge.

This year has seen billions across the globe being confined to work remotely from home due to COVID-19 which saw Mircroft’s revenue at a high of $143.02 Billion.

Microsoft cloud computing businesses have been going well which include Office 365 and Azure, which is no surprise considering this year's events.

Microsoft’s share price currently at 222.10 is predicted to jump higher in the new year, which it witnessed a jump in its share price with its new addiction, Azure Sphere.

Morgan Stanley’s have named Microsoft stock “one of our top picks heading into 2021”.

And this mega-brand makes our list as a strong beginner stock to buy for your starting out portfolio.

Your capital is at risk. Other fees apply.

4. Netflix (NFLX)

One thing is for sure, most of us this year have been Netflix - bingers at one point or another.

The production company which shows ample amounts of movies from classics to their very own Netflix originals has to date almost hit 200 million subscribers with the US and Canada making the most.

Although the vaccine news is enlightening and as we seek to head towards normality, the string of a new spread of the virus, is causing doubts amongst many.

But for Netflix, this could only potentially benefit even further for the business as stay at home enforcement is placed across the globe.

Looking into the future for Netflix, it is also rumoured that the smashing production company could even work its way into purchasing cinema brands, as it continues on in its successful pathway.

Adding to its success the new Netflix original adaption “The Queen's Gambit” has been named the most-watched series on the streaming platform to date.

An entertainment company that is a sure and solid addition to start in your stock journey. As the entertainment company is showing no sign of slowing down, in fact, the opposite as it looks to branch out further.

Your capital is at risk. Other fees apply.

5. Apple Inc (AAPL)

The distinctive iconic apple logo everyone will be familiarised with by now is Apple.

Apple has an astonishing market cap of an estimated $2.24 trillion, which just reading the figure is astonishing enough.

But the American manufacturing company is showing no signs of slowing down as the brand continues to create and release its upgraded iPhones each year, computers, computer software and more.

One of the latest creations by AAPL which was released to the world this year, the new iPhone 12 pro max.

The iPhone is not just drawing in Apple consumers just for its new upgrade but the handset also includes the latest generation 5G.

The brand knows how to time things well too, as the handset comes to the market just as we start approaching the holiday seasons.

Just like most companies above, Apple has carried on gaining in 2020 as sales were driven and the income came through, which was heightened during the intense lockdown periods.

Just like all companies that grace the list, buying the right stock at the right time is key.

Once the valuation looks ideal, this is the most opportune time to be a part and potential buy into the company in question.

As Apple is going to be around for the foreseeable, this mega-cap stock is one that is set in for the long-term and a great addition within your stock trading journey.

Read Also: Apple Stock Price Prediction For 2021 And Beyond

Your capital is at risk. Other fees apply.

Top 8 Dividend Stocks to Add to your Portfolio in 2021

Many investors look for the top-performing dividend stocks, or if not at least any good potential dividend stock that has potential.

There are numerous reasons as to why investors look to have these stocks, not only just for income but to show and have diversity within their portfolio.

Dividend stocks have been known, like general stocks to have many advantages and disadvantages.

The main advantage and what a dividend stock is, which is a periodic payment that pays its shareholders from the company's revenue. Most companies that offer dividends are paid to the shareholders quarterly (four each year).

Although the key attraction for dividend stocks is for investors to receive some income from their chosen stocks, having the option of having a DRIP (dividends reinvestment programme) being available for investors too is a big player.

A dividends reinvestment plan is a powerful tool for investors.

A DRIP enables shareholders to automatically reinvest their earnings to purchase more shares and typically at a discounted or a commission-free rate.

And additionally, some of the dividend stocks are in fact, top-performing stocks within the stock market.

The clear difference between a stock with dividends and non-dividend stocks is rather clear.

Whilst dividend stocks give that income to its shareholders generated from its revenue, non-dividend stocks will reinvest their revenue earnings back into the business in order to achieve greater growth.

Which will then lead to a greater share price for companies.

Now let’s take a look at 8 dividend stocks that are looking set to have a good 2021.

2. PepsiCo

3. AbbVie

5. Chevron

6. Coca-cola

8. McDonald’s

1. Honeywell International Inc (HON)

Honeywell International is projected to be one dividend stock that is likely to have a promising 2021, as it’s shown this year and is also a keep in your portfolio for the long-term.

Having a 1.7% dividend yield to date, which is calculated by dividing the annual dividend payment with the company's current share price.

