If you’ve ever pondered trading gold, gas or Bitcoin, perhaps taking part in the foreign exchange market, or investing in huge blue-chip stock companies - then you have come to the right place.

In this complete guide to trading online in Australia, we are going to go through all aspects of online trading. This includes everything from what assets are available and how they work - to common key metrics to look out for when choosing your online broker. Not only that, but we will include some popular trading strategies and a step by step sign up guide to get you started.

Online Trading Resources In Australia

If you’re looking to learn more about different types of online trading in Australia, check out the contents below:

What Does Trading Online Entail?

Which Tradable Financial Assets are Available in Australia?

- Online Trading CFDs (Contract for Difference)

- Trading Forex Online

- Trading Cryptocurrencies Online in Australia

- Stocks and Shares Trading Online

- Investing Versus Trading

- Tradable Commodities

- Commodities Categories

- Trading Indices Online

- Futures Trading

- Options Trading

Complete Guide to Trading Online in Australia: Top Tips

Guide to Trading Online in Australia: Useful Strategies

Complete Guide to Trading Online in Australia: Fees

How to Select an Australian Trading Platform

Sign up for a Trading Account in Australia Today

Online Trading Australia: The Verdict

What Does Trading Online Entail?

Regardless of the asset that you are interested in trading, the end goal is the same. Your objective as a trader is to buy and sell assets such as currency pairs (for example). The end target is to sell the asset for more than you paid for it - thus making you a profit.

Let’s say for example that you fancy trading Telstra stocks. You need to attempt to correctly speculate on whether Telstra stocks are going to go up - or down. If you are wrong, you could make a loss. If on the other hand, you speculate correctly then you will make gains. This is the essence of trading.

Now you understand the basic principles, you should know that in order to access these global markets to trade the vast amount of assets available - you need a broker to action your orders.

Don’t worry, even if you have never traded so much as a bag of rice - we are going to cover everything involved in the end to end process of choosing a platform. With that said, online brokers may vary in terms of fees, available assets and regulation - but the sign-up process is often pretty standard.

Below you find the most common 5 steps of a trading platform sign-up:

- Step 1: Find a trading platform

- Step 2: Elect to sign up for an account

- Step 3: Fund your new account

- Step 4: Decide which asset to trade, such as stock, oil, or gold

- Step 5: Execute a trade order to either buy or sell- depends on which way you think the markets will go

As you can see, as soon as you have a firm grasp on the important metrics of online trading - the course of action is straightforward enough. Further down this guide, we are going to not only delve into how to find a good brokerage, but also give you a heads up on commissions to look out for.

Next in your complete guide to trading online in Australia, we are going to clear the mist on what financial assets you will be able to trade.

Which Tradable Financial Assets Are Available In Australia?

Although it might sound a little vague - the long and short of it is, if there is supply and demand for a product - chances are you will be able to trade it via your online broker.

Please find below a list of tradable and investable assets which are suitable for both short-term and long-term trading goals.

Online Trading CFDs (Contract for Difference)

Just in case you aren’t aware of what a contract for difference (CFD) is - they are financial instruments that are used to trade online.

Trading via a CFD means that you do not ever need to own the underlying asset. Instead, you will speculate on the future price of the asset in question. This is a short-term way of trading and any gains will come from you correctly predicting the price fluctuations of the asset.

You could be forgiven for thinking that not owning the asset itself is a bad thing. But imagine for a moment if you had decided to trade oil. Where would you store hundreds of oil barrels - never mind the logistics of the whole thing?

In the case of CFDs, the contract is merely tracking the real-time value of the asset - in this case, oil. Moreover, this means that all that is left for you to do is choose your position - buy or sell. You may also apply leverage when trading CFDs, but more on that coming up.

There are thousands of brokers in the online space which will enable you to access a wide variety of markets, and trade CFDs quickly and with ease. And like we said, you never need to worry about accepting delivery of gold bullion bars or a tankard of oil.

Ready to get started trading CFDs on eToro?

81% of retail investor accounts lose money when trading CFDs with this provider.

We’ve put together some easily understandable examples throughout this guide. You will see below an example of the workings of CFDs.

- You decide to trade orange juice CFDs

- Your CFD broker quotes you $1.60 per drum

- In this case, the CFD uses FCOJ to benchmark the value of orange juice

- You think the value of orange juice will drop so place a ‘sell’ order

- 2 hours later the FCOJ values a drum at $1.20

- As a result, the CFD broker quotes you $1.20

- In order to lock in your profits, you close your position

- Because you speculated correctly, you made a profit totalling 25%

As you can see, the asset, in this case, was orange juice - which shifted from a value of $1.60 to $1.20. Your goal was to correctly guess whether the asset would go down or up in price. As is clearly apparent from our above example, CFDs always reflect the real-world value of the asset in question.

Because CFDs are not backed by a tangible product, you have absolutely no rights over a physical asset itself. The CFD is quite simply a contract you have with your broker.

CFDs are considerably more flexible than trading traditional stocks and such like - so to shed some more light on why that is please see below:

- Regardless of the direction of the markets - you are able to make a profit (if you speculate correctly)

- Leverage allows you to trade with more capital than you have in your trading account - by means of multiplying your stake

- CFD spreads can be super tight

- A lot of online brokers do not charge any commission on CFD trading

To be clear, CFDs can be traded against virtually any marketplace. Whether that’s forex, stocks, indices, bonds, interest rates, ETFs, hard metals, energies, or cryptocurrencies - a CFD market is certain to exit.

