Want to learn to trade cryptocurrencies in the UK but don't know where to start? This ultimate UK guide teaches you everything you need to know about crypto trading and review the best crypto broker in the UK.

In 2021, daily trading volumes in the cryptocurrency market often surpass the £70 billion mark. The most popular tradable crypto-assets being Ethereum, Dogecoin, Ripple and of course - Bitcoin.

There are a variety of ways in which you are able to trade cryptocurrencies. Crypto assets can be traded against each other - but are usually traded against fiat currency such as the US dollar. We explain everything about cryptocurrency trading in the UK. We cover trading options in detail throughout this guide.

First, we are going to divulge the most important information you need to help you on your way with your cryptocurrency trading endeavours. This includes what cryptocurrency trading actually is and how it works in the UK. We are also going to shed some light on trading order types, tips, strategies and how you can get started with a UK cryptocurrency trading account today.

What are Cryptocurrencies?

Just in case you aren’t fully aware of what cryptocurrencies are - the simple explanation is that they are digital currencies. The most well-known currency of this kind is undoubtedly Bitcoin. At the time of its creation in 2009 - it was the world's first cryptocurrency to grace its presence.

Crypto price tracking website CoinMarketCap recently reported that there are now 6,955 cryptocurrencies in existence. 11 years ago no one could have predicted that digital currencies would become so wildly popular to trade.

Unlike the banknotes and tangible coins we’ve used to pay for things our whole lives - cryptocurrencies are not created or printed by a governing authority.

Kind of like virtual tokens, you are able to trade, transfer and invest in crypto coins without having to use a credit card company or corporate bank. If you are a holder of cryptocurrency coins, chances are you will use a virtual crypto-wallet which comes with it's own private key.

Now that there’s no doubt you have a grasp on what cryptocurrencies are, we are going to dive right into how you can trade them.

What is Cryptocurrency Trading UK?

If you are trading cryptocurrency, you are trying to correctly predict the future price shifts in the relevant market. As with the trading of just about any asset, you are buying and selling cryptocurrencies, with the hope of making a profit. Put simply, the aim is to sell the asset for more money than you bought it for.

Let’s give you an example of how that might look:

- You are interested in the trading pair ETH/USD

- This means you are trading the price of Ethereum against the US dollar

- You place a £350 buy order on the pair at a quoted price of $450

- A couple of hours later you close the position at $480

- This represents an increase of 6.6% - so a £350 stake made you £23.10

On the other hand, some UK cryptocurrency trading platforms will enable you to go short. This essentially means that you are able to make gains whether the value of the crypto pair falls or rises - as long as you correctly speculate either way, of course.

We are going to cover cryptocurrency trading orders in more detail further down this page. Cryptocurrency trading is very comparable to forex trading, in the sense that the markets are built on currency pairs - specifically two currencies competing with each other.

The exchange rate of a cryptocurrency pair can fluctuate on a second by second basis. As such, your job as a UK crypto trader is to correctly hypothesise whether or not you think the rate is going to rise or fall Thanks to modern technology, and the accessibility of the internet - in the last decade or so in particular - trading has never been easier for your average Joe Bloggs.

What Does Cryptocurrency Trading in the UK Entail?

In order to be successful in trading crypto assets, you should first have a firm grasp of how the market works.

Whilst there is plenty of variety for you to choose from, we recommend reading our guide to ensure you understand the ins and outs of cryptocurrency trading - to get you off on the right trading foot.

After all, educating yourself on the workings of an asset you want to trade gives you a much better chance at accomplishing your long term trading goals.

The vast majority of cryptocurrency pairs being traded will include the US dollar. This isn’t a problem as UK trader, as you can easily deposit funds in GBP with your everyday debit/credit card or even an e-wallet like Paypal. FCA broker eToro for example, is a good option in this respect.

As we’ve said, you need to try and predict whether the price will go up or down in order to make any gains.

Let’s have a look at what cryptocurrency trading in the UK entails as well as some of the finer details such as pair categories.

Tradable Crypto Pairs

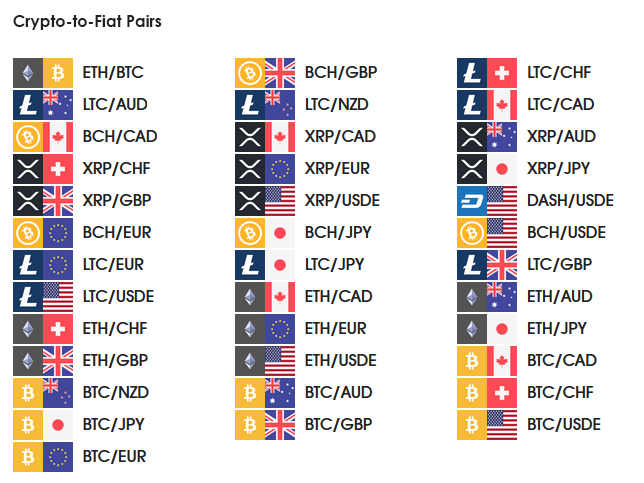

UK cryptocurrency trading platforms tend to split pairs into 2 different categories. This creates a universal way of differentiating between their qualities.

