In this detailed Plus500 review Australia, we will take a closer look at Plus500 website in Australia, its features, trading costs, tradable assets, and how it compares against its peers.

A multi-asset CFD trading platform, Plus500 has established itself as one of the most trusted global brands when it comes to business tools. The platform offers users over 2800 tradable instruments, allowing them access to features such as share trading through its Plus500 Invest platform. Users can also access a complete section of CFDs through its CFD platform, which is entirely separate.

Plus500’s offering is excellent for savvy investors looking for a platform that gives them easy access to diverse markets.

What Is Plus500?

Plus500 was established in 2008 and is headquartered in Israel. A global financial technology (fintech) company, the firm has been listed on the London Stock Exchange (LON: PLUS) since 2013. Additionally, it has been listed on the main markets since 2018 and was also ranked in the UK FTSE 250 among the leading mid-cap companies.

Plus500 is a high-quality online trading platform letting users invest through a broker. Users can purchase different forms of stocks or other instruments and markets through Contracts For Differences or “CFDs.” The Plus500 platform gives users online trading services for a host of CFDs. These include CFDs on commodities, ETFs, cryptocurrencies, shares, and forex options.

But what are CFDs? CFDs are instruments that allow traders to benefit from price movements in stocks, forex, indices, or commodities in the short term without actually owning the underlying asset. Plus500’s current portfolio consists of over 1000 instruments. The firm also has a mobile app for trading. Alternatively, users can also access the platform via its desktop website, iOS or iPad app, and Android and Windows App.

The platform was also the sponsor of one of the biggest clubs in Spain, Atletico Madrid, from 2015 to 2022. Currently, they are one of the official partners of the Chicago Bulls. If you are a trader based in Australia, it is worth knowing that its Australian subsidiary is licensed by the Australian Securities and Investment Commission (ASIC).

Overview Of Plus500

Before we begin our in-depth analysis of Plus500, let’s briefly overview the platform. The platform gives traders a whole raft of unique features that help in the overall decision-making process. Tools in its arsenal include push notifications based on market events, alerts on price movements, and changes in its in-house trader sentiment indicator.

Another key feature is its exclusive trading tool, Insights. The tool leverages real-time data, helping identify the platform’s most profitable trades, the instruments being traded, and other insights designed to assist traders. Let’s take a quick glance at Plus500 with the help of a table. As a publicly traded entity, Plus500 offers a variety of financial products, including forex, CFDs, individual shares, stock indices, commodities, ETFs, and futures. Such a diverse range of products helps users to access different markets and diversify their portfolios.

Plus500 offers CFDs in the form of 71 currency pairs, 19 cryptocurrency pairs, equity CFDs, 23 commodities, 1737 equity CFDs, 97 ETFs, 34 Index CFDs, and 877 options contracts, making it one of the leading CFD brokers. Thanks to its commission-free trading, free lifetime demo account, and well-designed trading interface, Plus500 has become a favorite amongst traders. Moving ahead, we will take a closer look at the platform’s features, how to begin trading, and how CFDs work on the Plus500 platform.

- Type Of Broker – Online

- Commission – $0

- Available Markets – 70 global currency pairings, cryptocurrency, commodities, stock CFDs, index CFDs, options

- Minimum Trade Size – N/A

- Minimum Opening Balance – $200

- Leverage – 30:1

- Customer support – Email and Live Chat

- Platform – Plus500 Trading Platform

CFD Service. Your Capital is at risk!

What Are CFDs?

CFDs are another addition to the growing list of abbreviations increasingly used in financial circles. Their full form is “Contract For Difference,” and they let users place a deposit instead of purchasing the complete trade. In CFDs, users do not buy the contract directly. Instead, they enter into a contract with a CFD broker who will stake the trade, allowing traders to open a position for a fraction of the value of the trade.