Forex Trading Online

Apart from stock trading, Forex has to be one of the most well known tradable assets in the world. However, for those who are unaware - forex, or FX, is the ‘foreign exchange’. The forex market has a daily trading volume totalling nearly $7 trillion.

.png)

To explain further, forex is the exchanging/trading of two different currencies against each other. The exchange rate that we’ve all experienced when going on holiday is determined by the cost paid for one currency for another - and this rate changes second by second.

81% of retail investor accounts lose money when trading CFDs with this provider.

Let’s give you an example:

- You want to trade the Australian Dollar against the Euro

- This pair will be shown as ‘AUD/EUR’

- In our example, the quoted market price is 0.60

- This means that for each Australian dollar you would get 0.60 euro

Now to give you a quick demonstration of how this might translate into an order:

- The quoted price on the AUD/EUR is 0.60

- If you think that the rate is going to drop - you place a ‘sell’ order

- If you suspect the exchange rate will climb - place a ‘buy’ order

AUD/EUR is classed as a cross-pair, which we will explain further in a moment. When it comes to currency pairs, there are over a hundred to trade. Pairs range from currencies we have all heard of such as the Australian, Canadian and US dollar, to the euro and British pound. There are also lesser-known currencies such as the Hungarian forint and South African rand.

To make things easier, we have categorised forex pairs into four categories - as they are commonly seen on trading platforms.

Please find these 4 FX pair categories listed below, with a simple description of each.

Minor Forex Pairs

Minor pairs are made up of two strong currencies - neither of which will be the US dollar. Minor pairs are often inclusive of the Japanese yen, British pound or the euro.

This type of FX pair includes the likes of:

- EUR/AUD (Euro/Australian dollar)

- CHF/JPY (Swiss franc/Japanese yen)

- GBP/CAD (British pound/Canadian dollar)

- EUR/GBP (Euro/British pound)

- NZD/JPY (New Zealand dollar/Japanese yen)

Major Forex Pairs

In contrast to minor forex pairs - major pairs always include the US dollar, which is by far the most traded currency in the world. The second currency will invariably be a different major currency, for example, the Japanese yen or the euro.

Major FX pairs include:

- USD/JPY (US dollar/Japanese yen)

- GBP/USD (British pound/US dollar)

- EUR/USD (Euro/US dollar)

- USD/CHF (US dollar/Swiss franc)

Commodity Pairs

Commodity pairs are some of the most regularly traded. This means that there will always be traders willing to buy and sell these pairs - which in turn means they are usually very liquid. Currencies within the commodity pairs category are usually currencies belonging to an economically safe country.

Commodity FX pairs include:

- USD/CAD (US dollars/Canadian dollars)

- AUD/USD (Australian Dollars/US dollars)

- NZD/USD (Newzealand dollars/US dollars)

More specifically, these pairs have a direct relationship with one another, insofar that the two respective economies have strong trading relations. As such, a major shift in one of these currencies is likely to have a big impact on the other - at least in terms of the exchange rate of the pair in question.

Exotic Forex Pairs

Exotic pairs are quite different from the other forex pairs listed above. The main reason is that they consist of an ‘emerging’ market currency, as well as a strong one.

To explain further, developing currencies include the Hungarian forint, Mexican peso, Turkish lira and more - as you can see below.

Exotic FX pairs include:

- AUD/MXN (Australian dollar/Mexican peso)

- USD/THB (Us dollar/Thai baht)

- GBP/ZAR (British pound/ South African rand)

- EUR/TRY (Euro/Turkish lira)

- JPY/NOK (Japanese yen/Norwegian krone)

- EUR/HUF (Euro/Hungarian forint)

- USD/MXN (US dollar/ Mexican peso)

It is important to note that trading exotic pairs can amplify your losses as well as your gains. This is due to the market being more volatile than majors, for example. It is advisable to tread with caution if you are a new trader, or have never traded in the forex market before.

A safer bet for you is probably majors or commodity FX pairs. You are able to access forex markets 24/5 via any good Australian broker. There is also some activity on Saturday and Sunday’s but nowhere near as high in terms of weekly trading volume.

Are you ready to trade Forex Online?

81% of retail investor accounts lose money when trading CFDs with this provider.

Further Reading:

- Best Forex Trading Platforms

- Risk Management in Forex Trading

- Best CFD Brokers In Australia

- Devising A Profitable Forex Trading Strategy

- The Psychology of Forex Trading

- How To Control Your Emotions When Trading Forex

Trading Cryptocurrencies Online in Australia

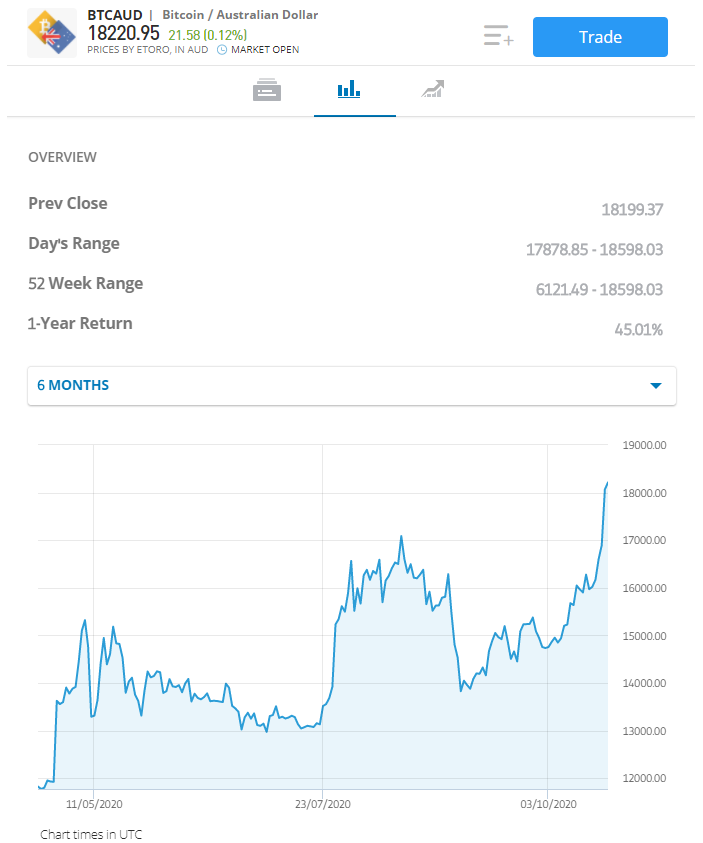

It seems like yesterday that the world's first cryptocurrency, Bitcoin, was launched. The truth is it was 11 years ago. And now, it’s estimated that there are now over 6,000 digital currencies in the online trading space.

Trading cryptocurrencies is not too dissimilar to trading forex - meaning your goal is to correctly speculate the future value of a currency pair. Albeit a digital one such as Litecoin or Bitcoin. As we’ve mentioned throughout this guide so far, the value of assets will naturally shift throughout each trading day due to supply and demand in the relevant markets.

Like minor pairs and major pairs etc in forex - cryptocurrencies are also split into categories which distinguish them from one another.

Fiat-to-Cryptocurrency Pairs Explained

Fiat-to-crypto pairs will always include one currency such as the USD and a cryptocurrency like Bitcoin. In a nutshell, fiat currency is money which is considered legal by the government - for instance, AUD, GBP, USD. Fiat currencies are printed and can be used to pay taxes.

Much like the case of trading Brent crude oil, these pairs are usually valued in USD. A popular way to trade Crypto to fiat pairs is to trade via CFDs. This way, you can potentially access regulatory protection, competitive spreads, and zero commission CFD trading.

Here is an example of how fiat-to-crypto trading works in Australia:

- Let’s say you want to trade the US dollar and Bitcoin

- In that case, your trading pair is BTC/USD

- Your broker quotes $11,100 for BTC/USD

- Your opinion is that the pair is worth more than that

- You place an AU$500 buy order

- 2 days later the price of the BTC/USD pair is $11,700

- This means that the price of BTC/USD increased by 5.40%

- Happy with your profit you execute a ‘sell’ to cash out.

- From your initial AU$500 you made AU$27

As you can see, in our example we used Bitcoin against the US dollar, but there are plenty of other pairs to choose from when trading fiat-to-crypto pairs. Other pairs of this type include BTC/AUD, ETH/USD and heaps more.

Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Cryptocurrency Cross-Pairs Explained

When it comes to cryptocurrency cross-pairs, they consist of two competing digital currencies. Let's say you are trading BTC/LTC (Bitcoin/Litecoin). Once again, your goal is to take a stab at what the future rate will be between Bitcoin and Litecoin.

Let’s give you a quick example:

- In our example, BTC/LTC is priced at 242.08

- For this pair, 1 Bitcoin is worth 242.08 Litecoin

- Similarly to fiat-to-crypto pairs - you have to predict the pair’s rise or fall in value.

Crypto cross-pairs are widely considered to be slightly more complex than the aforementioned fiat-to-crypto scene. Some traders, especially newbies - have trouble calculating gains and losses when trading these pairs. This is mainly because of the lack of a familiar ‘fiat currency’.

Further Reading:

- Best Crypto Exchanges – Find a Crypto Trading Platform

- Next Cryptocurrency To Explode

- How To Trade Cryptocurrencies During Inflation

- Best Cryptocurrency To Buy Right Now

- Top 10 Most Important Cryptocurrencies Other Than Bitcoin

- What Are The Most Popular Cryptocurrencies In Australia?

Trading Stocks and Shares Online

When most Australians think of trading - stocks and shares probably come to mind. After all, people have been trading the stock exchange for over 400 years.

.png)

These days, it’s easier than ever for Australians to trade online, as we said though, it is important that you choose a trusted trading platform. Without a broker, you cannot gain access to the global markets in which you can trade such worldly assets.

Investing Versus Trading

A common misconception amongst new traders is the stark contrast between trading stocks and investing in shares.

Let us clear the mist for you by explaining the differences between the two, starting with shares.

- When you decide to invest in shares, you are partaking in a long-term investment. Long-term investors can hold onto shares for years, even decades at a time. By investing in shares you are a ‘stockholder’ and you own the underlying asset itself.