We are going to start with Crypto to Cross Pairs.

Cryptocurrency Cross-Pairs

Cross pairs are made up of two rival virtual currencies - for example, BTC/ETH (Bitcoin/Ethereum). Here Bitcoin is the base currency, and Ethereum is the quote currency.

In our example, this is the cross pair you have chosen to trade - and here is how that trade would look:

- Crypto cross pair BTC/ETH is quoted at 32.50

- In this example for every Bitcoin, you will get 32.50 worth of Ethereum

- You must speculate whether this price will rise or fall

If you are new to trading cryptocurrencies in particular, then in all honestly you may find crypto cross pairs a little too complicated. Some newbie traders find it difficult to calculate losses and gains, largely due to the absence of a familiar currency (such as the British pound or the US dollar).

As we mentioned, ‘real’ money is also called ‘fiat’. With that in mind, we are going to run through cryptocurrency to fiat pairs and how that trade works.

Fiat-to-Cryptocurrency Pairs

As you may have guessed, a fiat to cryptocurrency pair invariably includes a fiat currency (think USD or GBP for example) - and of course one cryptocurrency, such as Ethereum.

In the same way assets such as oil and gold are usually quoted in US dollars - fiat-to-crypto pairs are often denominated in USD also. A really popular way to trade these pairs is via CFDs (Contract For Difference).

Generally speaking, by utilising CFDs, investors are able to access tight spreads and in most cases commission-free trading. You’ll also have access to leverage of up to 1:2 - which we cover later.

Let’s give you an example of how fiat-to-crypto pairs work:

- Let us hypothesise that you are interested in trading Ethereum against the US dollar

- This pair is illustrated as ETH/USD

- Your UK online broker quotes a pair price of $300

- You think that the pair is undervalued

- With that in mind, you place a buy order worth £1,000

- A few days later ETH/USD is valued at $350

- Here, the price of the pair has risen by 14.28%

- Your prediction was correct so you create a ‘sell’ order

- Your 14.28% profit plus your initial stake of £1,000 now equates to £1.142.50

- You made a profit of £142.50 from this trade

We used Ethereum against the US dollar in our scenario, however, there are plenty of other fiat currencies, and cryptocurrencies to choose from.

Just some examples of this type of pair are as follows:

- ETH/GBP (Ethereum/British pound)

- BTC/JPY (Bitcoin/Japanese yen)

- XRP/USD (Ripple/US dollar)

- And heaps more

Read More: 5 Popular Cryptocurrencies to Buy and Sell in British Pounds

UK Crypto Trading Orders

In order to start trading cryptocurrencies, you must first choose a pair to trade. As you can see from our above examples there are lots to select from.

When you have selected your crypto pair and feel ready to take the plunge, you will need to tell your broker how to proceed - by means of placing an order.

In this section of our cryptocurrency trading UK guide, we are going to run through the various order types you will be able to set up via your chosen trading platform.

Buy Orders and Sell Orders

We’ve said you will need to predict whether a crypto pair will rise or fall in value later down the line. We’ve also told you that this price can shift on a second by the second basis. After all, one of the primary driving factors in the value of an asset is supply and demand.

Buy and sell orders are something you will execute on a regular basis when trading crypto pairs.

Here is an example of how ‘buy’ and ‘sell’ orders play out, starting with a ‘sell’ order:

- Let’s say you are interested in trading crypto cross pair BTC/JPY

- You predict that the price of the pair will fall

- With this in mind, you place an order to ‘sell’

- Let’s imagine, on the other hand, that you think the opposite

- Meaning you suspect the value of BTC/JPY will go up

- In this scenario, you place a ‘buy’ order

Limit Orders and Market Orders

As well as utilising buy and sell orders, there are other orders which can enhance your trading strategies.

Let’s explain the difference between market orders and limit orders, and when you might use them when trading cryptocurrency in the UK.

- Let’s say the crypto pair you want to trade is priced at £235

- You wish to enter a trade at a specific price - say £220

- This is when you need to place a ‘limit’ order

- When your target price of £220 has been reached your broker will execute your order at that price

Now, in the case of a ‘market order’

- Should you want your order to be carried out at the going market price

- You place a ‘market’ order

- Your broker will carry out your order at the next available price

In the case of limit orders, due to the price specific nature of the trade - these orders are better suited to short-term trading strategies. Due mainly to the fact that you are essentially creating a very specific entry strategy and get out plan. It’s important to remember that the order will remain as it is until your target price has been reached.