Honeywell International, after a challenging first and second quarter, has seen its share price increase and is branded as one of the largest America based industrial companies on the market at present.

As Honeywell continues to strive forward, shareholders who have been a part of the glowing dividend stock from the start or near to, have seen market-beating returns over the years.

As it has been reported that over the past 10 years the company's total return stands at 493%.

The company has its sights set firmly on evolving within the data field as the future growth looks set to receive some big earnings in the coming years.

HON is a good dividend stock to add your portfolio.

2. PepsiCo (PEP)

The giant fizzy beverage brand which was founded back in 1965, is arguably one of the best beverage and snack brands on the market still today.

Outplaying it’s biggest rival Coca-Cola this year, which Pepsi have a big advantage over its rivals with their snack and food division which holds up well for the leading iconic brand.

As it stands today the Forward Dividend Yield for PepsiCo is 2.84% which is up by 6% within 2020.

Over the past 12 months, PepsiCo average Dividends Per Share Growth Rate was placed at 5.00%.

But on a bigger scale image over the past 10 years, PepsiCo’s Dividends Per Share Growth Rate was 8.10% per year.

With the brand's solid international presence and its room for growth over the coming years, the brand's revenue will certainly keep on growing as the company and analysts predict.

3. AbbVie (ABBV)

The research-based biopharmaceutical company has been a repeated player this year to hit many lists, for being a top-performing dividend stock to be a part of for the future.

The brand who’s most popular creation to date is Humira. A medication which is used to treat various forms of arthritis, Crohn’s disease and more.

With a market capitalisation of over $185 billion, this giant biopharmaceutical company also completed in its acquisition adding Allergan to the mega-brand.

As of today, the Dividend Yield is 4.56%.

Over the past three years, the company’s Dividend Per Share Growth Rate hit 87.72%.

The company is set to grow well in the coming years with its “blockbuster” medication, Humira as it continues to be distributed all over the globe.

4. Johnson and Johnson (JNJ)

Another healthcare giant company known globally around the world is Johnson and Johnson.

JNJ, a blue-chip-stock that continues to pull in the revenue yearly and pays dividends to its shareholders along with growing the dividends continuously.

This is in fact one key attraction for investors into buying this stock and has continued to do so for over 50 years.

Although the brand may come slightly behind AbbVie in terms of its share price this year, JNJ is still set firmly on their room for growth along with showing the continuing results.

Johnson and Johnson is spread over three business units which are pharmaceutical, medical devices and consumer health products which collectively have well- known big brands under its arm.

The company's geographical sales are of course a leading factor for the brand, with the US making up half of its sales.

Although JNJ has had its challenges this year, confirms in recent reports the brand's medical devices where the hardest hit sector, due to hospitals being overwhelmed with the current Covid-19 pandemic.

A dividend yield standing at 2.64%, which for a company spanning with over 50 years experience has been impressive, as it is showing its reliability as it has grown bigger each year.

5. Chevron Corporation (CVX)

Although this year has been a tough year for the oil industry, Chevron has adapted and used their time wisely.

Chevron, back in October completed its acquisition of Noble Energy which makes the company now the largest oil major in terms of market capitalisation.

This year hasn’t been the best performance for the company, however, there are still many positives as to why this global dividend stock is one to add diversity to your portfolio.

The company has increased its dividend to a generous 6% which is what many investors hope to archive from stocks within a year.

As of 2020, Chevron grew by almost 8% calculating at $1.29 per share.

Whilst the generosity of the new dividend is shown, the company’s balance sheet is also looking for the part.

For a company who is the largest oil maker by market capitalisation, its balance sheet is impressive and what is drawing in the eyes of many and which is performing better than its competitors, including having the lowest net debt position.

There is no wonder 10 analysts tracked by S&P Global Market Intelligence name this dividend stock a strong buy.

6. Coca-Cola (KO)

Because we spoke about it’s biggest competitor and in light of the company’s performances over the years, of course, Coca-Cola is going to make the list as a good dividend stock.

The beverage brand has had a flushing run for its returns in dividends over the past 50 plus years and analysts have predicted a further $36.6 billion revenue growth in 2021 for the brand.

Its dividend yield, currently at 3.1% which delivered a 41 cents per common share, was paid to its shareholders on its most recent payout December 15th 2020.

Even in the thick of a global pandemic, although it may not be the top priority on consumers lists, Coca-Cola is set to make greater strides as we head into the new year with new hopes of normality.

