eToro is a leading crypto exchange and stock brokerage firm and one of the most trusted platforms in the USA, the UK and many other countries as it is regulated and licensed from different jurisdictions .

The popular platform allows both beginners and experienced investors alike to invest in thousands of commission-free stocks and ETFs, alongside low-cost trades on forex, commodities, indices, and cryptocurrencies markets.

In this eToro review, we explore everything there is to know about the leading social trading platform – covering supported market areas, fees, account opening, payments, and more.

eToro is our overall best stock trading app and one of the top crypto exchanges in the market and is also a leading destination for those who want to learn how to buy cryptos or invest in stocks, as it is a top-rated trading platform for beginners.

eToro Review: Pros & Cons

The outcome of our full eToro review is summarised in the following pros and cons:

Pros

- ✅ No share dealing fees applicable

- ✅ Minimum deposit of $10 for US and UK clients

- ✅ eToro offers more than 3,000 stocks, 70+ crypto coins and over 150 ETFs

- ✅ User-friendly platform - Perfect for newbie investors

- ✅ Copy trading feature - Mirror a pro

- ✅ eToro Wallet for crypto holding

- ✅ Accepts most payment methods

Cons

- ❌ US Clients can't trade forex, commodities

- ❌ Not much in the way of technical analysis

Is eToro a Good Trading Platform? An in-depth look at the eToro trading and investing ecosystem

eToro is a multi-asset broker that encourages you to 'Trade with confidence on the world's leading social trading platform.'

But, is eToro trustworthy, and is eToro good for beginners?

eToro says you can trade and invest in Forex currency pairs, stocks, Indices and Commodities via CFDs. eToro promotes 0% commission on non-leveraged stocks.

- eToro has a cryptocurrency trading platform where you can buy and sell an expanding variety of cryptos.

- The Platform is excellent for cryptocurrency trading and social copy trading, with an overall trust score of 93 out of 99.

- eToro is not a publicly-traded company.

The web-based platform is user-friendly, and the mobile app is excellent for on-the-go trading or investing for beginners or experienced users.

In this eToro review, we explore what the eToro trading platform offers for traders and investors. We are going to delve into everything you can expect from this hugely popular social trading platform. Not only are we going to clear the mist on what eToro is, but also what assets you can trade, fees you can expect to pay, how the Copy Trading feature works, and how safe your money is and how to sign up.

Who Is eToro?

eToro first came onto the scene in 2007 and has been making a positive impression on the trading community ever since. The broker offers clients the chance to invest in a variety of cryptocurrencies including, but not limited to Ripple, Litecoin - and of course Bitcoin.

The trading platform provides ETFs, as well as shares from more than 17 stock markets. The minimum investment is just $10 for US and UK users which means fractional shares are possible. This is great if you don’t want to buy a full share.

In addition to that, there are more than 3,000 stocks to buy and sell. You can also trade CFDs including forex, indices, energies and metals. If you want to make the most of trading CFDs you can utilize leverage and even short-sell assets. It’s super cost-effective to maintain long-term investment positions via eToro.

This is because, unlike other broker platforms, the company doesn’t charge any maintenance fees. This is a striking contrast to the majority of established online stock brokers. In fact, some can and will charge in excess of $10. per trade.

eToro is one of the most popular social trading platforms in the space, largely due to the features on offer. One of the most valuable tools for inexperienced traders (as well as people who prefer to trade passively) is the ‘Copy Trader’ option. In a nutshell, this allows you to mirror the portfolio of other successful investors - which we’ll provide more detail on later.

eToro holds licenses from 3 jurisdictions and is therefore regulated - adhering to strict rules laid out by the relevant bodies. The licenses held by eToro have been issued by the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities & Exchange Commission (CySEC).

At eToro, there is a stark contrast between assets that can be ‘traded’ and assets that can be ‘invested’ in. This difference impacts aspects such as leverage, fees and of course - ownership.

It is for this reason that we have divided the eToro trading suite into ‘tradable assets’ and ‘investable assets’. In the next part of our eToro review, we are going to go into a little more detail on assets which are available to trade on the platform.

In 2017, when Bitcoin first rocketed to new heights, eToro added cryptocurrencies to their platform, and they continue to add new cryptos weekly.

In March 2018, eToro raised $100 million from private equity financing led by China Minsheng Financial, the SBI Group, a Korea Investment Partner, and other investors. eToro's estimated value at the time was $800 million.

eToro Trading Suite: Tradable Assets

eToro offers a well-developed trading suite with various facilities. As a trader, this enables you to trade based on the short-term price fluctuations of the asset in question.

You will likely only keep a trade open for a short length of time, anything from minutes to weeks. Consequently, the main objective of your trades will be to make small margins - on a regular basis. Should you trade via eToro the chances are you will trade CFDs.

Trading this way means that instead of owning the underlying asset, the CFD monitors the real-time price of the relevant market. For instance, should the price of Copper increase by 4%, this would be reflected in the CFD instrument that you are trading.

Below we have gone into a little more detail on all of the tradable CFD instruments on offer at eToro.

Forex

The forex market is open for trading 24 hours a day, 5 days a week - and it is without a doubt one of the most popular assets to trade globally. eToro offers nearly 50 currency pairs including minors, majors and exotics.

Below we’ve listed a few examples of pairs you can trade via this broker:

- Minor Pairs/Crosses: EUR/GBP, CHF/JPY, AUD/CAD

- Major Pairs: GBP/USD, USD/CHF), EUR/USD, USD/JPY

- Exotic Currencies: Polish zloty (PLN), South African rand (ZAR), Russian ruble (RUB), Singapore dollar (SGD).