Stop-Loss Orders and Take Profit Orders

Stop-loss and take-profit orders are considered somewhat of a risk management strategy amongst the UK cryptocurrency trading community. Whilst not compulsory, these orders are extremely useful in your plight to limit your losses and lock in your gains.

With that in mind, we are going to give you a couple of examples to clear the mist on what they are - as well as when they might be used.

Let us start with stop-loss orders, please see an example below:

- Let us imagine that you are trading ETH/GBP

- You place a £2,000 buy order

- The maximum amount you are willing to lose is 10% of your investment

- You decide to place a stop-loss order of £1,800

- The value of ETH/GBP falls to £,800

- Because you placed a stop-loss order - your broker closes your trade at that price

Moving on to take-profit orders, this is a great order for locking in your trading profits on an automatic basis. Please find below a practical example of how and when a take-profit order would be used:

- Let’s hypothesise that you are trading ETH/GBP

- The ETH/GBP buy order is £1,500

- Your goal with this trade is to make 15% in gains

- With your profit goals in mind, you place a take-profit order at £1,725

- Should the value of ETH/GBP reach £1,725 - your broker will close the position immediately

As we’ve said, utilising these orders provides your trading endeavours with some much-needed damage limitation and the ability to walk away from a position in profit when you are not your device.

Not only that but it eliminates the need for you to close your trades manually, as the order is executed by your broker at a point specified by you. This gives you greater control over your own risk management.

Is it Possible to Make a Profit When Trading Cryptocurrency in the UK?

Yes, it is possible to make money when using a UK cryptocurrency trading site. However, there are no guarantees. All trades come with some degree of risk.

With that said, there are some useful strategies you can take advantage of to give you the best chance at success.

Let’s take a look at how you could potentially make gains going ‘long’ and ‘short’ when trading cryptocurrency online.

Example 1: Going long on ETH/USD, based on the pair’s value rising

- ETH/USD has been quoted at $400

- You decide to place a £500 buy order

- A few hours later ETH/USD is quoted at $420

- The new price illustrates an increase of 5%

- With this in mind, you place an order to sell

- Your £500 has increased to £527.75 - showing a profit of £27.75

Example 2: Going short on BTC/USD, based on the pair’s value falling

- Let’s say on Monday BTC/USD is valued at $15,000

- You decide to place a £500 sell order

- By Thursday BTC/USD is valued at $12,000

- This price shift shows that the pair has dropped by 20%

- Because you went short on BTC/USD - you predicted correctly

- You now place a buy order in order to close the trade.

- You turned your £500 initial stake into a £600 - meaning you have made £100 gains (20%).

It's imperative to you remember that if you might be subjected to overnight financing fees for keeping your cryptocurrency trade open for longer than a day. We are going to discuss fees later on. This is because the majority of cryptocurrency CFD trading platforms in the UK charge a small daily fee - so always check this before signing up.

Which Cryptocurrencies am I Able to Trade in the UK?

As we touched on earlier, Bitcoin is the most well known of all crypto coins. Not only that, but it is the most traded globally. When it comes to the pair BTC/USD - this provides the most trading volume, liquidity, and tightest spreads.

Much like in the case of forex, cryptocurrencies also have a wide scope of market interest and value. A great place to find the up to date value of crypto coins is to head over to CoinMarketCap, or a trading platform such as eToro.

As there are almost 7,000 tradable cryptocurrencies, we couldn’t possibly list every single one. However, we have listed a bunch below for your consideration.

- Bitcoin

- Ethereum

- Stellar

- Binance Coin

- ZCash

- Bitcoin Cash

- Ethereum Classic

- Ripple

- IOTA

- Litecoin

- EOS

- Cardano

- NEO

- Dash

- Tron

All of the above cryptocurrencies are available at UK broker eToro - and can be traded commission-free. Although they are all priced against the US dollar - eToro also offers several pairs quotes in GBP, EUR, AUS and JPY.

Advantages of the UK Cryptocurrency Trading Scene

There are heaps of tradable assets available in the online trading space. These days, you can trade commodities like oil and sugar, forex, stocks and indices at the touch of a button

With that in mind, let's shed some light on the main advantages of trading digital currency pairs in the UK in particular.

✅ Applying Leverage - Amplifying Profits

When trading cryptocurrencies via CFDs, you will be offered the use of leverage. For those unaware, leverage enables you to trade using more than you currently have - call it a loan from your broker.

