eToro offers one of the best stock trading experiences in the world due to its zero commission policy and a wide range of stocks available on the platform which can also be purchased by fractions. Additionally, it has an extremely beginner-friendly interface with a combination of social trading tools that make your trading fun and simple.

In this guide, we will discusses How to Buy Stocks on eToro, and discuss all the pros and cons of the platform that you need to consider when buying shares. Creating an account with eToro and buying stocks is a quick and straightforward process that can be done through some basic steps.

How To Buy Stocks On eToro ― Quick Step by Step Guide

Wondering how to buy stocks on eToro? Here is a quick walkthrough to help you understand the basic steps in the process.

- Step 1 – Create an Account and Verify It: You cannot trade stocks on eToro without having registered an account. To do it, simply visit eToro’s website and click on the “Join Now” button. Providing such details as your name, surname, birth date, email, address, and other information is mandatory, hence, fill in the required data to open your account. eToro also requires you to verify your account in terms of your own safety.

- Step 2 – Deposit Funds into Your Account: To buy stocks on eToro you need to have funds in your account and meet the minimum deposit requirement which may differ depending on the payment method and country. You can charge your account using multiple billing methods, including credit and debit cards, wire transfers, and e-wallets.

- Step 3 – Browse to Find the Stock: Each stock has its ticker symbol (e.g. TSLA - Tesla, AAPL - Apple, AMZN - Amazon, etc), through which you can find it on the platform. Simply type the ticker symbol in the search toolbar and click on the first results.

- Step 4 – Buy Stocks on eToro: On the right corner near the stock name there is a “Trade” button. Click on it to open the order box and visit the “Buy” window. Fill in the amount of money you want to invest in it and complete the transaction. After you finalize the transaction, your broker will take care that your trade is executed when the market opens.

That’s it, if you follow these steps, you can buy stocks on eToro within minutes.

Your capital is at risk. Other fees apply.

In the next section, you will find more detailed explanations of each of those steps.

How To Buy Stocks On eToro - A detailed Step by Step Guide

In the previous section, we have provided a concise explanation of how to buy stocks on eToro but there are several nuances you need to consider in the whole process. Here is a more comprehensive explanation of all the steps you need to undergo - signing up for an account, verifying it, depositing money, and eventually buying your chosen stocks.

Step 1 - Open a Stock Trading Account at eToro

You need to start by signing up for an account if you don’t have one yet. Once you visit eToro’s website, you will notice a button for registration. By clicking on it you open the registration window on which you must fill in your email, and account username, and create a password. Next, you need to visit your email to verify your eToro account by provided link and continue the registration process.

To complete your account you need to provide such personal details as your name, surname, birth date, address, and phone number. After you fill in your phone number you will get a special code on it which you must use to undergo the phone number verification process. In the end, eToro will also ask you some questions about your capital, job, investment goals, etc.

Open an Online Trading Account at eToro

Step 2 - Complete the Necessary Information and Verify Your Account

eToro is a highly regulated brokerage platform and according to these regulations, each account that wants to trade on the platform must be verified. Hence, after you complete the whole registration process you must go through the KYC process. There are 4 levels of verifications required by the broker.

- Verification by email.

- Verification by phone number.

- Proof of identity verification.

- Proof of address verification.

You automatically do the first two verifications when you register for an account, but after that, you must continue with the second two and provide the necessary documents to complete the verifications. Here are the documents you can provide to verify your identity.

- A copy of your passport.

- ID copy.

- A driver’s license.

As proof of your residential address, eToro accepts the following documents.

- Credit card/bank statement.

- A utility bill (gas, electricity, water, or internet).

- Social insurance statement.

- Government tax letter/council tax.

- Driver’s license, etc.

Once you provide the required documents correctly, eToro will verify your account in up to 3 business days about which you will be notified. You can easily check whether your profile is verified or not in the “Settings” section. Moreover, a green tick will appear next to your account name once it’s verified.

Complete the Necessary Information and Verify Your Account

Step 3 - Fund Your Account

After you complete the registration and verification of your eToro account, you can eventually fund it to start buying stocks. Clicking on the “Deposit Funds” button a window will spring up where several payment options are listed including bank cards, wire transfer, online banking, rapid transfer, and e-wallets, such as Skrill and Neteller. You need to select one of them which is more appropriate for you and provide the necessary details about your payment methods.