Further Reading:

- The Most Volatile Currency Pairs

- Top 10 Forex Pairs To Trade

- How To Trade Exotic Forex Pairs

- Best Time To Trade Forex

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro USA LLC does not offer CFDs, only real Crypto assets available.

Crypto Assets

There are heaps of cryptocurrencies to invest and trade on this platform. In fact, our eToro review found that there are 94 tradable markets in total.

Should you choose to ‘go long’, without leverage - you are investing in the underlying asset (in this case crypto). If, on the other hand, you opt to apply leverage or ‘short-sell’ you will be trading CFDs.

Another option when trading in CFDs on eToro is ‘crypto-cross-pairs’. Essentially this is a pair made up of two conflicting cryptocurrencies - for example, Ethereum/Stellar (ETH/XLM) or Bitcoin Cash/Litecoin (BCH/LTC).

Indices

As you may already know, indices are thought to be a lot less risky than independent stocks. This is largely due to the fact they are made up of multiple different equities - so naturally, offset each other.

eToro offers indices as CFDs because they cannot be invested in on a direct basis. As we touched on earlier, trading via CFDs enables you to both short (sell) positions as well as long (buy). Moreover, you are able to open leveraged trades.

Some of the most popular indices on eToro include:

- GER30 Chart: This represents the Frankfurt Stock Exchange (FSE). The index represents 30 of the strongest blue-chip stocks - based on liquidity and capitalisation. Recognisable companies on the GER30 include Siemens, Volkswagen, Adidas, and BMW.

- NSDQ100: The NASDAQ 100 stock market index comprises 103 equity securities - all issued by some of the largest companies on the respective exchange. This includes Tesla, Apple, Microsoft, and Facebook, to name a few.

- DOW: This index tracks the performance of 30 publicly owned companies from a variety of sectors. Companies include McDonald's Corporation, The Walt Disney Company, Wal-Mart Stores Inc, and the American Express Company.

- SPX500: S&P 500 index comprises 500 of the biggest U.S publicly traded companies. This index includes around 80% of the equity market in America. Companies include Johnson & Johnson, Mastercard Incorporated, Netflix, and Amazon.com Inc.

- FRA40: This index is listed on the Euronext Paris Exchange and is made up of 40 companies - with weighting based market capitalisation. This includes L'Oréal, Renault, Carrefour, and Michelin.

If you would like to ‘invest’ in stock market indices such as those listed above, you might be better off choosing an ETF. The reason for this is that you would be able to ‘buy’ all of the shares that the index consists of - minus recurring fees or commission.

Stocks and ETFs

In the case of ETFs and stocks at eToro, they can be traded via CFDs as well. All in all, there are more than 150 ETFs, and over 1,700 stocks. Much like with cryptocurrencies (as we mentioned earlier), if you were to apply leverage or short-sell the asset in the question you’re trading stocks via CFDs. If you go long - you are investing in the stock.

Commodities

This trading platform is solid when it comes to tradable commodities. eToro offers metals such as silver, copper, gold, aluminum, platinum, and nickel.

Some of the commodities on the agricultural side include cotton, cocoa, wheat, sugar, and more. In terms of energies, they include but are not limited to oil and natural gas.

Trading CFDs

In terms of trading CFDs at eToro, you are able to short sell. In other words, when you place a sell order, you’re simply predicting that the price of the asset will fall. When trading via CFDs at eToro you can easily apply leverage, too.

It’s important to note that if you reside in any of the EU countries restricted by ESMA limits, you will be capped by the amount of leverage that you can apply.

The limits imposed by ESMA currently stand at:

- Cryptocurrencies - 1:2

- Stocks - 1:5

- Non-major indices - 1:10

- Non-gold commodities - 1:10

- Major indices - 1:20

- Minor and exotic forex pairs - 1:20

- Gold - 1:20

- Major forex pairs - 1:30

If you live outside of the UK - or are a professional trader - you can get your hands on much higher leverage limits.

Please note: By applying leverage at eToro you are risking your capital. Should the trade not go in your favor, you could face liquidation - meaning your margin is kept by the broker.

eToro Trading Hours

As is the case with most online brokers, eToro has a variety of trading hours which is entirely dependent on the market or asset. This doesn’t include cryptocurrencies as they can be traded 24 hours a day, 7 days a week.

To give you a little more insight into the different trading times offered by eToro - check out the below.

We have based this on GMT.

- US shares that are listed on the NASDAQ and NYSE can be bought 4.30 pm to 9 pm - Monday to Friday

- UK shares that are listed on the London Stock Exchange can be bought 8 am to 4.30 pm - Monday to Friday

- You can trade commodities such as gold, silver and oil between Sunday at 11 pm and Friday at 9 pm.

- You can trade the vast majority of forex pairs between Sunday at 10.05 pm and Friday at 9.30 pm.

If we haven’t listed the asset you are interested in, you can head over to the eToro website and check the opening and closing times for the market in question. If you won’t be available when that particular market is open, you can place an order anyway. In this scenario, your order will be executed when the market opens.

All you have to do is select a ‘limit order’ and choose the price you want to go in at. Consequently, your order will not be executed until the market price is in line with your predetermined limit order.

eToro Investable Assets

Now that you know what you can trade, in this part of our eToro review, we are going to run through what you will be able to invest in. In other words, the assets listed below can be purchased outright - meaning that you retain 100% ownership.