Leverage is illustrated as a ratio. For example, in the UK, traders can access as much as 1:2 when trading cryptocurrencies.

Let’s give you an example:

- You have £1,000 in your brokerage account that you want to use to trade ETH/USD

- Your broker offers you leverage of 1:2

- You can now trade ETH/USD with £2,000

Should you have a strong desire to trade with a little more leverage than that, some offshore trading platforms will offer as much as 1:100 - sometimes more. As you can no doubt see from our example above, this would turn your £1,000 stake into a £100,000 stake.

However, we would strongly advise against using an offshore, unregulated cryptocurrency broker. Instead, we prefer fully licensed, FSCS-partnered, and FCA-regulated platforms like eToro.

It is very important to note, that whilst adding leverage can greatly increase your profits - it can also work against you and multiply your losses.

✅ Trade 24hrs a day, 7 days a Week

All assets have market opening hours. For example, some stock market exchanges will only be open during the week between 8am and 5pm.

If you were trading on that particular market and wanted to ‘cash out’ you would likely have to wait until the following Monday when the markets re-open. This is because the vast majority of UK trading platforms do not allow clients to trade stocks over a weekend.

The cryptocurrency markets, however, are open for trading 24 hours a day, 7 days a week. If you like the idea of being able to trade any time the mood takes you - then crypto trading would enable you to do that.

Ready to dive into crypto market?

✅ Choice of Long-Term or Short-Term Trading

When it comes to trading, it is to each their own - meaning, as people are different, so are traders. Some people prefer to invest in the long-term, whereas some prefer to be in and out and trade on a short-term basis.

We’ve focused more on short-term trading strategies so far in this guide, however it is entirely possible to invest in cryptocurrencies in the long-term as well.

This is where the ‘buy and hold’ strategy comes into play. In a nutshell, this enables you to hold onto your crypto ‘coins’ for months at a time, or even years. If this is something you may be interested in then you need to completely bypass the aforementioned CFDs.

The reason to avoid CFDs when using a long-term trading strategy is due to leaving positions open for long periods at a time. This type of trading invites daily overnight financing fees which add up.

Once again, eToro is a good option if you want to invest in cryptocurrencies like Bitcoin and keep hold of the coins for several months or years. This is because - and on the proviso you do not go short or apply leverage, eToro allows you to buy Bitcoin commission-free and without overnight financing fees.

✅ Buy and Sell - Profit Either Way

If you’ve ever traded stocks before, you will know that you purchase shares because you believe the value of the stocks is going to rise.

If you speculate correctly, great - you’re making a profit. However, when investing in traditional stocks you aren’t able to make gains when the markets go the other way.

When it comes to cryptocurrency trading in the UK - you can benefit either way by opting to go long or short. Of course, you must predict the direction of the market correctly.

As we touched on earlier on, if you think the value of a crypto pair is going to fall - you can simply place a sell order. You just don’t have that option when investing in stocks.

Disadvantages of the UK Cryptocurrency Trading Scene

Now that we've gone through the advantages of cryptocurrency trading in the UK, it’s only fair that we divulge the disadvantages as well.

❌ Trading in Unregulated Currency Exchanges

If you are new to the idea of cryptocurrency trading, then chances are the word ‘unregulated’ rings alarm bells. This is understandable, but the fact is that cryptocurrency trading cannot be ‘regulated’ in the UK - at least not in the same way as traditional markets. While the UK regime has hinted at developing cryptocurrency-specific laws and regulations, it remains to be seen when this will be the case.

The lack of regulation in this space is mainly due to the fact it is not fiat currency. As we explained in more detail earlier on - cryptocurrencies are not legal tender which has been circulated by a monetary authority. This means that the value of crypto assets is determined by supply and demand in that particular market.

You might on the other hand like the sound of an unregulated market, afterall, some traders prefer to fly under the radar.

For instance, there are investors who would rather not hand over ID, or would like to access super high leverage. Some traders look to offshore broker platforms, not bound to the strict limits of UK regulation.

If like us, you see regulation as somewhat of a safety net, then we highly recommend only signing upto FCA approved CFD brokers. This means that your money is protected up to the amount of £85,000 via the FSCS - should the platform collapse.

Not only that, but the crypto CFD trading platform in question will have jumped through hoops to get a licence.

❌ Potentially Ultra-High Volatility

Cryptocurrency trading can be highly volatile, particularly when it comes to pairs which are considered to be less liquid. Digital currencies can fluctuate by over 10% in a single day of trading.

This is where the previously mentioned range of orders can be very useful. For instance - stop loss and take profit orders are going to soften your losses meaning you can lock in any gains - without having to execute the order manually at a pinnacle time.