Afterward, select the currency in the appropriate section and type the amount you want to deposit. Of note, eToro charges a conversion fee for non-USD contracts and a withdrawal fee of $5 but the US clients can enjoy free withdrawal and deposit options irrespective of the payment method. Also, keep in mind that there are speed differences between the payment methods: for example, bank card transactions are conducted faster than the wire transfer options which may take up to 7 business days.

Fund Your Account

Step 4 - Search for a Certain Stock

eToro supports trading hundreds of stocks in different industries, and if you have decided which company you want to invest in, the best way to find it is via search. After going public each company gets a ticker symbol through which you can easily find it just by typing its ticker name in the search toolbar. Then click on the first results and you will navigate to the appropriate section for buying the stocks.

If you have not decided which stock you want to buy, you can navigate through multiple options to find out the one that best suits you. To do it, click on the section of the market and select “Stocks” and you will be transferred to a page with multiple options. eToro also divides stocks by industries, so you can select your favourite industry, such as Tech, Software, Retail, Entertainment Transportation, Manufacturing, and several others.

Search for a Certain Stock

Step 5 - Use eToro Features to Analyze the Stock

Once you click on the name of the stock, you will navigate to a section where you can not only buy the stock but also get a lot of information about it. On eToro’s platform, you can find the latest news about that company and its stock, get a lot of charts and statistics, and be provided with a combination of research tools. All these tools will enable you to do a bit of research before you invest in the company.

Hence, if you have not decided which stock you want to invest in, you can navigate on eToro’s platform and use those graphs and research options to explore the best oil stocks, the best dividend stocks, the best tech stocks, etc.

Use eToro Features to Analyze the Stock

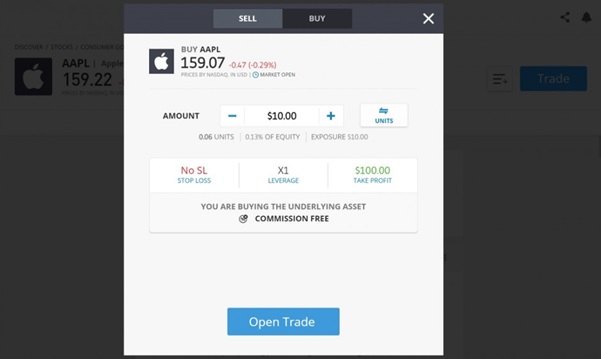

Step 6 - Place an Order and Buy the Stock

If you have a verified account, deposited funds on it, and determined which stocks you want to buy, your account is fully prepared to place an order. For this purpose, simply click on the “Trade” button next to the stock name and select the “Buy” window. You can place different types of orders with eToro.

If you simply want to buy the stock at its current price, you need to type the fraction of the number of shares you want to purchase and click on “Buy”. If the market is open, eToro will immediately conduct the transaction and you will see that your purchase is added to your exchange account. If the market is closed, you will see a “Set Order” button instead of “Buy” which means that you cannot conduct a transaction at that moment, but you can place the order and eToro will complete it automatically when the market opens.

Apart from the standard order, you can also place a limit order. It means that you can ask your broker to buy a stock when it decreases to a particular price. For instance, if you have done the research and consider that Microsoft stock will decrease below its current price, you can set the “Limit Order” and your broker will buy it when the prices drop. If the prices don’t decrease to the limit you have selected during a particular time, your transaction will be rejected.

Place an Order and Buy the Stock

Your capital is at risk. Other fees apply.

Buying Stocks At eToro - How Does It Work And How Much Does It Cost?

When you buy and sell stocks, you have to pay several trading and non-trading fees in the future. Hence, it is crucial to explore the pricing structure of the broker to better understand how much capital you need to invest and which part will go into paying those fees. eToro offers one of the most competitive pricing mechanisms in the market when it comes to stock trading.

Still, the structure may seem a bit complicated when you first use the broker and the fees may differ depending on the market and order type. In this section, we will talk about eToro’s pricing and what trading and non-trading fees the broker charges. In general, when you trade on a brokerage platform, there are two types of fees charged by it - trading and non-trading. There can be multiple trading and non-trading fees depending on the brokerage platform.