Plus500 Australia: Pros & Cons

Plus500 is among the most trusted and recognized brokers in Australia. Let’s look at the pros and cons of Plus500 Australia:

Pros:

- ✅ Users can easily trade stock and forex CFDs from a single account

- ✅ Offers users several advanced trading tools to give a seamless trading experience regardless of the user’s device

- ✅ Offers users free demo accounts

- ✅ Plus500 does not charge any signup fee or trading commissions

- ✅ Available in multiple major international markets.

- ✅ No commissions and tight spreads

- ✅ The web platform and mobile app both feature charting

- ✅ Offers cash rebates to active traders

- ✅ The web platform has a highly user-friendly interface, making it ideal for beginners

- ✅ High leverage trading is available

- ✅ 24/7 support

- ✅ Guaranteed stop-loss orders

Cons:

- ❌ Does not support physical share trading. Users on the platform can only trade in CFDs

- ❌ The platform charges inactive users an inactivity fee

- ❌ CFDs are known to be risky instruments

- ❌ Does not offer phone support. Customer support is restricted to email and live chat

- ❌ Only offers a narrow range of educational content to learn about financial markets

What Are The Key Features Of Plus500 Australia?

Plus500 Australia is a reputable CFD provider, offering interested traders CFDs over thousands of financial instruments. This includes all the popular currency pairs and AUD/USD. What’s more, users can also trade CFDs over commodities, ETFs, and indices in over 20 international markets.

The Australian market is a significant market for Plus500. This is why the platform has added Australian ETFs and Shares. As a result, users can trade the ASX200, along with individual Australian shares. These include the Commonwealth Bank of Australia, Telstra Corp, and others.

Opening an account on the Plus500 platform, which we shall discuss later in the article, is relatively straightforward and requires users to deposit a minimum of AU$ 200 as their first deposit. Furthermore, the platform does not rely on any sales team. This starkly contrasts with other industry players who depend on an aggressive and expansive sales team to follow up with potential clients and traders.

All traders need to do is finish the application process and make their first deposit. If you are a trader who despises aggressive sales tactics, the Plus500 Australia is your ideal CFD provider.

What Are The Tradable Assets On Plus500 Australia?

Since its inception, Plus500 has established itself as one of the best options for traders when it comes to CFDs. It has processed over $800 billion in trading volume and over 300 million positions opened. Here is a list of tradable assets available on Plus 500 Australia.

- Forex

- Cryptocurrencies

- ETFs

- Stocks

- Indices

- Commodities

Let’s look at each in a little more detail.

Stocks

Plus500 Australia allows users to access some of the most popular global stocks. Besides the usual markets, traders can also access shares in Greece, South Africa, Hong Kong, Japan, etc. Additionally, the platform also facilitates the trading of cannabis shares.

Traders can take advantage of a leverage of 1:5 to comfortably increase their positions. However, such an approach is better suited to advanced traders with a better risk management idea. The platform also does not charge any commissions for stock trading. Instead, traders pay for spreads. The average spread of a popular stock like Tesla is around $2.

Traders on Plus500 can also use the guaranteed stop feature to avoid slippage. It automatically closes a trade even if the price action is moving against a trader.

Read Also:

- New Stocks to Invest In

- Best AI Stocks To Invest In

- Next Stock To Explode

- Most Undervalued Stocks To Watch

Forex

Plus500 Australia is often hailed as one of the best forex brokers in Australia and the world. It offers over 60 currency pairs, giving traders access to majors, minors, and exotics. It also offers leverage of 1:30, allowing traders to open large positions. To make things better there is no commission involved. It doesn’t matter if you are new to forex trading or an experienced old hand; Plus500 Australia gives you all the tools necessary to make an informed decision when it comes to trades.

Popular pairs include EUR/USD, which usually have an average spread of 0.8 pips. The platform requires a maintenance margin of 1.67%, with overnight funding applicable to buy and sell positions. Another benefit of trading forex with Plus500 Australia is its inclusion of an events calendar. This calendar highlights critical global events that impact or could impact currency markets. It also highlights the degree to which a particular event could affect prices.