On the flip side, seasoned cryptocurrency traders actually crave volatility, as this presents ample opportunities to make larger gains!

Cryptocurrency Trading UK: Strategies

By now you should be fully armed with all of the information you need - in terms of how cryptocurrency trading in the UK works.

However that's not all, behind every good cryptocurrency trader is a good strategy - or several. Below we have detailed some of the most useful and popular strategies utilised by crypto traders today.

Using Market Corrections

Market corrections are used in all markets and can last anywhere from days, weeks, or even a few months at a time. Fundamentally, it is when a trend (going in either direction) is ‘halted’ on a temporary basis.

To give you an example:

- Let’s say that BTC/ETH has experienced an upward trend for the last few weeks - with gains of 30%,

- This upward swing couldn’t possibly continue at that speed indefinitely

- After all, large-scale investors are going to cash in their gains at some point

- When they do, the price of BTC/ETH will temporarily move in the other direction

The reason BTC/ETH went in the opposite direction is because the number of sellers outweighed the number of buyers. Again, supply and demand has a direct impact on the value of any cryptocurrency pair.

The aforementioned marker correction is not an indication of the demise of the upward trend on this pair. In fact, it simply indicates a brief interruption. Consequently, you might decide to place a ‘buy’ order when the market correction on the BTC/ETH is actioned. This action enables you to join the rising trend at a lower price.

Swing Trading Strategy

Many cryptocurrency traders in the UK use swing trading. It’s great for new traders, as well as people who just prefer to trade on a short-term basis.

The idea with swing trading is to buy and sell crypto pairs as and when you spot new trends. Cryptocurrency trends can last anywhere from hours to weeks. On the contrary to day trading strategies, you will be able to keep a trade open for days or even weeks at a time.

For instance, BTC/USD could stay on a upward or downward trend for a lengthy amount of time. If the feeling is that BTC/USD is bullish - you would want to keep your trade open throughout the upward trajectory.

Should the market reflect that the BTC/USD trend is no longer favourable - you would likely elect to close your BTC/USD trade and place a ‘sell’ order. By actioning this order you are making sure that you, as a swing trader, are catching the market correction in time.

Technical Analysis

Any experienced UK trader will tell you that technical analysis and indicators are a superb way of revealing the market sentiment of crypto pairs.

This is going to indicate to you whether you are dealing with a ‘bear’ market or a ‘bull’ market. If it looks as though your pair is in the ‘overbought’ category, then this is an indication that there is a strong possibility of a market correction being imminent.

It can take many years to completely master technical indicators. However, by at least trying to gain a firm understanding of the most important tools - you will find the decision-making process of cryptocurrency trading in the UK a lot easier.

Please find below a list of the most important technical indicators available to cryptocurrency traders. We have put together a brief explanation of each type of indicator, however please note that there are heaps more available.

Moving Averages

The overarching objective of a moving average is to filter out random price shift noise - which in turn, helps to level out price trends. You have a much better chance at predicting the price direction of a cryptocurrency pair trend by studying this indicator.

There are 4 different types of moving averages:

- Simple moving averages

- Linearly weighted moving average

- Smoothed moving averages

- Exponential moving averages

Bollinger Bands

Although realistically there is no easy way to know which way an asset's value will go - ‘Bollinger bands’ can certainly help you identify situations where you might be likely to succeed.

- This indicator consists of two different lines.

- When the two get close to each other near a moving average - this illustrates low volatility - with high volatility expected later.

- If however the lines are apart from one another - you’re looking at high volatility - with low to follow.

As you can see this makes Bollinger bands a great tool for traders, when trying to predict the volatility of a cryptocurrency pair.

You are able to use other indicators in conjunction with Bollinger bands, such as BBTrend and BandWidth - looking for entry and exit points using market volatility.

Directional Movement Index

The Directional Movement Index is a combination of 3 indicators; Minus Directional Indicator (-DI), Plus Directional Indicator (+DI), and Average Directional Index (ADX).

The goal of the directional movement index is to identify trends. The difference between this and some other indicators is that it doesn’t consider the direction of a trend. The direction of a trend is defined by the aforementioned +DI and -DI. This means that both direction and strength are taken care of.

Stochastic Oscillator

This indicator tracks cryptocurrency momentum and compares the digital asset’s price range and it’s closing price over a particular time frame. As such, the stochastic oscillator illustrates to traders what the growth and strength of a particular cryptocurrency is.

Moving Average Convergence Divergence

This particular technical indicator is good for both new traders and experienced. The reason being, it is simple and offers strong signals.

The moving average convergence divergence is another indicator which focuses on following trends, meaning it is a helpful tool for a variety of manners.