First of all, we need to mention that stocks are available on eToro not only through standard contracts but also through CFDs. In the second case, you don’t own the asset but benefit from its opening and closing prices. While stocks are available to buy without paying any commissions or other types of trading fees (only buy and sell differences are applied) when using CFDs you need to pay overnight fees and spreads.

Spread is the difference between the bid and ask prices and eToro charges a 0.09% spread for stocks and ETFs. Plus, you need to pay overnight fees if you leave the leveraged position open for a night. For now, you cannot trade CFDs in the US as the leveraged positions are banned in the country.

Deposit and Withdrawal Fees

Apart from the trading fees, brokers usually also charge non-trading fees which you need to pay for using any of the features of the platform. Non-trading fees may include withdrawal and deposit fees, monthly account fees, management fees, fees for using any of the trading tools on the platform, inactivity fees, etc.

Users on eToro are lucky enough to pay only withdrawal and deposit fees when it comes to non-trading fees. In fact, deposit fees are the same as conversion fees and are applied only when you use currencies other than USD. So, for USD contracts you don’t need to pay any deposit fees, but the platform charges a flat withdrawal fee of 5$ for any payment method you use.

There are no monthly account fees to open an eToro account. Neither does it charge any management fees for using its platform and social trading tools. CopyPortfolios and CopyTrader are provided. However, the platform will start charging a monthly inactivity fee if you don’t show any activity in your account for about a year.

Zero Commission Policy

One of the best things about eToro is its zero-commission policy which means that you can buy stocks traded on the US and international stock exchanges without paying any fees per slide. This is not a widespread thing and eToro is one of the very few leading brokers in the industry that does not take any commission fees.

Let’s show it through an example - suppose, you want to buy a company share listed on the London Stock Exchange and your broker charges a commission fee of 0.05% for each slide. It means that if you buy stock worth £3000, you will need to pay a commission fee of £15. Suppose that the prices increase over a particular time and you can sell it for $4000. Again, you need to pay a commission fee of 0.05% which is equal to £20. So, all in all, you will spend £35 on the commission fees (not considering any other fees applied by the broker). On eToro, you won’t pay these commission fees.

Stocks Spreads

Another type of fee that is usually charged by brokers is spreads which is the gap between the buy and sell prices of the stock. If we compare the spreads offered by eToro with other brokers in the market we can notice that eToro spreads are quite competitive. For instance, at the time of writing, you can buy AAPL stock for a price of $142.89 and sell it for $143.99 meaning that you will lose an extra $1.1 in the process.

Your capital is at risk. Other fees apply.

Selling Stocks At eToro’s Platform

Much like any stock trading platform, at eToro you can buy stocks as a short-term or a long-term investment, but in any case, you buy with the intention to profit from the price fluctuations. When the stock of a company has grown enough that you can generate high profits you can sell them and benefit from the price movements. To do it, first, you must visit your stock portfolio where you will see all the open positions.

To sell any of your stocks, click on it and select the “Close” option after which a window will appear on your screen. Here you can choose either to leave the position completely or to sell some of your stocks. Filling in the necessary details, you can click on the “Close Trade” button and if the market is open your trades will immediately be sold.

Once you get your money on your exchange account you can withdraw it using your credit card or PayPal wallet. Remember that you need to pay a flat fee of $5 for any withdrawal irrespective of the payment method you choose.

eToro Trading Platform Review - What Stocks Can You Trade on eToro Trading App?

eToro is the home to more than 3000 trading symbols, including such markets as cryptocurrencies, stocks, ETFs, commodities, indices, and currency pairs. eToro USA LLC does not offer CFDs, only real Crypto and Stocks assets available. The broker is most popular due to the versatility of stocks available on the platform and it lists stocks from various exchanges, including NASDAQ, NYSE, LSE, etc.

You can purchase on eToro the stocks of the most popular US public companies, including the best tech stocks, such as Microsoft, Amazon, Google, and Tesla, the best dividend stocks, the best metaverse stocks, and several others.

Apart from stocks, you can also trade ETFs on eToro’s platform. The term stands for the exchange-traded fund and represents a type of investment that makes a profit from the performance of a certain stock exchange or asset index. Among the most popular ETF types are stock index ETFs, style ETFs, bond ETFs, industry ETFs, etc. You can buy more than 200 ETFs on eToro with zero commissions.