Further Reading:

- The Most Volatile Currency Pairs

- Top 10 Forex Pairs To Trade

- How To Trade Exotic Forex Pairs

- Best Time To Trade Forex

ETFs

What is an ETF? An ETF or Exchange Traded Fund is an investment fund that consists of a basket of stocks, bonds, and other assets. Plus500 Australia offers traders a selection of over 60 ETFs. Some popular ETFs on offer include SPDRUSA500 and VXX Volatility, both of which are available without commission. The average spread on the VXX Volatility ETF stands at $0.32 with a leverage of 1:5 coupled with a maintenance requirement of 10%.

Plus500 Australia has made ETF trading a hugely convenient affair for traders, irrespective of their skill level. This is largely thanks to a simple platform that allows trades to be easily opened yet sophisticated enough to incorporate features preferred by professional traders.

Cryptocurrencies

If you’re based in Australia and looking to trade CFD cryptocurrencies, then Plus500 Australia is the platform for you. Plus500 Australia gives traders access to over 17 major cryptocurrency assets, traders can buy and sell CFD cryptos, including Filecoin, Chainlink, and Polkadot. Furthermore, the platform also offers an Ethereum/Bitcoin pair. But what sets Plus500 Australia apart from other players?

One key distinguishing feature is the Crypto 10 index. The Crypto 10 index consists of the ten best-performing crypto assets and tracks and measures their performance. As with its other offerings, Plus500 Australia does not charge any commissions, with the leverage set at 1:2. The platform also provides traders with 24/7, along with market insights and news. This is ideal for traders looking to adopt a fundamental analysis in their trading.

Traders on Plus500 Australia can trade round the clock, only needing to deposit AU$ 200 to get started. However, remember that the platform is down for one hour every Sunday for scheduled maintenance.

Read More:

- Best Altcoins To Invest In

- Best Crypto Exchanges Australia

- Best Future Crypto Coins To Buy

- Best DeFi Coins To Buy

- Best Meme Coins To Buy

- Next Cryptocurrency To Explode

- Most Undervalued Cryptos To Buy

- New Cryptocurrency To Invest In

Commodities

Another asset class offered by Plus500 Australia is commodities. Among the popular assets available in commodities are gold, silver, and oil at a 1:20 leverage. With an average spread of $0.4 when it comes to gold spot trading, Plus500 Australia is widely considered as one of the best gold trading brokers in the world.

When it comes to the range of commodities on offer, Plus500 Australia offers over 20 commodities, including natural gas, corn, wheat, and cocoa.

Indices

Indices are an excellent way for investors to diversify their portfolios. Indices allow investors to access mixed shares from particular exchanges and markets. For example, when a trader trades indices, they can access shares that track the performance of a specific market. By trading indices, traders can gain exposure to the top-performing assets in a particular country without purchasing individual stocks of those companies.

Plus500 Australia offers traders the chance to trade indices at a 0% commission. Traders can select indices in markets such as Australia, France, Poland, China, France, and several others. Another option for traders are sector indices, allowing traders to open positions in indices such as the Cannabis Stock Index and the Real Estate Giants Index. Over 20 country indices and seven sector indices are currently available on Plus500 Australia.

The platform offers leverage of 1:20 for indices. Traders incur a $0.7 spread when trading the USA 500 index, along with a maintenance margin of 2.5%.

Options

Plus500 Australia is widely regarded as one of the best platforms when it comes to options trading. It provides traders with a user-friendly interface through which they can easily access and trade options. But what is options trading? Options trading is a financial strategy where traders can speculate on the future price movements of an asset. Options contracts give traders the right to purchase or sell a specific asset at a predetermined time and price. Remember, this is a right, not an obligation.

Such flexibility hugely benefits traders, allowing them to make informed decisions after observing market trends, minimizing risk, and maximizing profits. There are two types of options contracts, Calls, and Puts. Call options give the trader the right to purchase an asset at a predetermined time and price. On the other hand, a put option allows a trader to sell the asset at a predetermined price and time.

Plus500 Australia allows traders to use call or put options on over 100 options. Traders can find all information related to options trading on Plus500 Australia in the FAQ section on the platform’s official website. It also offers a detailed guide on how to get started with options trading. Traders on the platform can use a 1:5 leverage.