ETFs

There are over 150 ETFs on offer at eToro, which enables you to invest passively. This includes a variety of Vanguard funds as well as iShares. If you are looking to diversify your own investment portfolio, ETFs are a great way to achieve that.

Opening a long, un-leveraged ETF position via eToro is considered a low-risk, long-term investment. The objective being to achieve steady gains over time. Depending on the provider you could potentially be buying hundreds if not thousands of stocks/bonds - all through one investment.

Cryptocurrencies

We’ve talked about cryptocurrencies with reference to trading, but you can also invest in crypto assets. There are 79 coins available on eToro, to name a handful of the most invested - Ethereum (ETH), Bitcoin (BTC), Bitcoin Cash (BCH), Cardano (ADA) and Ripple (XRP).

eToro has the most diverse list of crypto pairs available

And when we say that we don’t just mean different cryptocurrencies that can be traded against the US dollar, we mean cryptocurrencies that can be traded against other major currencies and even against other cryptocurrencies!

Did you ever think you could trade Ethereum against the euro? Or Stellar against the Japanese yen?

We were thinking about typing out the entire list of cryptocurrency trading pairs available on eToro, but the list is so long we thought it would be a lot better just to share with you the link where you can find eToro’s different cryptocurrency pairs.

No other cryptocurrency broker can compete at this level! eToro is really built for the modern-day cryptocurrency trader. But that by no means that older, more experienced traders will not be able to pick it up!

It is highly likely that eToro is the future of cryptocurrency trading, particularly with its social trading feature and we will likely see more brokers trying to emulate this.

Read More:

- Best Altcoins To Invest In

- Best Future Crypto Coins To Buy

- Best DeFi Coins To Buy

- Best Meme Coins To Buy

- Next Cryptocurrency To Explode

- Most Undervalued Cryptos To Buy

- New Cryptocurrency To Invest In

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Shares

There are over 3,000+ companies on eToro of which you can buy shares in. This not only covers companies which are listed on the London Stock Exchange, but also an additional 16 global markets. To give you an idea - other markets include the New York Stock Exchange and NASDAQ - as well as markets in Amsterdam, Paris, Stockholm and Saudi Arabia.

As we mentioned earlier, these markets give traders and investors access to a plethora of huge companies like Amazon, Johnson & Johnson, Apple, The Walt Disney Company, McDonald's Corporation and Adidas.

By investing in any of the aforementioned assets at eToro, you own the asset in question. Of course, if you were to cash-out that is no longer the case. Any dividend payments from your stocks or ETFs will be added to your eToro account automatically at the time of distribution.

Your capital is at risk.

eToro Fractional Ownership

In this part of our eToro review, we are going to run through the option of fractional ownership. In a nutshell, this enables you to invest as little as $10 USD.

To give you an example:

- You wish to buy a share in Amazon

- Let’s say a full share in Amazon will set you back $3,000

- The vast majority of us wouldn’t have $3,000 lying around to invest in stocks

- At eToro, you can invest as little as you like as long as it’s over $10

- Now let’s say you decide to invest a more manageable $100

- You now own 3.33% of a single Amazon share

Utilizing the option of fractional ownership on eToro is useful for a number of reasons. It might be the case that you can’t afford to buy a full share, don’t want to - or simply want to diversify your portfolio with small investments.

eToro Available Accounts

Our eToro review found that there are two account types available on the platform - a professional account and retail account.

Below we’ve put together a simple explanation of how both accounts work on the eToro site.

Professional Client Account

If you consider yourself a professional client you can request this type of account. In order to be successful, you will need to pass various tests and meet the criteria stipulated by eToro. Specifications include trading experience, transaction frequency, and trading volume.

eToro states that the platform will also give professional account holders the same protections as retail clients. That is to say that you will be entitled to ‘negative balance protection’. This protection means that if you encounter a losing position, eToro will revalue your equity to ZERO to protect you against a negative balance.

By opening a professional account you will not be subjected to the same ESMA leverage regulations as retail clients. In fact, when it comes to leverage, you can access up to 1:400 for some instruments as well as a margin rate reduction. The minimum deposit at eToro is $200 as standard.

Retail Client Account

Put simply, if you are not a professional client - you are a retail client. That is to say, you do not trade frequently or in super-high volumes.

As a retail client, you will be able to trade on a manual basis or use the ‘copy trade’ facility. As we have previously stated, retail clients are subject to leverage caps. The positive aspect of this is that you will be protected by the Investor Compensation Fund and Financial Ombudsman Service (if you’re based in the UK).

Lastly, as with professional accounts, you will also be given margin closeout limitations and negative balance protection.

eToro Fees Applicable

In this section of our eToro review, we’re going to shed some light on what fees you might be required to pay.

Let’s start with commissions.

Dealing/Commission Fees

One of the best things about eToro is that it is a completely commission-free trading platform. Although there are many commission-free ‘CFD’ brokers in the online scene, eToro enables clients to invest in ETFs and shares - also with zero commission.

A number of well-established brokers charge clients in excess of $10 per trade. This means that you would pay that fee when you buy the share, and also again when you sell it.

For example:

- Let’s say Broker XYZ charges $10 per trade

- You buy $125 worth of Nike shares and $125 worth of Johnson and Johnson shares

- This amounts to two trades - so at a commission of $10 - that’s $20

- You then sell the above shares a few weeks later

- Again, this amounts to two trades, meaning an additional $20

- All in all, Broker XYZ has charged you $40 in commission ($10 x 4)

At eToro, on the other hand, you would be charged zero commission, meaning you’ve saved $40 when compared to Broker XYZ.