- Should you, on the other hand, prefer a short-term trading strategy - then you can trade stocks. By engaging in stock trading you are partaking in a short-term trading strategy. Instead of owning the underlying shares - your shares will instead be supported by a CFD.

- As we covered earlier, CFDs monitor the price of the asset in real-time - in this, the stock price of a company. You must try to correctly speculate on the price of the stock later in time. Your main aim here is to make a profit from fluctuations in value - on a short-term basis.

A commonly used strategy used by Australian stock traders is to execute several orders throughout a trading week. The majority of these orders will be closed again within hours (or minutes). The idea is the potential to make regular small gains - rather than one big lump sum once a blue moon.

So, what stocks can be traded via CFDs? As we touched on, trading stocks this way just means the contract is measuring the real-world price of the asset. As a result, the possibilities are almost endless.

When stock trading online in Australia via CFDs, you should find that many brokerage firms will still offer you dividends.

In case you are unaware of what dividends are, please take a look at our quick example below:

- You strongly suspect that the value of APA Group stocks will go up

- Consequently, you decide to inform your broker you wish to ‘go long’

- The stocks go up in value

- APA Group distributes its dividends between shareholders

- Your CFD broker account will add this to your trading balance.

- Had you elected to ‘go short’ - you would see the appropriate negative result reflected in your CFD account

- In other words, short-sellers cover dividend payments for those going long

Would you consider trading stocks online?

Your capital is at risk. Other fees apply.

Stock Exchange Access

We told you that in order to access these stocks and shares, you must use a broker. The broker is going to provide you with access to global marketplaces so that you can trade until your heart’s content.

No two trading platforms are the same, so it’s worth noting that not every broker will offer the same exchanges - or assets for that matter.

With that said, below we have listed just some of the most popular stock exchanges offered by online brokers.

- Sydney Stock Exchange

- New Zealand Exchange

- London Stock Exchange

- Hong Kong Stock Exchange

- Toronto Stock Exchange

- Frankfurt Stock Exchange

- Shanghai Stock Exchange

- NASDAQ

- Johannesburg Stock Exchange

- Tokyo Stock Exchange

- Shenzhen Stock Exchange

- Deutsche Boerse

- New York Stock Exchange

- And lots more

Each stock exchange differs when it comes to trade volume and exchange size. Moreover, if there is a specific stock exchange that you want access to - confirm that the trading platform can offer that exchange, before signing up to become a client.

With that said, if you’re based in Australia and looking for an ASIC-regulated stock broker that offers heaps of markets - you might want to consider eToro. This trusted platform - which is home to over 13 million traders, offers 17 international markets. All share investments are commission-free, too.

Your capital is at risk. Other fees apply.

Tradable Commodities

Put simply, tradable commodities are exchangeable with goods of a similar ilk. One thing that most commodities have in common is that they are usually used in commerce - and are raw or natural resources.

.png)

These resources are often used to either produce other goods or in the case of fossil fuels etc - used to power other products. Most commodities are physical assets - think metals such as gold and silver, energies like natural gas, and agricultural assets such as sugar and oats.

The fundamental value of commodities is determined by supply vs demand. As supply and demand fluctuates continuously, so does the value of these assets. As such, commodities are highly condusive for trading online.

81% of retail investor accounts lose money when trading CFDs with this provider.

Commodities Categories

Commodities are considered to be interchangeable because irrespective of the ‘source’, the product will usually be the same. This means that gold from one producer should be the same as the next, meaning value can be combined.

This asset can be split into various different categories - such as ‘soft’ and ‘hard’ commodities, or ‘major’ and ‘minor’ commodities.

However, commodities are more often than not split into following 4 broad groupings:

- Metals: Metal commodities are inclusive of ferrous scrap, nickel, copper, cobalt, platinum, palladium, lead, steel. Of course, tradable metals also include gold and silver. Investing in precious metals can be a good way to hedge against weak currencies or inflation.

- Energy: Energy commodities are inclusive of natural gas, coal products, sweet crude oil, Brent crude oil, heating oil, ethanol, petroleum, uranium, propane, and purified terephthalic acid (PTA). Essentially energies are mostly made up of non-renewable waste and fossil fuels.

- Livestock and meat: Livestock and meat commodities are inclusive of lean hogs, pork, lamb, feeder cattle, mutton, fresh and frozen pork bellies, veal, beef, sheep, goats and even eggs. Although not to everyone’s taste, the livestock and meat commodities market is worth billions to the economy, globally.

- Agricultural: Agricultural commodities are inclusive of coffee, corn, rice, sugar, wheat, oats, hay, cotton, orange juice, and soybean.

Please note if the agricultural commodities sector interests you - assets can sometimes be super volatile during changes in the weather. However, the world's ever-growing population, as well as insufficient supplies, can actually create potential profit opportunities.

Many traders in Australia try to include a few commodities in their portfolio to diversify and reduce their overall risk.

Trading Commodities via CFDs

If you consider yourself somewhat of an inexperienced trader, then you can still trade the commodities of your choice in a fairly simple manner.

