Coinbase is the largest cryptocurrency exchange in the United States and one of the most popular trading platforms worldwide. It started as a private company and opened to the public in April 2021. Almost half a year after that, Coinbase hit its maximum valuation of $77 billion, but its value started to decrease after that.

In this guide, we will discuss the latest Coinbase stock price prediction for the short and long term, providing insightful information about investing in Coinbase stock, the latest news related to the company, and guide you where you can invest in Coinbase stock today – with low trading fees.

While this downtrend is associated with several factors, most importantly the “crypto winter” and the crushing prices of several popular cryptocurrencies, you may be interested in the future of this crypto platform and whether it is a good investment or not.

Coinbase Stock Price Prediction - Key Points

Based on 25 analysts offering 12 month price targets for Coinbase stock have a median target of $85, with a high estimate of $200 and a low estimate of $27. The average price target represents a 45% change from today's price.

To help you understand Coinbase’s perspective, below we have summarized Coinbase's stock forecast for the next few years:

- End of 2023 — Based on the results of the 25 analyses offering a 12-month price forecast for Coinbase, the average price target is $85, according to the data provided by CNN Money. The forecast gives a high estimate of $200 and a low estimate of $27 for the Coinbase stock in 2023. The poll among 30 analysts about Coinbase investment indicates that the consensus is to Hold the stock, with 13 of them recommending Hold, 9 Buy, 5 Sell, 2 Outperform, and 2 Underperform.

- End of 2024 — According to another algorithm-based platform, Panda Forecast, the average price target for the COIN stock price prediction over 2024 ranges from $60-$70. The platform suggests the highest price for the COIN is $74, and the lowest is $47.5.

- End of 2025 — The maximum price Coinbase stock prediction for 2025 can increase during the year is $79, and the minimum is $52. According to them, the average trading price for the COIN stock will fluctuate between $57-$73. In contrast, many analysts consider that its value will increase over the year, and by 2025 Coinbase stock forecasts can be traded at above $400.

- End of 2030 — While many price predicting platforms refrain from giving analyses about COIN price in the long-term perspective, analysts consider that it will continue to increase over the years. If everything goes well for Coinbase stock prediction, its value can reach $1000 before 2029 and hit $1,500 by 2030.

- End of 2040 — Our long term Coinbase stock price prediction for 2040 estimates that the stock can rise to as much as $2,500 per share before the end of 2040. Hence, the bullish case is that popular cryptos hit new all-time highs, which can make Coinbase a $600 billion market cap industry.

Your capital is at risk. Other fees apply.

First, What Is Coinbase?

Before we dive into our Coinbase stock price prediction, let's first understand what Coinbase is. When investing in an asset, it is crucial to understand what it is designed for, what services or products it provides, and how it can grow in the future. Hence, in this section, we will talk about Coinbase and understand what factors can affect its price. Above all, Coinbase is a cryptocurrency exchange that enables you to buy, sell, and trade cryptocurrencies.

Like all the other trading platforms, Coinbase charges fees for its services in the form of transaction fees. These are the fees you pay every time you buy or sell an asset on a trading platform, irrespective of its market price. Coinbase claims to generate most of its revenue from the transaction fees paid by the users on its platform.

A part of its revenue is also generated by crypto loans provided to its customers, paid subscription plans, custody services, etc. As the project’s revenue is mostly generated from transaction fees, its growth basically depends on the number of users. The more people trade cryptocurrencies on Coinbase, the more transaction fees they will pay.

Coinbase claims to have 108 million verified users from more than 100 countries which is twice as much compared to 2021. But why do people choose Coinbase, and what makes it a unique platform? Coinbase is a leading platform in the crypto space, and it is the largest crypto exchange in the whole US.

One of the top advantages of this exchange is its vast selection of crypto assets. It supports over 150 digital currencies and constantly updates its list with new tokens and coins. Coinbase’s massive selection of available coins enables traders to build a diversified crypto portfolio and manage the risks effectively.

Coinbase also provides a simple and advanced trading platform with a number of professional trading tools for advanced traders. The exchange is simple to use and is filled with useful educational content for beginners.