Spreads

Much like many other online trading platforms, spreads will change throughout the day depending on the market. This is a reflection of what the market conditions are at that time, for example, if the market in question is particularly volatile, the spread will be wider.

Especially during normal market hours, we found that the spreads at eToro are super competitive. As we have covered, there are heaps of assets available on this trading platform - to list them all would be beyond the boundaries of this review.

That said, to give you an idea of what to expect we have listed some typical spreads on popular assets.

- Crypto: Bitcoin - 0.75%, Ethereum - 1.90%, Litecoin - 1.90%

- FX pairs: EUR/USD - 1pip, GBP/USD - 2 pips,USD/CAD - 1.5pips

- Commodities: Oil - 5 pips, Copper - 2 pips, Sugar - 8 pips

- ETFs and Stocks - starting from 0.09%

Overnight Financing Fees

As is the case with spreads, the overnight financing fee will vary on the market or asset in question. In terms of buying crypto assets, ETFs and shares through this broker you are the owner of the asset itself.

By owning the underlying asset you are able to keep the position open for a long period of time without being subjected to overnight financing fees.

In the case of CFDs, it’s a different story because they are leveraged financial instruments - meaning you will be charged a small daily fee - otherwise known as ‘overnight financing’. It is worth noting that some CFD assets have a larger fee attached if your position is held open over a weekend.

As such, you should always conduct your own research and check the fee table before taking the plunge. Having said that, upon placing your order you will see the amount payable. At eToro, this is illustrated as a ‘per-day’ fee. Crucially, eToro is very transparent when it comes to fees.

eToro Deposit And Withdrawal Methods

When conducting research for this eToro review, we were impressed by the number of payment options available on this platform.

eToro allows you to deposit funds into your account using the following payment methods:

- Credit Card

- Debit Card

- Bank Transfer

- Neteller

- Skrill

- Paypal

With most of these payments, your deposit will be instantaneous, so you can begin to trade or invest right away. The exception to this is a bank transfer which can take anywhere up to 3 business days.

When it comes to deposit fees, there is just a currency conversion fee of 0.5% - if you deposit using anything other than US dollars. To give you an example, if you were to deposit €1,000 into your account you will be charged €5. With regards to withdrawal requests, you will be charged $5 for each withdrawal.

eToro Trading Platform: Usability

The eToro website is really user-friendly and easy to navigate - which makes it great for beginners. Entering or exiting a position is a simple process as the platform ensures that nothing is overcomplicated.

You will see categories like commodities, stocks, and ETFs on the site’s trading suite. Not only that, but there is a useful search box enabling you to look for a specific asset. For instance, if you want to make a beeline for Amazon stocks, simply type ‘Amazon’ into the search box and you will be redirected to the relevant trading page.

There is no need to download an application or install software if you don’t want to. On the contrary, you can just head over the website and invest or trade until your heart's content. If you prefer mobile trading - you’ll be pleased to know that eToro offers a native app for Android and iOS devices.

eToro MetaTrader4 Compatibility

eToro is not compatible with popular third-party trading platforms like Metatrader4 or Metatrader5. Instead, you will be using the in-house eToro trading suite. Its platform offers fewer features to that of MT4/5 - especially when it comes to technical analysis. Although this also means that you will miss out on the ability to deploy an automated trading robot - eToro offers its own copy trading feature which achieves the same goal.

eToro Technical Analysis and Tools

Analysis tools and technical indicators are a crucial part of being a successful trader. Whilst there is no trading crystal ball - studying historical price data, technical analysis, and keeping abreast of all the latest financial news can help you stay ahead of the curve.

This is especially the case if you plan on being a short-term investor and thus -opening and closing multiple positions in a trading day. Our eToro review found that the broker is somewhat lacking when it comes to technical analysis.

There are basic charts on offer, such as the platform’s ‘ProCharts’ integration. This enables you to see price fluctuations over a specific period of time. There are a few guides on the site, teaching traders how to utilise various technical indicators. Therefore it’s somewhat surprising that the eToro platform doesn’t offer these itself.

eToro offers hardly any fundamental analysis tools either, meaning no real-time financial or economic news. With that said, there are plenty of websites for you to source this information, most of which are free.

Finally, the platform gives you access to mass investor sentiment data from big hedge funds, as well as expert price forecasts.

eToro Social Trading Platform

If you’re a serious trader then the lack of technical indicators, analysis, and real-time financial news might be off-putting to you. However, our eToro review found that the social trading set up of this platform counteracts that efficiently enough.

For those unaware, eToro is a little like a social media platform (think along the lines of Twitter and Facebook) - only for traders and investors. Fellow investors frequently post financial and economical news updates, tips, and market predictions.

Much like a news feed on a social media platform, traders will post updates, but within the realms of the relevant asset. You will be able to reply to and ‘like’ posts and spark up a conversation with your fellow traders. Having a connection with a trading community on a global scale can be very beneficial - especially if you are new to the world of investing online.

eToro Copy Trading Feature

Past performance is not an indication of future results.

We have touched on the copy trading feature a couple of times throughout this eToro review. To clarify, so long as you meet the minimum investment amount of $200, you can copy an established trader like-for-like. eToro vets all of the copied traders on the platform and there are heaps to choose from.

Should you wish to copy a trader, you can choose that person based on assets you are interested in. Not only that, but by looking at the copy trader’s profile you will get a good idea of the individual’s trading style. It goes without saying that some investors like to focus on long-term investing, whilst others might only keep a position open for minutes or days.