Let’s give you a demonstration of what trading commodities via CFDs would look like when trading online in Australia:

- This time let's envisage that you want to trade silver

- You are quoted $28 per ounce, but you think that is overpriced

- Next, you decide to sign up to a CFD broker

- You feel like the value will fall so set up a ‘sell’ order totalling AU$800

- A mere 3 hours the later the value has fallen to $23

- This illustrates a price drop of 17.85%

- Due to the fact you took the decision to ‘go short’ - your profit is 17.85%

- Your stake was AU$800 - so your profit translates to a healthy AU$142.80

As you can see, when you are trading commodities, the base currency is peripheral. Irrelevant to which currency you are using, the best online brokers will let you deposit funds into your account and access a variety of markets.

Please note though that if you are a beginner and fancy investing long-term - it might be better for you to opt to trade via an ETF. The reason being that if you decide to keep commodity CFDs open for longer - you are going to find yourself subjected to overnight financing fees and other factors. More on this later.

Trading Indices Online

Like other forms of trading, when you invest in indices you are prophesying future price shifts. In a nutshell - indices are a quantification of the value performance of multiple shares from an exchange.

Some of the biggest indices in the world are the S&P 500, Dow Jones, Nasdaq Composite Index, and Euro Stoxx 50. In the case of the latter, the Euro Stoxx tracks the 50 biggest blue-chip companies in Europe.

When it comes to the infamous FTSE 100 Index, it’s the share index of 100 companies with the highest market capitalisation on the London Stock Exchange. Its value is determined by using multiplication of the share value of the organisation, by that of the number of shares issued.

Now, let’s give you an example to shed some further light on the subject of indices:

- Let’s imagine you are trading the S&P 500 (SPX)

- Your job is to speculate on whether the value of the S&P 500 will go higher or lower

- If your prediction is correct you stand to make a profit

- If you speculated incorrectly you stand to lose money

In light of the fact you can make money from the rise or fall of an index price, this could reduce your risk - in the sense that you are not just exposed to one singular organisation.

81% of retail investor accounts lose money when trading CFDs with this provider.

Options Versus Futures

Options and futures are often mistakenly considered to be the same thing. However, this is not the case.

As you can see from our below example there are very clear distinctions between the two:

Futures

- You have a futures contract with your broker

- The futures contract expiry date arrives

- At this point, you are under obligation to buy or sell your asset

Options

- You have an options contract with your broker

- The option contract expiry date arrives

- At this point, you are under no obligation to buy or sell

- You do, however, have the right to buy or sell the asset at the pre-agreed price

As you can see, the main difference between the two contracts is your ‘right to buy’ the underlying asset.

Complete Guide To Trading Online In Australia: Top Tips

In this section of our complete guide to trading online in Australia, we are going to offer you a handful of top tips used by seasoned traders of all ages and experience levels.

Of course, if making money by trading was easy peasy - then the millionaires of this world would make up much more than 0.9% of the population. There is no crystal ball, but by educating yourself on the most important aspects of trading, you stand a better chance of being successful.

We’ve covered the significance of successfully forecasting the direction of assets when trading to make a profit. Whilst this isn’t an easy feat - here are a few tips to inspire you and hopefully help you make a profit in the long run.

Top Tip One: Understanding Leverage

Leverage is a bit like a loan from your broker, as it allows clients to trade with more than they would have been able to otherwise. Some trading platforms call this facility ‘margin trading’. Leverage is shown as a ratio, for example 1:10, 1:15,1:20, 1:100, 1:200, 1:400, 1:500.

Imagine the following scenario:

- Let’s say you decide you want to trade gold

- You only have AU$250 left in your trading account

- Your broker offers you 1:100 leverage

- This means that for every $1 in your account - you have $100 to trade with

- You can now trade gold with $25,000

When it comes to CFDs, some brokers will offer you as much as 1:30 leverage. This means you can trade with an additional AU$30 for every $1 you stake.

To give you a further example of how high levels of leverage can affect your available trading capital, please see the below:

- You stake AU$200 on NZD/USD

- You apply leverage of 1:30

- You can now trade with $6,000

You will find that different assets come with different leverage caps. For instance in Australia, you can trade with as much as 1:30 when trading forex.

A word of caution. If you are considering using the leverage offered by your online broker - be mindful of the fact that as much as leverage can elevate your profits, it can also magnify your losses!

If you have incorrectly predicted the outcome of an asset’s value and opened a losing trade with hefty leverage - your broker could liquidate your position. This means that the trade will be closed automatically.

Top Tip Two: Educate Yourself on Order Types

When you’ve decided what asset you would like to trade, you will need to let your broker know what action you would like to take.

The action taken on your position is going to be the deciding factor in whether you make gains or losses. Put simply, unless you are using an automated trading robot, nothing will happen unless you have a broker execute it as per your manually-placed order.

Below we have listed the most commonly used orders to give you some ideas.

Simple Buy and Sell Orders

This is the easiest order to master. You know by now that you have to correctly guess which direction the value of an asset will go. When you have made your decision you can place your market order.

Here is a super easy example of a scenario when you might act a ‘buy’ order, or a ‘sell’ order.

- Let’s say you want to trade Brent crude oil

- You suspect that the value of the asset will fall in value

- You place a ‘sell’ order

- Now, let's assume the opposite is true

- You have a feeling that the price of Brent crude oil will rise

- You execute a ‘buy’ order

Risk Management: Take-Profit and Stop-Loss Orders

When it comes to risk management, there are two orders which you will no doubt find invaluable when trading online. The two orders we are referring to are ‘take profit’ and ‘stop-loss’.