When it comes to trading fees, Coinbase’s structure may seem a bit complicated and higher than average market fees. It charges two types of fees: maker/take fees and transaction fees, which both vary depending on the volume of your transaction. Additional fees may be charged depending on the payment method you use.

It’s quite a straightforward process to start trading with Coinbase. All you need to do is to download its mobile app or visit its website and create a personal account. As Coinbase is a regulated platform, it also requires you to go through the KYC procedure and verify your account. This is extremely important in terms of keeping your funds safe and secure from fraudsters.

Other benefits one may get from trading with Coinbase include its custody services, debit card, earning rewards by holding stablecoins, and other earning options. Other than being a crypto trading platform, users can also send, receive and store coins through Coinbase and make use of its lending and earning services and newly launched NFT marketplace.

Coinbase Price History

Before wrapping up this section of our Coinbase price prediction, here’s a history of the company.

Coinbase Global was founded in 2012 by Brian Armstrong and Fred Ehrsam, but the company went public only in April 2021. Coinbase was listed on the NASDAQ stock exchange under the ticker COIN, with its shares opening at $381. When we take a look at the Coinbase price history and consider the events happening in the crypto market, we can notice a correlation between Coinbase stock price and crypto market performance.

Coinbase kept its price at around $300, but its value dropped at the beginning of April, followed by the sell-off in the cryptocurrency market. At that time, Bitcoin dropped to $30,000 after hitting an all-time high of $63,000. However, when Bitcoin regained its value and hit its historical all-time high in November 2021, Coinbase stock price started to increase. In fact, the COIN stock price hit its all-time high of $368 in the same period.

Coinbase finished the year with a price of $252 and started 2022 not quite successfully. Its stock price had dropped to $110 by the beginning of May, and the downtrend continued after the company published its revenue for the Q1 of 2022. The problem was that it was less than the investors expected, which evoked doubts among the investors.

Things got even worse after one of the most popular cryptocurrencies, Terra LUNA, crashed in May 2022. The coin’s value dropped from as high as $80 to as low as $0.002 in a couple of days. This led to the massive crypto sell-off, with many people trying to avoid crypto trading. The events led to Coinbase's price dropping to $57 on 11 May. The stock price somehow recovered by the end of May, reaching $75, but it again dropped during June and hit an all-time low of $47.

Coinbase All-time Price Performance by NASDAQ

August was a bit more successful for Coinbase, and its value almost doubled compared to its June price reaching $98. However, it started to decrease shortly, which was somehow also affected by its Q2 revenue. The team explained that the decrease in their revenue is mainly associated with the events in the crypto market, as many people avoided trading during that period.

Coinbase Daily Price Chart by NASDAQ

However, another major downtrend occurred in the cryptocurrency space after the collapse of the popular crypto exchange - FTX, leading Bitcoin to drop as low as $16,000, and many other cryptocurrencies suffered from its fallout. The period which has become known as “crypto winter,” decreased the number of traders for this period significantly.

Coinbase started 2023 with a price of $35, and its price dropped even lower at the beginning of January. However, when Bitcoin recovered, getting back to $23,000, the company's stock price increased too and reached $73 on 4 February. Coinbase is currently traded at $65 and is included in the list of the 1000 largest companies by its market capitalization.

Your capital is at risk. Other fees apply.

Coinbase Stock Price Prediction 2023

Moving on, how could the Coinbase price prediction chart shape up in 2023? Coinbase stock price got affected significantly at the beginning of 2023, which is associated with a number of factors. First and foremost is the overall condition of the cryptocurrency market. The latter has been experiencing a long bear market, with many cryptocurrencies losing most of their value and high-profile tokens crashing.

This significantly affects people’s faith in cryptocurrencies, making them refrain from trading. As Coinbase’s revenue is mostly generated through the transaction fees paid by users, it significantly decreased in 2022 compared to this year. Hence, the stock value of Coinbase got affected too.

Another factor affecting Coinbase's value is the recent regulatory issues the company has faced. It was fined $50 million by the New York Department of Financial Services on 4 January. Later on, the company was fined $3.6 million by the Dutch Central Bank for not registering with the central bank before providing services within the country.