CFD Service. Your Capital is at risk!

What Are The Fees And Commissions On Plus500 Australia?

One of the most significant advantages Plus500 Australia offers traders are the fees, one of the key reasons behind its reputation as the “best trading platform.” There are no commissions involved, and the spreads are highly competitive. As a matter of fact, Plus500 Australia offers some of the lowest spreads when it comes to specific assets. Let’s understand the fee structure of Plus500 Australia a little better with the help of this table.

| Asset Class | Asset | Spread | Commission | Overnight Funding - Buy | Overnight Funding - Sell |

|---|---|---|---|---|---|

| Stocks | Tesla | $2 | 0% | -0.0645% | -0.0453% |

| Crypto | Bitcoin | $58 | 0% | -0.0568% | -0.022% |

| Forex | EUR/USD | 0.8 pips | 0% | -0.0112% | -0.001% |

| ETFs | VXX | $0.32 | 0% | -0.043% | -0.0302% |

| Indices | USA 500 | $0.7 | 0% | -0.0201% | -0.0073% |

| Commodities | Gold | $0.4 | 0% | -0.0283% | -0.0155% |

| Options | Oil Call 80 | $0.09 | 0% | 0% | 0% |

In our Plus500 Australia review, we will try to understand the platform’s fee structure and outline any additional costs or charges linked to the available assets. This will, we hope, help traders to reach an informed decision when it comes to their trading strategies.

Spread Percentage

The costs associated with trading a currency pair can be calculated by dividing the spread by the average daily range of the pair in question. This allows traders to get a somewhat accurate estimation of the spread costs for every transaction, allowing investors to gauge the profitability of their trading strategy.

Trading Fee

Plus500 Australia allows traders to trade freely without the specter of commissions hanging over their heads. The spreads are dynamic and depend on market conditions, meaning there are no minimum trade requirements or commission charges.

Inactivity Fee

Plus500 charges an inactivity fee on traders who fail to log in to the account for three months. However, the fee is a nominal $10 and can be avoided by keeping your account active and logging in occasionally, even if not actively engaging in trades.

Currency Conversion Fee

Plus500 also levies a currency conversion fee on profits and losses of up to 0.70%. This is rather simple to understand. If your account’s base currency is in USD or AUD, and you are trading assets denoted in EUR, then the platform will charge you a fee.

Stop Order Fee

Traders can use the option to use stop orders, which allows them to close their positions at a price of their choice regardless of market conditions. However, there is a fee applicable for using guaranteed stop orders.

Overnight Funding Fee

Plus500 casts an overnight funding fee if a trader holds a CFD position beyond market hours. This fee can be added or subtracted from the trader’s position depending on the direction of the trade and the instrument. However, if the trader has an open buy or sell position, it will be covered by Plus500. The fee in question is determined by swap rates applied to all overnight positions.

The fees can be determined by going to the “details” section of the trading platform. Here, traders can view a detailed breakdown of the fees levied for holding a particular position. Remember, the swap rate and overnight funding fee vary depending on market conditions.

CFD Service. Your Capital is at risk!

Plus500 Australia Charting And Analysis

When trading in CFDs or in general, traders and investors utilize several charts and tools to determine market trends and conditions. Plus500 charts are highly versatile, allowing traders to view them in full screen or combine them with other quotes. There are several different time frames that traders can utilize. They can also choose between the different types of charts types on offer, ranging from candle, line, and mountain. There is also a selection of advanced strategies that traders can use, such as the MACD, price oscillators, Bollinger Bands, and vortex indicators.

Plus500 also offers multiple chart views, allowing traders to compare assets when trading. The list of tools available on Plus500 includes Gartley, Pitchfork, and Fibonacci Retracements, along with standard tools such as channels and lines. There’s more! Traders can also get market insights from published pieces and articles on the Plus500 website. There are some limitations, though, when it comes to third-party automation tools. Plus500 does not allow the integration of third-party automation tools directly.