If you want to invest in different markets or multiple stocks on eToro you can also consider selecting an investment portfolio plan. These Smart Portfolios offered by the broker are used to collect all your financial assets in one place and they are built by a team of professionals considering such crucial factors as risk, balance, potential return, etc.

eToro Stock Trading Platform - Pros And Cons

If you are not sure why you should use eToro and prefer it to other brokers, here we have covered all the best things about the platform that may appeal to you. Additionally, we have also included the list of eToro’s cons you need to consider while using this broker.

eToro Stock Trading Pros:

- ✅ eToro supports thousands of stocks and ETFs listed on such stock exchanges as NASDAQ, NYSE, etc.

- ✅ eToro supports major US stocks as well traded companies based in Germany, France, the UK, Canada, Spain, and several other countries, are listed on the platfrom.

- ✅ eToro is extremely versatile and you can buy multiple other assets along with stocks, including cryptocurrencies, forex, commodities, and indices which are also available through contracts for differences.

- ✅ eToro offers a competitive pricing structure - you can buy stocks with zero commissions and spreads are below market rates.

- ✅ eToro supports a social trading platform where users can have discussions with other traders, ask questions to experts and follow the news.

- ✅ eToro offers social trading tools CopyTrader and CopyPortfolios for free which can be used to mirror the trades of any trader with a click of a button.

- ✅ eToro is very safe and uses top-notch safety mechanisms to protect your account from fraud and malicious logins.

- ✅ eToro is a highly regulated platform and is registered with such reputable institutions as ASIC in Australia, CySEC in Cyprus, FCA in the UK, and FinCEN in the United States.

- ✅ eToro is very beginner-friendly: it has a simple-to-use interface and educational content for newbies.

- ✅ eToro supports multiple payment methods - credit and debit cards, bank transfers, rapid transfers, Neteller, Skrill, etc.

eToro Cons:

- ❌ CFDs stock trading is not available in the USA

- ❌ The broker does not provide too many advanced tools for professional traders.

Conclusion - Buyin Stocks on eToro

In a nutshell, eToro is a leading brokerage platform in the industry that offers an excellent trading experience for beginners. In this guide, we have explained how you can quickly register for an account on eToro and buy stocks. There are thousands of US and international stocks available on the platform which you can buy also in fractions meaning that you can start trading on eToro with as much money as $100.

eToro also stands out with its safety policy and high regulations. With the broker, you can enjoy secure trading being sure that your data is not available to any third party. Plus, eToro is very cost-effective. The best thing about the platform is that you can buy stocks with zero commissions and pay extremely low spreads.

eToro – Buy Top Stock With 0% Commission

Open an account with eToro, deposit some funds with USD, and finally – buy Shares from just $10.

Your capital is at risk. Other fees apply.

Read More:

- How To Invest In Stocks Online For Beginners

- Most Undervalued Stocks To Watch

- The 10 Best Stock Trading Apps

- 10 Best Shares To Buy In The UK

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

FAQs - Buying Stocks on eToro

Why eToro is a good platform to buy stocks?

There are several reasons to choose eToro. First and foremost, eToro is a leading platform due to its functionality and safety. Next, eToro supports a wide selection of stocks that are listed on different stock exchanges. Finally, eToro offers cost-effective trading - stocks are available to buy without paying any commissions, and the broker charges only buy and sell spreads.

What’s the minimum deposit required to start trading stocks at eToro?

There is not an exact minimum deposit limit on eToro and the number differs depending on the country and payment method. Basically, it ranges from $50-$1000, and in some countries, you can even start trading with as low a deposit as $10.

Is eToro regulated?

eToro is one of the safest brokers worldwide and is regulated by several institutions, among them ASIC, FinCEN, CySEC, and FCA.

What else can I trade at eToro’s platform?

eToro offers a versatile trading experience - along with thousands of stocks and ETFs, you can also trade more than 60 cryptocurrencies, the most popular and exotic currency pairs. Commodities and indices are available through contracts for differences.

What are the most popular stocks I can find at eToro?

The most popular stocks traded on eToro include Apple (AAPL), Tesla (TSLA), Google (GOOGL), Microsoft (MSFT), Alibaba (BABA), etc.