COIN Stock Recommendation Poll - Source: Zacks.com

Facing the cryptocurrency market crash, revenue drop, and regulatory issues, Coinbase started the year with an all-time low of $33. But the COIN price increased at the beginning of February, and it was traded at above $80 once Bitcoin and other cryptos increased in value. How will the COIN stock perform during 2023? Let’s take a look at the predictions of analysts and find out what they think of COIN stock.

According to the CNN Money poll, 25 analysts offering a 12-month forecast give an average target of $55 for the COIN price. The high estimate for the Coinbase stock price prediction for the next 12 months is $200, and the low estimate is $27.

From the 30 participants in the poll, 13 analysts recommend holding the Coinbase stock, 9 of them recommend buying, and 5 selling, with 1 outperforming and 2 underperforming voices.

Another poll from the Wallstreetzen platform, with 23 analysts participating in it, suggests that Coinbase stock price prediction will be $96 on average for the 12-month forecast. The minimum forecast is $30, and the maximum is $314. 9 of the 25 analysts recommend holding the COIN, with 7 strong buy, 3 buy, 3 strong sell, and 3 sell votes.

Based on Coinbase stock price prediction for the short-term targets offered by 23 analysts, an average price of $67 for the Coinbase stock price prediction in 2023. The estimate ranges from a low of $30.00 to a high of $200.00.

Based on the recommendations from 22 brokerage firms, the platform calculates a 2.68 average brokerage recommendation for Coinbase stock on a scale from 1 to 5 with 8 strong buy, 7 hold, 4 strong sell, 2 sell, and 1 buy votes.

Algorithm-based platform Wallet Investor, on the other hand, is not so optimistic about Coinbase stock price forecasts. According to its data, COIN stock will be traded at $51 as its maximum value by the end of the year 2023.

It should be noted that neither analysts nor technical indicators can be the sole source to get information and invest in the stock. So, you must always do your own research, consider the latest news, explore the technical and fundamental data, and read experts’ opinions before making a final decision.

Your capital is at risk. Other fees apply.

Coinbase Stock Price Prediction 2024

It is fairly hard to predict the Coinbase stock future price performance because of the high volatility in the crypto space, many analysts refrain from making price predictions in the long-term perspective. If the cryptocurrency market survives and the prices of high-profile coins increase, it can positively affect COIN value.

But several other factors can decrease the number of traders and the amount of their trade, including regulations, taxes on crypto trading, etc. Tech News Leader predicts that the average Coinbase stock price prediction can reach $109 in 2024. If everything goes well for the company, the price can reach as high as $128.

Coinbase stock price prediction will be on average valued between $49-$69 in 2024, with a pessimistic target level of $47 and an optimistic target level of $72.

Your capital is at risk. Other fees apply.

Coinbase Stock Price Prediction 2025 - Long-Term Outlook

When analysing the long-term Coinbase stock price prediction outlook, its performance mostly depends on the direction of the crypto market and Coinbase's financial perspective. The co-founder of the company, Brian Armstrong, believes in the future of DeFi stating that there will be a more improved environment in the crypto space with better regulatory rules and more scalable blockchains.

Taking the positive perspective, we give a bullish forecast on Coinbase price forecast value for the next 5 years. According to experts, the Coinbase stock price prediction 2025 will be around $152 per share, and the highest price can be $185.

Coinbase stock prediction can grow up to $257 for 2026 with an average price of $229. Coinbase will experience steady growth according to the platform, so it can have a maximum value of $318 in 2027, $548 in 2028, $778 in 2029, and be traded above $1,100 by 2030.

Your capital is at risk. Other fees apply.

Coinbase Stock Price Prediction 2030

It is hard to predict Coinbase stock price forecasts in such a long-term perspective, the bullish case takes into account the platform’s huge potential for success, its future innovations, partnerships, collaborations, and, most importantly, the uptrend of the cryptocurrency market. If this is the case, it can draw public attention to COIN stock investment leading to a price increase.

Based on the bullish forecasts of experts, the Coinbase stock price prediction 2030 can reach as high as $1,141 per share. According to the latest data, the average price COIN stock price will be traded in that year is $973, with a minimum price of $946.