By copying a trader, you are able to opt into mirroring their portfolio, and also any future trades. eToro also allows you to close a particular trade, without having to close the full copy account. In the case of copying all trades - whatever the copied trader invests in will be reflected in your own portfolio (in proportion to your investment).

If you wish, you can also just elect to copy new trades moving forward. This way, any existing investments previously carried out by the copy trader will not be mirrored in your portfolio. Either way, newbie traders and experienced traders alike are able to actively buy and sell assets in a completely passive manner.

It is absolutely vital that you do some research of your own before investing in a copy trade account. eToro makes that fairly simple, as there is plenty of trading data and stats for you to study on the individual.

To give you an idea of what you should be looking out for when choosing a portfolio to copy, we have listed some key metrics to consider.

- What assets does the trader focus on?

- What is the trader’s average monthly profit?

- How long does the trader keep positions open?

- What is the trader’s eToro risk level? (between 1 and 10)

- How many other eToro users are copying the trader in question?

- What is the value of the assets under the management of the trader?

To reduce risk and diversify your portfolio - you can copy more than one trader. Say you have $1,400 to invest. By copying 7 traders - who perhaps focus on different asset classes, should someone have a bad trading day, your portfolio won’t suffer as much. You can invest in as many as 100 copied traders, but it’s important to remember the minimum investment is $200 per portfolio.

To give you an example of how a copy trading portfolio might work, check out the below:

- Let’s say your copy trader of choice has $30,000 worth of Disney stocks and $10,000 in silver

- The copy trader has $40,000 invested in total - 75% in Disney and in 25% silver

- Let’s say you invest $4,000 into the copy trader

- $3,000 of your portfolio is in Disney stocks (75%) and $1,000 in silver (25%)

Regardless of the precise amount the copied trader has invested, the amount mirrored in your own portfolio will always be the relevant percentage.

Ready to start copy trading?

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

eToro CopyPortfolios

Copy Entire Portfolios

eToro introduces the next generation investment product.

CopyPortfolios aim to help investors minimize long-term risk, seek opportunities for growth, by taking copy trading to the next level and creating diversified investments.

A super cool feature of eToro is the ability to copy entire portfolios, taking the idea of social trading one step further.

There are three different ways traders can copy portfolios.

They can either copy ‘top trader portfolios’ which are based on eToro’s top traders, ‘market portfolios’ based on different markets and ‘partner portfolios’, which are created by eToro’s partners.

Do bear in mind that copying an entire portfolio requires a lot more due diligence than copying a simple trade as there is a lot more to look into!

Can I Create Investment Portfolios with eToro?

Yes. You can create portfolios of your own, or eToro has an Investor Program you can follow. The best, high-performing investors share their portfolios with eToro clients. The theory is that if you copy a successful investor, your investments will replicate their success.

Investors to the program have a strict process to follow before eToro allows them to share their portfolios.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro Regulation

Before you sign up with a broker, find out if the company is authorized and regulated with a governing financial body aligned with your country. For trading or investing protection, this step is essential

eToro is licensed and regulated by several governing bodies, as outlined below.

eToro United Kingdom

eToro has a registered office in London. eToro is regulated by the Financial Conduct Authority (FCA), the governing body for the UK.

eToro Cyprus

eToro has a registered office in Cyprus and is regulated by the Cyprus Securities and Exchange Commission (CySEC).

eToro United States

eToro USA is operated by eToro USA LLC, registered with FinCEN as a Money Services Business.

eToro Australia

eToro Australia Pty Ltd is regulated by the Australian Securities & Investments Commission (ASIC) and a Corporate Authorized Representative (CAR) of Gleneagle Asset Management Limited.

eToro AUS Capital Pty Ltd is authorized by the Australian Securities & Investments Commission (ASIC).

As highlighted above, eToro is regulated in two-tier 1 jurisdictions and one tier 2 jurisdiction. This regulation makes eToro a secure broker for trading Forex and CFDs.

Where Does eToro Hold Client Funds?

An essential aspect of checking a broker or exchange is to find out where they hold client funds.

eToro states that client funds are held in segregated bank accounts or a segregated account with an authorized firm (which may be an affiliate of eToro), which means that your money is held separately from eToro's funds. These funds can only be used for operational costs. To adhere to licensing bodies is a standard requirement.

What Countries Does eToro Accept?

Always check that eToro supports your country for trading and investing. Regulations change all the time. The list below is the current list of countries not supported by eToro.

- Afghanistan - Aland Islands – Albania – Anguilla – Antarctica - Antigua, and Barbuda - Armenia – Aruba

- The Bahamas – Barbados - Belarus -Belize - Benin - Bermuda - Bhutan - Bonaire - Bosnia, and Herzegovina - Botswana - Bouvet Island - Brunei - Burkina Faso – Burundi

- Cambodia - Cameroon - Canada - Cape Verde - Central African Republic -Chad - Chagos Islands - China - Christmas Island - Cocos Islands – Comoros - Congo Republic - Cook Islands - Cote d'Ivoire - Crimea Region - Cuba – Curacao

- The Democratic Republic of the Congo – Djibouti - Dominica

- El Salvador - Equatorial Guinea - Ethiopia -

- Faroe Islands - Falkland Islands - Fiji

- Gabon - Gambia - Ghana - Greenland - Grenada - Guatemala - Guinea -Guinea-Bissau - Guyana

- Haiti - Heard Island and McDonald Islands – Honduras - Hong Kong

- India – Indonesia – Iran - Iraq

- Jamaica - Japan

- Kiribati – Kosovo - Kyrgyzstan

- Laos – Lebanon – Lesotho – Liberia - Libya

- Macau – Madagascar – Malawi – Maldives – Mali – Marshall Islands Mauritania – Mauritius – Micronesia – Moldova – Mongolia – Montenegro Montserrat – Morocco – Mozambique – Myanmar