Traders can also view real-time alerts and updates via SMS, push notifications, and email. They can also view the market sentiment, which tells them the number of buyers and sellers present on each asset. However, Plus500 does not offer algorithm trading or automated trading via professional traders. Additionally, traders must be active on the web trading platform. If they are inactive, they will automatically be logged out.

Plus500 Platforms

Unlike MT4 or MT5 brokers, Plus500 uses proprietary software for its web platform. This is markedly different from MetaTrader because it is unique in design and accessible from multiple devices. As a result, traders can access the platform from web browsers, PC, tablets, and even their mobile devices. The proprietary web-based platform offered by Plus500 is called WebTrader. This platform aims to give traders an efficient and user-friendly trading experience.

The platform works seamlessly across multiple devices and offers users a range of graphs and technical charts designed to give users a broad insight into prevailing market conditions. Plus500 is constantly improving its MetaTrader platform. So don’t be surprised to find new offerings, such as pre-defined watchlists, being added to the platform.

MetaTrader also allows traders to set alerts depending on client sentiment data. Such alerts can give users valuable insights into market trends.

Account Types On Plus500 Australia

There are two primary types of accounts on Plus500 Australia: Retail and Professional. Professional accounts have several benefits over Retail accounts, such as leverage. Retail accounts have a leverage of 1:20 or lower depending on the asset being traded. Meanwhile, Professional accounts have a leverage of 1:300. Professional account holders are also eligible to receive rebates.

To be eligible for a Professional account, traders must meet specific criteria, such as having net assets worth at least AU$ 2.5 million. The second criterion is that income over the past two financial years needs to be AU$ 250,000. Let’s look at each account in a little more detail.

Retail Accounts

Retail accounts allow traders to access maximum leverage of 1:30. Traders can start trading as soon as the KYC (Know Your Customer) processes are complete, allowing Plus500 to verify the trader’s identity. Retail accounts give investors basic trading options ideal for novice traders.

Professional Accounts

Professional accounts give traders access to advanced trading options. However, as mentioned earlier, to be eligible for a Professional account, traders must meet specific criteria related to their activity over the past 12 months and their net assets. They also need to have completed at least ten transactions per quarter.

While the criteria may be on the higher side, it ensures that only experienced traders can access Professional accounts and avail of the advanced features on offer. A high level of trading activity goes a long way in showing their commitment to the trading platform and a willingness to take on additional risks that come with a Professional account.

Demo Accounts

There is also a third type of account offered by Plus500, which is a Demo account. These accounts allow traders to take a low-risk approach when trading live markets using virtual currency. Such an account is readily available, with traders being able to access them without incurring additional charges. Traders using these accounts can access a host of trading options, including access to technical indicators, leverage, and more.

Traders on Plus500 Australia generally receive around AU$60,000 for demo trading purposes. The system reinstates the initial balance if this trading balance shifts below AU$300.

CFD Service. Your Capital is at risk!

The Plus500 Australia App Review

The Plus500 app is an excellent option for investors who wish to regularly access their accounts to open new positions, close orders, and adjust trades. The app is highly intuitive and offers a very user-friendly interface, offering all the bells and whistles found on its web platform and website. Traders can access the app from any mobile device and almost any location in the world.

The app allows traders to place trades at the push of a button and analyze charts, market trends, and economic calendars. Traders can also access their personal settings through push notifications. Apart from these, traders can also access real-time quotes and assets, all of which can also be found on the web platform. Furthermore, the app can tackle any query thanks to 24/7 support.

Plus500 has also greatly improved its charting, offering over 20 drawing tools and 109 indicators. However, there is still room for improvement regarding features like research, news, and advanced trading tools, all of which are currently not offered on the mobile app.

Android App – ✅

iOS App – ✅

Mobile Alerts - Basic Fields – ✅

Watchlist Syncing – ✅

Watchlists (Total Fields) – 9

Charting (Drawing Tools) – 21

Charting (Indicators) – 110

Mobile Charting (Multiple time Frames) – ✅

Mobile Charting (Draw Trendlines) – ✅

Forex Calendar – ✅

CFD Service. Your Capital is at risk!