After hitting an all-time high in 2030, COIN prices will keep increasing over the next few years. It can hit another all-time high of $1542 in 2031. Moreover, the COIN price is expected to be above $2000 in 2032.

While this is a bullish Coinbase stock prediction, anything can happen in the crypto market by 2030, which can affect Coinbase's value in the future. Some factors that can result in a COIN downtrend include the possible regulations governments can apply to take more control over the crypto market, crypto taxes, crypto market crashes, etc.

Your capital is at risk. Other fees apply.

Coinbase Stock Price Prediction 2040

Considering two possible directions the cryptocurrency market will take in the upcoming years, crypto analysts also predict two possibilities for the Coinbase stock future. The bullish case is that the market will thrive in the next few years, with Bitcoin and other top coins hitting new all-time highs and becoming a medium of exchange for businesses and individuals.

We can conclude this section by stating that Coinbase stock being one of the best stock out there, can rise significantly before 2040. Though price will continue to fluctuate, it will mostly head in the positive direction. That being said, our Coinbase stock price prediction for 2040 is $2,215 per share.

This can positively affect COIN value and keep it at the center of investors’ attention. Still, even the most bullish prediction for COIN stock value indicates that its market cap can reach somewhere at $600 billion. So, even in this case, COIN is not expected to become a trillion-dollar industry by 2040.

Meanwhile, if the market takes a negative direction and high-profile cryptocurrencies appear in the downtrend, this can mark the beginning of an “ice age” in the crypto market. According to analysts, in this case, not only will COIN lose its value, but it will be hard for it and many other crypto exchanges to make it till 2040.

Despite all of this, it is crucial to mention that the predictions made by analysts and algorithm-based AI platforms can be wrong. Though these predictions need to be considered, they are not the single data you must consider when investing in the best stocks. Doing your research is always the best thing you can do before buying any asset.

Additionally, you need to consider your financial status, invest with caution, and never put at risk the capital you can’t afford to lose.

Your capital is at risk. Other fees apply.

Potential Highs & Lows of Coinbase Stock Price

In the previous sections, we discussed in detail the possible highs and lows that COIN stock can perform in the future. Summing up all the analysis, below you will find a table with potential highs and lows of COIN by year to keep an eye on.

| Year | High | Low |

|---|---|---|

| 2023 | $87 | $73 |

| 2024 | $128 | $106 |

| 2025 | $185 | $150 |

| 2027 | $1146 | $946 |

| 2030 | $2590 | $1500 |

Your capital is at risk. Other fees apply.

Reasons To Buy Coinbase Stock

If you can’t make a firm decision about investing in COIN stock, you may need more information to better understand its future and make up your mind. Below, you will find four reasons to buy Coinbase stock.

Coinbase Partnership with Google

One of the reasons to consider investing in Coinbase stock is its collaborations and partners with leading companies. Google is one of those partners, with Coinbase announcing the strategic partnership between the two companies in October 2022. The partnership aims to accelerate the adoption of Web3 and has four main components.

First, Google will use Coinbase Commerce to enable select customers to pay for cloud services through cryptocurrencies. The second component is that Coinbase Cloud Node will power BigQuery, which can be used by Web3 developers to get Google Cloud’s blockchain data. The third point states that Google will apply Coinbase Prime for such crypto services as secure custody and reporting. Finally, Coinbase will rely on Google Cloud to build advanced exchange and data services.

Coinbase Q3 Earning Results in 2022

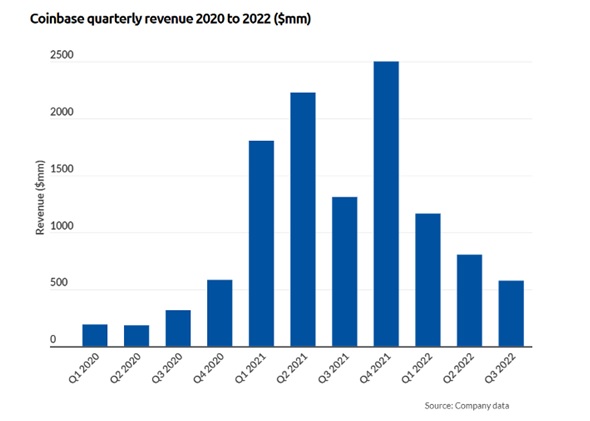

Looking at the Coinbase revenue by the year, we can see a considerable drop in the company's last year's earnings. Coinbase has already published the Q1, Q2, and Q3 earnings of 2022. So, the Q3 revenue is $576 million for Coinbase, which is more than 2 times less than the revenue of a similar period in 2021. Meanwhile, it has dropped by over $200 million compared to the previous quarter.