- Namibia – Nauru – Nepal – Netherlands Antilles –Nicaragua – Niger – Nigeria – Niue – Norfolk Island – North Korea – North Macedonia – Northern Cyprus

- Pakistan –Palau – Palestinian Territories – Panama – Papua New Guinea – Paraguay – Pitcairn Islands

- Russia – Rwanda

- Saint Helena – Saint Kitts and Nevis – Saint Lucia – Saint Pierre – Saint Vincent and the Grenadines – Samoa – San Marino – Sao Tome – Saudi Arabia – Serbia – Sierra Leone – Sint Maarten (Dutch Part) – Solomon Islands – Somalia – South Africa – South Georgia and the South Sandwich Islands – South Sudan – Sri Lanka – Sudan – Suriname – Svalbard and Jan Mayen – Swaziland – Syria

- Tajikistan – Tanzania – Timor-Leste – Togo – Tokelau – Tonga – Trinidad, and Tobago – Tunisia – Turkey – Turkmenistan – Turks and Caicos Islands –Tuvalu

- Uganda – Uzbekistan

- Vanuatu Vatican City –Venezuela –Virgin Islands (British)

- Yemen

- Zambia – Zimbabwe

The above exception list is extensive, but check eToro's up-to-date list before registering for an account with eToro.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Can I Use MetaTrader Platforms with eToro?

eToro currently does not offer Metatrader 4 (MT4) or Metatrader 5 (MT5).

eToro has a proprietary platform, a desktop (windows) platform, a web-based platform and a mobile app.

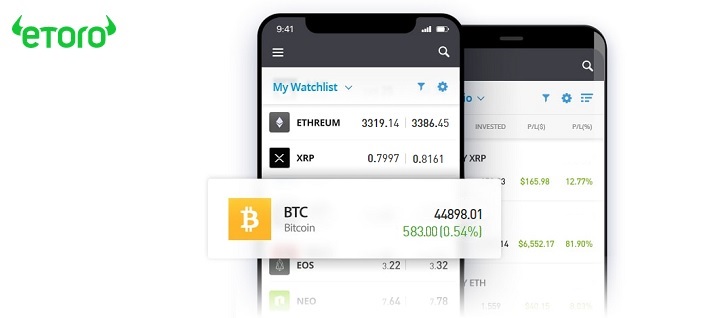

eToro App Review

The eToro app is available on Google Play Store and App Store to download for Apple and Android smartphones.

The eToro app uses a dark and light theme, which maintains the eToro web version's look and feel.

You can sync your watchlists and unify your charting, which is responsive but with only five indicators available instead of just under seventy indicators on the web version.

There are no drawing tools on the app, but otherwise, it is streamlined, functional, and responsive.

eToro Auto Copy Trading

The popular CopyTrader™ feature allows you to see what experienced traders are doing in real-time. You can select a trader that you like and start copying their trades automatically.

All copy traders on the eToro system are trading manually. Fully automated trading systems are not allowed with eToro. Other social trading platforms offering an auto copy trade system do not discriminate between manual and auto trading (where software algorithms place a trade)

With the rise and popularity of auto trading systems, it's good for beginners to know that with eToro, they follow a discretionary system whereby the trader is placing a trade manually.

CopyTrader™ is ideal for beginners to trading. We all have to start somewhere. But the service is also suitable for the time-strapped trader who doesn't have the time to analyse or watch trades.

On the website, the average yearly profit percentage for 2020 is 83.7% for 50 of the most copied traders on eToro.

As eToro is a social trading platform, you can learn from a collaborative group of traders and investors where the data is transparent.

You can view stats, risk scores, portfolios, and much more and chat with others to gain more knowledge about trading and investing.

There are no fees for copying the traders, but you may pay fees on spreads and a small fee for overnight trades.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Does eToro Offer Leverage On My Trading Account?

The eToro website states that leverage is available to retail clients, except for the United States.

ESMA (European Securities and Markets Authority) and ASIC (Australian Securities and Investments Commission) define the maximum leverage amounts.

- Major currency pairs (i.e. EUR/USD) = x 30

- Minor currency pairs (i.e. EURNZD) = x 20

- CFD stocks (securities) = x 5

eToro has disabled the ability to open leveraged crypto positions because of the volatile nature of trading cryptocurrencies. Navigating massive price swings with cryptocurrencies is high-risk, so removing leverage is a sensible decision by eToro

The details for leverage seem a little vague, and eToro could improve this information on the website.

Before using leverage, we recommend you get clarification for your country off the eToro website list.

eToro Cryptocurrency Wallet

The eToro Money crypto wallet is a secure, user-friendly digital wallet.

It's one of the safest crypto wallets available. The eToro Money crypto wallet has standardization protocols and several high-level security features. For example, the eToro Money crypto wallet has multi-signature facilities and DDoS (Distributed Denial of Service, which helps prevent an attack on the network infrastructure).

The eToro crypto wallet is free to download, and it's easy to buy and store multiple cryptocurrencies. You can receive and transfer over 120 cryptocurrencies, and you can change one crypto to another with no need to transfer.

The eToro Money crypto wallet comes with a private security key that you can use to recover access to your crypto wallet when needed. You can receive, store or transfer your cryptocurrencies anywhere on the blockchain with your own private on-chain address.