Not only will it give you a good indication of an imminent change in trend, but it could also show whether or not the short-term and long-term price momentum are going in the same direction as each other.

Relative Strength Index (RSI)

Knowing when to enter or exit a trade is hard enough as it is, but these technical indicators were created to aid traders in anticipating the market sentiment of the asset.

The Relative Strength Index (RSI) has been widely used by traders to analyse the financial markets since the 1970s. This is another indicator of momentum on our list - calculating the significance of recent price shifts. This enables the technical indicator to determine oversold or overbought cryptocurrencies (and other assets).

The indicator is hugely popular amongst seasoned UK traders and is superb for aiding you in spotting profit-making opportunities.

UK Cryptocurrency Trading: Potential Fees to Expect

Apart from love and laughter, not much in life is free. Brokers need to charge fees in order to make money, afterall it is a business, and they provide a service.

With that in mind, it’s important that we run through fees you might be liable for when you join an online cryptocurrency trading platform in the UK.

Spreads

When trading cryptocurrency, it’s crucial that you understand what a spread is. To put it in layman's terms, the spread is the contrast between the buy price and the sell price of a crypto pair.

Any broker offering you a service is going to include a spread in the price of placing a trading order. The spread is often shown as a percentage, so please see the below for an example of this.

- Let us say you are trading BTC/GBP

- The buy price of this crypto asset is £9,700

- The sell price is £9,850

- The spread in this scenario is 1.54%

As you can see, in order to break even, you have to make gains of 1.54%. Any gains above 1.54% you can count as actual profit

Commission Fees

Some trading platforms charge commission fees for each and every trade. This means that whether buying or selling an asset, you pay a percentage to the broker. Some UK brokers charge a flat fee, while others charge a variable fee which will be determined by your trading stake.

Here is how that would look in real trading conditions:

- You stake £500 on BTC/GBP

- Your broker charges 3% commission on all trades so you pay £15 extra in fees

- Later you decide to close your BTC/GBP trade

- Upon closing, your BTC/GBP trade is worth £800

- As such you pay the 3% required, which amounts to £24 (£800 + 3%)

- This means that in commission alone you have paid £39 - simply for opening and closing a position.

With that being said, there are some great UK trading platforms offering clients zero percent commission. As we’ve touched on, popular FCA-regulated platform eToro doesn’t charge any commissions for trading.

Inactivity Fees

It is worth noting that some trading platforms charge inactivity fees - meaning if you haven’t used your account for a specified amount of time, you will be charged a set fee.

No two brokers are the same in this respect. Some may charge you a fee if you go a month without engaging in any trading activities. Others might give you longer. For example, eToro charges $10 every month - but only after a full year of inactivity.

With this in mind, you should always check your broker’s terms and conditions.

Overnight Financing Fees

We’ve mentioned overnight financing fees a few times. Crucially, if you actively trade cryptocurrencies via CFDs you will be required to pay a daily fee.

Let’s give you a quick example of overnight financing fees, sometimes called swap-fees:

- On Monday you place a $1,000 ‘short sell’ order on ETH/USD

- You keep your position open until Sunday morning.

- At the time of writing, brokers like eToro charge clients a competitive $0.23 on a weekday - and $0.69 over the weekend

- You would be charged $1.15 in fees covering Monday to Friday

- Saturday is going to cost you $0.69 - meaning your Monday to Sunday trade cost you $1.84

It is important to reiterate that had you gone ‘long’ on the above position without leverage, eToro wouldn’t have charged you anything at all

Deposit and Withdrawal Fees

The deposit and withdrawal fees vary from broker to broker, and can be dependent on your payment method of choice.

You will come across trading platforms which charge for every single deposit and/or withdrawal - whereas some won’t charge anything at all. Always check the all important fee table before signing up.

Cryptocurrency Trading UK: Trading Tools and Software

Further up this page we explained the benefits of using technical analysis and indicators. Now we are going to run through algorithmic software and useful trading tools.

Cryptocurrency software is incapable of making emotional trading decisions and is instead designed to adhere to predetermined trading conditions. This advanced software is able to scan multiple global markets, 24 hours a day, 7 days a week.

For those who prefer to trade passively, or simply lack the time to make trading decisions - this software is invaluable. Not only that, but automatic trading is super helpful for newbie traders too.

It can take years to become a successful trader, from learning how the markets work, to learning how to use technical analysis. Consequently there are now heaps of companies offering automated crypto trading software.