Plus500 Australia Payment Methods

Now, let’s get to payment methods. Plus500 Australia makes it extremely simple for traders to fund their accounts by giving them various payment methods. Numerous payment methods have several advantages, chief among them being that it lowers the entry barrier. Traders can also compare the fees associated with each method and choose which suits them best. Plus500 Australia offers traders the following payment options.

- Mastercard

- Visa

- Bank wire transfer

- Skrill

- PayPal

- Bpay

- Google Pay

- Apple Pay

- Poli

Traders on Plus500 Australia are also required to deposit a minimum of AU$200. This is an ideal figure, allowing traders to not put up and risk losing too much money upfront. All withdrawal requests take between 1-3 business days to be processed. Once processed, the funds generally take around seven days to reflect in the trader’s account.

How To Begin Trading With Plus500 Australia?

Now that we have discussed account types, tradable assets, and the Plus500 app, let’s look at how you can start trading with Plus500 Australia. Opening an account with Plus500 is extremely straightforward. All you have to do is follow the steps we have outlined below.

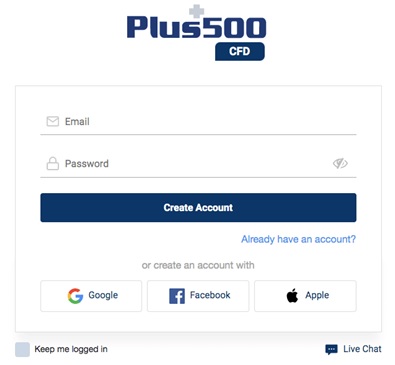

Step 1: Create Your Account

Obviously, you can only begin trading on Plus500 if you create an account. So this is the first step in our guide. All you have to do is go to the Plus500 Australia website and click the “Start Trading Now” button on the homepage.

Step 2: Enter Your Email And Create Your Password

As the title suggests, you will now be prompted to enter your email and create a password for your account. Remember, create a strong password that uses special characters as well. Alternatively, you can also directly login via your Google account.

Step 3: Verify Your Account

Now that you have created your account, you must verify it. Plus500 Australia mandates that all users on the platform register and verify their accounts by providing the required personal information and uploading the relevant government-issued documents. These are used to complete KYC guidelines. Upload the relevant documents and wait for the verification procedure to complete.

Step 4: Deposit Funds

Once your account has been verified, you can deposit funds into your Plus500 Australia account. To deposit funds, click on the “Funds” icon on the left of the page and then click “Deposit Funds.”

Step 5: Search For Your Preferred Asset

Now that you have funded your account, you can start trading. Search for the asset you wish to trade and click on “Buy” to get started!

CFD Service. Your Capital is at risk!

Plus500 Australia: Licensing And Security

Overall, Plus500 is regarded as a highly secure and trustworthy platform. Because it is publicly traded, it is a highly regulated entity. Plus500 is licensed by the Australian Securities & Investment Commission (ASIC) in Australia. Additionally, it is also regulated by the Financial Conduct Authority (FCA), the Financial Markets Authority (FMA), and the Monetary Authority of Singapore (MAS). CySEC, FSP, and AFSL. Strict regulation by so many regulatory and governing bodies bodes well for traders, as it shows that Plus500 is serious about upholding ethical financial standards.

Plus500 Australia Customer Support

Let’s take a look at Plus500 Australia’s customer support. No trader wants to wait for long durations to have their queries tended to. This is especially true when traders are in the middle of an active trading session or crypto traders who trade over the weekend. This is why Plus500 offers 24/7 customer support. However, we highly recommend traders check out the platform’s extensive FAQ section before contacting the support team. The Plus500 FAQ section contains a ton of information about the platform and trading in general.

However, if the FAQ section does not contain the answer to your queries, you can reach out to the support team via email, WhatsApp, or online chat. WhatsApp and online chat responses are quick, with an agent joining to assist with queries within minutes. Email is also prompt but could take a few hours during busy phases.