A stop-loss order is used to allow traders to cap the amount of funds which can be lost. Here is an example of how a stop-loss order would look:

- Let’s hypothesise you are trading BTC/XLM

- Next, you place a buy order worth AU$5,000

- You are not willing to lose over 12% of your initial stake

- With this in mind, you place a stop-loss order at AU$4,400

- The price of BTC/XLM falls to AU$4,400

- Your broker will exit your position at this price

Now, let’s take a look at take-profit orders. This type of order is kind of like an exit plan for traders. Using cryptocurrency pairs as an example again, let's have a look at how a take-profit order looks in practice.

- You are trading BTC/XLM

- Your buy order is worth AU$5,000

- In this scenario, you want to make gains of 25%

- With this in mind, you set up a $6,250 take-profit order ($5,000 + 25%)

- Next, the value of BTC/XLM rises to $6,250

- Your broker will close your position to lock in your gains.

Top Tip Three: Learn to Calculate Profits and Losses

At this point in our complete guide to trading online in Australia, we are going to show you a simple way to calculate your gains and losses.

Here is how that calculation works:

- Let’s envisage you are trading GBP/USD

- You decide to place a buy order worth AU$1,000

- Now, let's assume the price goes up by 8%

- In this particular scenario, you have made a profit of AU$80 (AU$1,000 * 8%)

- Had that very same pair gone done in value by, say 14% - your losses from the trade would be AU$140 (AU$1,000 * 14%)

Irrelevant to what asset you end up trading, this calculation will work across the board when working out your profits and losses.

Let’s have a look at another 2 scenarios:

- You choose to execute a sell order on FTSE 100 at a value of AU$500

- The index value drops by 5%

- You made a profit of AU$25

- Now, let’s hypothesise you execute an AU$1,000 buy order on Coca-Cola stocks

- The value of Coca-Cola stocks increases in value by 10%

- Your profit for this trade is AU$100

Top Tip Four: Practice on a Demo Trading Account

Not much in life comes for free these days. However, some online broker platforms offer clients a free account to practice on. With this in mind, it’s always worth checking what’s available to you before signing up - if this is something that interests you.

Demo trading accounts are not only superb for beginners but are equally as great for seasoned traders who want to try out new strategies.

Each broker will differ when it comes to a) offering a demo account, and b) how much paper money you get. Social trading platform eToro for instance offers clients a demo account with $100,000 worth of demo money to practise.

You will get to trade in market conditions which mirror the real thing, and it’s a great way to find your feet before you start dipping into your hard-earned money.

Top Tip Five: Try Copy Trading

Just in case you have never heard of copy trading - it is a phenomenon offering people the chance to mirror the trades of investors with a proven track record.

Whilst not every broker offers this feature, it is a great way to trade in a passive manner whilst you learn the ropes.

Whatever that investor buys or sells will be reflected in your own trading portfolio. If the investor in question trades using 2% or their own balance buying Apple shares, 2% of your own portfolio will be dedicated to Apple shares as well - for good or bad.

If copy trading interests you, eToro is the market leader in this space. The platform has thousands of eligible copy traders and you can personally perform due diligence before parting with your funds. For example, you can look at the trader’s monthly ROI since they joined the platform, what assets they like to trade, and how risky their trading profile and style is.

There are no fees to copy a trader either, and you can get started with a minimum investment of just $200.

81% of retail investor accounts lose money when trading CFDs with this provider.

Guide To Trading Online In Australia: Useful Strategies

In terms of trading strategies, we aren’t about to reveal the wizardry of trading in a way that’s going to make you wake up tomorrow filthy rich.

However, we have compiled some useful strategies which might just help you on your way. First, let’s talk about a few different trading strategies used by traders on a regular basis.

Trading Types

- Day Trading - Day trading is amongst the most popular trading strategies. In a nutshell, you are looking to open and close various different positions all through a trading day. The goal here is to make small profits, but often. Closing your positions before the end of the trading day enables you to completely swerve overnight financing fees.

- Breakout - For those unaware of a breakout when trading, this means the asset has broken through a support or resistance line. This tends to indicate that the asset will rapidly rise or fall in value.

- Swing Trading - Swing trading is the procedure of keeping a position open for more than one day, but usually closed anywhere from a few days, to a few weeks later. The idea is to spot trends and open positions accordingly. A tip here is to utilise a demo account next time you see a stock swing coming.

- Scalping - The scalping strategy is essentially traders honing in on ultra-small price gaps and flipping a position for gains. To simplify even further - scalpers want to keep positions open for seconds or minutes in the hope of making small profits on a frequent basis.

Utilise Trading Tools

As well as keeping up to date with ‘real-time’ financial and economic news - there are heaps of tools available for the Australian trading community. As we’ve said, each and every broker will offer a slightly different service.

Which technical analysis, price charts and trading tools you use will usually depend on your asset or market of choice. It’s also worth thinking about your long term trading goals.

For instance, when it comes to stock trading, the following tools are super useful:

- The Average Directional Index

- The On-Balance-Volume indicator

- The Relative Strength Index

- The Stochastic Oscillator.