Lets give you an example of how using cryptocurrency software works:

- You sign up and buy the software from the company of your choice

- Next, follow the link and download the software

- Select an online broker in the UK which is MetaTrader4 (MT4) compatible

- Download MT4

- Sign in to your new MT4 platform using your broker details

- Next you need to add the aforementioned cryptocurrency software to MT4

- Finally, give authorisation for the cryptocurrency software to trade for you

Now, your cryptocurrency software will buy and sell cryptocurrency pairs so that you don’t have to. The goal is that you can make gains, in a passive way. Some platforms call this software cryptocurrency trading robots, or EAs (Expert Advisors).

Cryptocurrency Trading UK: Trading Signal Service

Whilst some traders like the idea of a completely automated trading system, others prefer to have a little more control. This is where trading signal services come in. The major difference between the software and signals is that the buying and selling of assets isn’t done automatically.

Where the aforementioned software is going to buy and sell crypto assets whilst you put your feet up, the signal service will send you a real-time message informing you of potentially lucrative trades.

The service scans heaps of markets on a 24/7 basis and creates signals using algorithms.

Below you will see some of the signals you might expect to receive when using a cryptocurrency signal service.

- The first thing you will see is the asset the signal is referring to - for instance ETH/USD

- Next the signal is going to indicate whether it’s a good idea to buy or sell

- An indication of the limit order price it recommends you use (i.e $9,123)

- Stop-loss price suggestion (i.e $9,000)

- Take-profit price suggestion (i.e $9,300)

The signal provides the information, all you have to do is place the respective orders at your chosen UK cryptocurrency trading platform!

Cryptocurrencies Trading UK: Top Tips

You’ve stuck with us until this point in our UK cryptocurrency trading guide, so you are aware that trading digital assets is not risk-free.

In order to give you the best possible chance of being in the green when trading crypto pairs, we’ve put together 6 tips for you consider.

Tip One: Learn all Aspects of Cryptocurrency Trading

It’s a good idea to go into anything new with a bit of knowledge behind you, especially when there is money involved.

With that in mind, we recommend perhaps taking a cryptocurrency trading course, or reading one of the hundreds of books focussed on this market.

In terms of courses, there are heaps on offer in the online space - meaning you can learn to execute trade orders, manage risk, read charts and strategize - from your own home.

Crucially, you’ll also find a significant library of cryptocurrency trading resources here on our website. We offer courses on everything you need to know to get your crypto trading career off on the right foot. Whether it’s cryptocurrency trading strategies, deploying technical analysis, or how to spot trends - we have you covered!

Tip Two: Use a Regulated Broker

If you’ve ever googled ‘cryptocurrency broker’ you will have discovered that there are hundreds offering their services to UK residents.

Some trading platforms might offer you the moon on a stick, but if the broker isn’t regulated then you can never really be sure that it’s a trustworthy company. It is for this reason that we recommend only ever signing up with a broker who holds a licence from a regulatory body such as the Financial Conduct Authority (FCA).

By selecting an FCA approved broker you are providing yourself with a safety net of sorts. With UK brokers licenced by the FCA, your trading funds are protected up to the tune of £85,000 and the broker firm must segregate your money from it’s own.

Tip Three: Gain a Good Grasp of Chart Reading

Chart reading can be invaluable when trading cryptocurrency. As we’ve said, trading tools make the decision-making process a lot easier.

Not to forget, using a simple ‘buy and hold’ strategy means that you don’t need to focus on short-term trends when it comes to price action. This way, it means that you may hold on to your crypto assets for months or even years at a time.

With that said, the vast majority of seasoned cryptocurrency traders won’t keep their trade open for longer than a single trading day. Even if you decide to partake in a swing trading you will likely close your positions within a week or two.

Regardless of your strategy, it is really important that you have a grasp of charts and technical analysis. After all, how else will you spot possible digital currency trends?

Tip Four: Utilise Copy Trading

The copy trading feature offered by a few trading platforms is a game changer. The feature essentially allows you to choose a cryptocurrency trader with a good track record, and copy their portfolio like for like.

If that trader invests 1.8% or their investment portfolio in Ethereum, your own portfolio will mirror that percentage - but in proportion to your stake and account balance. Either way, 1.8% of your investment portfolio would be in Ethereum.

Let’s give you an example of what copy trading looks like in practice:

- In this scenario we are saying that the investor allocates 20% of their account funds to purchase Ethereum

- You initially invested £400 in the copy trader

- This means that £80 worth of your £400 is invested in Ethereum (20% of £400)

- If or when the investor decides to sell Ethereum - this will be reflected in your own portfolio.

eToro has one of the most popular copy trader facilities in the space. Not only is the website super user-friendly, but you can copy the entire portfolio of an investing pro for as little as $200. Best of all, the platform is home to over 700,000 verified copy traders - so you are sure to find one that meets your financial goals and ambitions!

Would you like to copy top traders on eToro?