Is Plus500 Australia User-Friendly?

Now that we have discussed Plus500 Australia in detail, one question remains. Is the platform user-friendly? One of the main advantages of the Plus500 Australia platform is the simplicity it offers traders. The platform is user-friendly, and traders can easily follow the options on the screen and make their way around the platform. All asset classes are neatly organized on the left side of the column, while popular assets are listed at the top of the chart.

Opening a trade is also extremely simple. All users need to do is click on the “buy” or “sell” button of the asset they wish to trade and then simply follow the instructions. To help simplify things, the navigation tools act as an excellent guide for users on the Plus500 platform. Additionally, Plus500 Australia has kept the language clean and simple, keeping newer traders in mind. As a result, traders can open or close positions in just a few clicks.

However, while highly convenient for new traders, don’t assume that Plus500 has not kept the experienced trader in mind. The platform also offers advanced trading tools, allowing advanced and experienced traders to incorporate them into their trading strategies. This allows traders to refer to analysis or news alerts before placing a trade on the platform.

As you can see from our review, Plus500 Australia is extremely user-friendly and offers something for both novice and experienced traders.

CFD Service. Your Capital is at risk!

Plus500 Education Platform

Currently, Plus500 does not offer an extensive collection of resource material for traders when compared to other leading platforms. However, it has launched its own trading academy consisting of written articles, video content, and webinars. Its learning center has a dedicated section consisting of articles and educational videos. However, there is not much on offer beyond this, leaving significant room for improvement. Adding more articles and videos would go a long way in correcting this shortfall.

Client Webinars – ✅

Client Webinars (Archived) – ✅

Forex or CFD Education – ✅

Videos For Beginners – ✅

Videos For Advanced Traders – ✅

Investor Dictionary – ❌

Summary - Plus500 Australia Review

We hope our in-depth Plus500 Australia review has given you a better idea of the platform and its benefits. Plus500 is one of the premier brokers in operation, offering traders over 2000 instruments and several asset classes. Through the platform, traders can access global markets, commodities, options, cryptocurrencies, forex, and stocks.

Other benefits of using the platform include competitive spreads, news alerts, market insights, and 0% commission. Furthermore, advanced traders can use the Professional account offered by the platform and avail of benefits such as a 1:300 leverage.

Read More:

Plus500 Review - FAQs

Is Plus500 Australia Good For Beginners?

Plus500 Australia is an excellent choice for beginners thanks to its user-friendliness and ease of use. This makes it easy for users, especially beginners, to navigate the platform compared to other players in the field. However, remember that this does not guarantee your success as a trader. However, Plus500 could improve the collection of educational content on its platform.

Is Plus500 Good For Experts?

Yes, The platform is an ideal option for experienced traders as well. Traders can easily incorporate the advanced tools offered by the platform into their trading strategies.

Is Plus500 Australia A Good Broker?

Yes, Plus500 Australia is one of the best options when it comes to selecting a broker. As a platform, it continuously seeks to improve its offering for new and advanced traders by adding many advanced trading tools and charting to its arsenal. It is also heavily regulated, being licensed in Australia by ASIC. It is also regulated by other governing and regulatory bodies, including the FCA, MAS, AFSL, CySEC, FSP, and FMA.

Is Plus500 Legal In Australia?

Yes, the Plus500 platform is 100% legal in Australia. It is regulated by the Australian Securities & Investment Commission (ASIC). It is also regulated by multiple regulatory bodies across the globe, including the Financial Conduct Authority (FCA), the Financial Markets Authority (FMA), and the Monetary Authority of Singapore (MAS). Other bodies involved in its regulation include AFSL, FSP, CySEC, and FMA.

Is Plus500 A Trusted Entity?

Yes. Plus500 is one of the most reputable brokers in operation today. Thousands of customers are satisfied with the product, and the sheer number of positive reviews about the platform is a testament to that. Additionally, Plus500 is also regulated by several regulatory and financial authorities.

Is Plus500 Available In Australia?

Yes, Plus500 is available in Australia and over 50 other countries.