Coinbase Quarterly Earnings by Year

Comparing the Q1 and Q2 periods of 2022 with the same periods of 2021 also indicates a stiff decline. The Q1 for 2022 has decreased by $650 million compared to the $1.8 billion of Q1 2021. And Q2 for 2022 has decreased almost by $1.5 billion compared to $2.2 of Q2 2021. The company has just released its Q4 2022 earnings, which dropped by $1.8 billion compared to the Q4 of 2021.

Overall, Coinbase’s earnings for 2022 have dropped by $7.8 billion compared to 2021. As long as Coinbase gets its profit from the customer’s fees, this revenue drop is associated mostly with the drop in the number of traders on Coinbase. The latter results from unhappy events around the crypto market, leading people to refrain from trading.

However, it also means that Coinbase has a lot of room for growth once the crypto market recovers. Hence, Coinbase will probably be at the center of traders’ attention once the market thrives again and it can regain its stock value. This, as a matter of fact, can be the best time to buy COIN stock at its lower price, while the stock is undervalued, and profit when the stock value increases.

Cryptocurrency Adoption Continues to Gain Momentum

Another reason to invest in COIN stock is the growing percentage of crypto adoption worldwide. Despite the recent crypto market crash, cryptocurrencies are becoming more real-world and gaining more practical usage in the last few years. With this being said, you can invest in crypto indirectly if you buy COIN stock, as Coinbase is a leading exchange in the crypto world.

Bitcoin to USD Price Performance since the Beginning of 2023 - Source: Coinmarketcap.com

It is still unclear whether the crypto market will recover soon or not, but Bitcoin has already shown some signs of recovery from the beginning of the year, with many other cryptocurrencies following it. Furthermore, Bitcoin is predicted to hit a new all-time high in a few years, which can rebuild the users’ trust in cryptocurrencies. This will lead to more people coming back to crypto exchanges.

Coinbase Stock Has Been Rising Since the Beginning of the Year

COIN stock has risen since the beginning of 2013, which is clearly another reason for buying the stock. It has increased by 75% YTD after starting the year at as low as $33. The highest price for COIN stock during 2023 is $81, which the company hit on 2 February. After that, COIN stock has never been traded below $50, and its value is not $65. It is highly possible that COIN will keep gaming value along with the trending crypto market.

COIN Stock Price Performance since the Beginning of 2023 - Source: Nasdaq.com

Your capital is at risk. Other fees apply.

Where To Buy Coinbase Stock

Coinbase is listed on Nasdaq with a ticker name COIN, but you can’t buy it directly from Nasdaq. Hence, you must open an account on a brokerage platform supporting buying Coinbase. There are multiple platforms where you can buy COIN stock, but first, you need to take a look at their features and understand which one best suits your expectations.

We consider eToro the best broker to buy COIN stock for several reasons. First and foremost, eToro offers a competitive pricing structure which is quite attractive when it comes to stocks. The platform does not take any commission fees when you buy stocks and ETFs, so the only trading fee you pay here is the bid/ask difference.

Buy COIN Stock on eToro

eToro’s non-trading fees are also quite affordable. The broker does not charge deposit fees; the minimum deposit on your account to start trading is $10. The latter can differ depending on your country. Other non-trading fees include the small withdrawal fee of $5, a conversion fee for non-USD contracts, and an inactivity fee of $10/month if you don’t do anything on your account in one year.

Another reason to trust eToro is its regulatory system. The broker is regulated by 4 top-tier institutions to ensure your money is safe. This is why you must go through the KYC procedure before buying anything on eToro. Regarding trading experience, eToro has a lot to offer here.