If it’s forex you are trading you might consider using:

- Time Zone Converter

- Economic Calendar

- Correlation Matrix

- MetaTrader 4 and MetaTrader 5

- Financial News Wire

Cryptocurrency traders swear by the following tools:

- CoinMarketCap

- CoinTracking

We have only listed a handful of helpful tools here, but as you can see, there is lots of information out there to make use of. Not only that, but some Australian traders swear by reading books relating to the assets or trading strategies they are interested in.

To reiterate, by using demo account, technical analysis and money management strategies - as well as being aware of how trading works - you stand a better chance of a positive outcome. In addition to that, some broker platforms offer clients educational content like webinars, videos, and up to date news breaks.

81% of retail investor accounts lose money when trading CFDs with this provider.

Complete Guide To Trading Online in Australia: Fees

It’s important when trading online in Australia that you pay attention to any fees payable to your broker. After all, this can impact your potential profits.

For instance, traders who aren’t careful can have commission and overnight fees eat away at their trading account balance in no time.

Let us explain further some of the fees you might see when shopping for an Australian broker.

Broker Commission Fees

There are a lot of brokers in the space who will let you trade on a commission-free basis, with some making up for it in the spread. Others might charge a fee for each individual trade - but then offer a tighter spread.

Here is an example of how some trading platforms might charge a commission on your trades:

- Imagine you are trading USD/JPY

- Your trading platform of choice charges 1.2% commission

- You go ahead and stake AU$1,000

- Your broker is going to take $12 for opening the position

- Later on, you want to close that USD/JPY position

- Let’s say your position at the time of closing is worth AU$1,300

- Your broker requires an additional 1.2% for closing your position

- The commission on this will cost you AU$15.60

- Finally, your total commissions for opening and closing your USD/JPY trade totalled AU$27.60

If you want to trade via CFDs, you should find that the majority of brokers will allow you to do this on a zero commission basis.

81% of retail investor accounts lose money when trading CFDs with this provider.

Online Broker Spreads

For those who are unaware of spreads, this is the difference in value between the buy price of the asset and the sell price.

We’ve put together a simple example of this below, using stocks.

- You buy Facebook stocks for AU$270

- Facebook’s sell price is quoted at AU$267

- The spread here is $3

The spread can be shown in various ways, but will usually be a ‘bid-offer’. If like in the above example your spread is $3, you need to make $3 to break even. The wider the spread is between the buy and sell price, the more profit you need in order to get yourself back into the green.

In terms of forex trading, this will almost always be shown to you as pips. See an example below.

- The buy price for EUR/USD is 1.1819

- The sell price for EUR/USD is 1.1817

- The spread illustrated here is ‘2 pips’

Overnight Financing Fees

Unless you are trading in a way that means you have closed your position before the end of a trading day - you will likely be charged an overnight financing fee.

This fee, sometimes called a swap-fee, is a bit like a trading interest payable on leveraged positions held overnight. These charges are generally attached to trades with no expiration date.

If a trading platform doesn’t clearly advertise fees like this, you can always just check out the fee table and terms and conditions. Rates tend to differ depending on the market and the asset, and some brokers charge more on weekends.

How To Select An Australian Trading Platform

By this point in our guide, you probably feel confident enough to go ahead and choose a trading platform to trade through.

In the online broker space, there are a lot of disingenuous companies promising the earth to traders. On the other side, there are reputable and trusted brokers used by thousands of traders every single day.

To help you sort the wheat from the chaff we’ve compiled a list of high priority metrics to look out for.

Is the Broker Regulated?

We highly recommend using a broker who holds a licence from ASIC (Australian Securities & Investments Commission). Other respected regulatory bodies you might have heard of include the FCA (Financial Conduct Authority of the UK) and CySEC (Cyprus Securities and Exchange Commission).

What the aforementioned bodies have in common is that they regulate financial conduct. This includes anti-money laundering, combatting the financing of terrorism, KYC (Know Your Customer), risk disclosure, fund segregation and more.

Put simply, these bodies were created to make the financial space a much safer place for everyone, especially traders. ASIC is responsible for enforcing strict rules on brokerage companies, ensuring they submit annual account audits and abide by customer care due diligence.

In addition to the hoops a trading platform must jump through to gain an ASIC licence - they are also legally obligated to segregate your trading funds from their own company account. This means that in the unlikely event the broker firm goes bankrupt - your money is out of the firing line. Furthermore, ASIC licenced brokers must use a tier-1 bank with no connection to the trading platform.

ASIC brokers are legally required to have AU$1 million in their company account before they can even begin to offer a service to traders and investors.

Is the Trading Platform User-Friendly?

This consideration applies to both new traders and well-experienced ones. If the broker’s platform isn’t very usable, then it’s only going to make your trading endeavours more complicated.

We recommend using an easy to navigate broker site such as eToro, as the platform makes it easy for you to execute trades at the touch of a button, and find what you can’t see with ease. If you are a beginner, you should definitely look out for the option of the eToro demo account as we mentioned earlier.

What Fees are Payable?

We’ve covered commission, overnight fees and spreads. Now you know what to keep an eye out for, you should have no trouble determining whether or not the broker you are considering has reasonable fees on offer.

To clarify, if a broker is offering you commission-free trading and tight spreads - you could be onto a winner.