Tip Five: Trade a cryptocurrency copy portfolio

If you don’t feel like trading cryptos manually or on your own or copying other people’s trades, you may consider trading or investing in one of the cryptocurrency portfolios offered by eToro.

You can invest in or trade two types of Copy Portfolios: Top Trader Portfolios which comprise the best performing and most sustainable traders on eToro, and Market Portfolios that bundle together CFD cryptos, stocks, commodities or ETFs under one chosen market strategy.

Ready to choose the CopyPortfolio that fits your strategy?

Tip Six: Practice on a Demo Account

The majority of online brokers enable clients to trade using ‘paper funds’. For those unaware, this is demo money.

Demo accounts are usually completely free of charge to use, and fully reflect the real-market conditions of the cryptocurrency pair - including trends, trading volume and price fluctuations.

Demo accounts are not only great for cryptocurrency traders with little experience, but also seasoned investors who want to try out a new strategy. One of the major benefits of demo account is that you are able to practice until your heart's content and not risk a penny in terms of cold hard cash.

How to Start Cryptocurrency Trading UK – Tutorial

In this section of our cryptocurrency trading Uk guide, we are going to walk you through the process of opening a cryptocurrency trading account.

Our example is based on an FCA broker eToro, as the platform allows you to trade and invest in cryptocurrencies, and other markets, without paying any commissions.

Step 1 - Open a Cryptocurrency Trading Account

Head over to eToro trading platform you chose, and elect to open an account. Because you are joining a regulated cryptocurrency broker, then you are going to need to provide your full name, residential address, date of birth, mobile number and email address.

Do not be too surprised if you’re also asked to provide a copy/photograph of your government issued photo ID - this is standard practice.

eToro – Best Cryptocurrency Trading Platform in the UK

eToro have proven themselves trustworthy within the industry over many years – we recommend you try them out.

67% of retail investor accounts lose money when trading CFDs with this provider.

Step 2 - Deposit Into Your Account

Although all brokers are different, In terms of deposit methods, eToro supports: credit/debit cards and bank transfers, e-wallets like Paypal and Skrill.

Select your preferred option from the drop down menu and deposit the minimum amount required into your account.

Step 3 - Choose a Cryptocurrency Pair to Trade

Before you can place an order, you need to think about what cryptocurrency pair you would like to trade.

On most trading platforms you will find this process really easy, as there will either be a search bar feature, or an asset menu with a section for crypto assets to select from.

Step 4 - Place a Cryptocurrency Order

Now you know what cryptocurrency pair you would like to trade, you can go ahead and place your order. We covered orders throughout this guide, so you should by now know how to set one up with eToro.

When you have submitted all necessary elements of your order, the stake will be taken from your trading account funds so that your trade can be executed. Hopefully, your first UK cryptocurrency trade is a profitable one!

Cryptocurrency trading UK: Conclusion

When trading cryptocurrencies in the UK you have access to nearly 7,000 digital assets. With that said, most will stick with highly liquid pairs that contain Bitcoin or Ethereum. Not only that, but most UK brokers will allow you to trade with leverage of up to 1:2. This means that you can trade with 2 times the amount you have in your trading account.

Trading isn’t easy and confidence can only take you so far. With this in mind, we do recommend that you educate yourself fully on the ins and outs of cryptocurrency trading before risking your own money.

Hopefully our guide has got you off on the right foot. However, we believe you should always conduct plenty of research, from various sources - as well as learning how to reach charts and understand analysis.

When you feel ready to sign up to a broker, please proceed with caution and try to only stick with FCA approved trading platforms like eToro. Moreover, it’s always worth taking advantage of free demo account when signing up, so you can find your feet on the platform without spending a penny of your actual trading account balance.

FAQs

How am I able to trade cryptocurrencies in the UK?

To trade cryptocurrencies you must first sign up with a broker offering crypto pairs. You then need to speculate whether the price is going to rise and fall.

Will I be offered leverage when trading cryptocurrencies in the UK?

Yes, you will likely be offered leverage. Albeit, you will need to sign up with a platform that offers CFDs. UK traders are allowed leverage of up to 1:2 when trading cryptocurrencies. It is down to the FCA broker to provide you with this leverage.

Can I short Bitcoin?

If you happen to think that a specific crypto pair is over priced - simply place a sell order with your CFD trading platform

What is the most popular cryptocurrency pair to trade?

Undoubtedly the most popular crypto pair is the Bitcoin against the US dollar. Shown as BTC/USD, this pair offers huge liquidity and super tight spreads.

How can I be sure that a broker is genuine?

To make sure a trading platform is legitimate, you should check that it holds a licence from a regulatory body such as the FCA, ASIC or CySEC.