Apart from investing in stocks directly, you can use the option of CFDs. CFD stands for contract for differences; in this case, you don’t own the stock. Instead, you have a contract with your broker to settle the difference between yourselves when the position closes. You can also use the ability to apply leverage, and eToro provides 5X leverage for CFDs.

eToro also provides exciting tools for portfolio diversification. Building a strong portfolio is crucial in trading in terms of managing risks. First, eToro supports a wide selection of stocks, with more than 700 stocks and ETFs available to trade. The broker also provides CopyTrader and CopyPortfolio tools that enable you to mirror the trades or the portfolios of expert trading with one click.

Pros:

- ✅ More than 28.5 million users from over 100 countries.

- ✅ Competitive trading fees

- ✅ No commissions on stocks and ETFs

- ✅ Wide selection of assets

- ✅ Heavy regulations and security mechanisms

- ✅ Easy-to-use platform

- ✅ CopyTrader, CopyPortfolio tools

- ✅ Multiple payment methods

Cons:

- ❌ An inactivity fee is applied if you don’t show any activity in 12 months.

- ❌ The minimum deposit can be high, depending on your location.

Your capital is at risk. Other fees apply.

Latest Coinbase News

Before we get to the very end of our Coinstock price prediction guide you need to understand the importance of getting relevant news about the stock along with technical analysis, it is also crucial to explore the fundamental analysis of the asset before investing in it.

Learning about the latest news regarding picking stocks is one of its components because, in that way, you keep track of the company's development and understand what factors can influence its price in the future.

Below we will share the latest news about Coinbase stock to help you better understand its performance.

- Coinbase announces very bad news: The cryptocurrency exchange says it received a warning from the Securities and Exchange Commission (SEC), suggesting a possible enforcement action.

- XRP relisting - Coinbase has recently delisted several cryptocurrencies, including Ripple (XRP). XRP is currently the 6th largest cryptocurrency with a market cap of $19.8 billion. Coinbase announced delisting it along with some other coins, such as Bitcoin Cash, Ethereum Classic, and Stellar, reasoning that those coins have low usage on the platform.

After that, the coin’s supporters started a campaign on Twitter with the hashtag #delistXRP, claiming that it would not only be good for XRP but Coinbase could benefit millions from the fees of the XRP transactions. Rumors also suggest that Coinbase plans to relist it anyway; however, there is no evidence for this. - Cathie Wood’s Ark investment - Coinbase’s successful rally in January was also due to the huge investment made by Cathie Wood’s Ark Investment company. The latter bought 162,325 shares of COIN worth $9.26 million at the time of making the contract.

- SEC news regarding Coinbase - Securities and Exchange Commission is a US government agency that manages the securities industry and protects investors. SEC’s decisions and fines regarding the crypto exchanges can directly affect their reputation and discourage investors from buying the stock.

For example, Coinbase CEO Brian Armstrong has recently raised concerns in response to rumours about SEC’s planning to take action against crypto staking. This led to a loss of 14% for the COIN stock, according to CNBC.

- Coinbase 2022 Q4 Revenue - Coinbase published its 2022 Q4 revenue on 21 February, which states that the company’s earnings for the last quarter of 2022 are $629 million. The number has significantly dropped compared to the $2.5 billion revenue of Q4 2021. Overall, Coinbase earnings for 2022 have dropped by 75% compared to the previous year's revenue due to the ongoing crypto winter.

- Coinbase partnership with Google - Coinbase has promising collaborations and partnerships with different companies, including Google, which the company announced in October 2022. The strategic partnership is meant to contribute to Web3 adoption and development.

- Coinbase partnership with BlackRock - Coinbase has also partnered with BlackRock, a large company providing investment, advisory, and risk management solutions. The collaboration of these two companies is meant to help institutional investors more easily trade Bitcoin.

Your capital is at risk. Other fees apply.

Conclusion - Coinbase Stock Price Prediction

To sum up, this guide provided a detailed understanding of the Coinbase stock price prediction and its future. In short, Coinbase price predictions indicate that the company can take either a bullish direction or a bearish one depending on the overall state of the cryptocurrency market.