What Tradable Assets are Available?

Another thing to bear in mind is that you might only be interested in trading a single asset like cryptocurrencies right now - but later down the line, chances are you will want to diversify your trading portfolio.

By choosing a trading platform that offers a variety of forex pairs, commodities, stocks, indices, and other multiple global markets - you are starting off on the right foot.

What are the Deposits and Withdrawal Options?

Before you can begin to trade you will need to deposit funds into your broker account. Whilst some brokers allow deposits from a wide variety of payment methods like credit/debit cards, e-wallets, Bitcoin, and pre-paid cards - some might only accept a bank wire.

With this in mind, if there is a specific payment method you need to use it’s important to check what's available on the platform.

Another thing to look into is the broker’s deposit and withdrawal procedure. For example, is there deposit fee and how long will it take for the broker to process your withdrawal request? One thing to note about deposits is that wire bank transfers can take up to 3 business days to reach your account - while Australian debit/credit cards and e-wallets are typically processed instantly.

Is Quality Customer Support Available?

Customer support is often overlooked by new investors, but the fact is if you need help with something you need access to a good team. Even full-time professional traders need to contact customer support from time to time.

To get an idea of how good a platform's customer support team might be there are a few options.

- Check available contact methods, the more the better - 24/7 support is best

- Read real client reviews - bad customer service news travels fast

- Have a look at the broker’s social media accounts - as above

There are plenty of well-respected trading platforms to use in Australia, so never settle for one with sub-par customer service. After all, you will be trading with your own hard-earned cash.

81% of retail investor accounts lose money when trading CFDs with this provider.

Sign Up For An Online Trading Account In Australia Today

Hopefully, by now you are well equipped enough to sign up with a broker and start trading online. In addition to your own decision making, analysis reading and speculating skills - the trading platform you choose is going to play a major part in your trading endeavours.

With that in mind, we have created a generalised four-step sign up guide.

Step One - Elect to Open an Account

First thing’s first - head over to the trading platform you have chosen and select ‘sign up’. You will usually need to enter simple information such as; name, address, telephone number, and email.

If you have chosen an ASIS regulated broker like eToro - you will be required to provide a copy of your passport or driving licence. All you need to do is take a clear photograph of your ID and send as instructed.

Step Two - Fund Your Account

We discussed deposits and withdrawals earlier on. Simply deposit the minimum amount required, using whatever payment method you prefer from the accepted list. eToro requires a minimum deposit of $200 - which is about AU$281.

Step Three - Choose an Asset to Trade

Now you should be able to select from the list of available assets or use a search bar function to find your desired asset.

Step Four - Place a Trade Order

Let’s presume you have now chosen the asset you wish to trade. Next, you need to set up an order. This will instruct your broker as to what you think will happen with the asset in question.

We covered orders in great detail further up this page, but let’s give you a quick recap:

- Choose how much you want to stake

- Select your orders - limit/market, buy/sell, stop-loss/take-profit etc

- Select your leverage (if any)

- Place your trade order

As soon as you have completed your order details your broker will action the trade on your behalf.

81% of retail investor accounts lose money when trading CFDs with this provider.

Online Trading Australia: The Verdict

Hopefully, you now have the confidence to start trading online in Australia. These days, wherever you have access to the internet you can buy and sell your chosen assets with ease.

It’s crucial that if you are planning to trade on the move, you elect to find a broker with a user-friendly mobile app. Not only that, but by choosing a broker with a diverse selection of assets you will always have options when it comes to branching out and trying a new trading strategy.

Whilst there are hundreds of brokers offering their services to traders in Australia, we do recommend signing up with one holding a licence. This is why we suggest checking out eToro - which is regulated not only by ASIS - but the FCA and CySEC too. eToro also offers a 100% commission-free pricing structure and it is especially useful for beginners.

eToro – The Best Online Trading Platform In Australia

eToro have proven themselves trustworthy within the industry over many years – we recommend you try them out.

81% of retail investor accounts lose money when trading CFDs with this provider.

Read More:

FAQs Trading Online in Australia

How will I know if a trading platform is legitimate?

The only way to know for sure if a broker is genuine is to check the platform holds a licence from a reputable regulatory body - such as ASIC, FCA or CySEC.

Can I trade gold online in Australia?

Yes, you can. In fact, there are heaps of tradable assets to choose from. It’s crucial that if you have something specific in mind, such as gold, you confirm your broker can provide access to that market.

Will I be able to practice trading online in Australia?

Yes - provided your broker of choice offers a demo account facility. With a demo account, you will be provided with thousands of dollars worth of paper money (demo funds) and will be able to trade in a way which reflects real market conditions.

How can I open an online trading account in Australia?

Once you find a broker you like, opening an account usually takes less than 10 minutes. Generally speaking, you will need to provide the trading platform with your name, residential address, email address and telephone number. Next, you will need to deposit the minimum amount required.

What assets can you trade online in Australia?

You can now trade thousands of assets from the comfort of your home. This includes everything from Forex, gold, oil, Bitcoin, stocks and more!

Am I able to use leverage when trading online in Australia?

Yes, the vast majority of brokers will offer leverage on most assets. To give you an example - you can leverage as much as 1:30 on forex trades. This means that for every AU$1 you stake, you will have AU$30 to trade with.