7. Diamondback Energy (FANG)

As we head into the future, the energy sector will carry on playing a vital and key part in the world.

Diamondback Energy has been praised highly by analysts as they watch the company intently and have also called it a “generous” dividend stock for now and the future.

With a market cap of $7.55 billion and its dividend yield at 3.33%, this Oil company is not only a leading dividend stock but it is also a stock which has been predicted and showing fantastic growth.

Which is why analysts are being very bullish on the company’s growth leading into the long-term with a 20% total return to be made in 2021.

8. McDonald’s (MCD)

What is not to love about this iconic fast-food chain that has captured billions of hearts across the globe, McDonald’s.

McDonald’s has a dividend yield of 2.4% and despite the heartbreaking effects COVID-19 has sprung on businesses, saw businesses within the hospitality sector slash their dividends.

On the other hand, McDonald’s did the opposite as the board announced a 3.2% increase back in October from its previous share price at $1.25 per share.

If McDonald’s can increase its dividend in one of the worlds most testing years to date, then it says it all for the company.

Dating back to almost 50 years ago, McDonald’s has been known to be a strong dividend key player as it continues to rise its total revenue further each year.

Considering the world has been restricted to long-period lockdown measures on multiple occasions, McDonald’s reported in their third-quarter report total revenue of $5.4 billion which is only down by 2% year-over-year.

As the company adapted to the new safety measures impressively quickly, McDonald's caught the eye of many investors as it saw its stock risen by 8.6%.

McDonald’s is currently trading in at 212.02 per share with its annual dividend yield at 2.4%.

If you are an investor looking for stability with a dividend stock, McDonald’s has proven to be one strong performer advised for investors to add to their portfolio.

How to Begin your Stock Trading Journey?

If you feel that you are ready to start your stock trading journey, now you need to know where to begin.

There are many online trading platforms that are available online and can be found as quickly as you can say ‘Go’.

However, finding the right broker on the right trading platform is not only advised but it’s crucial that you choose wisely. As the last thing you want to be a victim of is a crooked- broker whose purpose is to look out for only one person, themselves.

Finding an online trading platform with regulated licences and the same for the broker acting on your behalf is advised when searching to begin your trading journey.

eToro, the world's leading social and trading platform offers it all at your leisure. The online trading platform makes your start into stock trading simple, stress-free, effective and fast.

With ample amounts of accessible trading-recitation material available whenever you feel is needed.

Finding a broker and opening a trading account can be carried out within minutes with eToro, along with access to all you need.

If you feel that practising is what you need to carry out further before jumping in, eToro offers you access to a virtual trading platform where you can practise until your heart's content.

Getting familiar with strategies, knowing how stock trading operates and the understanding of trading in front of your own eyes is the best way to learn and gain a thorough understanding of trading stocks.

With the added benefit of not investing your own money.

There is no rush when trading in stocks, it's always wise to take your time, get a thorough undertaking of how stock trading operates and always invest within your financial means.

Happy Trading.

eToro – Top Stock Broker, Buy stocks with 0% Commission

eToro have proven themselves trustworthy within the stock market over many years – we recommend you try them out.

Your capital is at risk. Other fees may apply

Final Key Takeaways

If you remember anything from our Best Stocks To Buy In 2021, make it these key points.

- Top 20 stocks to buy and add to your portfolio for 2021 come with both strong positives and with their own risk elements.

- There is a clear difference between dividend stocks and non-dividend stocks, be sure as to what you wish to gain before investing.

- On the same note, before investing it’s worth conducting additional or as much research as possible into your chosen stocks.

- Being wise whilst investing is a key element. Creating budget sheets and keeping accounts separate is advised.

- If you're a beginner, it’s wise to not take “Tip-Offs” or indulge into Penny Stocks.

- Lastly, practice makes perfect within your trading journey. Take the time to practise on an online virtual platform to understand and learn how stock trading operates.

If you enjoyed reading our 20 Top Stocks To Buy In 2021 - Including Top Stocks Every Investor Should Look To Add To Their Portfolio, please share with anyone else you think it will be of interest to.

Please Note: Past performance is not an indication of future performance. The value of investments can go down as well as up. Any opinions, news, research, analyses, prices, or other information contained on this website are provided as general market commentary, and do not constitute investment advice. Trading Education shall not be responsible for any loss arising from any investment based on any recommendation, forecast or other information provided.