You can download the eToro Money crypto wallet app from Google Play Store or on the App store.

eToro Educational Content

Although eToro is somewhat lacking in technical analysis, the platform does offer some great educational material to clients. You will find step by step guides on how to use the platform and trading suite, as well as some investing fundamentals and tips.

As well as catering to newbie investors, the trading platform also provides heaps of webinars and informative podcasts. On the webinars, in particular, you are able to ask the host any questions you might have.

eToro promotes online courses, weekly webinars, and podcasts.

Due to the Covid-19 pandemic, there are no physical classroom meetings planned for the foreseeable future.

Before Covid, the 10 am to 5 pm eToro crash course in trading was a one-day live training course at London's Canary Wharf.

Subjects covered are :

- The financial markets

- Types of trader – learn what type of trader YOU are

- Key terms – understand terms with simple examples

- Trading – explore the essentials of crypto, stock, and currency trading

- Q&A – your chance to ask our trader anything

The eToro podcasts cover such topics as below:

- How to buy stocks

- How to buy Bitcoin

- How to CopyTrade

For such a large client base, eToro could improve its base of podcast subjects

What Financial Instruments Can I Trade With eToro?

eToro offers the following financial instruments:

Cryptoassets

Cryptocurrencies are growing in popularity and are becoming the go-to investment option for many traders.

Crypto's are volatile, so considered high-risk, and subsequently, crypto trades on eToro are unleveraged.

When you buy cryptocurrencies on eToro, you are investing in the underlying assets, and, as such, they are unregulated, so you have no investor protection. This is standard practice for cryptocurrencies.

If you sell cryptocurrencies on eToro, your trades are executed using CFDs which fall under CySEC regulation

eToro has a vast range of available cryptocurrencies, and they continue to add new cryptos.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Commodities

Commodities have a real-world physical representation, such as gold, silver, oil, rice, etc.

You trade commodities on eToro as CFDs, so you don't purchase the underlying asset.

You can sell (short) positions and leveraged trades. And you have fractional ownership. For example, you can invest small amounts such as $100 in gold or silver, even if the single unit costs $1500

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Currencies

Forex (foreign exchange) is a highly liquid financial market, trading over $6.6 trillion 24/5. Forex is a popular trading platform on eToro where you can use leverage to grow your Forex account.

On eToro, currencies are traded as CFDs, meaning you are trading currencies and not buying the currency.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

ETFs

When you invest in ETFs on eToro, you buy a non-leveraged position, which means you are investing in the underlying asset.

There are additional functions where you can use ETF trading. You can sell CFDs with leverage and buy fractional shares in the same way you can short sell commodities.

Is eToro Suitable For Professional Traders?

eToro offers retail and professional accounts. A retail client is a trader that isn't trading professionally. Retail clients have access to all trading assets, but leverage may be restricted.

eToro retail clients have protection with the Investor Compensation Fund, which means you have recourse to the Financial Ombudsman Service.

eToro offers margin close-out restrictions and negative balance protection for retail traders.

Professional trading clients have to pass a test to assess suitability for professional trading status on eToro.

Unlike retail clients, there is no protection for professional traders from ESMA and no recourse to the Financial Ombudsman Service, but there is negative balance protection. Professional eToro clients may have higher leverage offered by eToro where appropriate.

To apply for professional status, you fill in an application form, and if you meet eToro's criteria, your application will be approved.

How to Start Trading With eToro

This eToro review will now explain the process required to get started with this platform.

With over 30 million investors using eToro, you can bet that it’s popular amongst the trader/investor community. If you are by this point eager to sign up, we’ve put together a simple 5 step process to get you started.

Step 1: Open a new account on eToro

First thing is first - you need to go to the official eToro website and hit ‘sign up’. As with all regulated brokers, you will need to provide your name, address, telephone number and email address.

You may be required to enter some more information depending on the country you reside in.

Step 2: Verify your Account

Next, you will likely need a copy of your photo ID, which must be government issued. For example, a passport or driving license.

In addition to this, you will need to send over a clear copy of a document verifying your home address. Again this needs to be something official such as a utility bill or bank statement (importantly, this usually has to be from the last 3-6 months).

Your account will be confirmed in a matter of minutes.

Note: You can skip the KYC process and still deposit up to $2,250. But, this needs to be done before you can withdraw funds out of eToro.

Step 3: Deposit Funds Into Your Account

As we’ve said, there are various payment methods available at eToro - simply deposit $200 minimum using your payment method of choice.

Step 4: Choose an Asset you Want to Trade

Now that you've funded your eToro account you can begin trading. To get started, simply enter the stock, CFD, ETF etc into the search box and hit enter.

Once you have found what you were looking for, you can proceed to click on the blue ‘Trade’ button. This is going to redirect you to an ‘order’ box.

Step 5: Place Your First Trade

At this point, you can set your order up and enter your preferred stake. For instance, if you want to trade $250, you need to enter that into the ‘amount’ section.

We mentioned further up this eToro review that you can check the overnight financing fee for each trade. It is at this time you can scroll down to see the daily fee applicable. To clarify, if you don’t use leverage, there will be no overnight fee.

Finally, confirm the order to complete your commission-free eToro investment!

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

It's easy to join eToro.

- Click on the join now on the eToro home page

- Complete the electronic form with your personal details

- Read eToro's terms and conditions and privacy policy

- Tick the relevant boxes to confirm the agreement

- Submit the information

How Do I Withdraw From My eToro Account?

To withdraw from eToro, click on the Withdraw Funds tab in the left-hand menu and enter the total you wish to withdraw funds. Complete the form and submit

Wire transfers and credit or debit cards can take up to 8 business days from withdrawal. Most other withdrawal options are 1-2 business days.