We have discussed the COIN stock price prediction based on the data provided by analysts and algorithm-based platforms. These platforms indicate the possible maximum, minimum, and average price ranges for the COIN stock in the years ahead.

You can also find information about Coinbase company, its exchange platform, and what features it provides. As it is important to consider the stock’s price history, we discussed COIN's previous price performance and explained what factors influenced its peaks and downtrends. The latest news in the article about Coinbase will also help you make a better decision about investing in COIN stock.

Finally, we also shared some reasons to buy COIN stock in 2023 and shared what platform you can use to buy the COIN stock.

We recommend eToro as the best online broker to buy stocks due to its competitive fees, a wide selection of trading options, and variety of assets to buy. With this being said, always remember that investing involves high risks, so always consider the factor of losing your money and invest reasonably.

More Stock Price Predictions

- Tesla Stock Price Prediction

- Alphabet (GOOG) Stock Price Prediction

- Apple Stock Price Prediction

- Microsoft Stock Price Prediction

- Amazon Stock Price Prediction

- Netflix Stock Price Prediction

- Walt Disney Stock Price Prediction

- Meta Platforms (FB) Stock Price Prediction

- PayPal Stock Price Prediction

- NIO Stock Price Prediction

- Intel Corporation Stock Price Prediction

eToro – Buy Coinbase Stocks With 0% Commission

Open an account with eToro, deposit some funds with USD, and finally – buy Coinbase shares from just $10.

Your capital is at risk. Other fees apply.

Read More:

Coinbase Stock Price Prediction - FAQs

What was the IPO price of Coinbase stock?

Coinbase went public in April 2021 with an IPO price of $381. The coin got listed on the Nasdaq stock exchange under the ticker COIN marking a new milestone in the cryptocurrency space, as Coinbase was the first crypto trading platform in the US to open to the public.

Is Coinbase stock a buy right now?

Coinbase is one of the world's leading crypto exchanges and the second-largest crypto exchange. The company has a lot of room for growth along with the development of the crypto market and the adoption of cryptocurrencies. There are multiple reasons to buy COIN stock, including its partnership with Google, its popularity and high number of customers, the growing ecosystem, etc.

Is it a good time to buy Coinbase stock?

COIN stock price has dropped significantly due to the recent events around the crypto market. The stock price dropped below $60 after Bitcoin, and other popular cryptocurrencies significantly lost value. But the stock price will likely rise once the crypto market recovers and more people return to trading coins. So, it can be a good time to invest in Coinbase as he is currently trading at a low price.

What was Coinbase stock's highest price?

The highest closing price of the COIN stock was $357, which the company reached in November 2021. At the time, the cryptocurrency market was in a bull run, with Bitcoin skyrocketing to its all-time high of $65,000. This once again proves that Coinbase’s revenue and stock price are affected by the state of the cryptocurrency market.

What is Coinbase’s market capitalization?

Coinbase’s market capitalization - or the total value of all its stocks - is almost $26.5 billion as of end-February 2023. This makes Coinbase one of the 1000 largest companies in the world by market capitalization.

What will Coinbase be worth in 2030?

If everything goes well for Coinbase, its stock will keep increasing over the years. According to the analyst's predictions, COIN stock can hit $1000 by 2030 and be traded at $1141 as its maximum price. The average price target for COIN stock is $973 in 2030, with a minimum price of $946.

Will Coinbase stock go up?

Coinbase stock price will likely go up in the coming years. It is an exciting company backed by some of the best individuals and institutions in the industry.

How much will Coinbase stock be worth in 5 years?

Five years is enough time for Coinbase stock to gain popularity and the stock can take advantage of this to soar. According to the latest COIN price forecast, the stock can reach $400 per share.

What is the Coinbase stock price prediction for 2024?

If we record a decent improvement in Coinbase stock price this year, then it is likely that it will build on the momentum and possibly Coinbase stock price prediction reach $72 by the end of 2024.

What will Coinbase stock be worth in 2025?

According to the latest Coinbase stock price prediction 2025, the COIN stock can grow in the coming years, but that will happen at a modest pace that will see the Coinbase stock price prediction reach $185 by the very end of 2025.