All withdrawal requests are subject to a $5 fee.

There is also a currency conversion fee if you withdraw currency that isn't the dollar. These fees vary, but the fees are pips rather than fiat currency.

Does eToro Offer A Demo Account?

Yes, as standard practice, when you open an eToro account, you have access to a free $100,000 demo account.

eToro Review – Conclusion

Our eToro review found that the leading exchange and broker offers thousands of international stocks including the top US stocks and ETFs at 0% commission, and dozens of cryptocurrency coins at just 1% fees.

All things considered, eToro is one of the best trading platforms we've come across. 30 million users can’t be wrong. The stand out feature has to be the ability to copy a successful trader’s portfolio like-for-like.

We should note that this 100% passive copy trading feature is not only reserved for inexperienced users - but also well-seasoned investors who simply lack the time to commit to analysis and research.

When it comes to fractional investing, at eToro you can get involved for as little as $10 on cryptocurrencies, ETFs and stocks. Again, this type of trading can be great for newbies - but also experienced investors looking to diversify. Remember the minimum deposit still stands at $10.

The cherry on the cake is that eToro is a well-respected social trading platform, fully licensed by more than one regulatory body and thus - you are in safe hands. That said, always conduct your own research before committing to any broker, or copy trader for that matter.

eToro – Best Trading Platform For Traders And Investors

eToro have proven themselves trustworthy within the industry over many years – we recommend you try them out.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro is a multi-asset platform which offers both investing in stocks and crypto assets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as a basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorized and regulated by the Cyprus Securities and Exchange Commission.

eToro Review - FAQs

Is eToro trustworthy?

Finding a broker you can trust is the first step in your trading journey. On 8th March 2021, eToro proudly announced they have 20 million users registered globally. By Q3 2021, eToro plans to be listed on the NASDAQ. eToro adheres to licensing regulations. They ensure solvency with adequate capital and a track record of customer service, with 20 million users that prove eToro is a trustworthy broker.

Is eToro really free?

The copy trading service is free, but be aware that there may be overnight fees and small costs factored into eToro's spreads (the difference between the bid and the ask price). Like any business, eToro has to profit to stay in business, making their money in these two areas, as do most online brokers.

Do eToro offer Analysis Tools?

eToro incorporates fundamental analysis into the platform for shares trading. eToro uses the trades of their professional traders to calculate sentiment data. eToro also has a wall feed, similar to Twitter, that shares the collective comments for a financial instrument. You can see a stream of updates and learn what other traders are thinking or doing regarding a trade you may be considering. Though the feed may not always be top quality content, it can assist in estimating market sentiment. Content from in-house staff or professional traders is of higher quality and will likely bring better rewards if you follow their suggestions. But you'll soon work out who is best for trade analysis.

Can you make money with eToro?

It's possible to make money with eToro, but there are no guarantees. Trading has a 95% failure rate, with any broker, and even professional traders lose occasionally. eToro has an immense database of pro traders, and the copy trades are real-time. But, to succeed long-term, it's less about blindly copying trades and more about learning to do your own analysis, manage your risk, make good decisions, and keeping your losses small and under control. Some pro traders may trade with higher risks, and others take fewer low-risk trades. Only you can decide which trader to copy. Being successful as a trader or investor is about making the right trading choices. Focus on risk-management decisions, keeping average losses small relative to average profits over time (whether you are trading manually or copy trading). Know when to quit, perhaps after three consecutive losses, and don't trade late to the party. If a trader called a copy trade 30-minutes earlier, you might have missed the opportunity. Wait for another trade.

What type of broker is eToro?

eToro wears a couple of different trading hats. They can either be a market-maker or agency broker, depending on several factors. Market-maker brokers act in opposition to your trade, so if you buy, they will sell. Agency brokers direct your order to other market-makers. Agency brokers may get rebates or commissions in return, profit-sharing, or wider spreads. For instance, eToro Europe and eToro U.K. act as market-makers. But they can hedge their client's trades and act as an agency broker if needed. It's all part of the internal risk management process. What matters to you and all eToro clients is that they adhere to the best execution regulations, which eToro must do mandated by law.

Is eToro good for beginners?

eToro is great for beginners, far more so than many other trading platforms. eToro's platform is not complex, and so it is easy to learn. The tools and features for the web-based platform and the mobile app are user-friendly. If you are new to trading and investing, you'll have a learning curve, and it's essential to remember that just because the platform is simple to use, that doesn't mean you'll find it easy to make money long-term. It takes time to figure out effective ways to analyse and trade. Most new traders over-trade, and you may over-think your trading too. You may wish to consider the risk score and the average number of trades placed weekly by eToro copy traders. One good trade is better than the stress of multiple trades that may or may not end up in profit.

Is eToro Legitimate?

Yes. eToro is an international broker with offices in Limassol, London, Tel Aviv, New Jersey, Sydney and Shanghai. And just like any well-known international broker, eToro is regulated by many regulators, including CySec in Cyprus (which means eToro is regulated throughout the EU), the FCA in the UK, ASIC in Australia and by FinCEN (Financial Crimes Enforcement Network) in the USA. eToro is one of few trusted exchanges that has managed to gain acceptance in the USA.

Does eToro accept US retail clients?

eToro accept US investors. But it’s important to note that US users are able to buy Cryptos and stocks with eToro, they not be able to trade CFDs.

What is the minimum deposit on the eToro Trading Platform?

For US and UK investors, the minimum deposit with eToro is $10